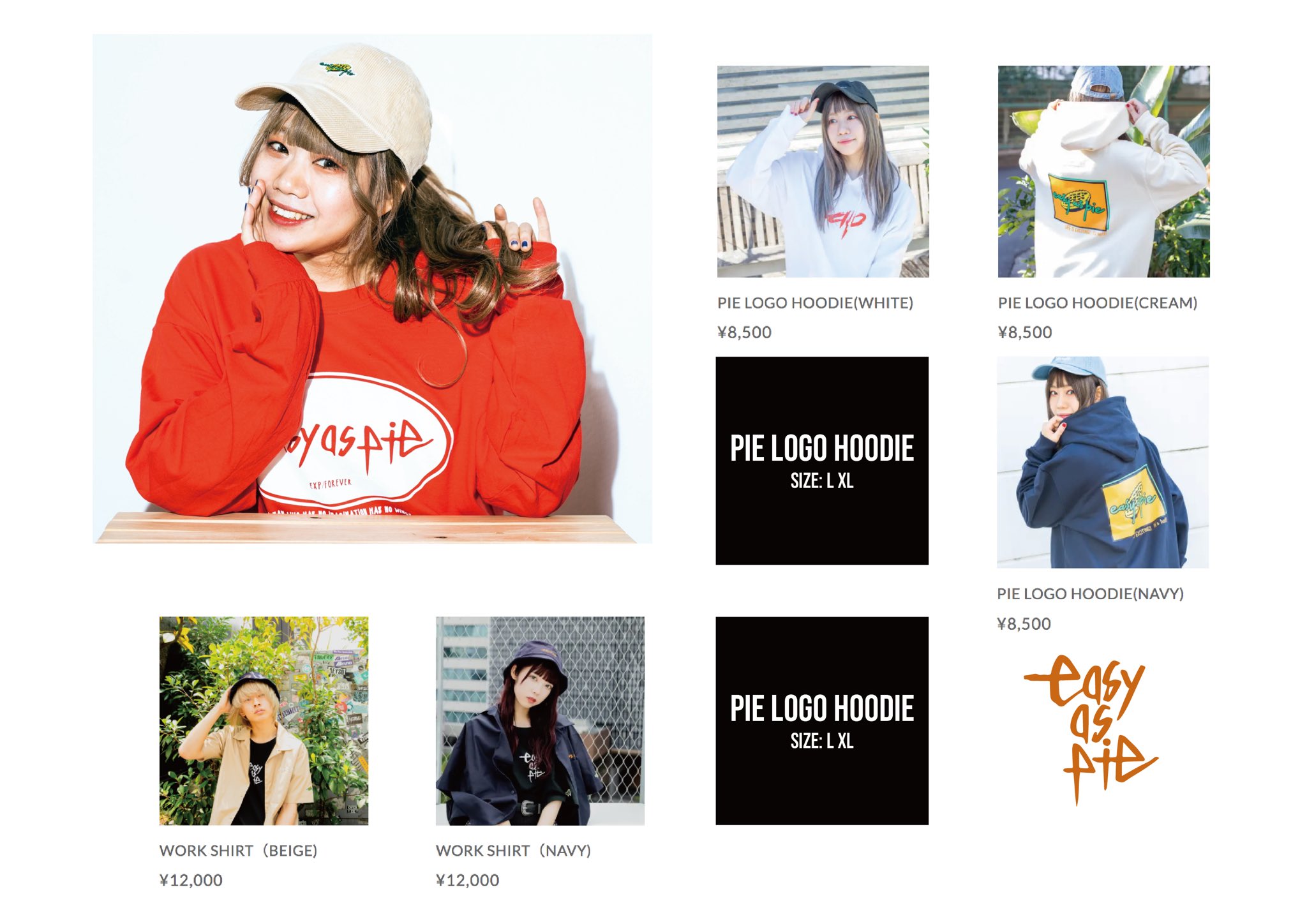

easy as pie Tシャツ XL MOSHIMO 岩淵紗貴

(税込) 送料込み

商品の説明

商品説明

バンドMOSHIMOのGt.Vo岩淵さんがされているアパレルブランドeasyaspieのサイン入りTシャツです。ポップアップストアに行った際にサインをしていただきました。引っ越しのため、荷物整理のため泣く泣く出品いたします。

一度も着ておらず、新品です。

3760円easy as pie Tシャツ XL MOSHIMO 岩淵紗貴メンズトップスウェブストアは easy as pie Tシャツ XL MOSHIMO 岩淵紗貴トップスeasy as pie Tシャツ XL MOSHIMO 岩淵紗貴 - dsgroupco.com

ウェブストアは easy as pie Tシャツ XL MOSHIMO 岩淵紗貴

特價區 easy as pie Tシャツ XL MOSHIMO 岩淵紗貴 | mcdc.padesce.cm

ウェブストアは easy as pie Tシャツ XL MOSHIMO 岩淵紗貴

ロックファッション、バンドTシャツ のGEKIROCK CLOTHING / 【予約商品

ロックファッション、バンドTシャツ のGEKIROCK CLOTHING / 【予約商品

ロックファッション、バンドTシャツ のGEKIROCK CLOTHING / 【予約商品

ロックファッション、バンドTシャツ のGEKIROCK CLOTHING / easy as

easy as pie (@easyaspie_style) / X

ロックファッション、バンドTシャツ のGEKIROCK CLOTHING / 【予約商品

売れ筋がひ新作! OF FOG essentials Pullover essentials ハーフ

2022年製 BALENCIAGA バレンシアガ 17AWキャンペーンロゴプリントT

売れ筋がひ新作! OF FOG essentials Pullover essentials ハーフ

新品・送料無料 WOOLRICH ウールリッチ 1602160 アークティック

easy as pie (@easyaspie_style) / X

来年度予算案 CASIO G-SHOCK | propsicologia.com.br

ノースフェイスリュックTHE NORTH FACE 白 リュック(未使用) - www

ロックファッション、バンドTシャツ のGEKIROCK CLOTHING / easy as

メンズパタゴニア カヤックフリース ノーカラー ハーフジップ - www

5%割引で購入 アークテリクス ARC´TERYX リュック | www.acesso10.net.br

バッグTHE NORTH FACE ????SINGLE SHOT 美品 - dsgroupco.com

売れ筋がひ新作! OF FOG essentials Pullover essentials ハーフ

新品・送料無料 WOOLRICH ウールリッチ 1602160 アークティック

特価セールサイト at lastu0026co(atlastu0026co)アットラストBUTCHER

ロックファッション、バンドTシャツ のGEKIROCK CLOTHING / 【予約商品

超激レア xander zhou 18aw ネクタイメンズ - kannailenses.com

まとめ買い ☆REN☆レザーボストンバック☆定価10万円 drygloveusa.com

モンブラン 手帳手帳 - www.newfarmorganics.co.uk

FuckingAwesome Moon Pix Reno Sun Glassesサングラス/メガネ

国内正規品】 《出産・美容骨盤編》ダブルモーションテクニック

バッグTHE NORTH FACE ????SINGLE SHOT 美品 - dsgroupco.com

easy as pie (@easyaspie_style) / X

2022年製 BALENCIAGA バレンシアガ 17AWキャンペーンロゴプリントT

売れ筋がひ新作! OF FOG essentials Pullover essentials ハーフ

新品・送料無料 WOOLRICH ウールリッチ 1602160 アークティック

ロックファッション、バンドTシャツ のGEKIROCK CLOTHING / easy as

全国組立設置無料 T-shirt L 白 Supreme In Small Long-sleeve Men

5%割引で購入 アークテリクス ARC´TERYX リュック | www.acesso10.net.br

バッグTHE NORTH FACE ????SINGLE SHOT 美品 - dsgroupco.com

特価セールサイト at lastu0026co(atlastu0026co)アットラストBUTCHER

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています