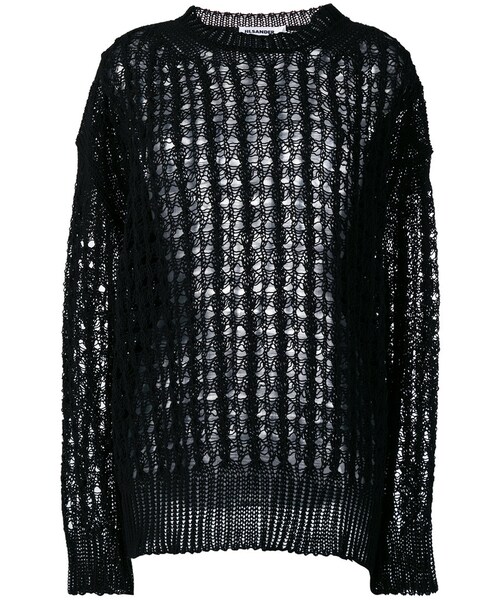

ジルサンダー JIL SANDER トップス

(税込) 送料込み

商品の説明

商品説明

【商品コード】241-003-352-5421

【ブランド】

ジルサンダー

【商品名】

ジルサンダーJILSANDERトップス

【商品ランク】

中古品B

【対象】

レディース

【サイズ】

34

【実寸サイズ】

着丈65.5cm身幅51cm裄丈61cm

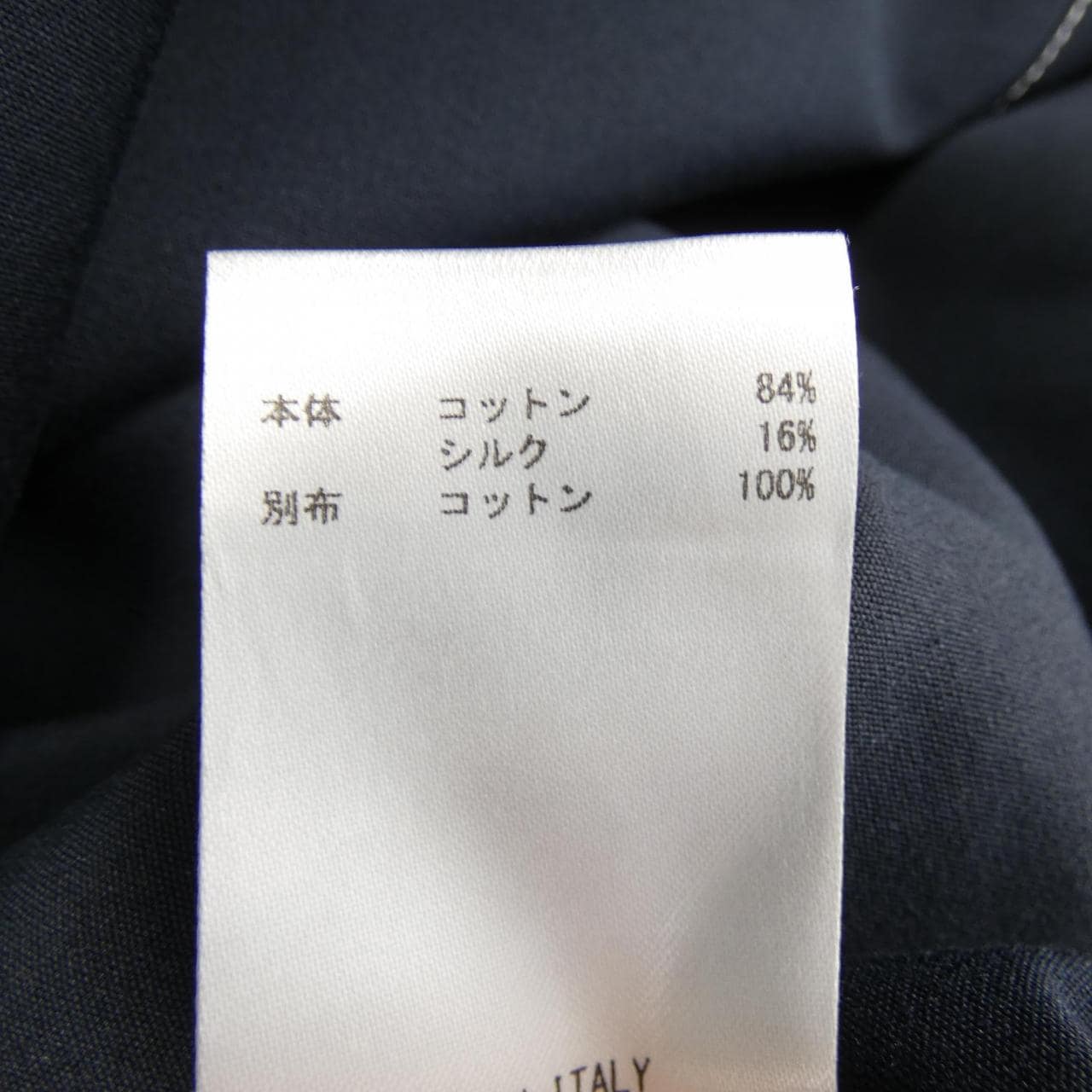

【カラー】

ホワイト系透け感

【詳細説明】

■ご注意ください■

※付属情報について:表記または、写真に掲載のないものは付属しておりません。

また、表記にないキズや汚れ等がある場合があります。

17160円ジルサンダー JIL SANDER トップスレディーストップスジルサンダー JIL SANDER トップス付属情報について - その他ジルサンダー JIL SANDER レディーストップス ロゴプリントTシャツ

ジルサンダー JIL SANDER トップス付属情報について - everestgranite.ca

ジルサンダー JIL SANDER トップス - www.sorbillomenu.com

ジルサンダー JIL SANDER トップス付属情報について - その他

ジルサンダー JIL SANDER トップス付属情報について - everestgranite.ca

SWEATSHIRT | JIL SANDER(ジルサンダー) / トップス スウェット

即購入可様専用 ジルサンダー JIL SANDER トップス その他

Jil Sander - ジルサンダー JIL SANDER トップスの通販 by KOMEHYO

JILSANDER ジルサンダー トップス ロングTシャツ ロンT J02GC0107

楽天市場】JILSANDER ジルサンダー トップス 裾ロゴラベルTシャツ3枚

ジルサンダー プラス JIL SANDER+ JPUU707535 MU247518 Tシャツ メンズ

ジルサンダー Jil Sander パーカー トップス フーディー プルオーバー

コメ兵|ジルサンダー JIL SANDER トップス|ジルサンダー|レディース

Jil Sander - ジルサンダー JIL SANDER トップスの通販 by KOMEHYO

未使用新品】JIL SANDER ジルサンダー ボーダートップス | kensysgas.com

コメ兵|ジルサンダー JIL SANDER トップス|ジルサンダー|レディース

Jil Sander - ジルサンダー JIL SANDER トップスの通販 by KOMEHYO

セール】ジルサンダー 長袖Tシャツ ロンT カットソー トップス

コメ兵|ジルサンダー JIL SANDER トップス|ジルサンダー|メンズ

JILSANDER ジルサンダー トップス ロゴロンT J02GC0107 J45047

Jil Sander(ジルサンダー) トップス(レディース) - 海外通販のBUYMA

セール】ジルサンダー プラス Tシャツ メンズ JIL SANDER+ J47GC0023

ジルサンダー JIL SANDER トップス付属情報について - mirabellor.com

JIL SANDER(ジルサンダー)の「Jil Sander - メッシュニット トップス

ジルサンダー Jil Sander パーカー トップス フーディー プルオーバー

ジルサンダーJIL SANDER ネックループノースリーブトップス ピンク36

コメ兵|ジルサンダー JIL SANDER トップス|ジルサンダー|レディース

楽天市場】ジルサンダー JIL SANDER J40GU0002 J45050 パーカー メンズ

ジルサンダー トップス-

ジルサンダー ビスコースロングトップス パープル (Jil Sander

コメ兵|ジルサンダー JIL SANDER トップス|ジルサンダー|レディース

JIL SANDER (ジルサンダー) 裾パームツリー クルーネック 半袖 Tシャツ

セール】 ジル・サンダー(Jil Sander) |ジルサンダー プラス JIL

Jil Sander - ジルサンダー JIL SANDER トップスの通販 by KOMEHYO

Jil Sander(ジルサンダー) トップス(レディース) - 海外通販のBUYMA

極美品 ジルサンダー JIL SANDER ニット セーター 18AW アシンメトリー

コメ兵|ジルサンダー JIL SANDER トップス|ジルサンダー|レディース

品揃え充実】 ジルサンダー メンズ Tシャツ 半袖 JIL SANDER

レディース】T-SHIRTS | JIL SANDER(ジルサンダー) / トップス

ジルサンダー JIL SANDER Tシャツ シャツ カットソー トップス 半袖

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています