ポールスミス コレクション マルチストライプ フローラル バード 花柄シャツ

(税込) 送料込み

商品の説明

商品説明

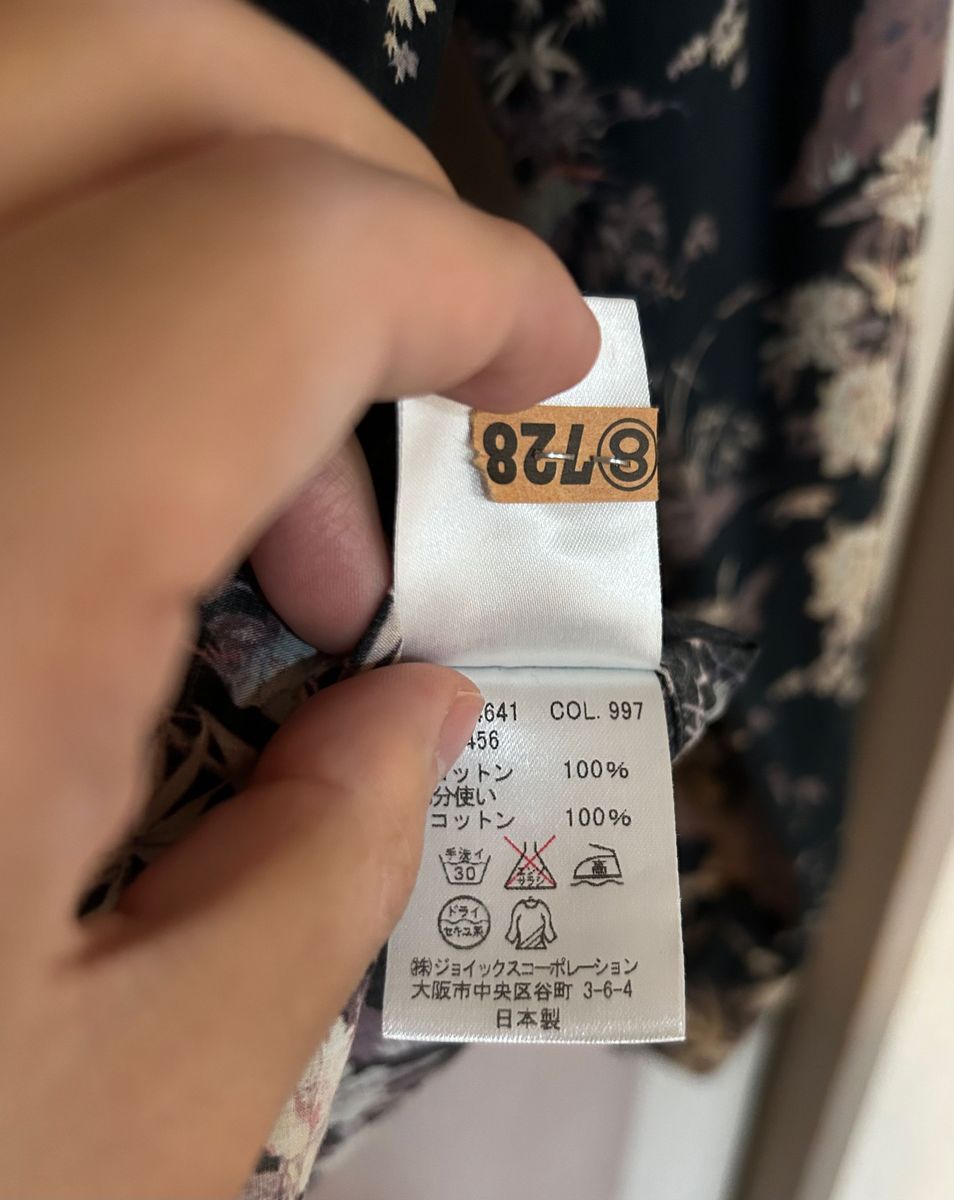

☑︎商品説明・上質なコットン100%を使用して作られた花柄シャツとなります。

鳥と花柄のコントラストが見事で日本画のような和柄がかっこいいデザインとなっております。

ガゼッド部分がマルチストライプなのもポールらしく遊び心のあるアイテムとなります。

☑︎サイズ

・肩幅45

・着丈76

・身幅104

・袖丈59

☑︎使用感/状態

・少し使用感は見られますが、全体的に綺麗です。

・古着なので神経質な方はご遠慮下さい。

☑︎購入店舗

・on-lineshop

☑︎ショッパー/箱の有無

・無し

9750円ポールスミス コレクション マルチストライプ フローラル バード 花柄シャツメンズトップスPaul Smith COLLECTION - ポールスミス コレクション マルチストライプPaul Smith COLLECTION - ポールスミス コレクション マルチストライプ

ポールスミス コレクション マルチストライプ フローラル バード 花柄シャツ

ポールスミス コレクション マルチストライプ フローラル バード 花柄シャツ

Paul Smith COLLECTION - ポールスミス コレクション マルチストライプ

Paul Smith COLLECTION - ポールスミス コレクション マルチストライプ

超特価セール ポールスミス 長袖カジュアルシャツ M バードフローラル

ポールスミス シャツ(メンズ)(花柄)の通販 1,000点以上 | Paul Smith

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

サイズポールスミス コレクション マルチストライプ フローラル バード

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

Paul Smith COLLECTION - ポールスミス コレクション マルチストライプ

ポールスミス ハート シャツ(メンズ)の通販 46点 | Paul Smithのメンズ

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

ポールスミス マルチストライプ バルーン&ボタニカル 花柄シャツ

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

ポールスミス マルチストライプ バルーン&ボタニカル 花柄シャツ

Paul Smith COLLECTION - ポールスミス コレクション マルチストライプ

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

Paul Smith COLLECTION - ポールスミス コレクション マルチストライプ

特急 ポールスミス コレクション マルチストライプ フローラル バード

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

Paul Smith COLLECTION - ポールスミス コレクション マルチストライプ

ポールスミス マルチストライプ バルーン&ボタニカル 花柄シャツ

ポールスミス シャツ(メンズ)(花柄)の通販 1,000点以上 | Paul Smith

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

Paul Smith COLLECTION - ポールスミス コレクション マルチストライプ

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

特急 ポールスミス コレクション マルチストライプ フローラル バード

ポールスミス 長袖シャツ 花柄 マルチカラー - www.sorbillomenu.com

ポールスミス シャツ(メンズ)(花柄)の通販 1,000点以上 | Paul Smith

Paul Smith ONLINE SHOP|ポール・スミス

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

Paul Smith ONLINE SHOP|ポール・スミス

ポールスミス シャツ(メンズ)(花柄)の通販 1,000点以上 | Paul Smith

2024年最新】ポールスミス マルチ ストライプ シャツの人気アイテム

Paul Smith(ポールスミス)の「マルチストライプシャツ / 103309

値頃 美品 ポールスミス ブリティッシュコレクション マルチストライプ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています