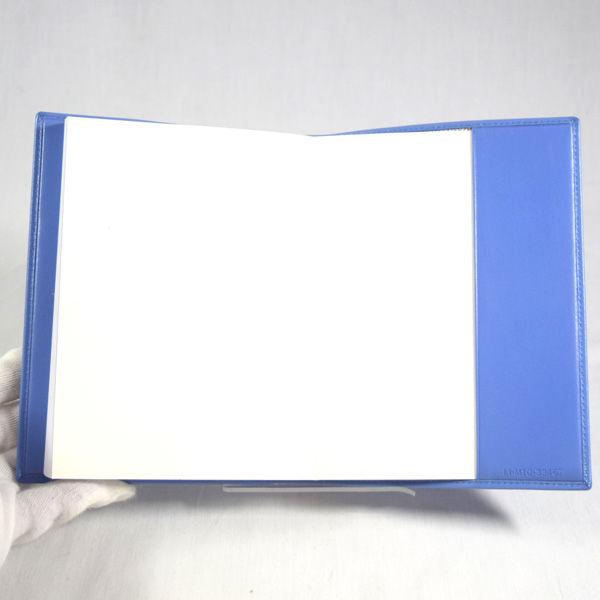

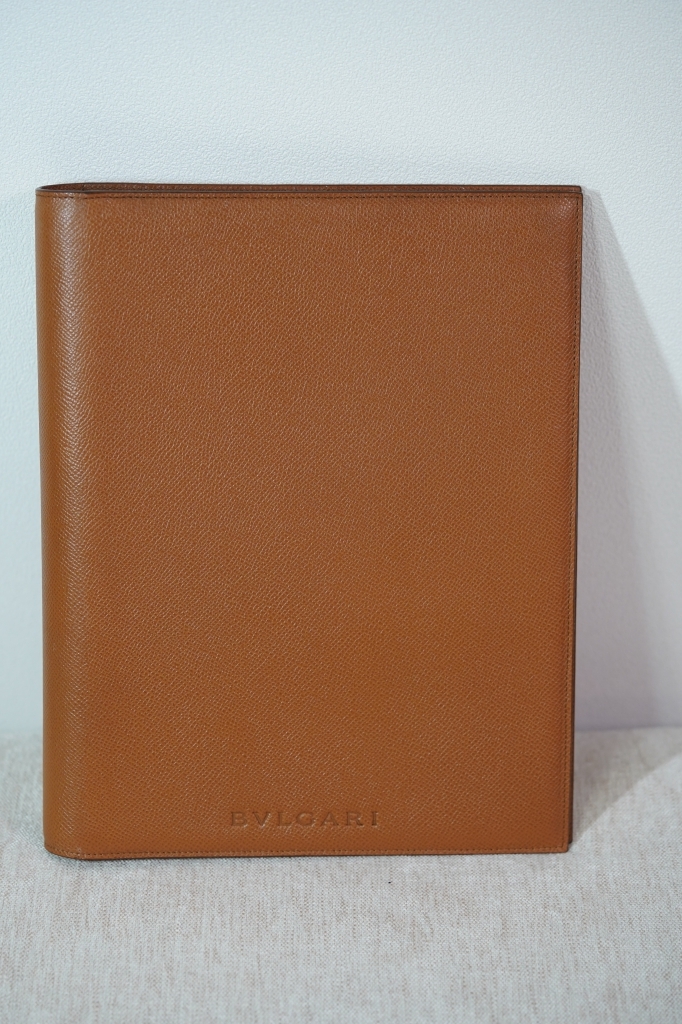

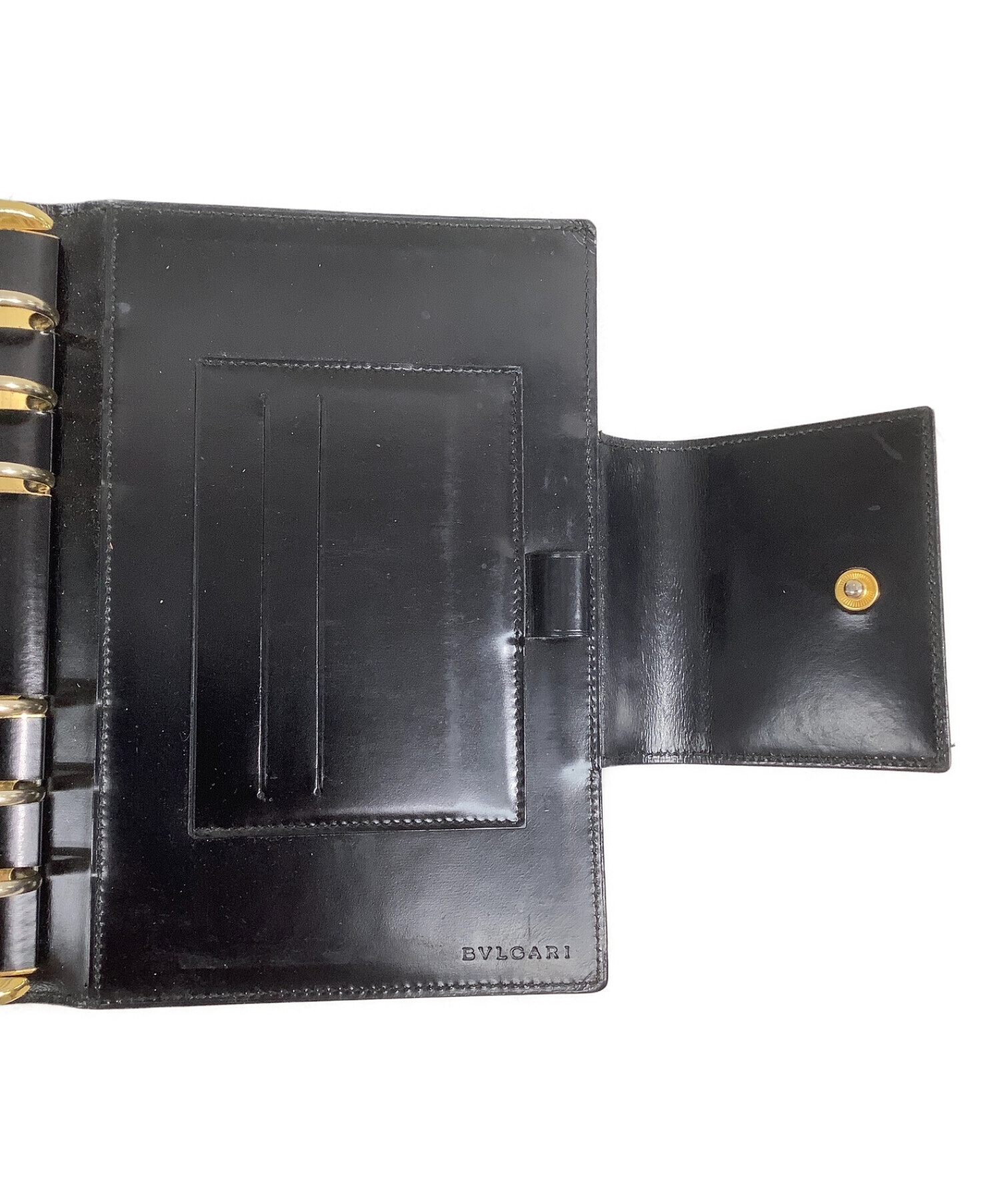

BVLGARI / ブルガリ ■ ノート ノートカバー 手帳 レザー ブルー 手帳 / アドレス / 住所録 ブランド 未使用 [0990010125]

(税込) 送料込み

商品の説明

商品説明

・メーカー:BVLGARI/ブルガリ・サイズ:横幅(約cm):13,奥行(約cm):17,厚み(約cm):2.2,重量(約g):320,

・色(柄)の系統:青系(ブルー)

・デザイン:手帳・アドレス帳

・付属品:箱

--------------------商品状態--------------------

・ランク:S(使用が1~2回程度の使用感がないもの。)

・詳細:きれいな状態で、まだまだ永くご愛用頂けます。

手帳/アドレス/住所録

※写真の色が実物と異なる場合があります

※店頭販売しており販売済の場合があります予めご了承下さい。

MNLT1BMNLT

12114円BVLGARI / ブルガリ ■ ノート ノートカバー 手帳 レザー ブルー 手帳 / アドレス / 住所録 ブランド 未使用 [0990010125]メンズファッション小物BVLGARI / ブルガリ ノート ノートカバー 手帳 レザー ブルー ブランドBVLGARI - BVLGARI / ブルガリ □ ノート ノートカバー 手帳 レザー

BVLGARI / ブルガリ ノート ノートカバー 手帳 レザー ブルー ブランド

BVLGARI / ブルガリ ノート ノートカバー 手帳 レザー ブルー ブランド

BVLGARI / ブルガリ ノート ノートカバー 手帳 レザー ブルー ブランド

BVLGARI / ブルガリ □ノート ノートカバー 手帳 レザー ブルー

BVLGARI / ブルガリ □ ノート ノートカバー 手帳 レザー ブルー 手帳

BVLGARI / ブルガリ □ ノート ノートカバー 手帳 レザー ブルー 手帳

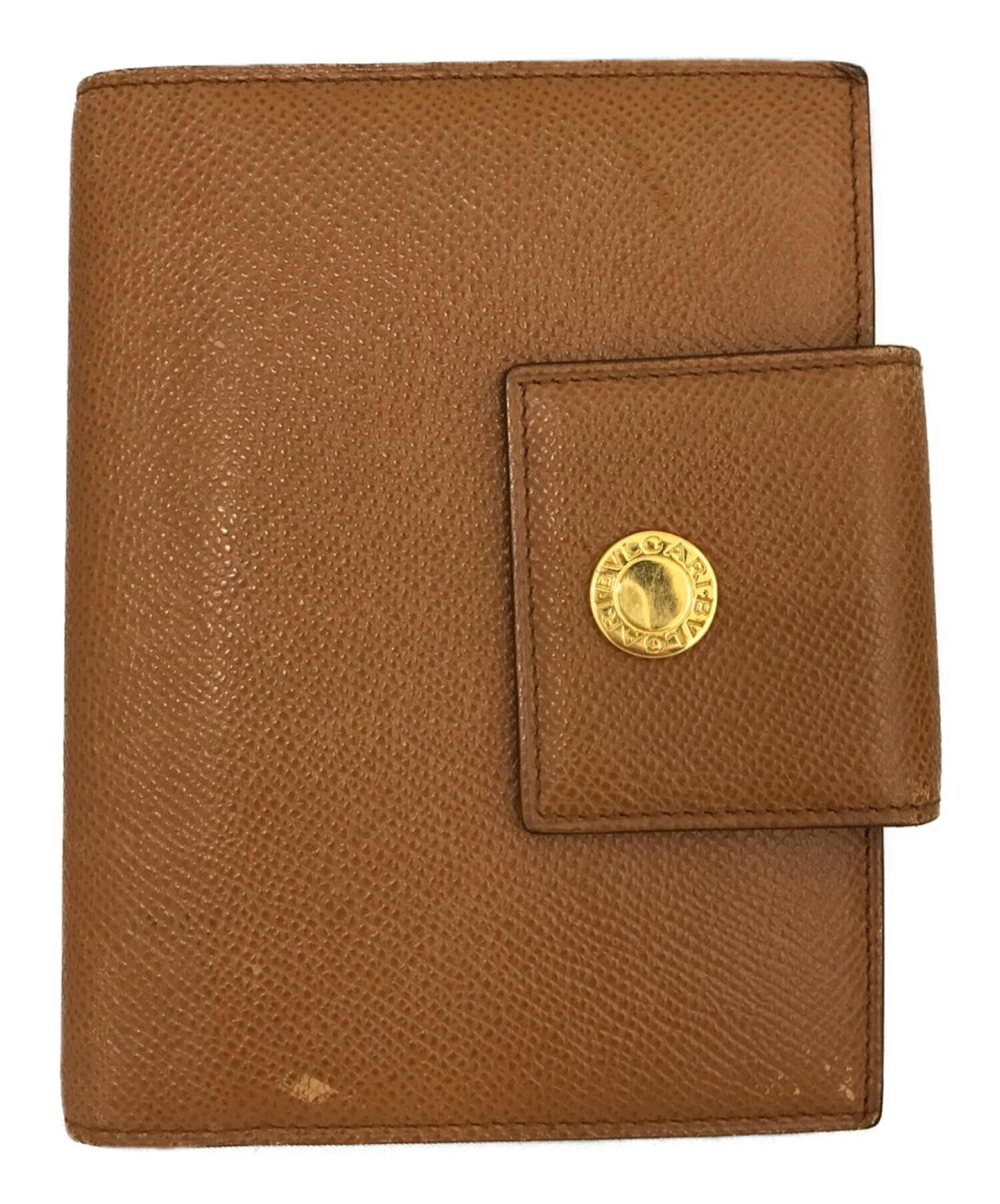

ブルガリ(BVLGARI)システム手帳カバー箱無し - 手帳

ブルガリ 手帳(メンズ)の通販 23点 | BVLGARIのメンズを買うならラクマ

BVLGARI / ブルガリ □ ノート ノートカバー 手帳 レザー ブルー 手帳

BVLGARI ブルガリ 手帳

ブルガリ 手帳の通販 57点 | BVLGARIを買うならラクマ

BVLGARI ブルガリ 手帳

カラー□新品□未使用□ BVLGARI ブルガリ ロゴマニア キャンバス 手帳

ブルガリ 手帳(メンズ)の通販 23点 | BVLGARIのメンズを買うならラクマ

BVLGARI ブルガリ 手帳

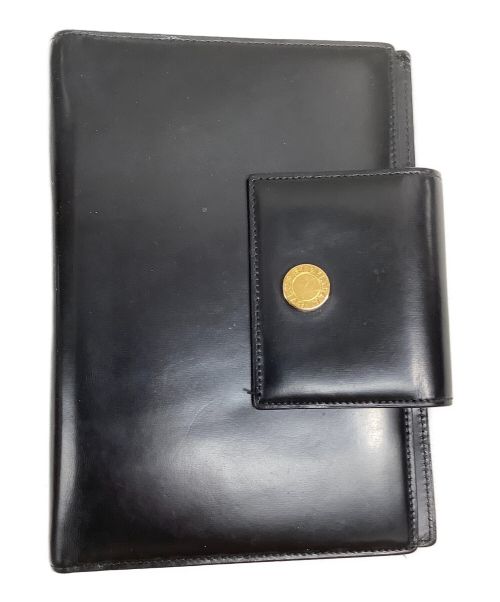

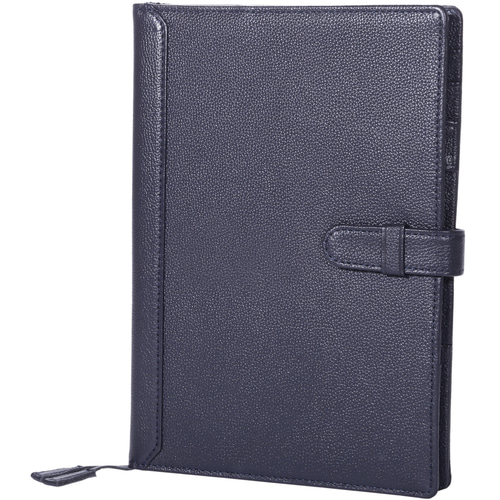

中古・古着通販】BVLGARI (ブルガリ) 手帳カバー ブラック|ブランド

BVLGARI / ブルガリ ノート ノートカバー 手帳 レザー ブルー ブランド

BVLGARI - BVLGARI / ブルガリ □ ノート ノートカバー 手帳 レザー

2024年最新】ブルガリ 手帳カバーの人気アイテム - メルカリ

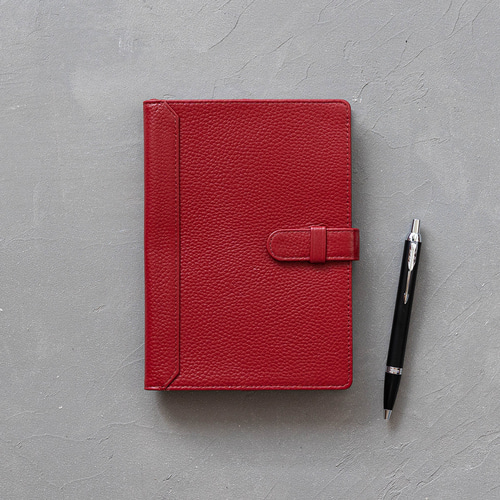

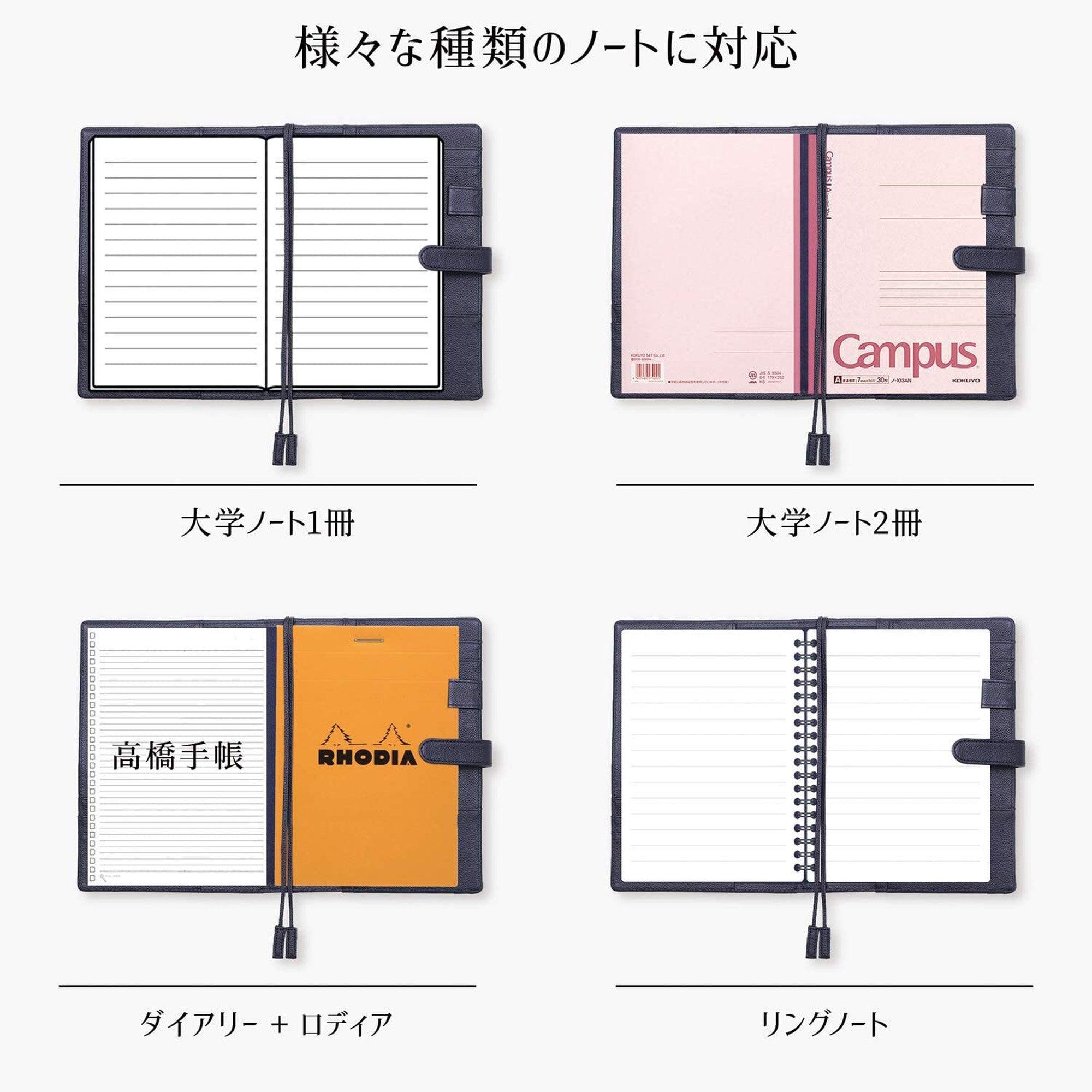

ほぼ日手帳Editにも対応◎】レザーノートカバー B6 本革 手帳カバー

BVLGARI ブルガリ 手帳

BVLGARI / ブルガリ □ ノート ノートカバー 手帳 レザー ブルー 手帳

コスパ◎やる気が出ます】レザーノートカバー A5 本革手帳カバー

2024年最新】ブルガリ 手帳カバーの人気アイテム - メルカリ

ブルガリ 手帳(メンズ)の通販 23点 | BVLGARIのメンズを買うならラクマ

BVLGARI ブルガリ 手帳

中古・古着通販】BVLGARI (ブルガリ) 手帳カバー ブラック|ブランド

ブルガリ 手帳(メンズ)の通販 23点 | BVLGARIのメンズを買うならラクマ

2024年最新】ブルガリ 手帳カバーの人気アイテム - メルカリ

マークジェイコブス MARC JACOBS ラウンドファスナー長財布 レザー

コスパ◎やる気が出ます】レザーノートカバー A5 本革手帳カバー

BVLGARI ブルガリ 手帳

ほぼ日手帳Editにも対応◎】レザーノートカバー B6 本革 手帳カバー

BVLGARI - BVLGARI / ブルガリ □ ノート ノートカバー 手帳 レザー

2024年最新】ブルガリ 手帳カバーの人気アイテム - メルカリ

中古・古着通販】BVLGARI (ブルガリ) 手帳カバー ブラック|ブランド

BVLGARI ブルガリ 手帳

BVLGARI / ブルガリ □ ノート ノートカバー 手帳 レザー ブルー 手帳

ほぼ日手帳Editにも対応◎】レザーノートカバー B6 本革 手帳カバー

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています