WTAPS ダブルタップス 19AW×NEIGHBORHOOD RIPPER SS TEE ネイバーフッド リッパー 半袖Tシャツ カットソー ブラック192ATNHD‐CSM01S

(税込) 送料込み

商品の説明

商品説明

【ブランド】WTAPS(ダブルタップス)【品名】19AW×NEIGHBORHOODRIPPERSSTEEネイバーフッドリッパー半袖Tシャツカットソーブラック192ATNHD‐CSM01S

【対象】メンズ

【表記サイズ】L

【実寸】着丈:73.8センチ身幅:58.7センチ肩幅:52センチ袖丈:23.5センチ

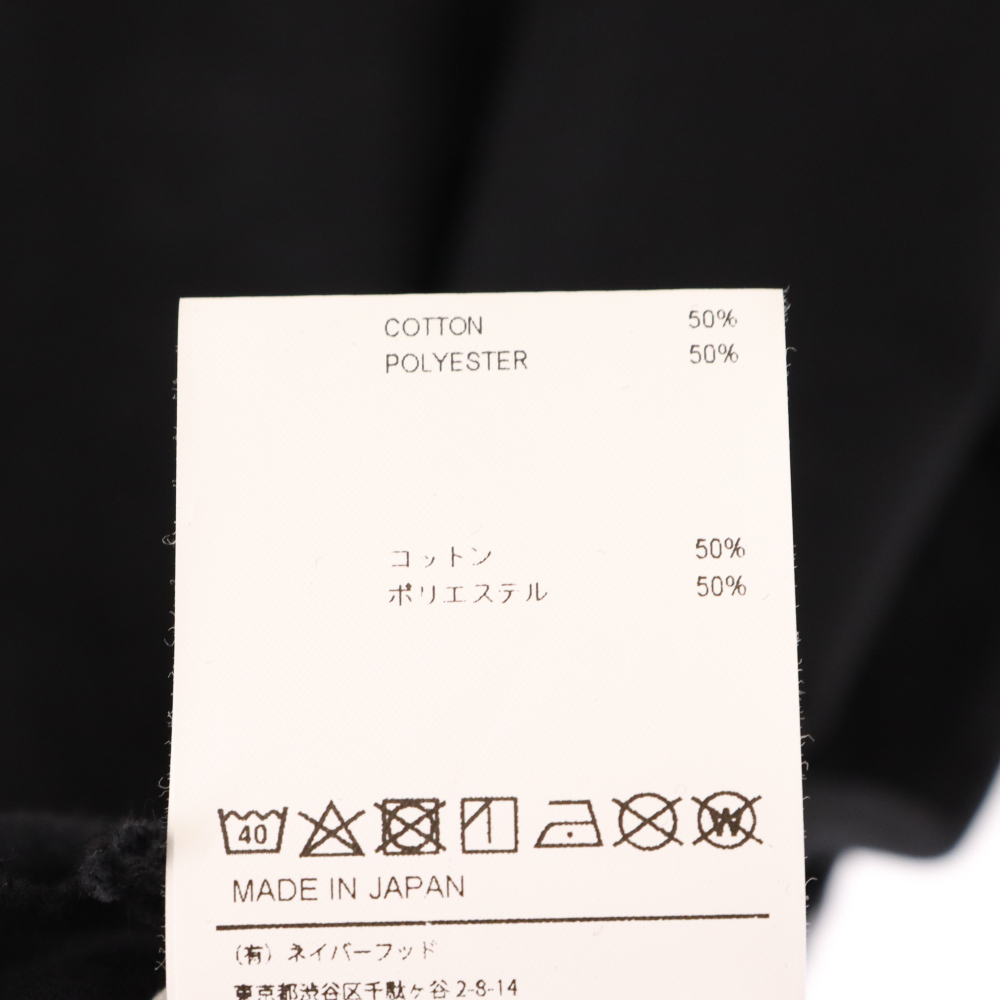

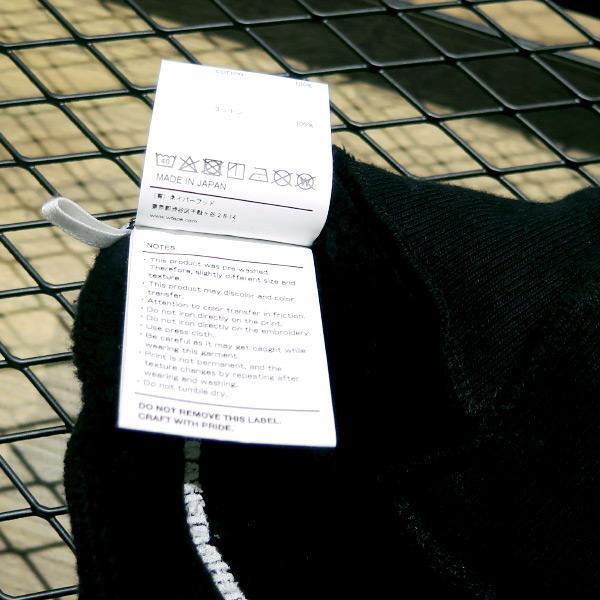

【素材表記】画像参照

【原産国】日本製

【カラー】ブラック

【商品状態】

数回程度の使用感有り

前身頃にスレ有り

【商品番号】9223K290019

【ランク】SA

【付属品】写真に写っているものがすべてです。

【備考】-

※ランク説明

N…新品同様~未使用品

S…未使用品

A…使用感の少ない比較的状態の良い中古品

B…使用感がありダメージや汚れが見受けられる中古品

C…汚れやダメージが多数見受けられる中古品(難あり品)

≪注意事項はプロフィール欄をご覧くださいませ。≫

こちらの商品はラクマ公式パートナーのBRINGによって出品されています。

8580円WTAPS ダブルタップス 19AW×NEIGHBORHOOD RIPPER SS TEE ネイバーフッド リッパー 半袖Tシャツ カットソー ブラック192ATNHD‐CSM01SメンズトップスWTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS楽天市場】WTAPS(ダブルタップス) サイズ:L 19AW×NEIGHBORHOOD RIPPER

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

楽天市場】WTAPS(ダブルタップス) サイズ:L 19AW×NEIGHBORHOOD RIPPER

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

楽天市場】WTAPS(ダブルタップス) サイズ:L 19AW×NEIGHBORHOOD RIPPER

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

楽天市場】WTAPS(ダブルタップス) サイズ:L 19AW×NEIGHBORHOOD RIPPER

楽天市場】WTAPS(ダブルタップス) サイズ:L 19AW×NEIGHBORHOOD RIPPER

WTAPS NEIGHBORHOOD RIPPER SS TEE L - www.sorbillomenu.com

楽天市場】WTAPS(ダブルタップス) サイズ:L 19AW×NEIGHBORHOOD RIPPER

WTAPS x NEIGHBORHOOD 19AW RIPPER CREW NECK/SWEATSHIRT 192ATNHD

楽天市場】WTAPS(ダブルタップス) サイズ:3 19SS×ネイバーフッド

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

WTAPS NEIGHBORHOOD RIPPER SS TEE L - www.sorbillomenu.com

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

【楽天市場】【新品】 WTAPS (ダブルタップス

WTAPS x NEIGHBORHOOD 19AW RIPPER CREW NECK/SWEATSHIRT 192ATNHD

W)taps - WTAPS ダブルタップス 19AW×NEIGHBORHOOD RIPPER SS TEE

WTAPS × NEIGHBORHOOD RIPPER SS TEE BLACK - www.sorbillomenu.com

WTAPS x NEIGHBORHOOD 19AW RIPPER CREW NECK/SWEATSHIRT 192ATNHD

楽天市場】【新品】 WTAPS (ダブルタップス) × NEIGHBORHOOD

W)taps - WTAPS ダブルタップス 19AW×NEIGHBORHOOD RIPPER SS TEE

Tシャツ ダブルタップス ネイバーフッド - Tシャツ

楽天市場】【新品】 WTAPS (ダブルタップス) × NEIGHBORHOOD

WTAPS NEIGHBORHOOD RIPPER SS TEE L - www.sorbillomenu.com

WTAPS x NEIGHBORHOOD 19AW RIPPER CREW NECK/SWEATSHIRT 192ATNHD

楽天市場】【新品】 WTAPS (ダブルタップス) × NEIGHBORHOOD

☆大人気☆WTAPS×NEIGHBORHOOD RIPPER SS / TEE (Neighborhood/Tシャツ

WTAPS ダブルタップス x NEIGHBORHOOD ネイバーフッド 19AW RIPPER SS

トップスWTAPS NEIGHBORHOOD RIPPER SS tシャツ XL 4 - Tシャツ

Tシャツ ダブルタップス ネイバーフッド - Tシャツ

W)taps - WTAPS ダブルタップス 19AW×NEIGHBORHOOD RIPPER SS TEE

楽天市場】【新品】 WTAPS (ダブルタップス) × NEIGHBORHOOD

期間限定ポイント5倍キャンペーン中!!] 【数量限定特別価格】 新品

WTAPS × NEIGHBORHOOD 19AW RIPPER CREW NECK SWEATSHIRT サイズ04 ブラック 192ATNHD-CSM02S ダブルタップス ネイバーフッド スウェットトレーナー

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![期間限定ポイント5倍キャンペーン中!!] 【数量限定特別価格】 新品](https://makeshop-multi-images.akamaized.net/cliffedge/itemimages/000000003123_1_N5aZbwo.jpg)