2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属

(税込) 送料込み

商品の説明

商品説明

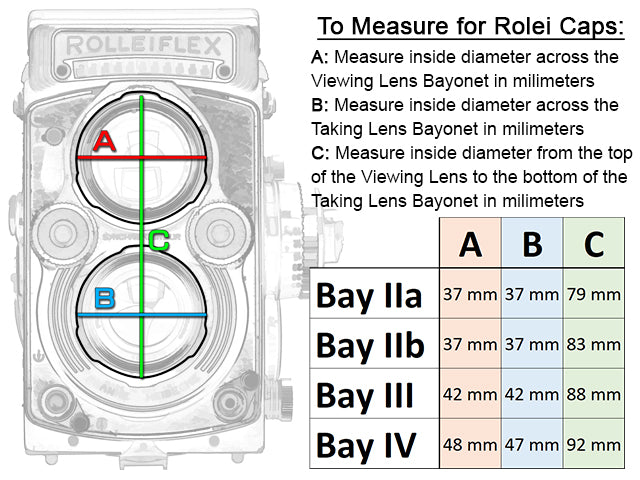

新品社外品FOTProduce会社製2個セットRolleiローライフレックス二眼bay2UVフィルター(bay2→39mm)フィルターを付けた後用簡易キャップ付属(純正ではありません3.5Eは使えません)*図にはカメラは含まれません

6825円2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属スマホ/家電/カメラカメラ2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の

2個セット Rollei ローライ フレックス二眼2 8FX/2 8GX/2 8F/2 8E用

当店限定販売】 【美品】ROLLEIFLEX 3.5F☆DBGM☆二眼レフカメラ

大海物語 Rollei ローライ bay4 NDフィルター 二眼4.0FW 50/55用

2024年最新】Yahoo!オークション -ローライ フィルター(二眼レフ)の

2024年最新】フィルター bay3の人気アイテム - メルカリ

未使用品 純正品Rolleiflex 二眼 2.8FX/2.8F用 カメラケース-

未使用品 純正品Rolleiflex 二眼 2.8FX/2.8F用 カメラケース-

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

2024年最新】ローライフレックス 3.5 eの人気アイテム - メルカリ

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

2024年最新】ローライフレックス フィルターの人気アイテム - メルカリ

未使用品 純正品Rolleiflex 二眼 2.8FX/2.8F用 カメラケース-

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

2024年最新】ローライ UVフィルターの人気アイテム - メルカリ

未使用品 純正品Rolleiflex 二眼 2.8FX/2.8F用 カメラケース-

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

未使用品 純正品Rolleiflex 二眼 2.8FX/2.8F用 カメラケース-

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

2024年最新】ローライ UVフィルターの人気アイテム - メルカリ

2024年最新】フィルター bay3の人気アイテム - メルカリ

2024年最新】フィルター bay3の人気アイテム - メルカリ

2024年最新】ローライフレックス 3.5fの人気アイテム - メルカリ

2024年最新】ローライ UVフィルターの人気アイテム - メルカリ

2個セット Rollei ローライ フレックス二眼用 bay1UVフィルター 簡易

2024年最新】ローライ UVフィルターの人気アイテム - メルカリ

2024年最新】フィルター bay3の人気アイテム - メルカリ

2個セット Rollei二眼3.5F用bay2UVフィルター 簡易キャップ付属の通販

2024年最新】フィルター bay3の人気アイテム - メルカリ

2024年最新】ローライ UVフィルターの人気アイテム - メルカリ

2024年最新】フィルター bay3の人気アイテム - メルカリ

2024年最新】ローライフレックス 3.5fの人気アイテム - メルカリ

KANI、ローライフレックス用のBay3フィルター。ND16と白黒用Y2

2024年最新】フィルター bay3の人気アイテム - メルカリ

Cap for Rollei Camera BayII 2.8A/3.5F - fits Bay II Mount 2.8A

2024年最新】ローライフレックス 3.5 eの人気アイテム - メルカリ

2024年最新】ローライフレックス フィルターの人気アイテム - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています