針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws

(税込) 送料込み

商品の説明

商品説明

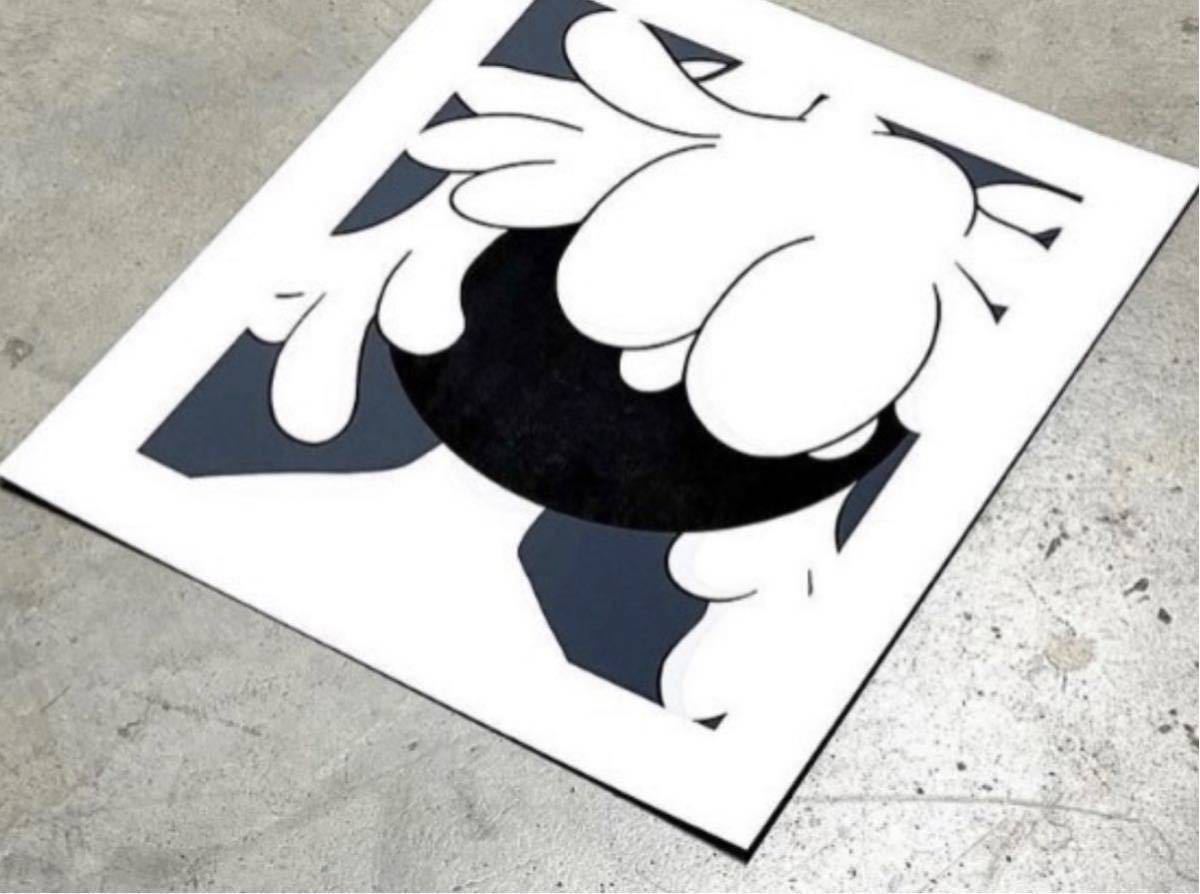

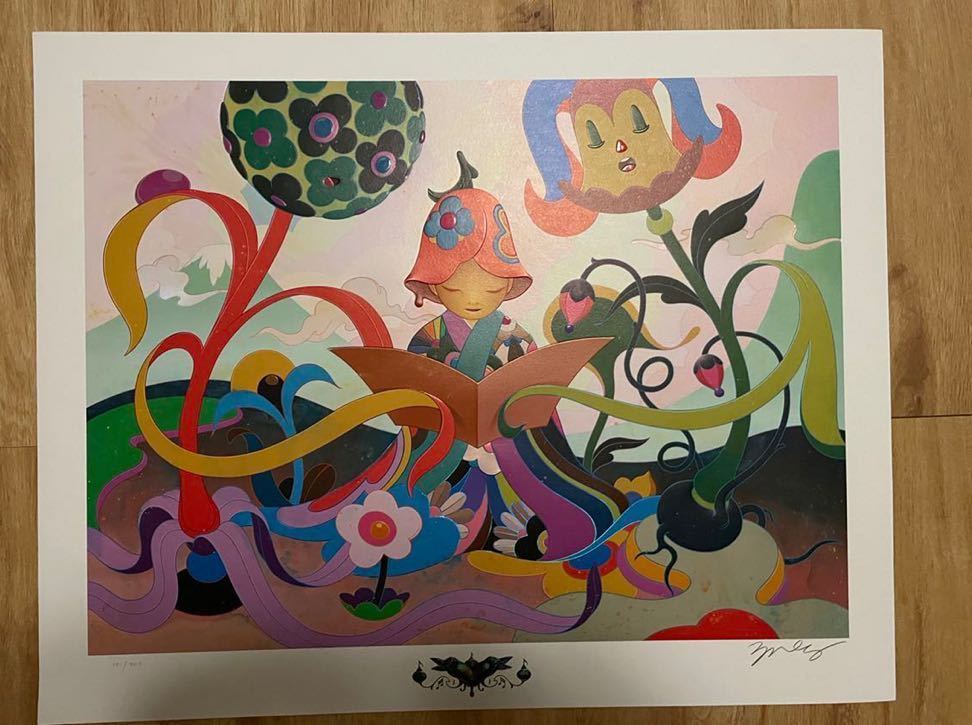

針谷慎之介ShinnosukeHariya

"ぼうや"

インクジェットアートプリント

エディション20

Edition20

ED.20

ーーー

2021年京都での個展で発表された

作品です。

最近では海外の有名ギャラリーでも取扱い

されるほど、今後益々活躍が期待される

ネクストブレイクアーティストの1人です。

到着後は、中身を確認し、

大きめの段ボールに平らにセットした後、

日の当たらない場所で保管しておりました。

コレクションが増えすぎ、

大好きな作品ですが、泣く泣く

今回出品致します。

なお個人情報を外した請求書等は

添付可能です。

メッセージでご指示下さい。

※ご指示頂いた場合のみ添付してます、

ない場合は、添付しておりませんので、

必要な場合は、必ず発送前にご指示願い

ます。

ーーー

●アーティスト:針谷慎之介

●タイトル:ぼうや

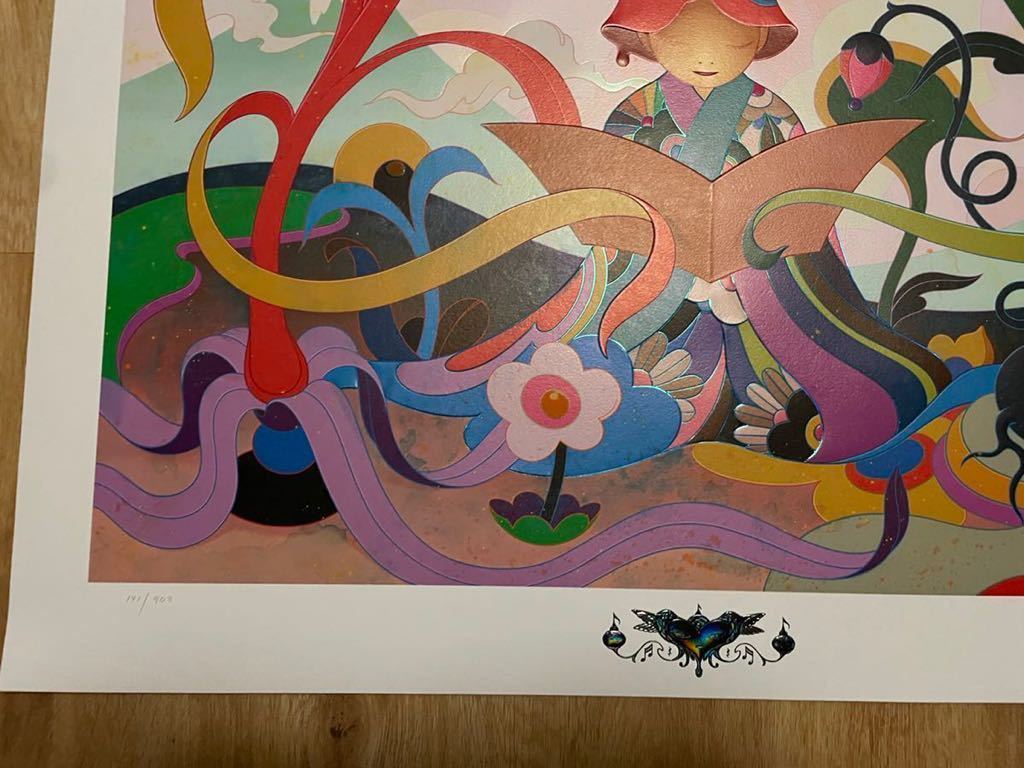

●サイズ:393mm×505mm※多少の誤差はご了承下さい

●エディション:●/20

●印刷:インクジェットアートプリント

●サイン:直筆サイン、エデションナンバー

●コンディション:未額装品

ーーー

2枚目にあるように、大きめの段ボールで

挟んだ状態で発送予定です。

あくまでも自宅保管品で

一度人の手に渡ったものということを

ご理解の上ご購入を検討下さい。

別サイトでも販売してますので、

売切の場合キャンセルとなります、

ご了承下さい。

即購入OKです!!

ーーー

DOLK

ドルク

banksy

バンクシー

kaws

カウズ

kyne

キネ

meguruyamaguchi

山口歴

Hebrubrantley

NickWalker

LY

MartinWhatson

Mt.Brainwash

YusukeHanai

花井祐介

ハナイユウスケ

ロッカクアヤコ

SayuriNishikubo

ニシクボサユリ

AdrianaOliver

アドリアナオリバー

idetatsuhiro

backsideworks

michaelKagan

JUNOSON

RoamCouch

ロームカウチ

小畑多丘

奈良美智

草間弥生

村上隆

長場雄

橋爪悠也

ハシヅメユウヤ

天野タケル

Lotta

仲衿香

今井麗

小泉悟

山田航平

品川亮

小田望楓

友沢こたお

白根ゆたんぽ

水戸部七絵

22200円針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kawsエンタメ/ホビー美術品/アンティーク針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws針谷

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

針谷慎之介 kyne 花井祐介 ロッカクアヤコ LY ハシヅメユウヤ

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws針谷

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kawsの通販

高知インター店 Lotta ナカノアヤノ kyne Ayano Nakano ナカノアヤノ

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY ハシヅメ

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY ハシヅメ

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY ハシヅメ

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY ハシヅメ

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

大山エンリコイサム ポスター kyne キネ 花井祐介 kaws 村上隆-

花井祐介 花井 祐介 Yusuke Hanai 栓抜 Bottle Opener-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

長場雄yu nagaba Nagabayu シルクスクリーン2個セット額付kyne 花井

ロッカクアヤコ ビーチタオル kyne 花井祐介 rokkaku ayako-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

価格は安く Lotta Ayano Nakano ナカノアヤノ kyne 花井祐介 kaws

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY ハシヅメ

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kawsの通販

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY kaws-

ユウヤの値段と価格推移は?|16件の売買データからユウヤの価値が

大山エンリコイサム ポスター kyne キネ 花井祐介 kaws 村上隆-

James Jeanシルクスクリーン江口寿史ロッカクアヤコ凪backsideworks

主人公 shujinkou アニメ kyne backsideworks LYの通販 by おりょん's

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY ハシヅメ

James Jeanシルクスクリーン江口寿史ロッカクアヤコ凪backsideworks

花井祐介 限定 ポスター yusukehanai kyne シルクスルリーン | Shop at

公式通販にて購入 原神 刻晴 (コクセイ) コスプレ COSPLAY | www.ouni.org

ロッカクアヤコ ビーチタオル kyne 花井祐介 rokkaku ayako-

James Jeanシルクスクリーン江口寿史ロッカクアヤコ凪backsideworks

針谷慎之介 針谷 慎之介 kyne 花井祐介 ロッカクアヤコ LY ハシヅメ

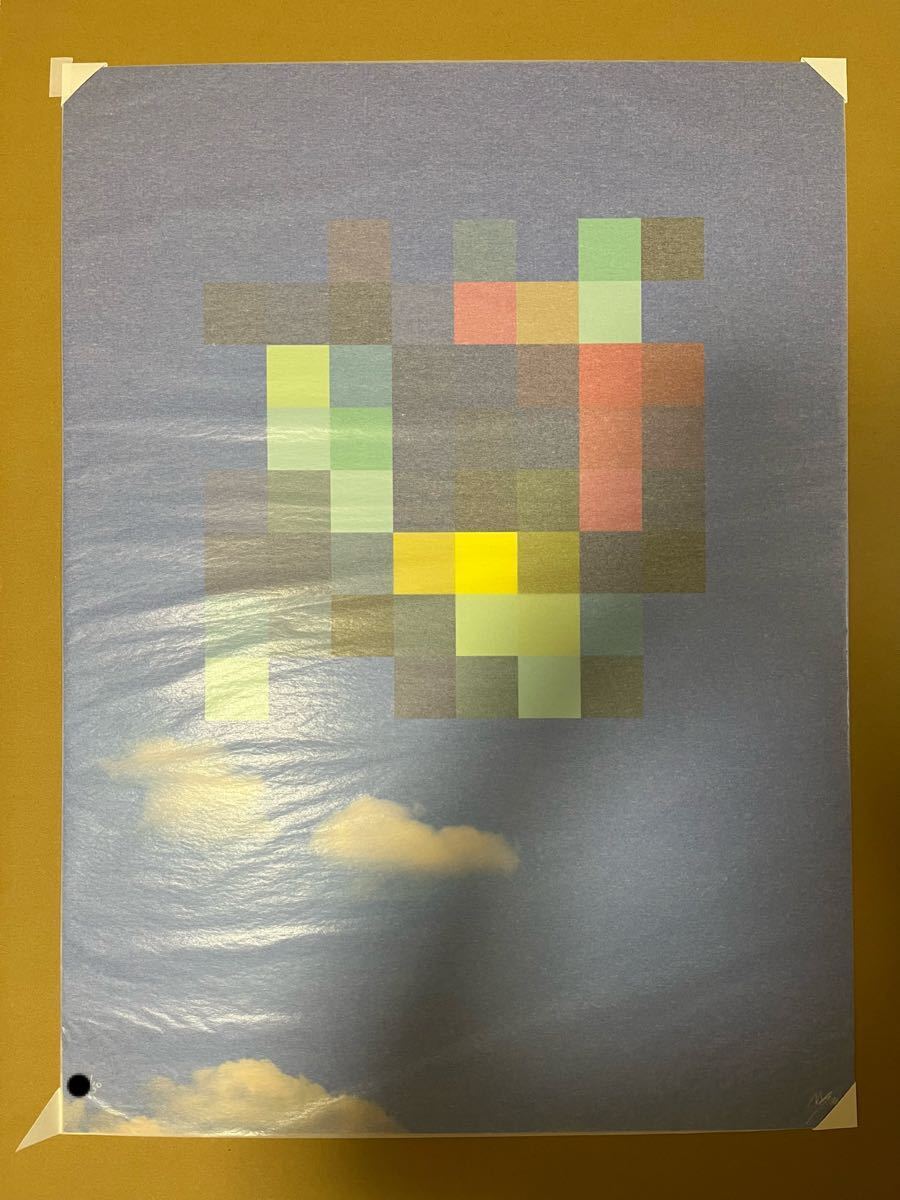

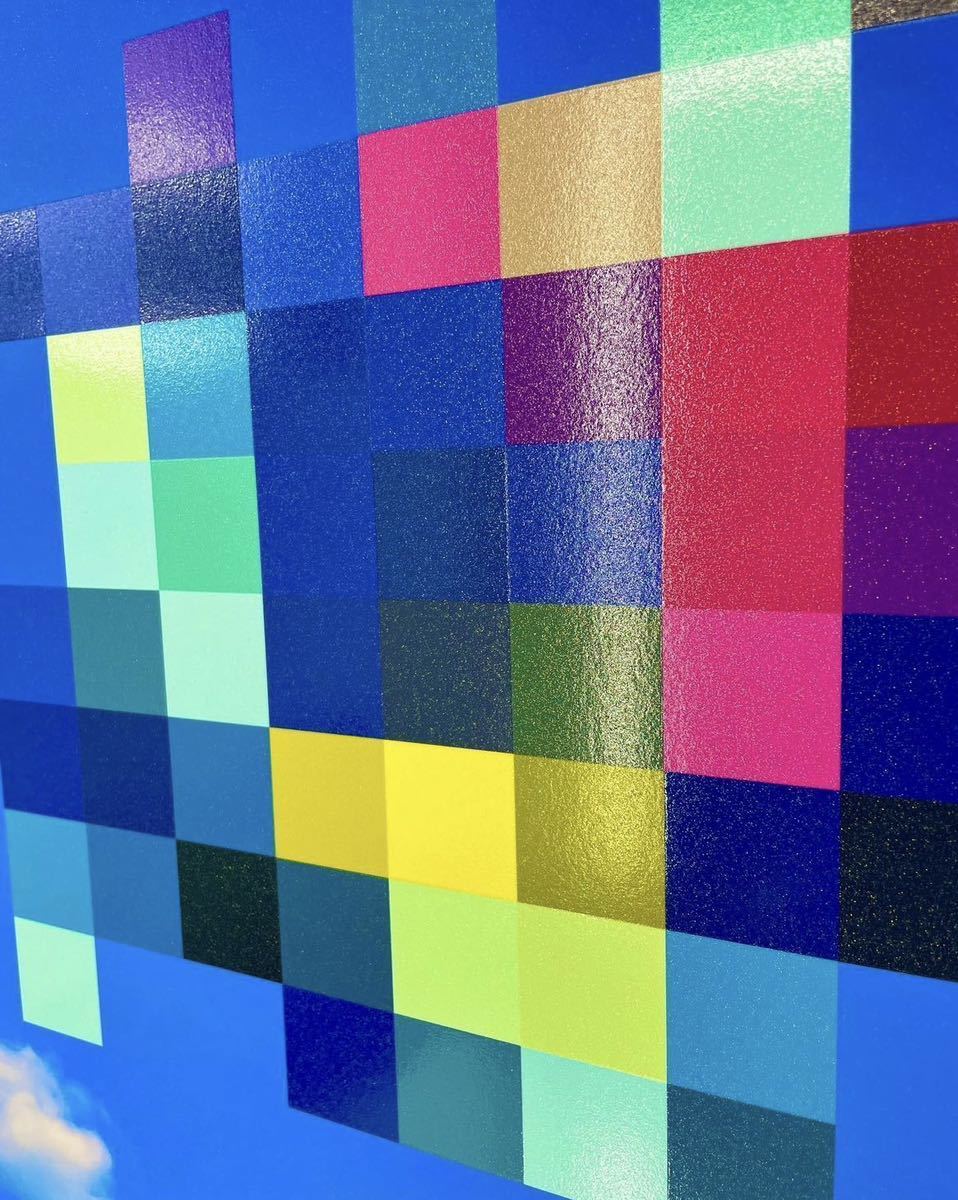

MAKERS SPACE Pixel-57 Sky Pixelated 山口真人の+solo-truck.eu

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています