SONY XQDカード 64GB QD-G64E

(税込) 送料込み

商品の説明

商品説明

SONYXQDカード64GBになります。買い替えの為出品します。

読み書きに不具合はありませんでした。

フォーマット済みです。

クリックポストにて発送させていただきます。

すぐには発送できませんので、お急ぎの方はご購入をご遠慮ください。

6825円SONY XQDカード 64GB QD-G64Eスマホ/家電/カメラカメラ(中古)SONY (ソニー) XQDメモリーカード Gシリーズ 64GB QD-G64E(商品ID:3717017845964)詳細ページ | デジタルカメラ、ミラーレスカメラ、交換レンズの総合サイト|マップカメラソニー XQDメモリーカード 64GB QD-G64E J

ソニー XQDメモリーカード 64GB QD-G64E J

Gシリーズ | 記録メディア | ソニー

(中古)SONY (ソニー) XQDメモリーカード Gシリーズ 64GB QD-G64E(商品ID:3717017845964)詳細ページ | デジタルカメラ、ミラーレスカメラ、交換レンズの総合サイト|マップカメラ

ソニー XQDメモリーカード 64GB QD-G64E J

SONY XQDカード64G & リーダーの+inforsante.fr

超お買い得! XQDカード sony xqdメモリーカード」の落札相場・落札

ソニーu3000SONY XQD 64GB QD-G64E メモリーカード 商品の状態 大阪大

SONY XQDカード 64GB QD-G64E ② 美品 ソニー ニコン等に 日本に 3572

Amazon.com: Sony Professional XQD G Series 64GB Memory Card

2024年最新】○◇ソニー QD-G64E XQDメモリーカード 64GBの人気

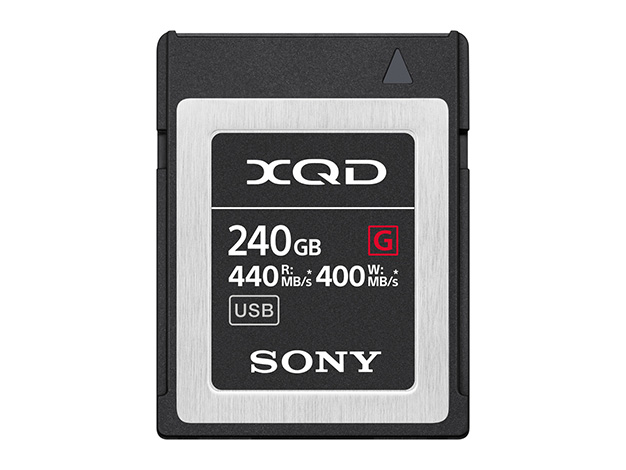

SONY(ソニー) XQDメモリーカード 240GB QD-G240F(QDG240F)(240GB

SONY XQDカード 64GB QD-G64 - カメラ

中古品】SONY QD-G64E XQDメモリーカード Gシリーズ 64GB - 業務用撮影

サイズ交換OK】 SONY XQDカード 64GB QD-G64E | www.butiuae.com

SONY|XQD|HARDOFFオフモール(オフモ)|2013790000101161

ソニーu3000SONY XQD 64GB QD-G64E メモリーカード 商品の状態 大阪大

SONY (ソニー) XQDメモリーカード Gシリーズ 64GB QD-G64E

Amazon.com: Sony Professional XQD G Series 64GB Memory Card (QD

SONY QD-G64E [64GB] 価格比較 - 価格.com

2024年最新】○◇ソニー QD-G64E XQDメモリーカード 64GBの人気

Yahoo!オークション -「ソニー 64gb xqdメモリーカード qd-g64e」の

中古)SONY (ソニー) XQDメモリーカード Gシリーズ 64GB QD-G64E(商品

オンライン取寄 ソニー SONY XQD 64GB QD-G64E メモリカード 箱付き

QD-G64E [XQDメモリーカード Gシリーズ 64GB]: 中古(フジヤカメラ

2024年最新】○◇ソニー QD-G64E XQDメモリーカード 64GBの人気

Amazon | ソニー XQDメモリーカード 64GB QD-G64E J | ソニー(SONY

廃盤商品 Sony XQDメモリーカード QD-G64E 64G aylu.es

SONY (ソニー) XQDメモリーカード Gシリーズ 64GB QD-G64E

ヨドバシ.com - ソニー SONY QD-G64F [XQDメモリーカード 64GB] 通販

2024年最新】ソニー SONY XQDメモリーカード 64GB QD-G64E Jの人気

格安販売 SONY XQDカード 64GB | artfive.co.jp

SONY XQDメモリーカード QD-G64Eの通販 5点 | フリマアプリ ラクマ

SONY - SONY XQDカード 120GBの+solo-truck.eu

中古品】SONY QD-G64E XQDメモリーカード Gシリーズ 64GB - 業務用撮影

SONY QD-G64E [64GB] 価格比較 - 価格.com

SONY XQDカード64G & リーダーの+inforsante.fr

Amazon | ソニー XQDメモリーカード 64GB QD-G64E J | ソニー(SONY

SONY|XQD|HARDOFFオフモール(オフモ)|2013790000101161

SONY XQDメモリーカード QD-G64Eの通販 5点 | フリマアプリ ラクマ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![SONY QD-G64E [64GB] 価格比較 - 価格.com](https://bbsimg03.kakaku.k-img.com/images/smartphone/icv/3330229_l.jpg)

![QD-G64E [XQDメモリーカード Gシリーズ 64GB]: 中古(フジヤカメラ](https://www.fujiya-camera.co.jp/img/goods/3/C2120127757279_3.jpg)

![ヨドバシ.com - ソニー SONY QD-G64F [XQDメモリーカード 64GB] 通販](https://image.yodobashi.com/product/100/000/001/005/247/591/100000001005247591_10208_001.jpg)

![SONY QD-G64E [64GB] 価格比較 - 価格.com](https://bbsimg03.kakaku.k-img.com/images/smartphone/icv/3330228_l.jpg)