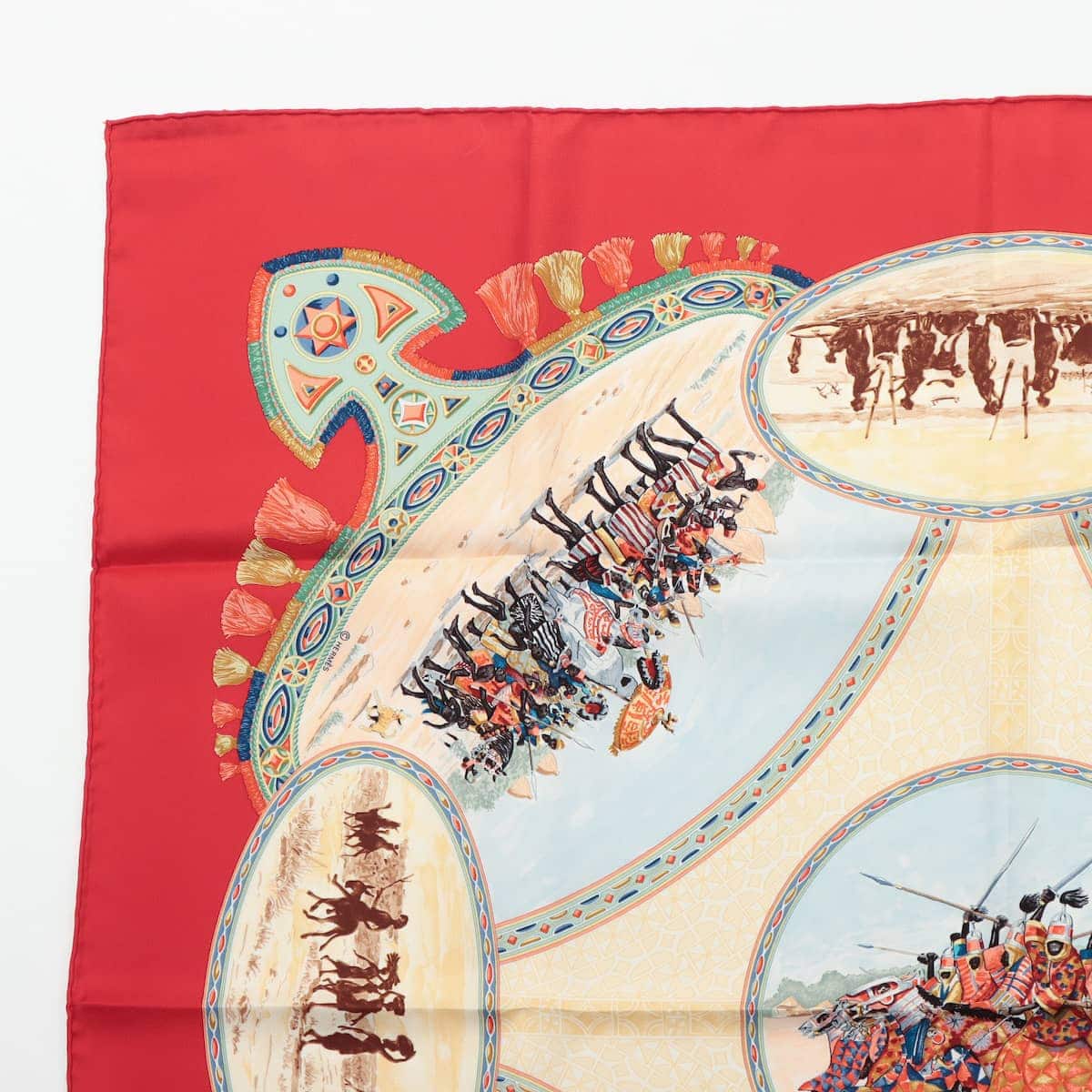

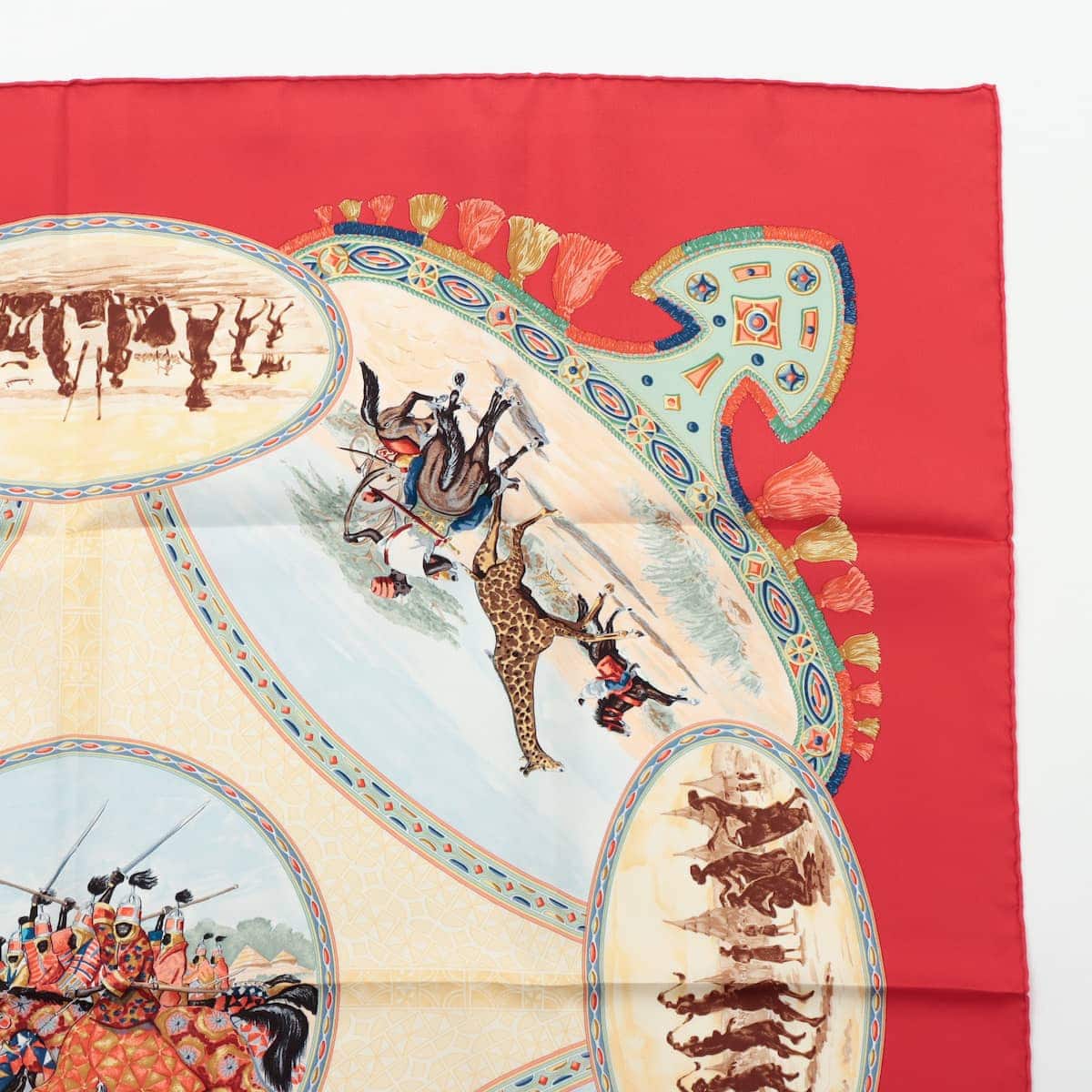

エルメス カレ90 CAVALIERS PEULS プール族の騎手 スカーフ ネ

(税込) 送料込み

商品の説明

商品説明

エルメスカレ90・CAVALIERSPEULSプール族の騎手・スカーフネックウェア/ネイビー/HERMES【♀】【B】【レディース】/b231209★■504197【中古】■商品番号:ISCA0939L

■SEX:レディース

■付属品:無し

■刻印/型番:

■ブランド名:エルメス/Hermes

お問い合わせ番号■504197(isca0939l)

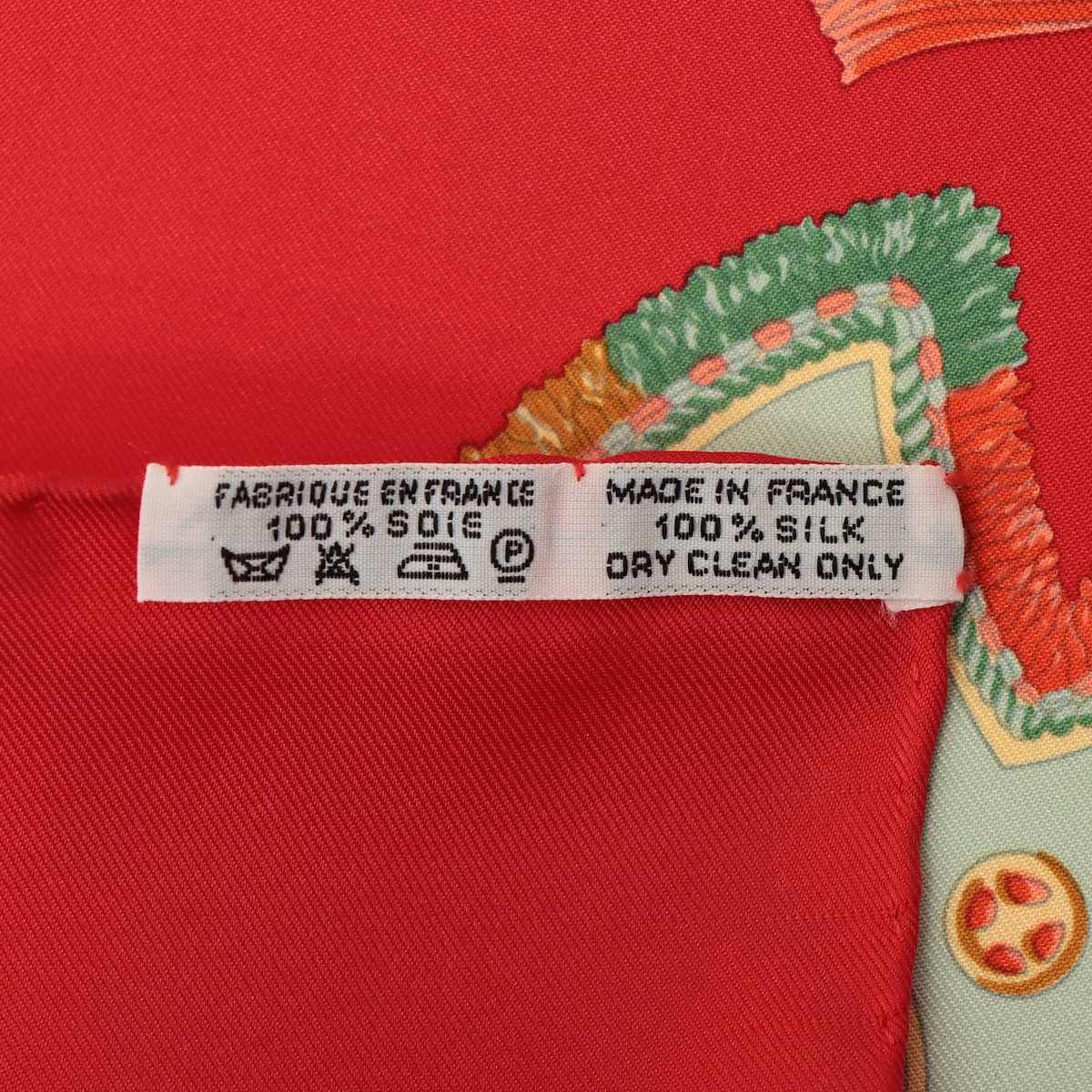

■素材:シルク

■色:ネイビー

■コンディション:

状態はお写真にてご確認をお願い致します。

■実寸サイズ:

ライン:カレ90

アイテム名:CAVALIERSPEULSプール族の騎手

[サイズ(以下約)]

全長:90cm

横幅:90cm

【価格交渉は行っておりません。現在の価格でご検討くださいますようお願いいたします。

また価格交渉のみのお問い合わせにつきましては、返信できかねる事もございますので、ご了承ください。】

こちらの商品はラクマ公式パートナーのリファスタによって出品されています。

12870円エルメス カレ90 CAVALIERS PEULS プール族の騎手 スカーフ ネレディースファッション小物在庫あり送料無料 エルメス カレ90 CAVALIERS PEULS プール族の騎手在庫あり送料無料 エルメス カレ90 CAVALIERS PEULS プール族の騎手

在庫あり送料無料 エルメス カレ90 CAVALIERS PEULS プール族の騎手

在庫あり送料無料 エルメス カレ90 CAVALIERS PEULS プール族の騎手

在庫あり送料無料 エルメス カレ90 CAVALIERS PEULS プール族の騎手

メーカー再生品 エルメス カレ90 CAVALIERS PEULS プール族の騎手

楽天市場】HERMES エルメス カレ90 CAVALIERS PEULS(プール族の騎手

楽天市場】【ラッピング可】エルメス HERMES カレ 90 CAVALIERS PEULS

在庫あり送料無料 エルメス カレ90 CAVALIERS PEULS プール族の騎手

高質 【ラッピング可】エルメス HERMES カレ 90 CAVALIERS PEULS

エルメス カレ90 CAVALIERS PEULS プール族の騎手 スカーフ シルク

Hermes - □新品□未使用□HERMES エルメス CAVALIERS PEULS【プール族

Hermes - エルメス カレ90 CAVALIERS PEULS プール族の騎手 スカーフ

Hermes - エルメス カレ90 CAVALIERS PEULS プール族の騎手 スカーフ

エルメス HERMES スカーフ カレ90 プール族の騎手 - バンダナ

日本正規代理店 エルメス カレ 90 CAVALIERS PEULS レディース

エルメス HERMES スカーフ カレ90 プール族の騎手 - バンダナ

楽天市場】エルメス カレ90・CAVALIERS PEULS プール族の騎手

エルメス カレ90 CAVALIERS PEULS プール族の騎手 スカーフ シルク

HERMES エルメス スカーフ カレ90 プール族の騎手 ヴィンテージ 箱付-

楽天市場】エルメス カレ90・CAVALIERS PEULS プール族の騎手

HERMES エルメス スカーフ カレ90 プール族の騎手 ヴィンテージ 箱付-

Hermes - □新品□未使用□HERMES エルメス CAVALIERS PEULS【プール族

エルメス HERMES スカーフ カレ90 プール族の騎手 - バンダナ

高質 【ラッピング可】エルメス HERMES カレ 90 CAVALIERS PEULS

米ロ首脳会談 エルメス カレ90 CAVALIERS PEULS プール族の騎手

エルメス HERMES スカーフ カレ90 プール族の騎手 - バンダナ

高質 【ラッピング可】エルメス HERMES カレ 90 CAVALIERS PEULS

新作人気商品 エルメス カレ90 CAVALIERS PEULS プール族の騎手

エルメス HERMES スカーフ カレ90 プール族の騎手 - バンダナ

美品✨エルメス スカーフ カレ90 スカーフ プール族の騎手 ネイビー

エルメス スカーフ カレ90 シルク100% サ - バンダナ/スカーフ

HERMES エルメス カレ90 スカーフ CAVALIERS PEULS プール族の騎手

日本正規代理店 エルメス カレ 90 CAVALIERS PEULS レディース

エルメス カレ90 CAVALIERS PEULS プール族の騎手 スカーフ シルク

楽天市場】HERMES エルメス カレ90 CAVALIERS PEULS(プール族の騎手

エルメス HERMES スカーフ カレ90 プール族の騎手 - 小物

エルメス HERMES スカーフ カレ90 プール族の騎手 - バンダナ

メーカー再生品 エルメス カレ90 CAVALIERS PEULS プール族の騎手

高質 【ラッピング可】エルメス HERMES カレ 90 CAVALIERS PEULS

エルメス HERMES スカーフ カレ90 プール族の騎手 - 小物

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています