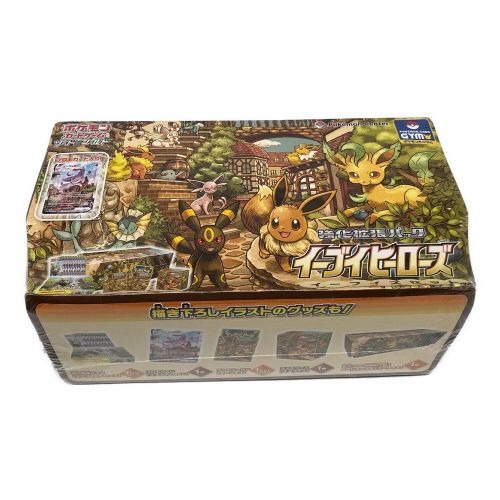

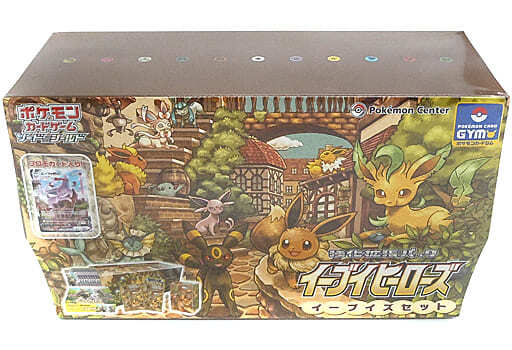

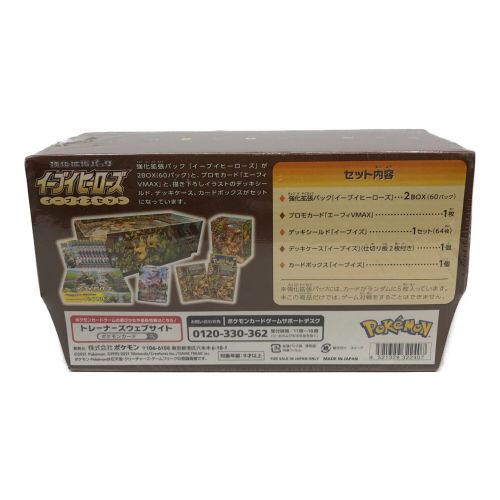

強化拡張パック『イーブイヒーローズ』【未開封BOX】

(税込) 送料込み

商品の説明

商品説明

☆商品説明欄は最後までお読みください☆☆初めて購入の方はプロフィールもご覧ください☆

当方の商品をご覧いただき、

ありがとうございます!

●内容

強化拡張パック『イーブイヒーローズ』【未開封BOX】1箱

写真に写っているものが全てです。

●状態

写真にてご判断ください。

気になる点がある場合は、コメント欄でご指摘いただければ真摯に対応いたします。

●配送方法

匿名配送送料出品者負担(ポスト投函)

ご要望があれば追加料金にて変更いたします。

※紛失・破損などの配送事故が起きた際の責任は取れませんのでご理解ください。

上記事故が発生した場合の補償金額は、配送会社もしくは出品サイトの補償限度額までとなります。

●梱包について

段ボール+気泡緩衝材にて梱包

●同梱対応について

受け付けております。

価格含め、ご相談ください。

●注意事項

商品によっては他サイトで併売している場合があります。

トラブル防止のためプレイ用でお願いいたします。

※すり替え防止の為、商品発送後の返品・キャンセルはお受けできません。

●コメント

ポケモンセンターオンラインで購入し、開封せずに保管していたものになります。

22800円強化拡張パック『イーブイヒーローズ』【未開封BOX】エンタメ/ホビートレーディングカードイーブイヒーローズイーブイヒーローズ 強化拡張パック 2BOX - Box強化拡張パック『イーブイヒーローズ』(S6a)【未開封BOX】{-}

Amazon.co.jp: ポケモンカードゲーム ソード&シールド 強化拡張パック

Amazon.co.jp: ポケモンカードゲーム ソード&シールド 強化拡張パック

イーブイヒーローズイーブイヒーローズ 強化拡張パック 2BOX - Box

楽天市場】【楽天スーパーセール期間中限定割引クーポンあり】ポケモン

ポケモンカードゲーム ソード&シールド 強化拡張パックイーブイ

イーブイヒーローズ box 未開封 シュリンク付きBox/デッキ/パック

Box/デッキ/パックイーブイヒーローズ 拡張パック 2BOX - Box/デッキ

値引きする ポケモンカードゲーム 強化拡張パック イーブイヒーローズ

即発送可能 【未開封BOX】ポケモンカード イーブイヒーローズ 未開封

1カートン 12箱入り 新品未開封 イーブイヒーローズ BOX ポケモン

ポケモンカード 未開封品 @ 強化拡張パック イーブイヒーローズ

新品 未開封】強化拡張パック イーブイヒーローズ-

2024年最新】強化拡張パック イーブイヒーローズ boxの人気アイテム

ポケモン「強化拡張パック イーブイヒーローズ イーブイズセット

のオンラインショップ イーブイヒーローズ 未開封box ポケモンカード

大人気新品 イーブイヒーローズ 強化拡張パック『イーブイヒーローズ

イーブイヒーローズ 未開封box シュリンク付き - www.sorbillomenu.com

人気の定番ラインから ポケモンカードゲーム強化拡張パック イーブイ

韓国版 強化拡張パックイーブイヒーローズ 1ボックス シュリンク付き

強化拡張パック『イーブイヒーローズ』(S6a)【未開封BOX】{-}

公式サイト ポケモンカード 強化拡張パック イーブイヒーローズ 未開封

イーブイヒーローズ 未開封BOX PK-21 1BOXの通販 がーび(1575188015

ポケモンカードゲーム ソード&シールド 強化拡張パック イーブイ

未開封:外装傷みあり》【ポケカ】強化拡張パック「イーブイヒーローズ

ポケモンカードゲーム 強化拡張パック イーブイヒーローズ 未開封

2024年最新】イーブイヒーローズ box 未開封の人気アイテム - メルカリ

未開封:外装傷みあり》【ポケカ】強化拡張パック「イーブイヒーローズ

ソード&シールド 強化拡張パック イーブイヒーローズ BOX 未開封

強化拡張パック『イーブイヒーローズ』(S6a)【未開封BOX】{-}

s6a ポケモンカード イーブイヒーローズ 未開封BOX 強化拡張パック の

楽天市場】【未開封】ポケモンカードゲーム ソード&シールド 強化拡張

シュリンク付 未開封】ポケモンカードゲーム 強化拡張パック イーブイ

イーブイヒーローズ 未開封BOX 1BOXの通販 Card Shop Yorozuya

イーブイヒーローズイーブイヒーローズ 強化拡張パック 2BOX - Box

2024年最新】強化拡張パック イーブイ ヒーローズ BOXの人気アイテム

ポケモンカード 未開封品 @ 強化拡張パック イーブイヒーローズ

強化拡張パック イーブイヒーローズ イーブイズセット 未開封

韓国版 強化拡張パックイーブイヒーローズ 3ボックス シュリンク付き

Box/デッキ/パックイーブイヒーローズ 未開封 - Box/デッキ/パック

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています