1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証

(税込) 送料込み

商品の説明

商品説明

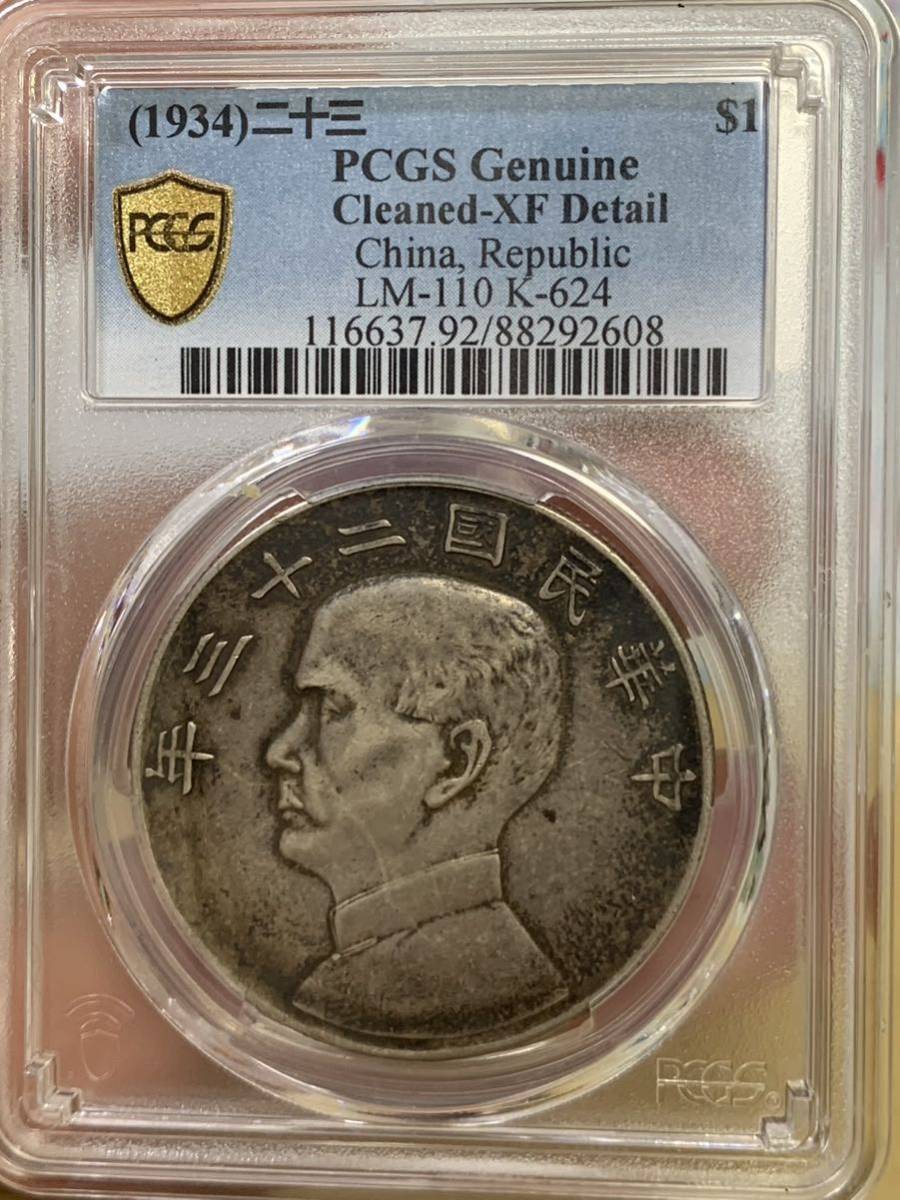

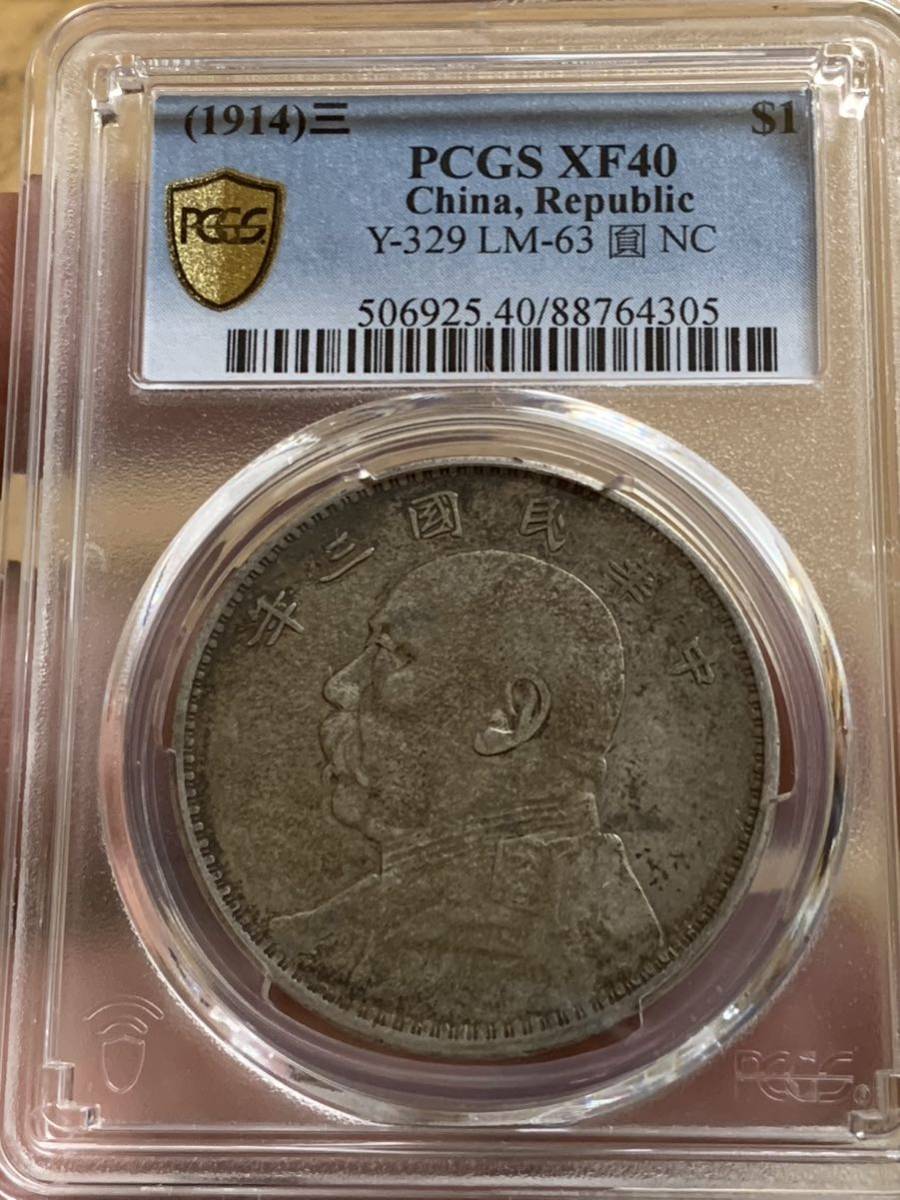

1914年NGC鑑定済中国袁世凱中華民國三年AUDETAILSの中国銀貨です。本物を保証致します。

袁世凱(えんせいがい)

中国・清朝末期から中華民国初期の軍人、政治家。1859年に生まれ清国軍人となり、朝鮮駐留軍を率いて日本と対峙。日清戦争の敗北後、軍の近代化に成果を挙げ宮中の有力者に。1911年の辛亥革命では皇帝を退位させ、中華民国の大総統に就任しました。

【NGC】とはアメリカに本社を置く第三者のコイン鑑定機関です。万全なセキュリティの元で鑑定と管理が行われています。

①鑑定士は全てその道20年以上のベテランが鑑定します。

②1枚のコインを鑑定士1人で鑑定する事は無く、必ず複数の鑑定士が同じコインをチェック。格付けを行います。

③公正な鑑定をする為、鑑定士はコインの売買を禁止されています。ちなみに鑑定士は鑑定するコインが誰の物なのか一切知らされません。公平性を保つ為です。

④鑑定済みのコインは専用スラブケースに封印され全て写真に撮られて登録されます。

配送は追跡が出来て匿名で安心のクロネコヤマトのネコポスにてお支払い翌日に送料無料で発送致します。

22200円1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証エンタメ/ホビー美術品/アンティーク1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証 売り出し1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証 売り出し

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証 - その他

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証 売り出し

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証 売り出し

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証 売り出し

1914年 NGC AU DETAILS 中国 袁世凱 中華民國三年 本物保証 美術品

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証の通販|ラクマ

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証 売り出し

中国古銭 中国銀幣 中華民国三年袁世凱壹圓 NGC鑑定済 斷民版 本物 - 貨幣

NGC AU55 中華民国三年 袁世凱壹圓 (ハネ華)-

PCGS 中華民國壹圓銀貨1914年中華民國三年中華民国古銭中国袁世-

PCGS 中華民國壹圓銀貨1914年中華民國三年中華民国古銭中国袁世-

袁世凱中華民国3年NGC鑑定済み銀貨本物壹圓-

PCGS MS62 袁世凱壹圓中華民国3年中国古銭銀貨-

袁世凱中華民国3年NGC鑑定済み銀貨本物壹圓-

PCGS AU58 袁世凱 壹圓 中華民国9年 中国 古銭 銀貨-

中国古銭 中国銀幣 中華民国三年袁世凱壹圓 NGC鑑定済 斷民版 本物 - 貨幣

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証の通販|ラクマ

新品未読品 中国 袁世凱 中華民国三年 壹圓 一圓銀貨 | everestfin.com

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証の通販|ラクマ

PCGS MS62 袁世凱壹圓中華民国3年中国古銭銀貨-

中国古銭銀貨中華民国九年袁世凱壹圓-

袁世凱中華民国3年NGC鑑定済み銀貨本物壹圓-

中華民国三年袁世凱壹圓銀貨-

NGC鑑定済】壹圓銀貨 PF68中国中国硬貨 中国銅銭 古銭 渡来銭幣

壹圓 中華民国三年 袁世凱 古銭 写真追加あり-

中国古銭 中国銀貨 中華民国三年 袁世凱 壹圓 三角圓 本物 旧貨幣/金貨

1914年 NGC AU DETAILS 中国 袁世凱 中華民國三年 本物保証 美術品

2. 中华民国三年(1914)袁世凯像壹圆银币(L&M-63) | NGC

袁世凱壹圓銀貨中華民國三年海外大型銀貨-

中華民国三年袁世凱壹圓銀貨-

袁世凱 中華民国3年 NGC鑑定済み 銀貨 本物 一円 壹圓

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証 - www

1914年袁世凱像民國三年壹圓近年成交價- 中國金銀幣日誌部落格- udn部落格

1914年 NGC 中国 袁世凱 中華民國三年 AU DETAILS 本物保証の通販|ラクマ

中華民国3年壹圓(袁世凯)

ベストセラー PCGS 十枚當一圓 VF35 銀貨 中国銀貨 中華民国三年 PCGS

中国古銭中華民国袁世凱五年貳角銀幣PCGS鑑定済みXF45本物保証-

PCGS AU58 袁世凱 壹圓 中華民国9年 中国 古銭 銀貨-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

Yuan Shih-Kai L&M-63 Dollar_full.png)