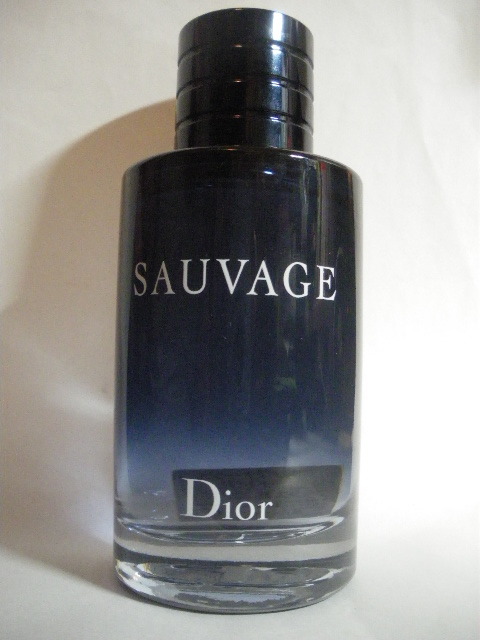

香水 クリスチャンディオール SAUVAGE Dior 100mL

(税込) 送料込み

商品の説明

商品説明

香水クリスチャンディオールSAUVAGEソバージュDior100mLオードゥトワレ開封のみ

定価15,120円

送料込み

ジョニーデップがCMしている香水です。

三代目JSoulBrothersも使用している大人気香水になります。

7475円香水 クリスチャンディオール SAUVAGE Dior 100mLコスメ/美容香水EDTSPクリスチャン ディオール Dior ソヴァージュ EDT 100ml - 香水香水Dior クリスチャン ディオール ソヴァージュ100ml送料込 香水

Amazon.co.jp: クリスチャンディオール Christian Dior ソヴァージュ

DIOR】 ソヴァージュ(ソバージュ/SAUVAGE) - メンズフレグランス・香水

EDTSPクリスチャン ディオール Dior ソヴァージュ EDT 100ml - 香水

新品 クリスチャン ディオール ソバージュ パルファン 100ml - 香水

クリスチャン ディオール ソバージュ パルファン 100ml - 香水(男性用)

DIOR】 ソヴァージュ オードゥ パルファン - フレグランス

DIOR】 ソヴァージュ(ソバージュ/SAUVAGE) - メンズフレグランス・香水

DIOR クリスチャン ディオール ソヴァージュ EDP SP 100ml - ユニセックス

クリスチャンディオール ソヴァージュ オードトワレ 100mL EDT SP 香水 ディオール : 3348901250146 : コスメスタイルセレクトストア - 通販 - Yahoo!ショッピング

楽天市場】【最大1,000円offクーポン】クリスチャン ディオール Dior

香水クリスチャン ディオール ソヴァージュ アフターシェーブ

EDTSPクリスチャン ディオール Dior ソヴァージュ EDT 100ml - 香水

SAUVAGE 100ml メンズ 香水 Christian Dior - 香水(男性用)

Amazon.co.jp: Christian Dior CHRISTIAN DIOR Sauvage Eau De Parfum

DIOR】 ソヴァージュ オードゥ トワレ - フレグランス

楽天市場】クリスチャン ディオール CHRISTIAN DIOR ソヴァージュ

新品 クリスチャン ディオール ソヴァージュ EDT SP 100ml 香水 - 香水

公式】 残8割 クリスチャンディオール 香水 メンズ ソヴァージュ

新品未開封 クリスチャン ディオール ソヴァージュ 100ml EDT SP

再再販! ディオール ソヴァージュ EDP EDP DIOR 香水(男性用

クリスチャン ディオール CHRISTIAN DIOR ソヴァージュ

楽天市場】クリスチャンディオール オーソバージュ オードゥトワレ

売り切れ クリスチャン ディオール 香水 CHRISTIAN DIOR オー

未使用クリスチャンディオール ソヴァージュ 100ml - 香水(男性用)

ディオール(クリスチャンディオール) ソバージュ パルファン 100ml

dior sauvage 香水 100ml

Amazon | クリスチャン ディオール CHRISTIAN DIOR ソヴァージュ 100ml

クリスチャン ディオール ソヴァージュ エリクシール EDP・SP 60ml

クリスチャン ディオール ソヴァージュ 100ml DIOR 香水 - 香水(男性用)

DIOR】 ソヴァージュ(ソバージュ/SAUVAGE) - メンズフレグランス・香水

Diorクリスチャン ディオール ソヴァージュEDT 100ml - 香水(男性用)

Christian Dior クリスチャン ディオール ソヴァージュ 100ml EDT オードトワレ メンズ 香水 コスメ 新品 送料無料

Dior SAUVAGE EAU DE PARFUM クリスチャンディオール コスメ・香水

Christian Dior Eau Sauvage 3.4oz (100ml) EDT Spray

Dior ディオール ソヴァージュ オードゥ パルファン 100ml 特別価格

新品即日出荷 クリスチャンディオール オーソバージュ EDT

クリスチャン ディオール CHRISTIAN DIOR◇ ソヴァージュ EDT・SP

クリスチャン ディオール ソヴァージュ EDT SP 100ml 香水

クリスチャン ディオール CHRISTIAN DIOR◇ ソヴァージュ EDT・SP

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています