早い者勝ち!お値下げ!9000円!

(税込) 送料込み

商品の説明

商品説明

早い者勝ちです。6/27値下げ!

箱なし簡易包装プチプチのみです。

コーチCOACH

レインブーツ❤︎長靴❤︎

✴︎新品未使用✴︎

アメリカサイズ5

日本サイズ22〜22.5㎝

筒周囲34㎝

底からの全体の長さ35㎝

重さ380g(片足、感覚としては軽いです)

大人、子供用

ブーツはお箱に入れて保管してあったので状態は綺麗です✴︎

お箱は少しよれています。(写真4)

気になる方はまずはお気軽にコメント下さい✴︎

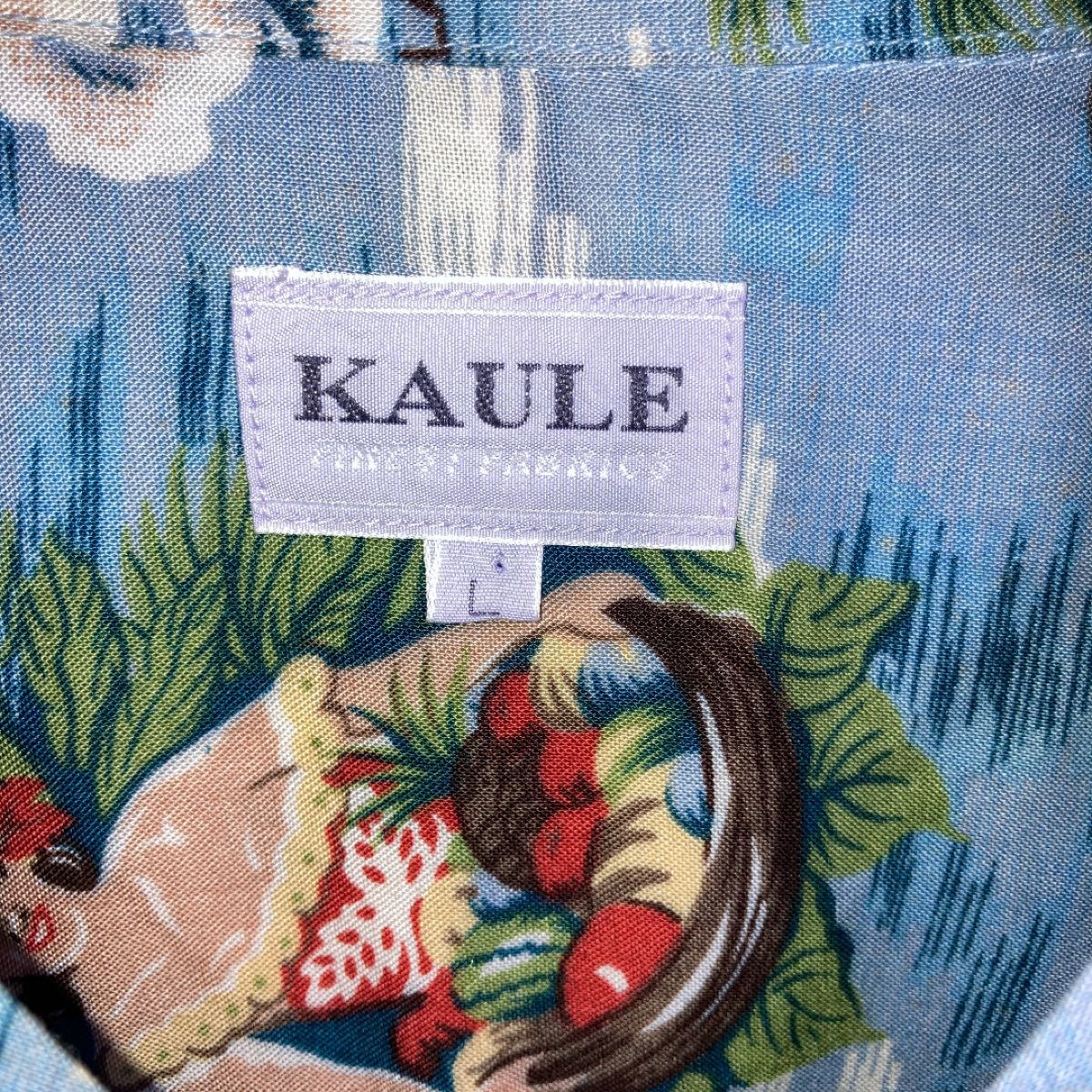

6300円早い者勝ち!お値下げ!9000円!レディース靴/シューズ購入9000円 早い者勝ち お値下げ 新品 アロハシャツ 夏オシャレ ハワイ購入9000円 早い者勝ち お値下げ 新品 アロハシャツ 夏オシャレ ハワイ

購入9000円 早い者勝ち お値下げ 新品 アロハシャツ 夏オシャレ ハワイ

購入9000円 早い者勝ち お値下げ 新品 アロハシャツ 夏オシャレ ハワイ

購入9000円 早い者勝ち お値下げ 新品 アロハシャツ 夏オシャレ ハワイ

購入9000円 早い者勝ち お値下げ 新品 アロハシャツ 夏オシャレ ハワイ

購入9000円 早い者勝ち お値下げ 新品 アロハシャツ 夏オシャレ ハワイ

高騰・早い者勝ち・即購入歓迎・大幅お値下げ不可】ふりそで sr SR

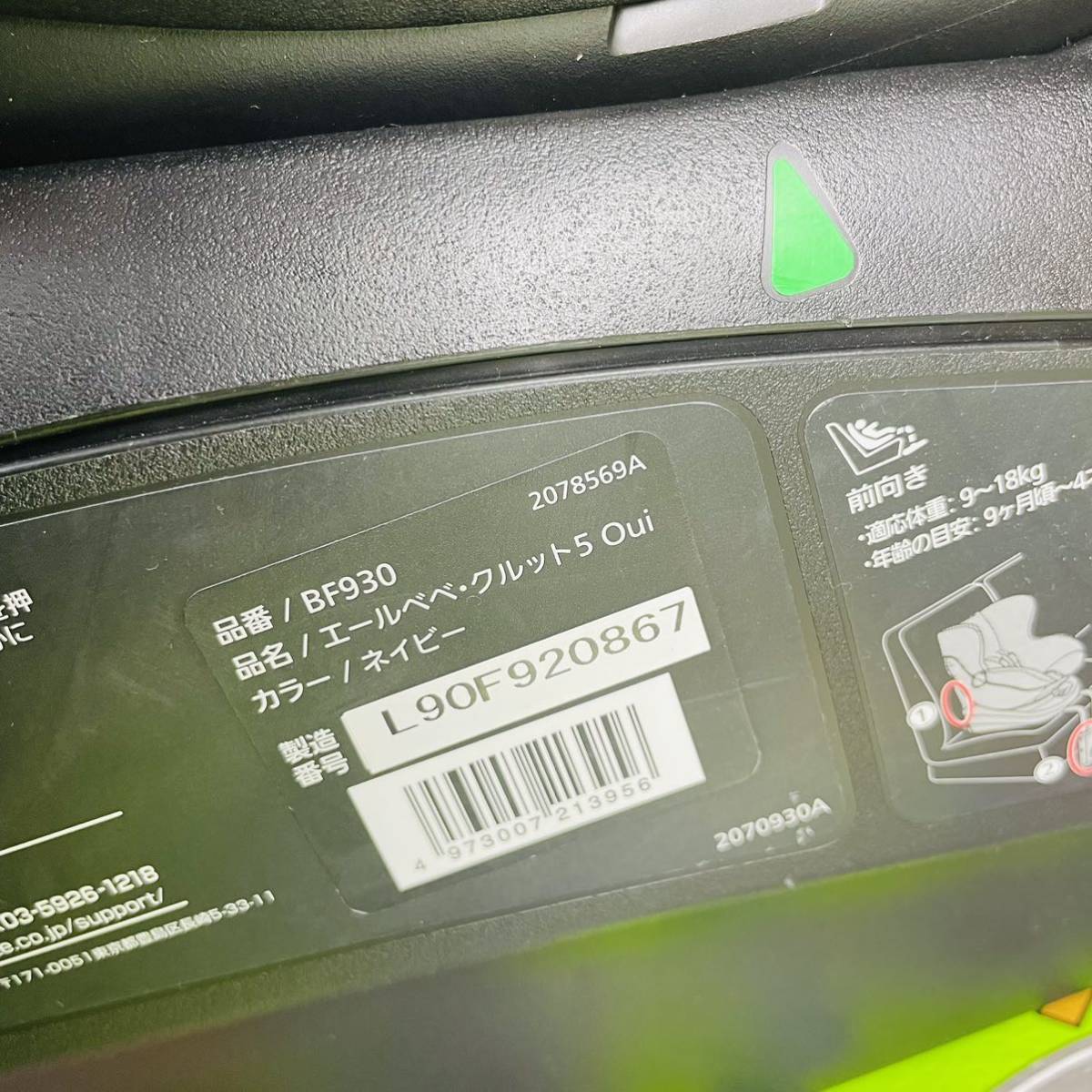

使用5ヶ月程 エールべべ クルット5 oui 付属品完備 チャイルドシート

早い者勝ち!!お値引き可能!A賞 紅き仮面のサイヤ人!リペイント♪

大幅値下げ!早い者勝ち!S級不死 デッドゾーン CS プロモ-

使用5ヶ月程 エールべべ クルット5 oui 付属品完備 チャイルドシート

使用5ヶ月程 エールべべ クルット5 oui 付属品完備 チャイルドシート

使用5ヶ月程 エールべべ クルット5 oui 付属品完備 チャイルドシート

使用5ヶ月程 エールべべ クルット5 oui 付属品完備 チャイルドシート

早い者勝ち!!お値引き可能!A賞 紅き仮面のサイヤ人!リペイント♪

⭐️値下げ可⭐️強キャラ多数‼️早いもの勝ち‼️

早い者勝ち!!お値引き可能!A賞 紅き仮面のサイヤ人!リペイント♪

値下げ交渉ok‼パーティードレス

グラマシーニューヨークまとめ売り(最終値下げ、早い者勝ち) 菓子 ご

早い者勝ち!!お値引き可能!A賞 紅き仮面のサイヤ人!リペイント♪

使用5ヶ月程 エールべべ クルット5 oui 付属品完備 チャイルドシート

グラマシーニューヨークまとめ売り(最終値下げ、早い者勝ち) 菓子 ご

クリアランス 【2/9まで値下げ!即購入ok早い者勝ち】スノーボード

値下げしました!! 早い者勝ち!! TBC エクストラエッセンス-

値下げ交渉ok‼パーティードレス

大幅値下げ!早い者勝ち!S級不死 デッドゾーン CS プロモ-

続々値下げ!】 早い者勝ち 廃盤品伏見桃山城 記念メダル 京都

お値下げ‼︎ ラルフローレン ポインテッド 本革 フラット パンプス

素晴らしい品質 テレビドアフォン Panasonic 早い者勝ち【新品未使用

早い者勝ち!!お値引き可能!A賞 紅き仮面のサイヤ人!リペイント♪

値下げ交渉ok‼パーティードレス

9000円 クリスマス前にお値下げ、早い者勝ちです。 代引き手数料無料

チュッパチャップス 腕時計 ラバーウォッチ レア 希少 コレクション

神宮寺勇太『早い者勝ち!』キンプリツアーグッズ - ミュージック

早い者勝ち!!お値引き可能!A賞 紅き仮面のサイヤ人!リペイント♪

緊急値下げ】angel R ドレス【早い者勝ち】 - ドレス

大幅値下げ!早い者勝ち!S級不死 デッドゾーン CS プロモ-

値下げ交渉ok‼パーティードレス

値下げしました!! 早い者勝ち!! TBC エクストラエッセンス-

早い者勝ち!お値下げしました!【激レア】雨の日限定マグカップ クリスマス 田中千智氏 福岡限定 完売商品

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています