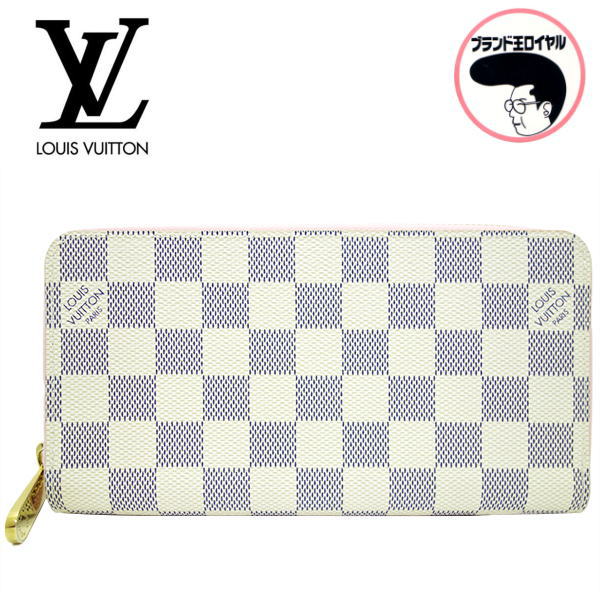

■ルイ ヴィトン■ ダミエ・アズール ジッピーウォレット ラウンドファスナー財布

(税込) 送料込み

商品の説明

商品説明

■ルイヴィトンダミエ・アズールジッピーウォレット■ラウンドファスナー長財布N60019

■商品説明■

男女共に人気の高いダミエラインからイタリアの

リゾート地リビエラの海と砂をイメージして作られた

ダミエアズールの『ジッピーウォレット』

表面は防水性・機能性に優れ汚れに強く非常に丈夫な

素材のジッピーウォレットは紙幣・コインはもちろん

クレジットカードなども収納できる優れものです

飽きのこないデザインでどんなファッションにも

合わせやすくサイズ感も丁度良いので、普段使いから

旅行・スーツスタイルなどのビジネスシーンにも

おすすめです

合わせやすいカラーリングで派手な配色ではないので

年齢、性別を問わず幅広く様々なシチュエーションで

お使い頂けるロングウォレットです

■商品詳細■

ブランド:ルイヴィトン

品名・ライン:ダミエジッピーウォレット

品番:N60019

シリアル:CA2039

素材:ダミエ

サイズ:約W19.5×H10.5cm

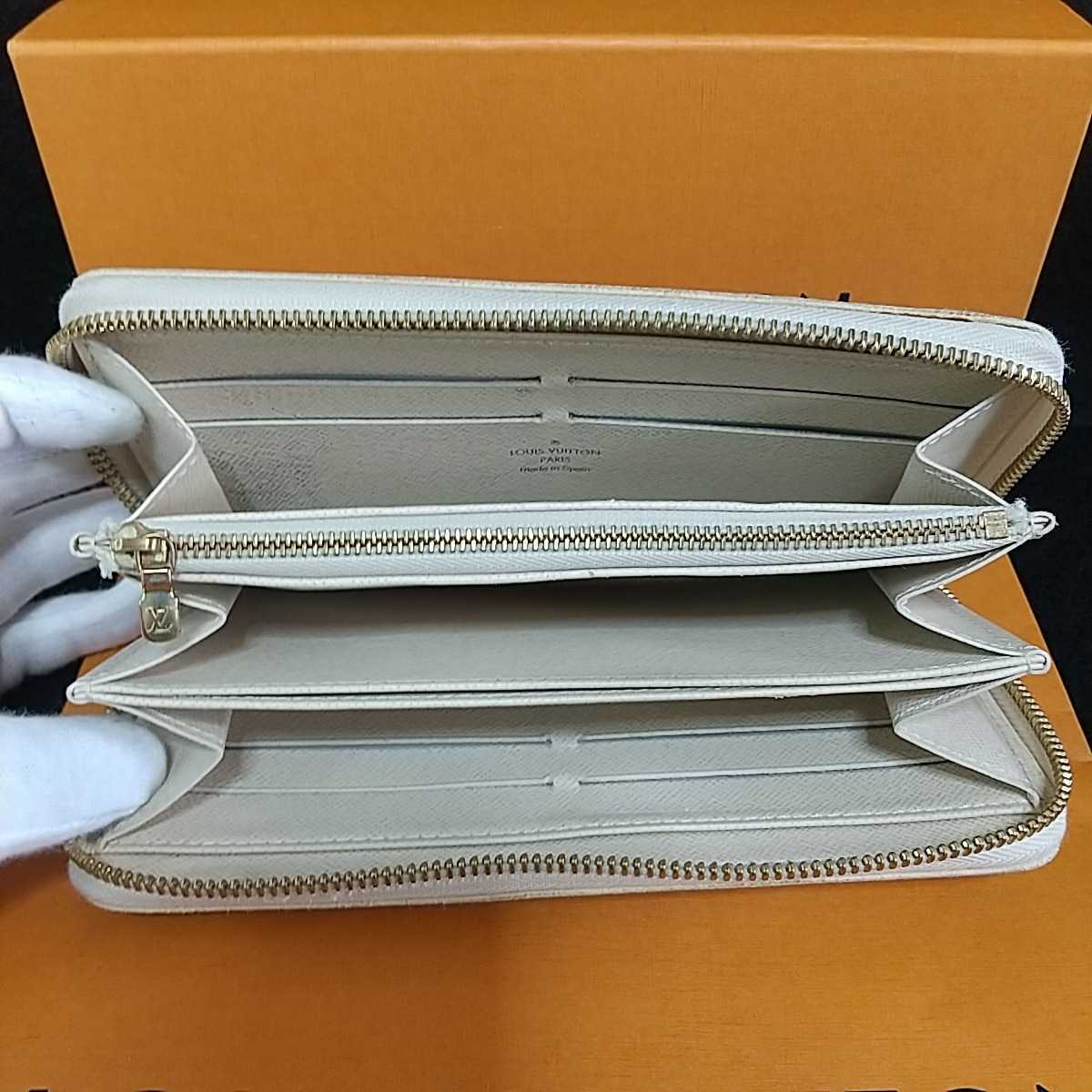

仕様:札入れ×1小銭入れ×1

カードポケット×8ポケット×3

状態

外側:画像のように良い状態の商品です

ファスナー多少切れ箇所御座います

内側:画像のように良い状態の商品です

※商品の状態は個人差がありますので

写真にて確認をお願い致します

==========================

安心の日本ブランドオークション加盟店です

・購入経路の記載・

正規店にて購入した商品です

出品の商品は全て鑑定士による鑑定済みの正規品(本物)です

万が一偽物だった場合、送料も含め全額返金

させて頂きますので、ご安心してお買い求め下さい

==========================

中古品の状態は、僅かな使用感など全てをお伝えする事は

難しい為、神経質な方のご入札はお控え下さい

■↓ブランド品・バックetc↓■

#流通センターブランド系

HBSBST

14880円■ルイ ヴィトン■ ダミエ・アズール ジッピーウォレット ラウンドファスナー財布メンズファッション小物日本超高品質 ルイヴィトン LOUIS VUITTON ジッピーウォレット N60019ジッピー・ウォレット ダミエ・アズール|ルイ・ヴィトン 公式サイト

綺麗 LOUIS VUITTON ルイヴィトン ジッピー ダミエアズール ラウンド

全ての LOUIS 【200】 VUITTON VUITTON ルイ・ヴィトン ジッピー

日本超高品質 ルイヴィトン LOUIS VUITTON ジッピーウォレット N60019

楽天市場】ルイヴィトン 長財布 ジッピーウォレット ダミエ アズール

楽天市場】ルイヴィトン 長財布 ジッピーウォレット ダミエ アズール

日本超高品質 ルイヴィトン LOUIS VUITTON ジッピーウォレット N60019

LOUISVUITTON ルイヴィトン ジッピーウォレット ダミエアズール - 長財布

限定ブランド 〇〇LOUIS VUITTON ルイヴィトン ダミエ アズール

美品】ルイ・ヴィトン ダミエアズール ジッピーウォレット 8カード

楽天市場】【10%OFF】 ルイヴィトン 長財布 ジッピーウォレット 鳥と

a13 ルイヴィトン 1円☆良品☆ ダミエ アズール クレマンス ラウンド

☆決算特価商品☆ ルイヴィトン ダミエ ラウンドファスナー長財布

公式オンラインショップ ダミエアズール ルイヴィトンジッピー

ルイヴィトンダミエアズールジッピーウォレットラウンドファスナー長

LOUIS VUITTON - LOUIS VUITTON / ルイヴィトン □ ダミエアズール

ルイヴィトン ダミエ アズール ジッピーウォレット 長財布-

Amazon | Louis Vuitton ルイヴィトン 長財布(ラウンドファスナー

美品】ルイ・ヴィトン ダミエアズール ジッピーウォレット 8カード

ルイヴィトン LOUIS VUITTON ダミエアズール ジッピーウォレット 長

316 ルイヴィトン ダミエ ジッピーウォレット ラウンドファスナー 長財布-

新品・当店売れ筋 ルイヴィトン ダミエ アズール ジッピーウォレット

LOUIS VUITTON - □ルイ ヴィトン□ ダミエ・アズール ジッピー

□ルイ ヴィトン□ ダミエ・アズール ジッピーウォレット ラウンド

Amazon | [ルイヴィトン] ジッピーウォレット ダミエアズール ピンク

楽天市場】【10%OFF】 ルイヴィトン 長財布 ジッピーウォレット 鳥と

ルイヴィトン(LOUIS VUITTON)ジッピーウォレット|ダミエアズール

ネット販売品 LOUIS VUITTON ルイヴィトン ダミエ アズール ジッピー

316 ルイヴィトン ダミエ ジッピーウォレット ラウンドファスナー 長財布-

極美品【ルイヴィトン】ダミエジッピーウォレット長財布ラウンド

LOUIS VUITTON - ルイヴィトン LOUIS VUITTON ジッピーウォレット

1円~CA2078 美品正規品 LOUIS VUITTON ルイ ヴィトン ジッピー

ルイ・ヴィトン】ダミエ・アズール☆長財布 ジッピーウォレット

極上美品】新型 ルイヴィトン ダミエ アズール ジッピーウォレット 長

Amazon | [ルイヴィトン] 長財布(ダミエアズール) PORTEFEUILLE ZIPPY

LV ルイヴィトン ダミエ ジッピーウォレット ラウンドファスナー長財布

ルイヴィトン ジッピーウォレット ダミエの通販・価格比較 - 価格.com

若者の大愛商品 LOUIS VUITTON ルイヴィトン/ダミエ・アズール/ジッピー・ウォレット

楽天市場】【中古】 未使用 LOUIS VUITTON ルイヴィトン ダミエ

ルイヴィトン ダミエ アズール ジッピーウォレット ラウンドファスナー

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![Amazon | [ルイヴィトン] ジッピーウォレット ダミエアズール ピンク](https://m.media-amazon.com/images/I/51x 0qvGgL._AC_UY580_.jpg)

![Amazon | [ルイヴィトン] 長財布(ダミエアズール) PORTEFEUILLE ZIPPY](https://m.media-amazon.com/images/I/51mLxQ3jszL._AC_UY580_.jpg)