EDIFICE インナーダウン

(税込) 送料込み

商品の説明

商品説明

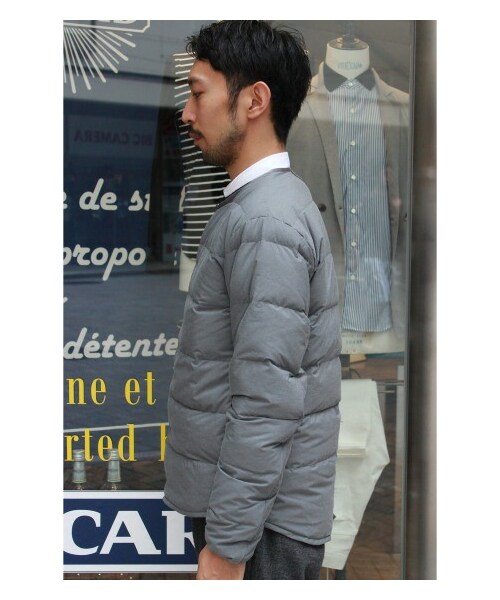

EDIFICEのインナーダウンsize:S

color:ネイビー

170cm60kgで着用感はややタイト目です。

着丈:65cm

身幅:45cm

袖丈:58cm

素人採寸のため誤差はご容赦ください。

zipタイプの物でスマートに着こなせます。

薄手ですが、かなり暖かく

ジャケットのインナーにも着れるくらいの厚さです。

Vゾーンからネクタイ等も綺麗に魅せることができます。

コンパクトに折り畳む事も可能で、収納袋も付いています。

よろしくお願い致します。

6440円EDIFICE インナーダウンメンズジャケット/アウター700FP Vネック スナップインナーダウンEDIFICE インナーダウンダウンジャケット - ダウンジャケット

EDIFICE インナーダウンダウンジャケット - ダウンジャケット

700FP Vネック スナップインナーダウン

700FP Vネック スナップインナーダウン

エディフィス インナー ダウンジャケット(メンズ)の通販 8点 | EDIFICE

EDIFICE インナーダウンダウンジャケット - ダウンジャケット

エディフィス インナー ダウンジャケット(メンズ)の通販 8点 | EDIFICE

EDIFICE インナーダウンダウンジャケット - ダウンジャケット

撥水加工 417 EDIFICE ダウンベスト インナーダウン ブラウン - アウター

700FP Vネック スナップインナーダウン(001343018) | エディフィス

結婚祝い エディフィス インナーダウン EDIFICE|大人が着るべきダウン

EDIFICE (エディフィス) ノーカラー インナー ダウン ジャケット

コレだけ守れば間違いなし!鉄板ダウン着こなしルール3選|EDIFICE

エディフィス インナー ダウンジャケット(メンズ)の通販 8点 | EDIFICE

inherit JOURNAL STANDARD EDIFICE インナーダウンダウンジャケット

EDIFICE(エディフィス)の「700FP クルーカーデ インナーダウン

柄デザイン無地EDIFICE インナーダウン取り外し可 - ステンカラーコート

700FP Vネック スナップインナーダウン

エディフィス インナー ダウンジャケット(メンズ)の通販 8点 | EDIFICE

EDIFICE(エディフィス)の「700FP クルーカーデ インナーダウン

ステンカラーコート/FUNCTION 3WAY/インナーダウン付属/河田ダウン/S/GRY

☆EDIFICE×PARIS SAINT GERMAIN/エディフィス×パリサンジェルマン

エディフィス インナー ダウンジャケット(メンズ)の通販 8点 | EDIFICE

5年保証 エディフィス インナーダウン イエロー - ryokan-yamatoya.com

定価89640円 TATRAS エディフィス別注ステンカラー インナーダウン付

417 EDIFICE エディフィス インナーダウン 黒 サイズS - アウター

417 EDIFICE インナーダウン付 ステンカラーコート - アウター

ステンカラーコート/FUNCTION 3WAY/インナーダウン付属/河田ダウン/S/GRY

楽天市場】EDIFICE エディフィス X PSG JP INNER DOWN JKT インナー

ステンカラーコート/L/ポリエステル/ネイビー/20年/インナーダウン

phenix / プラスフェニックス】別注 GORE-TEX スタンド ダウンコート

結婚祝い エディフィス インナーダウン EDIFICE|大人が着るべきダウン

エディフィス インナー ダウンジャケット(メンズ)の通販 8点 | EDIFICE

ステンカラーコート/インナーダウン着脱可/46/ポリエステル/NVY/19-020-300-2100-3-0

FUNCTION 3WAY/インナーダウン付ステンカラーコート/M/ポリエステル/NVY

DANTON / ダントン】で始める冬支度|417 EDIFICE(フォーワンセブン

ALLIED / アライド】 DOWN / ダウンジャケット(ダウンジャケット

ALLIED / アライド】 DOWN / ダウンジャケット(ダウンジャケット

エディフィス インナー ダウンジャケット(メンズ)の通販 8点 | EDIFICE

EDIFICE|大人が着るべきダウンアウター4選|EDIFICE(エディフィス

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています