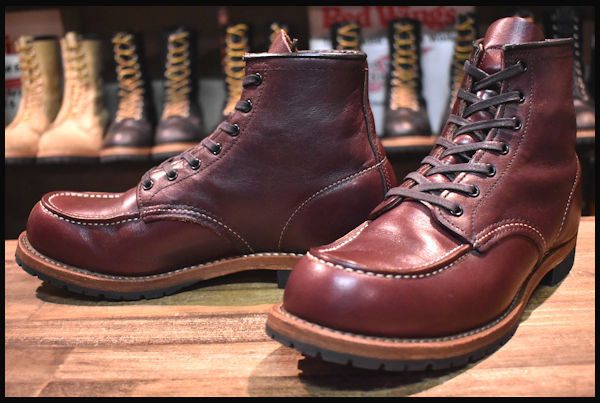

redwing 9010 レッドウイング ベックマン モックトゥ

(税込) 送料込み

商品の説明

商品説明

スペックアッパー:BLACKCHERRY"FEATHERSTONE"(ブラックチェリーフェザーストーン)

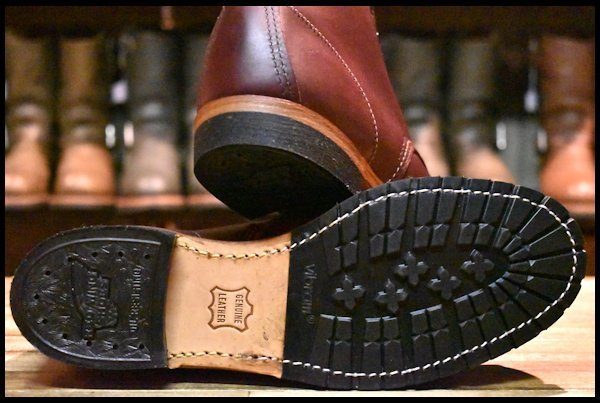

ソール:ビブラムソール交換

ワイズ:D

生産国:アメリカ

足入れ:レッドウィングは一般的なスニーカーサイズと比べ大きめに作られております。

サイズusa6uk7eur40.5

(スニーカーサイズ27cm相当)

使用頻度が低かったので美品かと思ます。

取引後のクレーム、返品は受けかねます。

中古にご理解のない方、神経質な方は購入をお控え下さい。

匿名配送利用、当方送料負担のため配送は可能な限りコンパクトにさせていただきますのでご了承下さい。

プロフィールも合わせてご確認下さい。

#レッドウイング

#redwing

#ベックマン

#Beckmann

#9010

#モックトゥ

#Schott

#バイク

#bike

#ブーツ

#ビブラムソール

#Vibram

14880円redwing 9010 レッドウイング ベックマン モックトゥメンズ靴/シューズレッドウィング ベックマン 9010 26.5cm - ブーツredwing レッドウィング ベックマン 9010 - ブーツ

redwing レッドウィング ベックマン 9010 - ブーツ

redwing レッドウィング ベックマン 9010 - ブーツ

レッドウィング ベックマン 9010 26.5cm - ブーツ

redwing レッドウィング ベックマン 9010 - ブーツ

レッドウィング ベックマン 9010 26.5cm - ブーツ

redwing レッドウィング ベックマン 9010 - ブーツ

公式通販サイト特価 redwing 9010 レッドウイング ベックマン

公式通販サイト特価 redwing 9010 レッドウイング ベックマン

9010良品7.5D/レッドウィングベックマンブラックチェリーフェザー

公式通販サイト特価 redwing 9010 レッドウイング ベックマン

美品】8D RED WINGレッドウィング9010ベックマン ブラックチェリー

RED WING 9010 US7D 25cm ベックマン モックトゥ - ブーツ

レッドウィング ベックマン モックトゥ 9010 美品 ❗ レッドウィング

お買い得パック 【廃盤】RED WING 9010 ベックマン | www.ouni.org

RED WING ベックマン 9010 モックトゥ ブラックチェリー-

レッドウィング ベックマン モックトゥ 9010 美品 ❗ レッドウィング

9010redwing 9010 レッドウイング ベックマン モックトゥ - ブーツ

レッドウィング 8282 100周年モデル ベックマン モックトゥ ブーツ

未使用]RED WING 9010 BECKMAN MOC TOE BOOTS (ベックマンモックトゥ

お買い得パック 【廃盤】RED WING 9010 ベックマン | www.ouni.org

未使用]RED WING 9010 BECKMAN MOC TOE BOOTS (ベックマンモックトゥ

レッドウィング ベックマン モックトゥ 9010 美品 ❗ レッドウィング

公式通販サイト特価 redwing 9010 レッドウイング ベックマン

公式通販サイト特価 redwing 9010 レッドウイング ベックマン

ケース付】☆レッドウイング ベックマン No,9013 26.0cm ブラウン - ブーツ

レッドウィング ベックマン モックトゥ 9010 美品 ❗ レッドウィング

RED WING 9010 US7D 25cm ベックマン モックトゥ - ブーツ

公式通販サイト特価 redwing 9010 レッドウイング ベックマン

RED WING ベックマン 9010 モックトゥ ブラックチェリー-

RED WING 9010 US7D 25cm ベックマン モックトゥ - ブーツ

Red Wing レッドウィング 9010ベックマン 26.5cm - ブーツ

公式通販サイト特価 redwing 9010 レッドウイング ベックマン

ロシア大手銀行 redwing 9010 レッドウイング ベックマン 26.5cm US8

REDWING - redwing 9010 レッドウイング ベックマン モックトゥの通販

RED WING ベックマン 9010 モックトゥ ブラックチェリー-

3人目の #ベックマン 入手しました🙌 #beckmanboots#featherstone

商売 レッドウィング ベックマン モックトゥ | www.quimtex1.com.ar

RED WING(レッドウィング) / レースアップブーツ・ベックマン

REDWING MOC TOE BECKMAN BOOTS #9010 〔レッドウィング モック トゥ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています