yori ボンディングジレ

(税込) 送料込み

商品の説明

商品説明

yoriのボンディングジレです。再販で運良く購入しましたが、丈が私には少し長いので出品します。

未使用、タグつきです!

現在ブランドサイトでは売り切れてる商品です。

2021年7月購入

定価税込28,600円

17160円yori ボンディングジレレディーストップスyori ボンディングロングジレ-yori ボンディングジレ | hmgrocerant.com

yori ヨリ ボンディング ジレ | Shop at Mercari from Japan! | Buyee

yori ボンディング ジレ - www.sorbillomenu.com

yori ボンディングロングジレ-

yori ボンディングジレ | hmgrocerant.com

最大お値下げしました‼︎美品 yori ヨリ ボンディングロングジレ - ベスト

2024年最新】yori ボンディング ロング ジレの人気アイテム - メルカリ

yori ボンディングジレ | hmgrocerant.com

新品☆完売品☆yori ボンディングジレ - www.sorbillomenu.com

yori ボンディングロングベストジレ - ベスト

yori ボンディング ジレ-silversky-lifesciences.com

yori ボンディング ジレ-silversky-lifesciences.com

yori ボンディング ジレ - www.sorbillomenu.com

ヨリ ボンディングジレ ブラック ヨリ レディース 正規取扱い店

yori ボンディングジレ 商品の状態 激安 セール店舗 メンズ トップス

最先端 yori ボンディングジレ | writethisproject.com

yori ボンディングジレ ヨリ 待望の新作登場 ベスト/ジレ serendib.aero

美品 yori ボンディングジレ ブラック www.judiciary.mw

福袋 yori ボンディングジレ ネイビー | emplumado.mx

ヨリ ボンディングジレ - その他

yori ボンディング ジレ-

2024年最新】yori ボンディング ロング ジレの人気アイテム - メルカリ

yori ヨリ バイカラーボンディングジレ ロングジレ ヨリ オンライン

yori ボンディングロングジレ ∕ BLACK身幅約50cm - ベスト/ジレ

yoriボンディングジレ - nstt.fr

yori 】ボンディングジレ ブラックベスト/ジレ - mirabellor.com

yori ボンディング ジレ - www.sorbillomenu.com

yori ヨリ バイカラーボンディングジレ ロングジレ-

yoriボンディングジレ|Yahoo!フリマ(旧PayPayフリマ)

yori ヨリ バイカラーボンディングジレ ロングジレ Yahoo!フリマ(旧

yori ボンディングジレ ブラック 独特の素材 www.konoandorca.com

yori ヨリ バイカラーボンディングジレ ロングジレ-

yori ヨリ バイカラーボンディングジレ ロングジレ - ベスト

2024年最新】yori ボンディング ロング ジレの人気アイテム - メルカリ

yori ヨリ ボンディングジレの通販 by mimi22's shop|ラクマ

yori ヨリ バイカラーボンディングジレ ロングジレ ヨリ オンライン

yoriボンディングジレ|Yahoo!フリマ(旧PayPayフリマ)

海外 正規品 yori ヨリ ボンディング ジレ ロング | rachmian.com

yori フリルボンディングロングジレ ブラック ヨリ (正規品、美品

オンライン 【yori】2回着用 美品✨ ボンディング ロング フリル ジレ

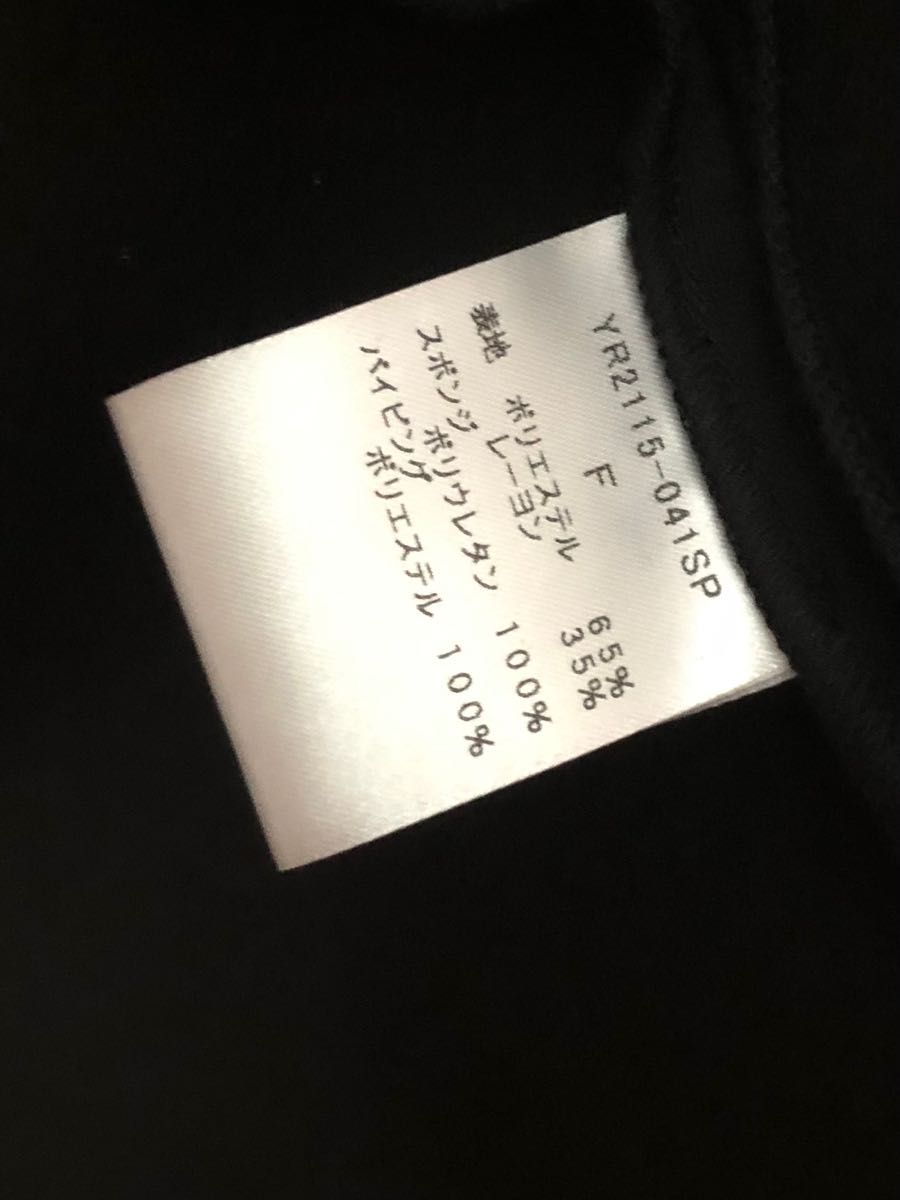

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています