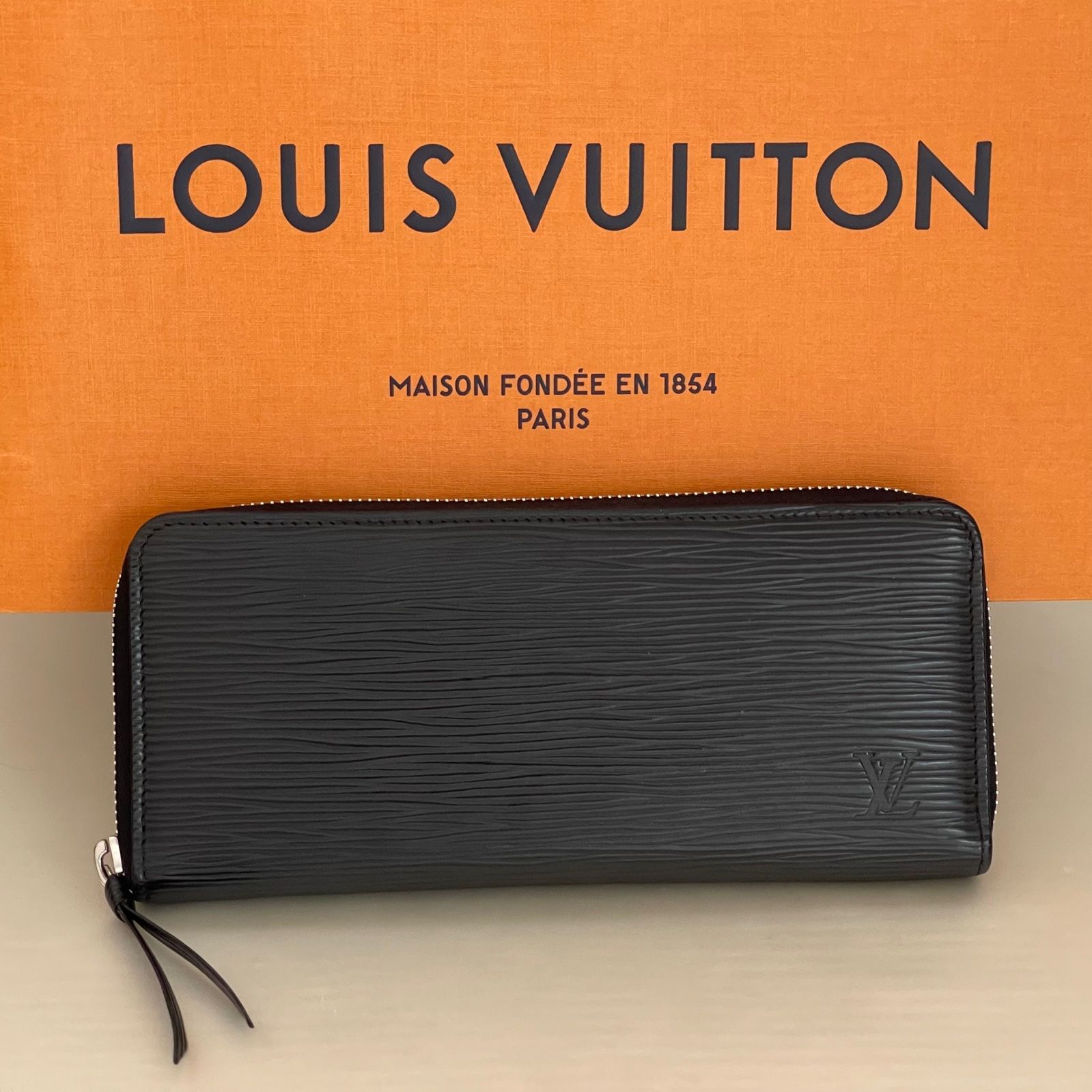

ルイヴィトンポルトフォイユ・クレマンスM60915

(税込) 送料込み

商品の説明

商品説明

【カラー】・ブラック

・金具シルバー

【素材】

・素材:エピ・レザー(皮革の種類:牛革)

・ライニング:グレインレザー

【寸法】

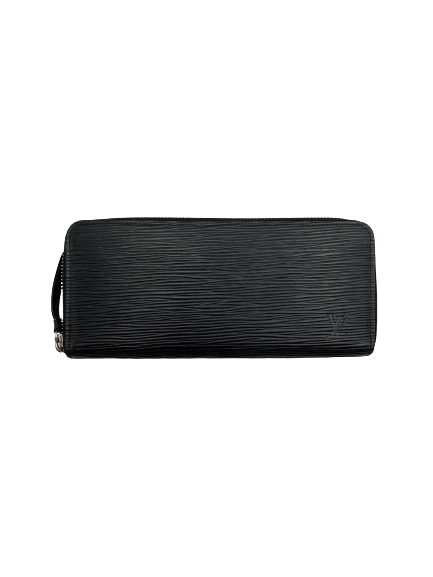

約W19.5cm×H9.0cm×D1.5cm

【仕様】

・ファスナー開閉式

・まち付きコンパートメントx2

・ファスナー式コインケース

・内フラットポケットx2

・カード用ポケットx8

【商品ランク】

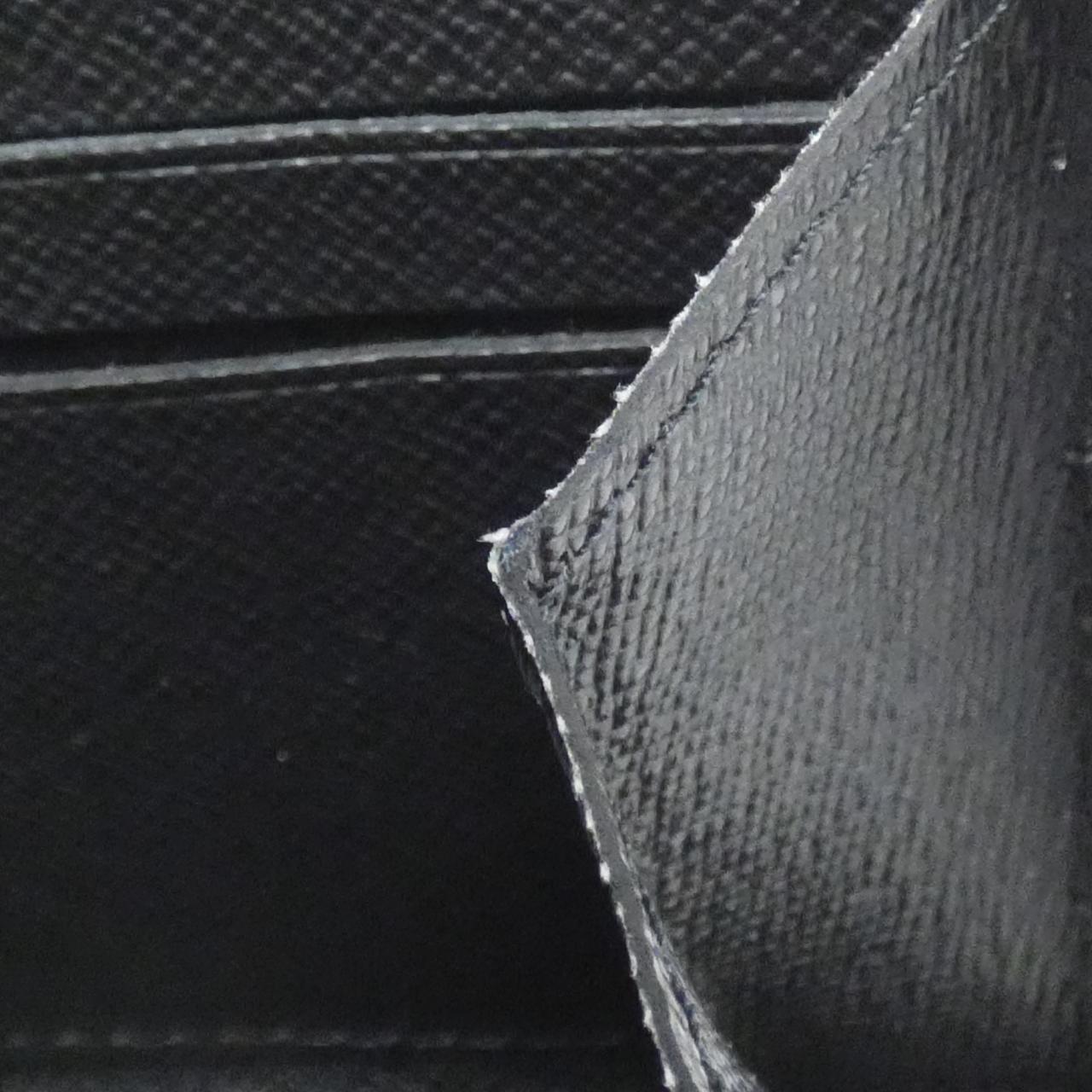

5段階で5を新品とすると2.0です。

【商品状態】

・財布表裏の一部、四隅角、ファスナー、コバ部分に擦れ小傷剥げが御座います。

・ファスナー小銭入れ部分、財布内使用感が御座いますがまだまだ十分使用可能な状態です。

【商品コメント】

・男女共に使用可能です。

・シリアル番号MI2166

・ルイ・ヴィトンを象徴するエピ・レザーで仕立てた、なめらかでスリムなフォルムの長財布「ポルトフォイユ・クレマンス」。

・2つの充分な容量のコンパートメントに加え、中央のファスナー付きコインポケットと複数のカードスロットを備え、優れた機能性が魅力。

・レザーの引き手が付いた印象的なシルバーカラーのファスナーが光ります。

【購入先】

当店の掲載商品は買取り商品、質流れ商品、宝石商からの購入品及び業界オークションにて購入した商品になりますので、全てが鑑定・真贋済みの正規商品となりますので、ご安心下さい。

【コメント】

・大阪にて質屋業を営んでおり「古物商許可証」を取得して70年以上。

・全国質屋組合連合会加盟店

「質屋許可番号」

大阪府公安委員会許可第62230R037505号

「古物商許可番号」

大阪府公安委員会許可第62230R035861号

「時計・宝飾品商」

・あくまでもUSED品の為、神経質な方はご遠慮願います。

・プロフィールは必ず一読下さい。

19680円ルイヴィトンポルトフォイユ・クレマンスM60915レディースファッション小物ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布

ルイヴィトン エピ ポルトフォイユ・クレマンス M60915 ブラック

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布

LOUIS VUITTON ルイヴィトン ポルトフォイユ クレマンスM60915-

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス ラウンド

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布

LOUIS VUITTON ルイヴィトン 長財布 ポルトフォイユクレマンス エピ

未使用品級✨ルイヴィトン エピ ポルトフォイユ クレマンス M60915 長財布

楽天市場】ルイヴィトン エピ ポルトフォイユ・クレマンス M60915【A

美品】ルイヴィトン LOUIS VUITTON M60915 エピ ポルトフォイユ

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布 3734

LOUIS VUITTON ルイヴィトン ポルトフォイユ・クレマンス エピ

ルイヴィトン/長財布/ポルトフォイユクレマンス/ノワール/型番:M60915

楽天市場】ルイヴィトン LOUIS VUITTON ポルトフォイユクレマンス

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布

未使用品級 ルイヴィトン エピ ポルトフォイユ クレマンス M60915 長財布-

LOUIS VUITTON - ☆SALE 【4ec3766】ルイヴィトン 長財布/エピ

ルイヴィトン エピ ポルトフォイユ・クレマンス M60915 ブラック

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス ラウンド

LOUIS VUITTON】ルイヴィトン『エピ ポルトフォイユ クレマンス

コメ兵|ルイヴィトン エピ ポルトフォイユ クレマンス M60915 財布

LOUIS VUITTON ルイヴィトン M60915 ポルトフォイユ・クレマンス 長

LOUIS VUITTON ルイ・ヴィトン ポルトフォイユ・クレマンス 財布・小物

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布

ルイヴィトンポルトフォイユクレマンス 14127 ノワール ユニセックス

在庫有◎国内発送 LV ポルトフォイユ クレマンス エピ (Louis Vuitton

美品】ルイヴィトン LOUIS VUITTON M60915 エピ ポルトフォイユ

コメ兵|ルイヴィトン エピ ポルトフォイユ クレマンス M60915 財布

良品】ルイヴィトン エピ ポルトフォイユ クレマンス 長財布 m60915

美品】ルイヴィトン エピ ポルトフォイユ クレマンス 長財布 m60915

LOUIS VUITTON - ☆SALE 【4ec3766】ルイヴィトン 長財布/エピ

LOUIS VUITTON(ルイヴィトン) / 長財布/ポルトフォイユ・クレマンス

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス ラウンド

Amazon | ルイヴィトン LOUIS VUITTON 財布 長財布 レディース

有名な】 ルイヴィトン LOUIS VUITTON ポルトフォイユ・クレマンス

ルイヴィトン M60915 エピ ポルトフォイユ クレマンス 長財布 3734

エピレザー皮革の種類ルイヴィトン ポルトフォイユ・クレマンスM60915

楽天市場】ルイヴィトン LOUIS VUITTON ポルトフォイユクレマンス

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています