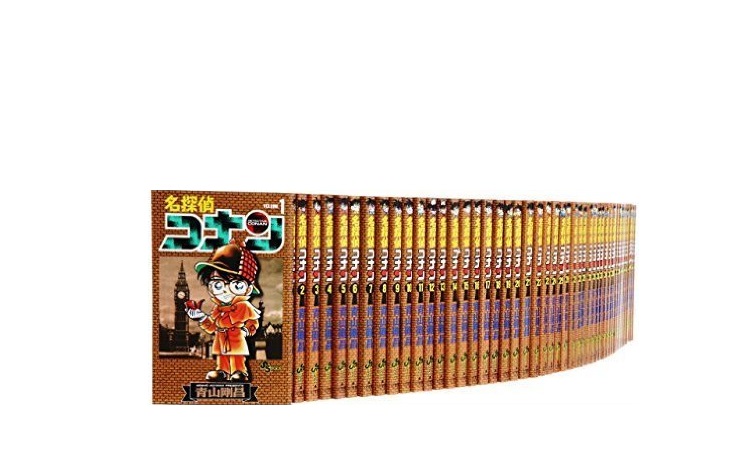

送料無料❗️名探偵コナン全巻 1〜103巻+おまけ2冊 青山剛昌

(税込) 送料込み

商品の説明

商品説明

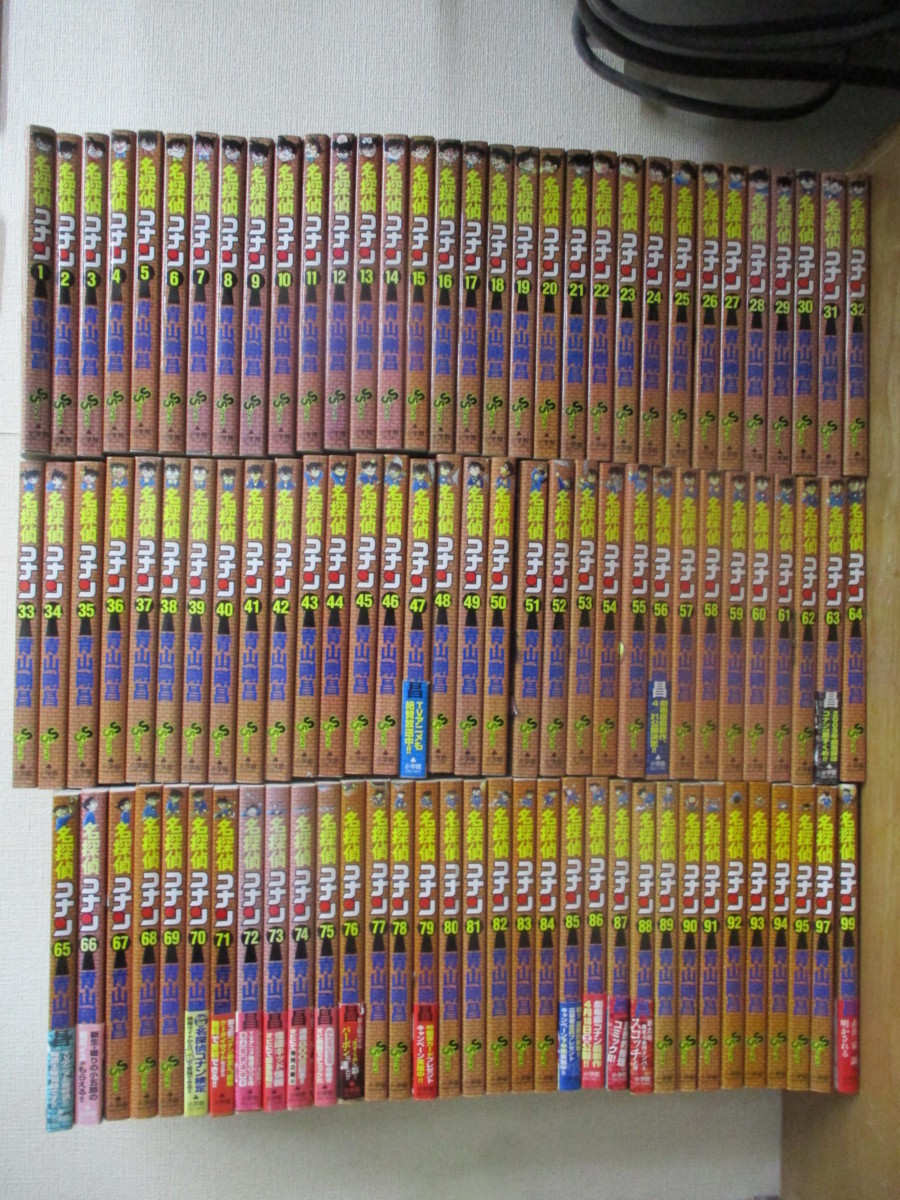

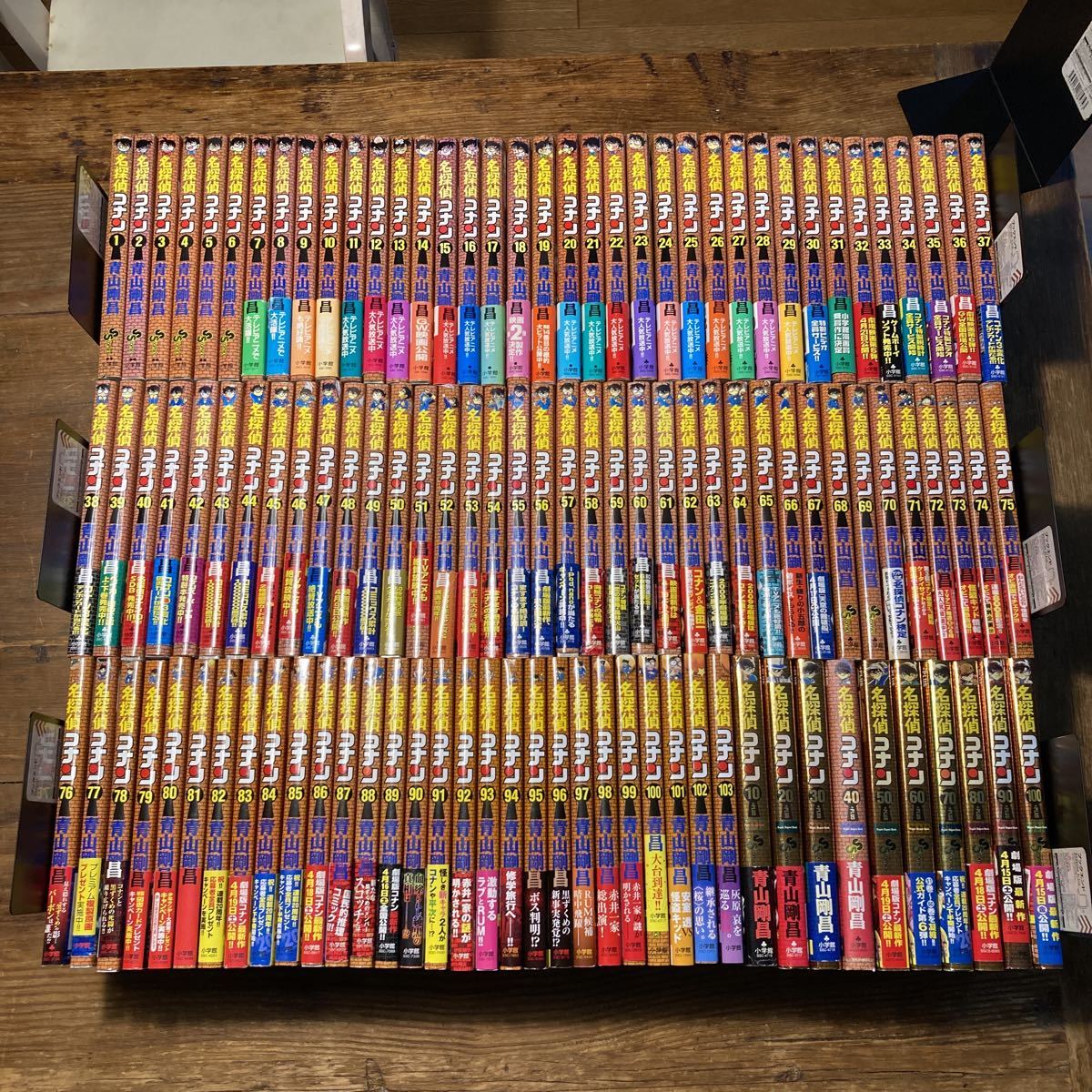

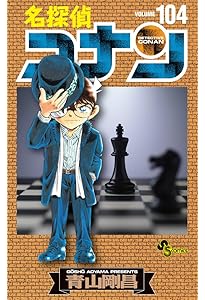

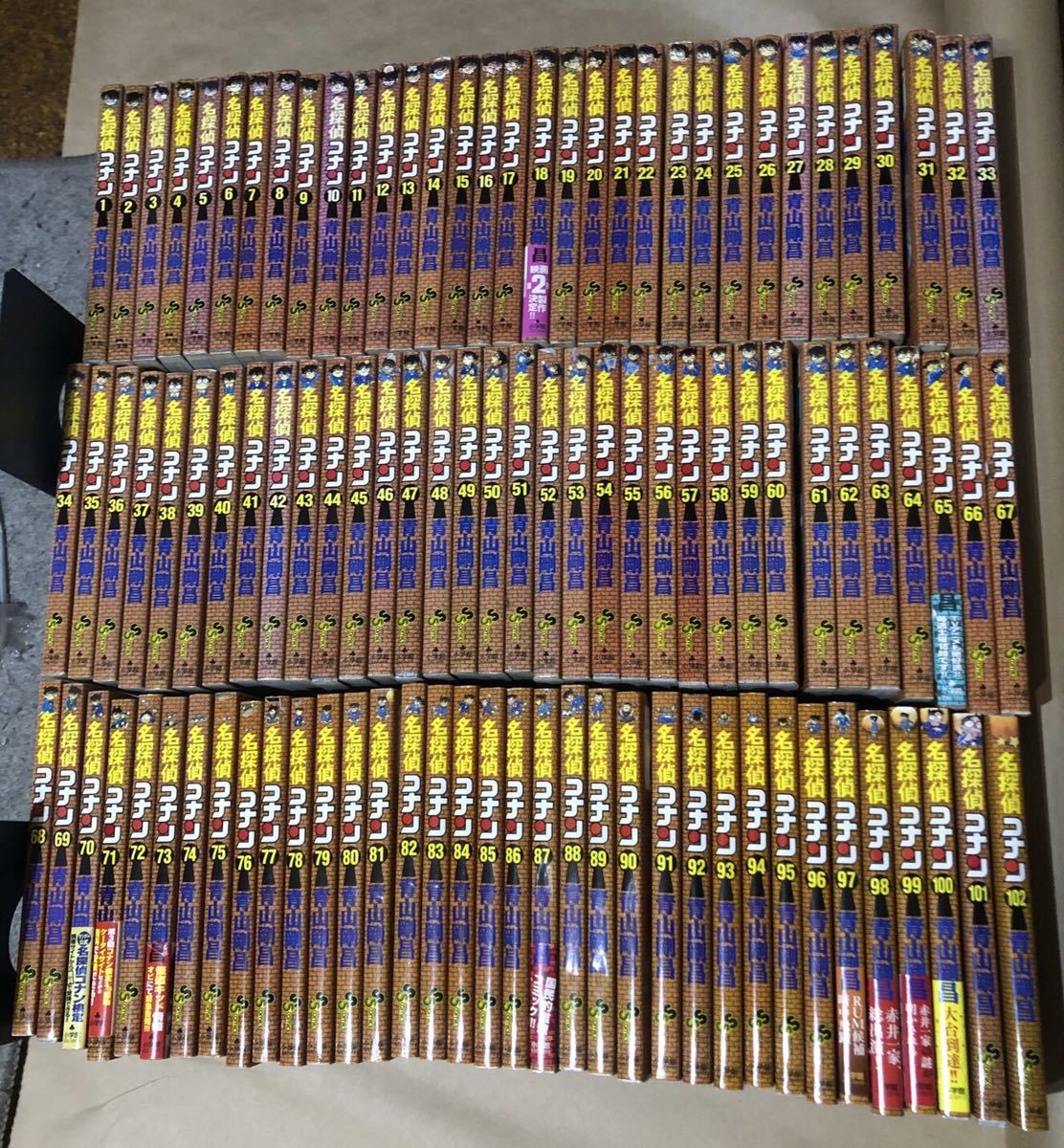

ご覧頂きましてありがとうございす。名探偵コナン全巻1~103巻

劇場版名探偵コナン2冊

計105冊です!

ヤケ・シミなどの使用感がある巻もございますが、良品も複数含まれておりますので通読には全く問題ありません(^^)

送料は当方が負担させて頂きますので、コナンがお好きで大切にして頂ける方にお譲りできれば幸いです。

これ以上のお値下げはできないものですから申し訳ありませんm(__)m

迅速に発送させて頂きますね。

よろしくお願い致します(^^)

12675円送料無料❗️名探偵コナン全巻 1〜103巻+おまけ2冊 青山剛昌エンタメ/ホビー漫画名探偵コナン 全巻 1〜103巻-良品❗️送料無料❗️名探偵コナン全巻 1〜103巻 青山剛昌-

良品❗️送料無料❗️名探偵コナン全巻 1〜103巻 青山剛昌-

良品❗️送料無料❗️名探偵コナン全巻 1〜103巻 青山剛昌-

名探偵コナン 全巻 1〜103巻-

送料無料❗️名探偵コナン全巻 1〜103巻+おまけ2冊 青山剛昌の通販 by

良品❗️送料無料❗️名探偵コナン全巻 1〜103巻 青山剛昌-

Amazon.co.jp: 名探偵コナン(103) (少年サンデーコミックス

コナン 全巻 1-103巻 と おまけ2冊 - 全巻セット

名探偵コナン 全巻セット 青山剛昌 103冊 - 全巻セット

Amazon.co.jp: 名探偵コナン (103) (少年サンデーコミックス) : 青山

名探偵コナン 青山剛昌 [1-103巻 コミックセット/未完結] | 漫画専門店

人気ブランドの新作 1〜102巻+おまけ2 名探偵コナン コナン漫画 日本

送料無料❗️名探偵コナン全巻 1〜103巻+おまけ2冊 青山剛昌の通販 by

バーゲン! 1〜103巻+おまけ2冊 名探偵コナン 1-103巻 送料無料 即

還元祭 名探偵コナン 既刊全巻103冊+関連本6冊 漫画 www.sanut.com

名探偵コナン 全巻セット1〜102+おまけ 青山剛昌 - 全巻セット

名探偵コナン 青山剛昌 [1-103巻 コミックセット/未完結] | 漫画専門店

☆中古☆名探偵コナン 劇場版コミック 16作品(29冊)セット 青山剛昌

名探偵コナン 全巻 1~103-

名探偵コナン 青山剛昌 [1-103巻 コミックセット/未完結] | 漫画専門店

☆中古☆名探偵コナン 劇場版コミック 16作品(29冊)セット 青山剛昌

名探偵コナン 漫画 10冊+おまけ - 青年漫画

Amazon.co.jp: 名探偵コナン (103) (少年サンデーコミックス) : 青山

名探偵コナン 全巻 1~103-

2023年レディースファッション福袋特集 【全巻セット】名探偵コナン 1

名探偵コナン 103巻 青山剛昌 - 小学館eコミックストア|無料試し読み

名探偵コナン 全巻とおまけ - 全巻セット

名探偵コナン 1〜103 全巻-

送料無料❗️名探偵コナン全巻 1〜103巻 青山剛昌 全巻セット 新作登場

送料無料❗️名探偵コナン全巻 1〜103巻+おまけ2冊 青山剛昌の通販 by

正規店定番 名探偵コナン 1〜101巻 全巻 +関連本多数‼︎ 青山剛昌の

名探偵コナン 青山剛昌 [1-103巻 コミックセット/未完結] | 漫画専門店

名探偵コナン 漫画 10冊+おまけ - 青年漫画

名探偵コナン 全巻 1〜103巻-

名探偵コナン コミック 1-103巻セット | 青山 剛昌 |本 | 通販 | Amazon

名探偵コナン』漫画 【最新全103巻+10冊】 計113冊セット マンガ 全巻

名探偵コナン 全巻 青山剛昌 - 全巻セット

☆中古☆名探偵コナン 劇場版コミック 16作品(29冊)セット 青山剛昌

ELDEN 名探偵コナン 全102巻 全巻 関連本 36冊 | www.terrazaalmar.com.ar

名探偵コナン 103巻 青山剛昌 - 小学館eコミックストア|無料試し読み

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![名探偵コナン 青山剛昌 [1-103巻 コミックセット/未完結] | 漫画専門店](https://imagedelivery.net/QondspN4HIUvB_R16-ddAQ/64dde92640aa6200342e7cc7/d4ea84f53b5f205ed22f.jpg/fit=cover,w=800,h=960)

![名探偵コナン 青山剛昌 [1-103巻 コミックセット/未完結] | 漫画専門店](https://imagedelivery.net/QondspN4HIUvB_R16-ddAQ/64dde92640aa6200342e7cc7/d8e9ee27d18e4ea8dd59.jpg/fit=scale-down,w=1200)

![名探偵コナン 青山剛昌 [1-103巻 コミックセット/未完結] | 漫画専門店](https://imagedelivery.net/QondspN4HIUvB_R16-ddAQ/64dde92640aa6200342e7cc7/3e7ae02f9a6e3db01500.jpg/fit=cover,w=800,h=960)

![名探偵コナン 青山剛昌 [1-103巻 コミックセット/未完結] | 漫画専門店](https://imagedelivery.net/QondspN4HIUvB_R16-ddAQ/64dde92640aa6200342e7cc7/d095a5e10484168bb18d.jpg/fit=scale-down,w=1200)