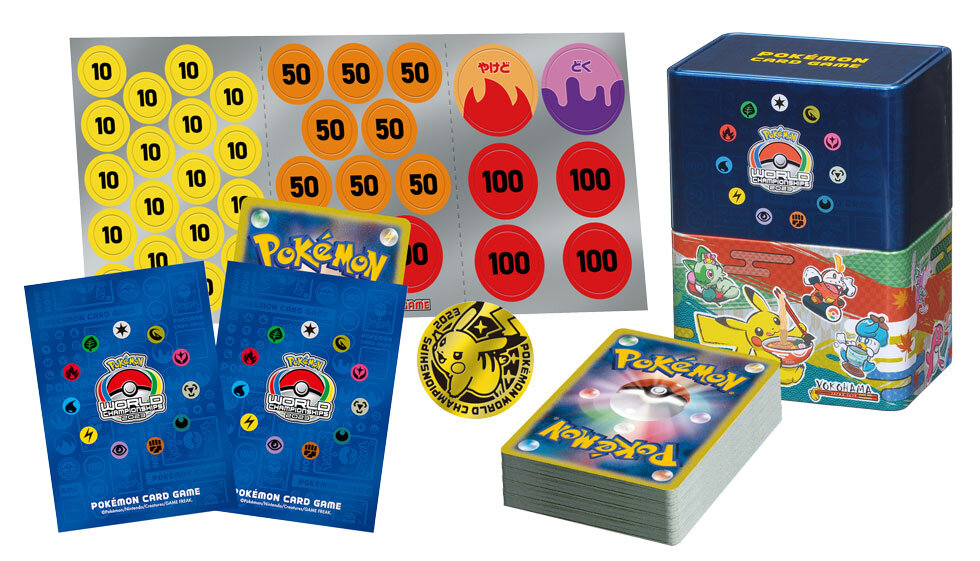

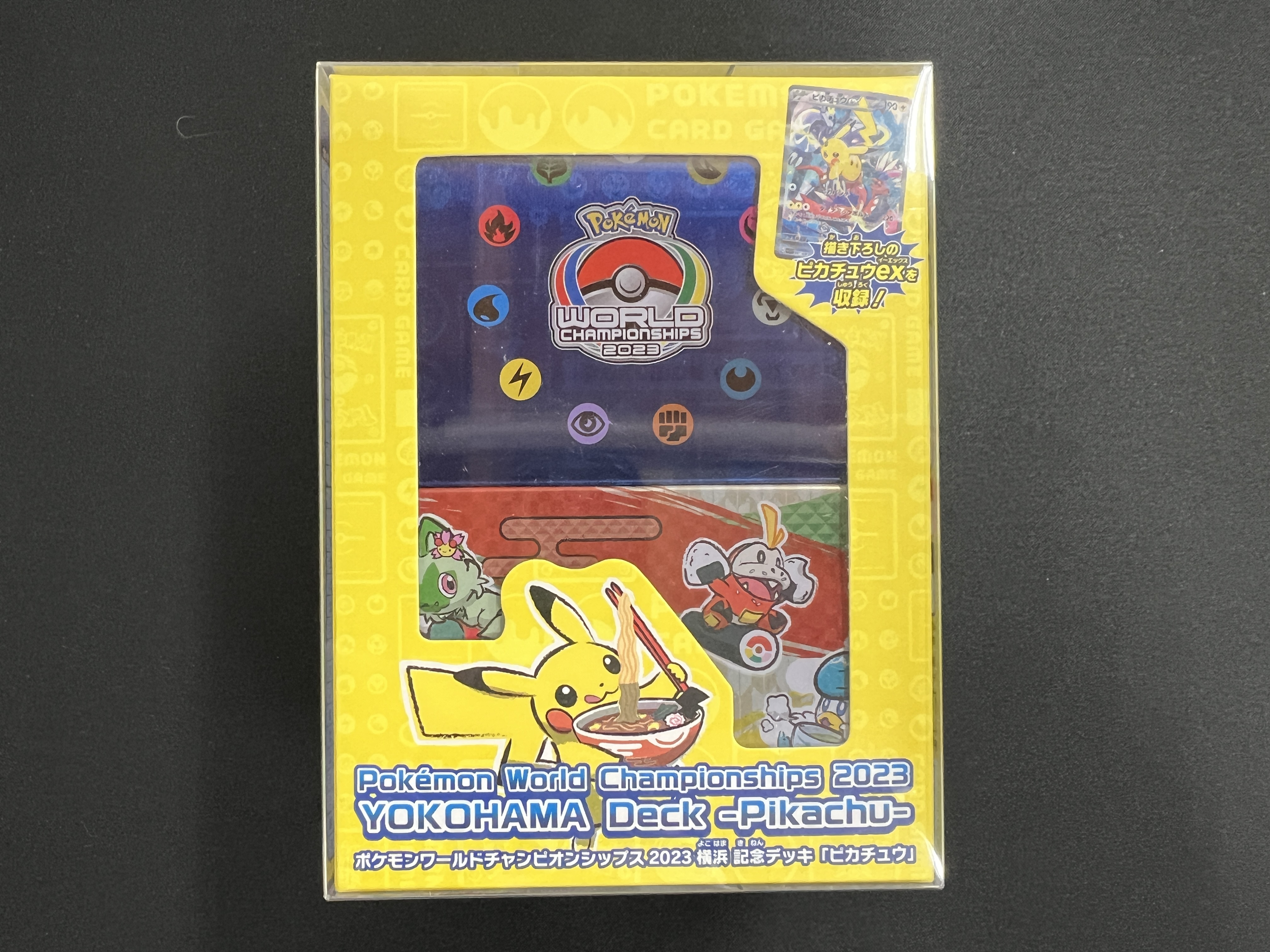

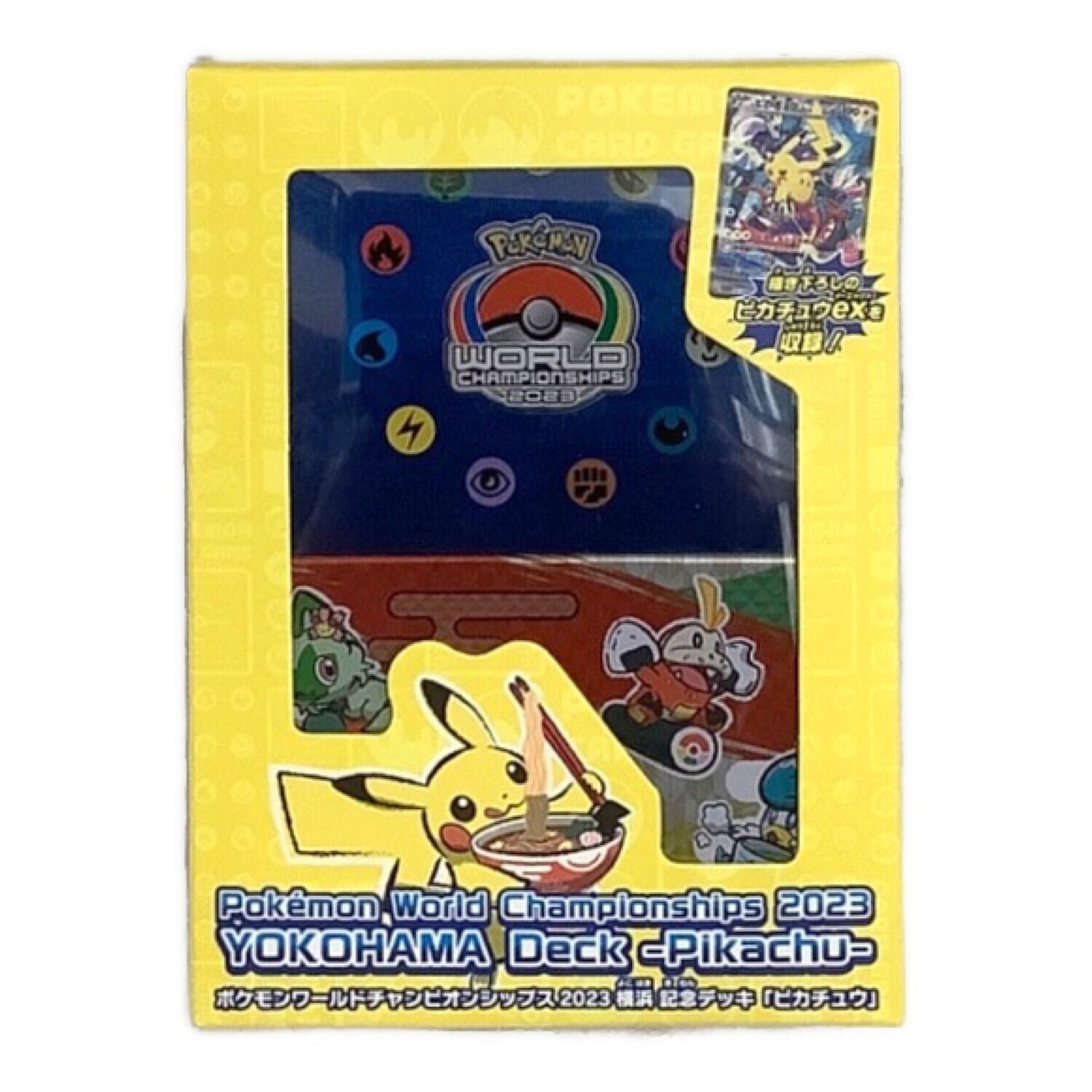

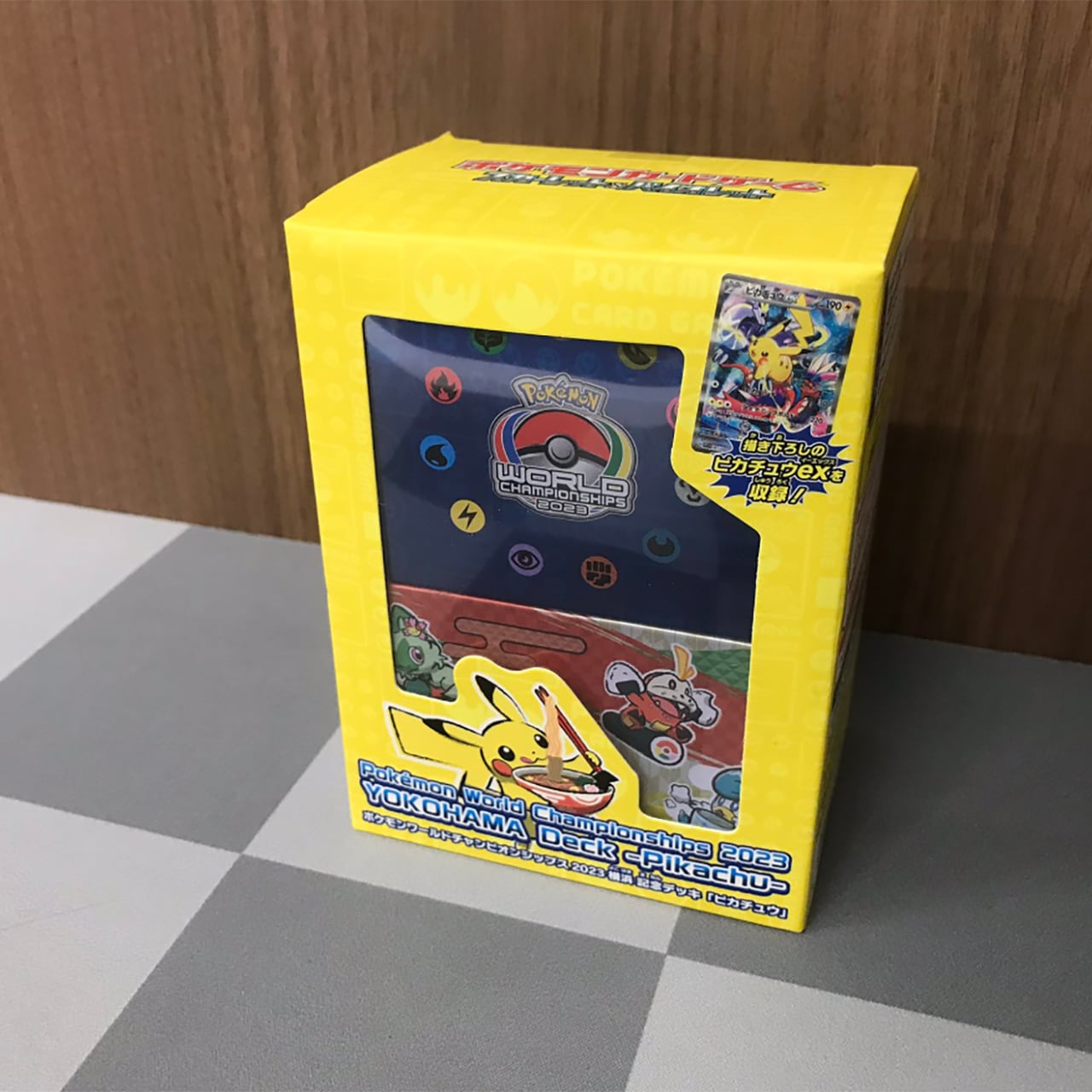

ポケモンカード ワールドチャンピオンシップス2023横浜記念デッキ「ピカチュウ」

(税込) 送料込み

商品の説明

商品説明

ポケモンワールドチャンピオンシップス2023横浜記念デッキ「ピカチュウ」

ポケモンセンターオンライン当選品

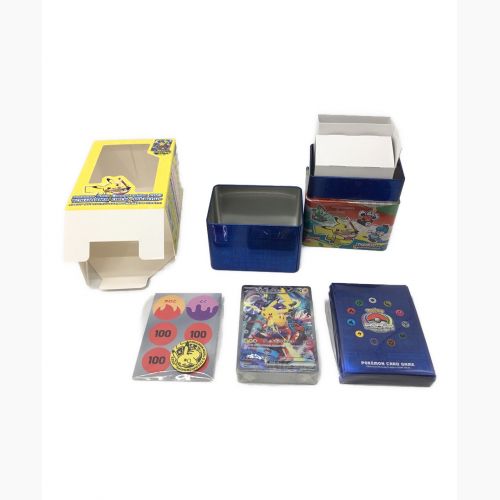

中身は確認のため一度開けさせて頂きます。

ご了承ください。

発送方法

ポケモンセンターオンラインの箱のまま発送いたします。

即日発送可能

新品・未使用、すり替え防止のため返品不可となります。

22800円ポケモンカード ワールドチャンピオンシップス2023横浜記念デッキ「ピカチュウ」エンタメ/ホビートレーディングカードポケモンワールドチャンピオンシップス2023横浜 記念デッキポケモンワールドチャンピオンシップス2023横浜 記念デッキ

ポケモンワールドチャンピオンシップス2023横浜 記念デッキ

ポケモンワールドチャンピオンシップス2023横浜 記念デッキ

ポケモンワールドチャンピオンシップス2023横浜 記念デッキ

ポケモンカード ポケモンワールドチャンピオンシップス2023 横浜記念

ポケモンワールドチャンピオンシップス2023横浜 記念デッキ

32800 円 日本産 ポケモン ポケカ』WCS ワールドチャンピオンシップス

ポケモンカード ポケモンワールドチャンピオンシップス2023 横浜

ポケモンワールドチャンピオンシップス2023横浜 記念デッキ

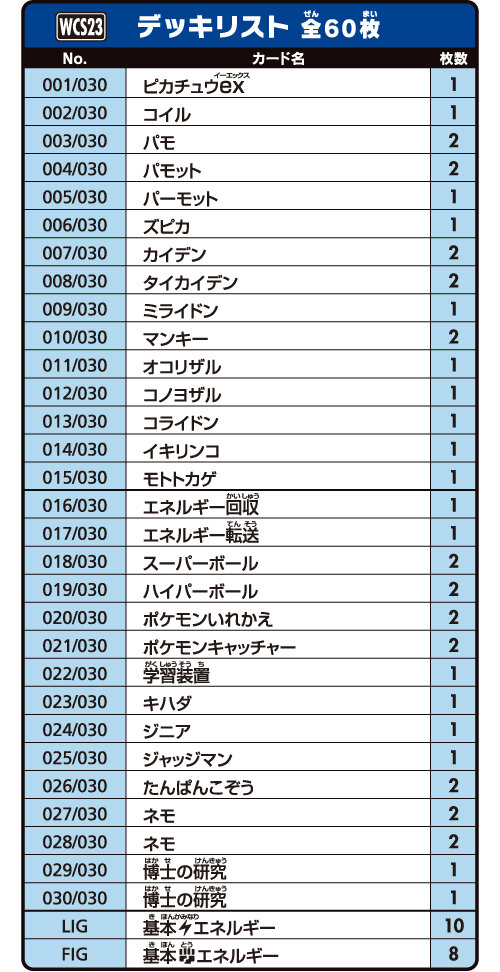

ピカチュウ [WCS23 001/030](ポケモンワールドチャンピオンシップス

ポケカ』WCS 2023開催記念デッキ「ピカチュウ」の追加抽選販売が決定

ポケモンカードゲーム ポケモンワールドチャンピオンシップス2023横浜

ポケモンカード ポケモンワールドチャンピオンシップス2023横浜 記念

2024年最新】ポケモンワールドチャンピオンシップス2023横浜 記念

ポケモンワールドチャンピオンシップス2023横浜 記念デッキ

ポケモンカードワールドチャンピオンシップス 2023横浜記念デッキ

T-ポイント5倍 ポケモンカードワールドチャンピオンシップス2023

ポケモンワールドチャンピオンシップス2023横浜記念デッキ「ピカチュウ」-

ー品販売 ピカチュウex ポケモンカード 横浜記念デッキ ピカチュウ

20400円 ポケモンワールドチャンピオンシップス2023横浜 記念デッキ

ポケカ』WCS 2023開催記念デッキ「ピカチュウ」の追加抽選販売が決定

何でも揃う ポケモンカード ワールドチャンピオンシップ横浜記念デッキ

ポケモンワールドチャンピオンシップス2023横浜 記念デッキ

2024年最新】ポケモンワールドチャンピオンシップス2023横浜 記念

新発売の キャラクターグッズ ポケモンカード WCS 2023 横浜記念デッキ

今週特売 ポケモンワールドチャンピオンシップス2023横浜記念デッキ

半額購入 ポケモンカード ワールドチャンピオンシップス2023 横浜記念

お洒落 ポケモンカード ポケモンワールドチャンピオンシップス2023横浜

ポケモンワールドチャンピオンシップス2023 横浜記念デッキ ピカチュウ

ポケモンカード WCS2023 横浜記念デッキ - www.sorbillomenu.com

素晴らしい品質 ポケモンカードワールドチャンピオンシップス 記念

16800円引き ポケモンワールドチャンピオンシップス2023 横浜 記念

ポケカ』WCS 2023開催記念デッキ「ピカチュウ」の追加抽選販売が決定

ポケモンカードゲーム スカーレット&バイオレット ポケモンワールド

当店人気NO.1 ポケモンワールドチャンピオンシップス2023横浜記念

ポケモンワールドチャンピオンシップス2023 横浜記念デッキ

ポケモンカードゲーム ポケモンワールドチャンピオンシップス2023横浜

ポケモンカード ポケモンワールドチャンピオンシップス2023 横浜記念

新品・未開封 ポケモンカードワールドチャンピオンシップス2023横浜

ポケモンワールドチャンピオンシップス2023横浜 記念デッキ ピカチュウ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています