エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ブランド小物 ラ

(税込) 送料込み

商品の説明

商品説明

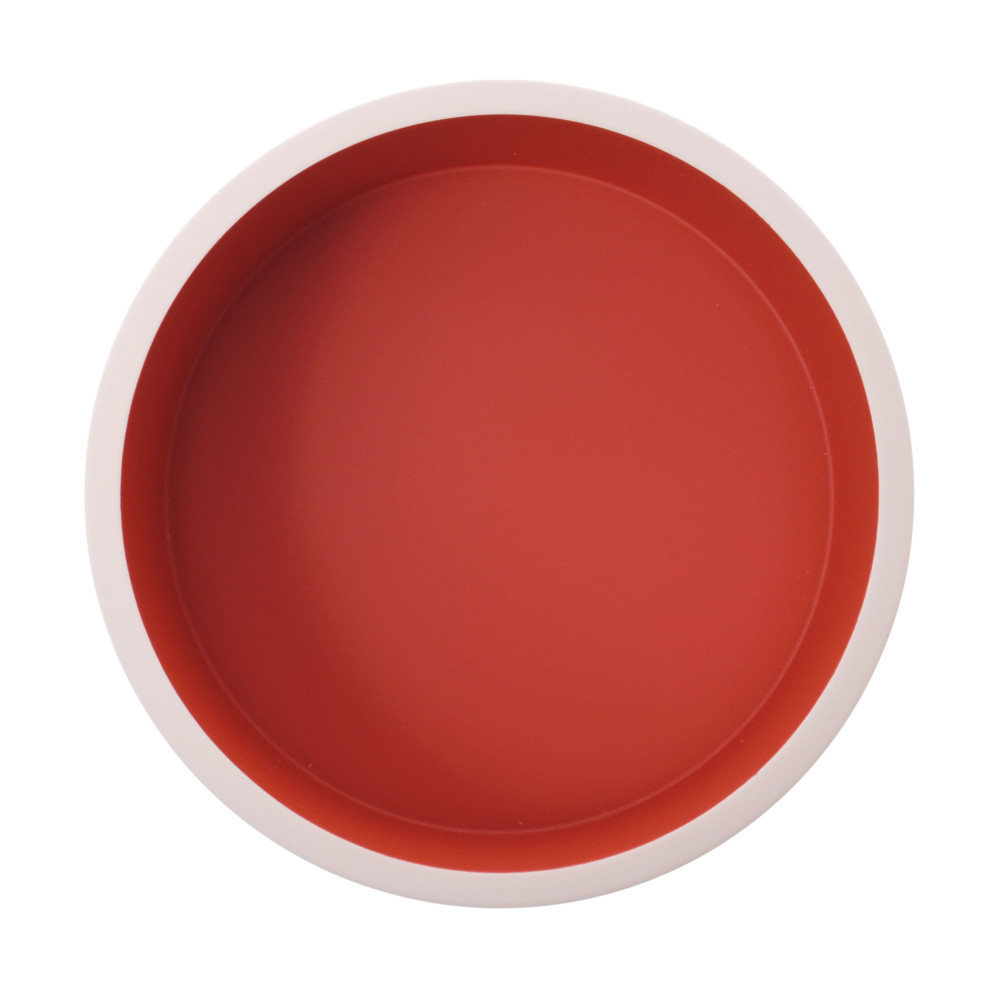

【管理番号】898000002334000エルメスよりちょっとした小物を入れておくのに最適なヴィドポッシュブドワール。

こちらはラッカー加工を施した木製の蓋付きの小物入れです。

玄関やオフィスなど、インテリアとしてラグジュアリー感を高めてくれるアイテムです。

※写真と記載内容をご確認いただき、ご理解の上ご購入手続きをお願いいたします。

イメージ違い、サイズ違いなどによる返品はお受けできません。

H:約7.5cm(最大)xW:約11.6cmxD:約11.6cm

素材:ラッカーウッド

カラー:ライトグレーピンク系/赤系

付属品:箱

状態:破損状態付属品:ダメージ:小

外装:特に目立つダメージのない新品です。店頭販売を行っておりますので展示新品とお考えください。

内装:-

こちらの商品はラクマ公式パートナーの銀蔵によって出品されています。

21780円エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ブランド小物 ラインテリア/住まい/日用品インテリア小物エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ブランド小物 ラHermes - エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ

楽天市場】HERMES エルメス ヴィドポッシュ ブドワール 蓋付き 小物

HERMES エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ライトグレーピンク系/赤系 ユニセックス ラッカーウッド ブランド小物 新品 銀蔵 | 銀蔵・楽天市場店

エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ブランド小物 ラ

エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ブランド小物 ラ-

特別セール エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ

HERMES エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ライトグレーピンク系/赤系 ユニセックス ラッカーウッド ブランド小物 新品 銀蔵 | 銀蔵・楽天市場店

エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ブランド小物 ラ

エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ブランド小物 ラ-

エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ブランド小物 ラ

HERMES エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ ライトグレーピンク系/赤系 ユニセックス ラッカーウッド ブランド小物 新品 銀蔵 | 銀蔵・楽天市場店

エルメスヴィド ポッシュ 小物入れ レザートレイ オレンジ シルバー

今日の超目玉 訳あり エルメス ブドワール 小物入れ トレー | paraco.ge

Hermes - エルメス ヴィドポッシュ ブドワール 蓋付き 小物入れ

エルメス HERMES ヴィド・ポッシュ レザー 正方形 小物入れ トレイ

楽天市場】HERMES エルメス ヴィドポッシュ ブドワール 蓋付き 小物

ショッピング大特価祭 エルメス ヴィドポッシュ レザー トレー 小物

エルメス(HERMES)ヴィド|ポッシュ|ミニ|トレイ|小物入れ|レザー|ダークブラウン|ハイブランド・ブランド専門の中古通販サイト(91573)

長期納期 新品 エルメス ボックス エポぺGM 小物入れ

HERMES(エルメス) 小物入れ(トレイ)(ライフスタイル) 3ページ目 - 海外

長期納期 新品 エルメス ボックス エポぺGM 小物入れ

今日の超目玉 訳あり エルメス ブドワール 小物入れ トレー | paraco.ge

新品 未使用品 エルメス HERMES ヴィド ポッシュミニ トレー ゴールド 小物ケース【中古】5146 : 5146 : スターマイン - 通販 - Yahoo!ショッピング

HERMES(エルメス) 小物入れ(トレイ)(ライフスタイル) 3ページ目 - 海外

エルメスヴィドポッシュ 小物入れ トレイ 馬柄 ピンク ユニセックス

お気に入り】 トールペイント作品 小物入れ 仕切り 持ち手付き 小物

2024年最新】ミニ・ヴィド・ポッシュの人気アイテム - メルカリ

今日の超目玉 訳あり エルメス ブドワール 小物入れ トレー | paraco.ge

HERMES(エルメス) 小物入れ(トレイ)(ライフスタイル) 3ページ目 - 海外

夏セール開催中 MAX80%OFF! リモージュボックス 花屋のカート 小物

エルメス HERMES ヴィド・ポッシュ レザー 正方形 小物入れ トレイ

エルメスヴィドポッシュ 小物入れ トレイ 馬柄 ピンク ユニセックス

エルメス 小物入れの通販 200点以上 | Hermesのインテリア/住まい

約200x230枕カバー2点ワイドダブル ベッド用品4点セット .寝具 枕

HERMES(エルメス) 小物入れ(トレイ)(ライフスタイル) 3ページ目 - 海外

HERMES 小物入れ-

長期納期 新品 エルメス ボックス エポぺGM 小物入れ

エルメスヴィドポッシュ 小物入れ トレイ 馬柄 ピンク ユニセックス

発売済 幻!!非売品 イマンダイアナローズ ピアノ型小物入れ 小物入れ

小物入れエルメス ヴィドポッシュ レザー トレー

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています