「くまちゃん様専用」iPhoneXSMAX ブラック

(税込) 送料込み

商品の説明

商品説明

64GB顔認証不可

simフリー

3枚目の傷が1番大きいです、その他同じような傷が角にあります。

付属品はありません。本体のみの発送となります。

22320円「くまちゃん様専用」iPhoneXSMAX ブラックスマホ/家電/カメラスマートフォン/携帯電話くまちゃん様専用YUYIB iPhone Xs Max 用 ケース シリコン ソフト かわいい くまちゃん

Amazon.co.jp: スタンド付きクマちゃんiPhoneケース、スタンド付き

Amazon.co.jp: スタンド付きクマちゃんiPhoneケース、スタンド付き

くまちゃん様専用

くまちゃん様専用

Amazon.co.jp: スタンド付きクマちゃんiPhoneケース、スタンド付き

くまちゃん様専用

くまちゃん様専用

ー品販売 アップル ブラック 第2世代 未開封品 64GB iPhoneSE 第2世代

プロモーション到着 iPad第7世代 32GB WiFi +cellular | sambesx.com

くまちゃん様専用

メーカー直送 新品同様 A SIMフリー 新品同様 OPPO ブラック【OPPO

くまちゃん様専用

2023年秋冬新作 Romi❤︎さま専用 PRADA - iPhonexsmax iPhonexsmax

YUYIB iPhone Xs Max 用 ケース シリコン ソフト かわいい くまちゃん

Amazon.co.jp: スタンド付きクマちゃんiPhoneケース

くまちゃん様専用

Amazon.co.jp: スタンド付きクマちゃんiPhoneケース、スタンド付き

くまちゃん様専用

くまちゃんiPhoneケース iPhoneケース・カバー sorari 通販|Creema

くまちゃん様専用

iphone7Plus 8Plus 用 スマホケース くまのプーさん iphone 7 plus 用

くまちゃん様専用

くまちゃん様専用

くまちゃん様専用」iPhoneXSMAX ブラック-

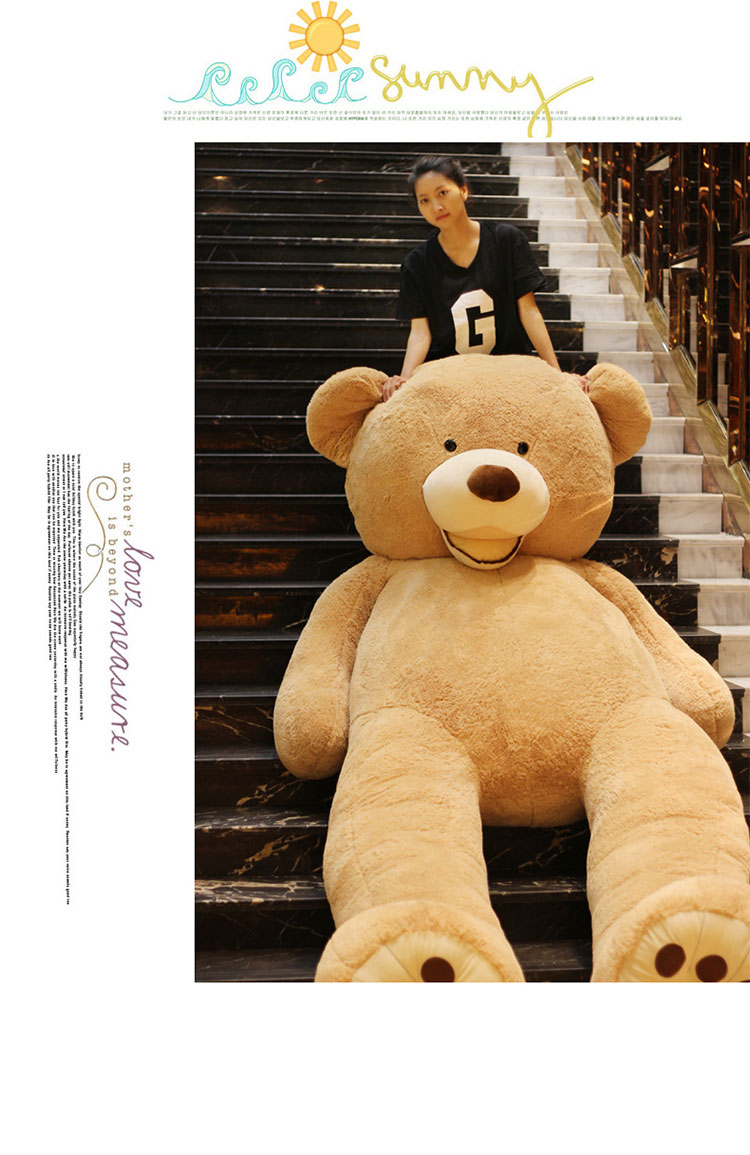

もふもふくまちゃんぬいぐるみマスコットBC付 |おもちゃ・ホビー・ゲーム・縁日玩具・大国屋

スマホケース iPhone 13/12/11/XR/XS/SE2/8/7 グリップケース クリアー

くまちゃん様専用

くまちゃん様専用」iPhoneXSMAX ブラック-

くまちゃんiPhoneケース iPhoneケース・カバー sorari 通販|Creema

メリージェニー くま iPhoneケースの通販 100点以上 | merry jennyの

YUYIB iPhone Xs Max 用 ケース シリコン ソフト かわいい くまちゃん

SH-41A AQUOS sense4 シルバー SIMフリー 本体 ドコモ Aランク スマホ

くまちゃん様専用

ベビーグッズも大集合 【新品・未開封】HUAWEI 3 nova lite 3+

韓国デザイン♡超可愛い くまちゃん ぬいぐるみ ショルダー iPhone

iPhone Xs Max Gold 256 GB SIMフリー www.judiciary.mw

くまちゃん様専用

くまちゃんiPhoneケース iPhoneケース・カバー sorari 通販|Creema

現品限り一斉値下げ! SIMフリー iPhone SE2 第2世代 64GB ホワイト

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています