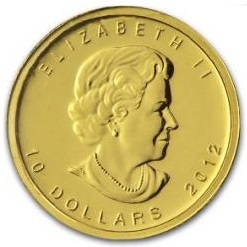

メイプルリーフ金貨 1/10ozt

(税込) 送料込み

商品の説明

商品説明

メイプルリーフ金貨1/10ozt99.99%finegold

値下げ交渉不可

22200円メイプルリーフ金貨 1/10oztエンタメ/ホビー美術品/アンティークエンタメ/ホビーメイプルリーフ金貨 1/10ozt - padrepontoons.com楽天市場】【中古B/標準】 24金 メイプルリーフ 金貨 1/10オンス 1

メイプルリーフ金貨 1/10ozt - siyomamall.tj

楽天市場】【中古A/美品】 24金 メイプルリーフ 金貨 1/10オンス 1

エンタメ/ホビーメイプルリーフ金貨 1/10ozt - padrepontoons.com

メイプルリーフ金貨 1/10オンス ペンダント | 高品質 金・プラチナ

エンタメ/ホビーメイプルリーフ金貨 1/10ozt - padrepontoons.com

メイプルリーフ金貨1/10ozの買取実績 | 買取専門店さすがや

楽天市場】【1枚売り】2022年 カナダ メイプルリーフ金貨 1/10オンス

2022春夏新色】 メイプルリーフ金貨 1/10ozt 貨幣

メープルリーフ金貨1/20oz(オンス)の重さと直径と品位等|色石BANK

K24(24金)の主な金貨|ゴールドプラザのコラム

【送料無料】未使用品 メイプルリーフ 金貨 1/10オンス 純金 24金 3.11g 1/10oz インゴット | 【tomatosarada】トマトサラダ

メイプルリーフ金貨 1/10オンス ペンダント | 高品質 金・プラチナ

楽天市場】未使用品 メイプルリーフ金貨 1/10オンス クリアケース入

1/10oz メープルリーフ コイントップ | 芦屋Antico

メイプルリーフ金貨 1/10オンス ペンダント | 高品質 金・プラチナ

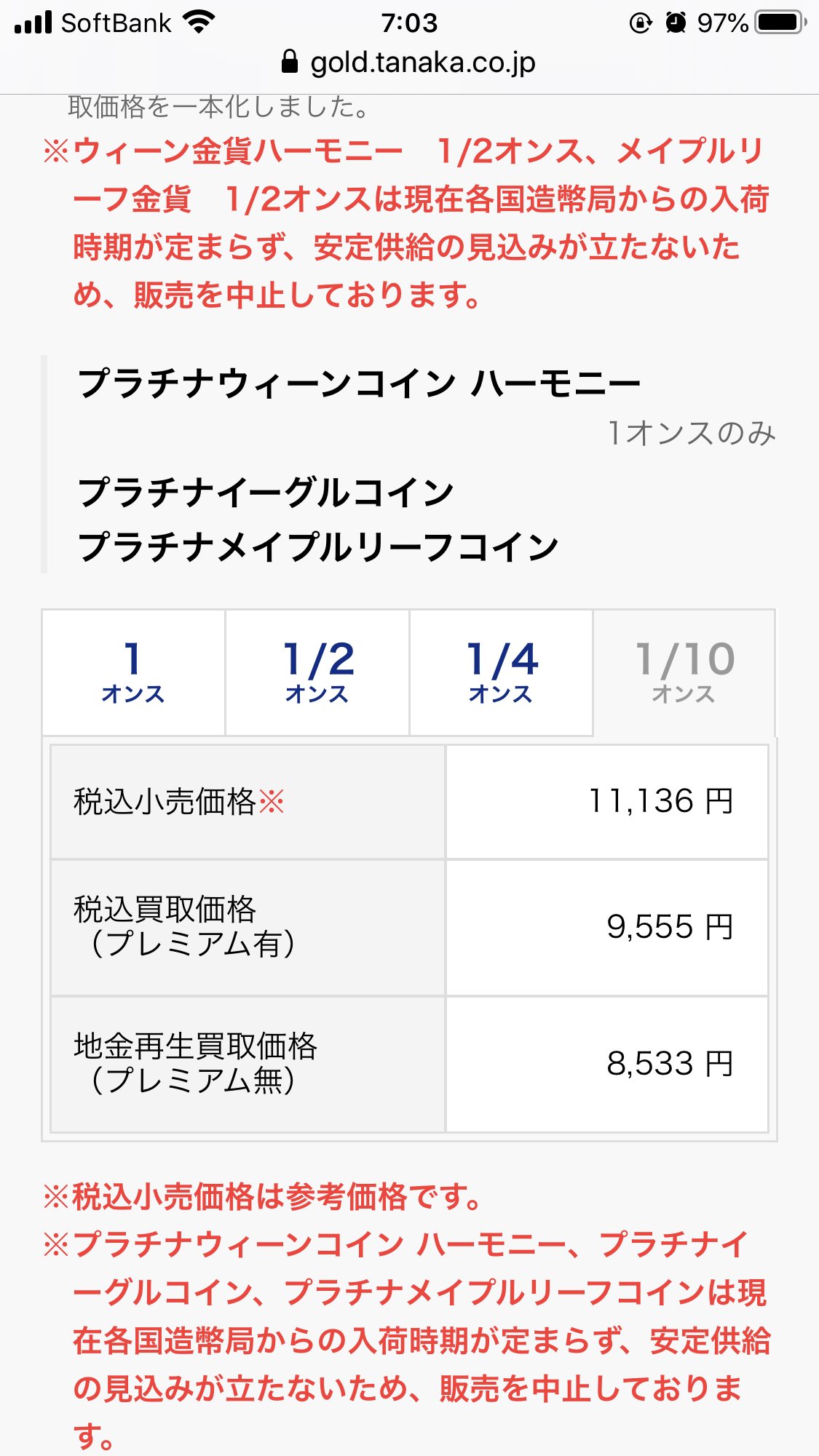

田中貴金属工業株式会社|メイプルリーフ金貨

メイプルリーフ金貨の買取価格一覧|金貨買取本舗

メイプルリーフ金貨の買取価格一覧|金貨買取本舗

メイプルリーフ金貨 1/10オンス ペンダント | 高品質 金・プラチナ

K24(24金)の主な金貨|ゴールドプラザのコラム

メイプルリーフ金貨の買取価格一覧|金貨買取本舗

メイプルリーフ金貨 1/10オンス ダイヤモンド ルビー ペンダント | 高

メイプルリーフ金貨 1/10オンス ペンダント | 高品質 金・プラチナ

メイプルリーフ 1/10オンス 金貨 古銭の人気商品・通販・価格比較

メイプルリーフ金貨の買取価格一覧|金貨買取本舗

国内発送】 トランプ大統領 45代大統領記念銀貨 1オンス 2020 貨幣

田中貴金属工業株式会社|メイプルリーフ金貨

1/10oz メープルリーフ コイントップ | 芦屋Antico

entandet (@pilatusman) / X

プラチナメープルリーフコイン 1/10oz|コイン買取専門 月の金貨

プラチナメープルリーフコイン 1/10oz|コイン買取専門 月の金貨

メイプルリーフ金貨 1/10オンス ペンダント | 高品質 金・プラチナ

楽天市場】メイプルリーフ金貨 1/10オンスの通販

メイプルリーフ 1/10オンス 金貨 古銭の人気商品・通販・価格比較

本日のカナダ 1/10oz メイプルリーフ金貨 5ドル K24(純金・24金)の買取

1/10oz メープルリーフ コイントップ | 芦屋Antico

メイプルリーフ金貨 1/10オンス ペンダントトップ | 高品質 金・プラチナ

楽天市場】【新品】『エジプト王妃ネフェルティティ 純銀 コイン 1/10

在庫限り】 メイプルリーフ 1/10 金貨 貨幣 - www.capitalconsignado

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています