デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルクネクタイ

(税込) 送料込み

商品の説明

商品説明

上質なヴィンテージ紳士衣料を多く出品いたします!サイズに関してはカテゴリを参考にせず、実寸をご覧ください。[概要]

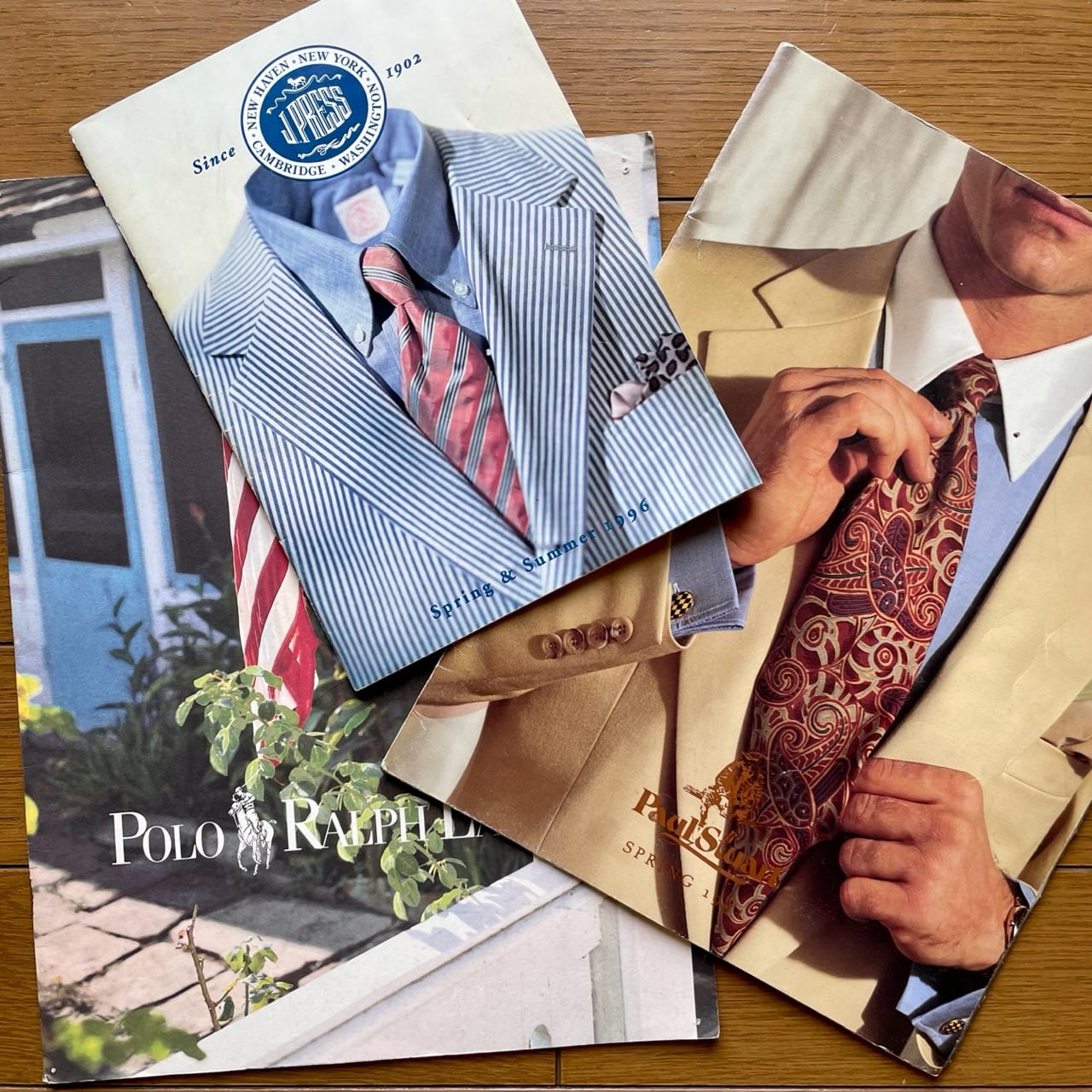

-大変希少な最初期の60sのポロラルフローレンです。ネクタイで名を挙げたブランドですので最初期のネクタイは傑作揃いですが、その中でもこちらは特に魅力的な一本です。

-畝の表情が素晴らしい肉厚で弾力のあるシルクが使われています。

-今ではありえない英国手染めの風合いがよく出ています。絵筆で描いたようなペイズリー柄が当時のハツラツとした雰囲気を今に伝えています。春夏にベージュなどの、アースカラーを使ったジャケットと合わせると素敵かと思います。

[状態]

着用感がないのでデッドストックと判断いたしました。

##phot02678

12096円デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルクネクタイメンズファッション小物デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルクデッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

phot02644希少 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

Yahoo!オークション - ネクタイの最高峰 ポロラルフローレン 60s

販売公式 デッドストック 最初期ポロラルフローレン 60sヴィンテージ

時間指定不可 最初期ポロラルフローレン 最初期ポロラルフローレン 60s

デッドストック USAヴィンテージ シルクジャガード 60s ネクタイ

初期ポロラルフローレン シルクネクタイ ブルー ブレザー 70s

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

時間指定不可 最初期ポロラルフローレン 最初期ポロラルフローレン 60s

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

とんでもなく重厚で華やか 最初期ポロラルフローレン 60sヴィンテージ-

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

公式オンラインストア& 最初期ポロラルフローレン 60sヴィンテージ

最初期ポロラルフローレン レジメンタルストライプ シルクネクタイ-

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

最初期ポロラルフローレン レジメンタルストライプ シルクネクタイ-

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

デッドストック 最初期ポロラルフローレン シルクネクタイ ブラウン

デッドストック スペシャル 最初期ポロラルフローレン 英国手染め

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

時間指定不可 最初期ポロラルフローレン 最初期ポロラルフローレン 60s

デッドストック USAヴィンテージ シルクジャガード 60s ネクタイ

デッドストック スペシャル 最初期ポロラルフローレン 英国手染め

超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ

最初期ポロラルフローレン レジメンタルストライプ シルクネクタイ-

デッドストック 最初期ポロラルフローレン 60sヴィンテージ シルク

公式オンラインストア& 最初期ポロラルフローレン 60sヴィンテージ

初期ポロラルフローレン シルクネクタイ ブルー ブレザー 70s

デッドストック USAヴィンテージ シルクジャガード 60s ネクタイ

デッドストック ポロラルフローレン 60s 70s ヴィンテージ ネクタイ

2024年最新】ポロ ラルフローレン ネクタイの人気アイテム - メルカリ

時間指定不可 最初期ポロラルフローレン 最初期ポロラルフローレン 60s

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています