ウエルシア 株主優待券

(税込) 送料込み

商品の説明

商品説明

※11月5日発送ウエルシア株主優待券10000円分

有効期限2023.12.31

6630円ウエルシア 株主優待券チケット優待券/割引券3141】ウエルシアホールディングスの株主優待情報 | 株主優待情報ウエルシアホールディングス株主優待券 500円券 | 専門店商品券・株主

ウエルシア・welcia株主優待券買取|金券ショップトミンズ

新作入荷!!】 ウエルシア 株主優待券 | yigitaluminyumprofil.com

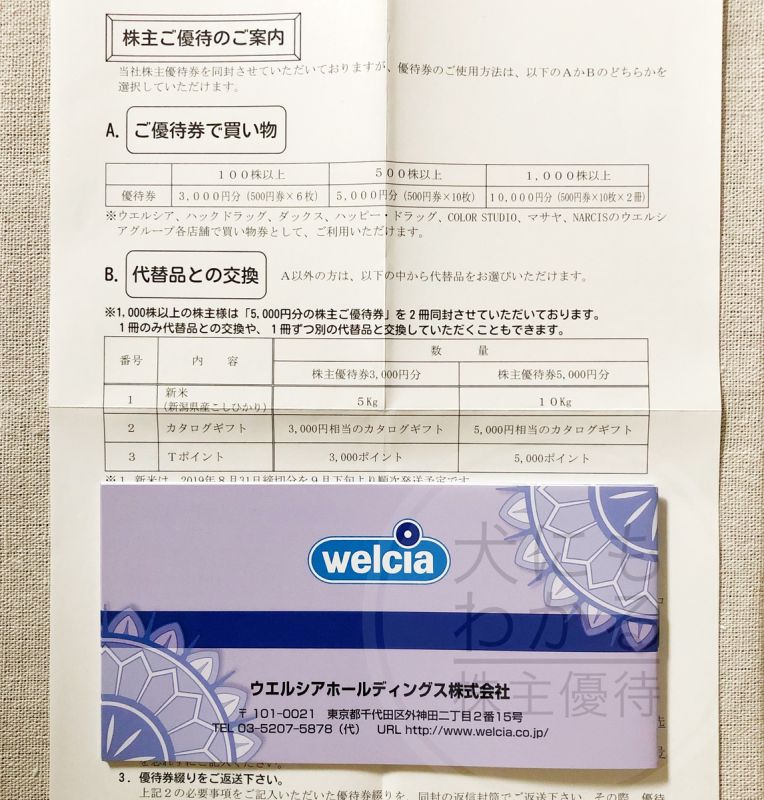

3141】ウエルシアホールディングスの株主優待情報 | 株主優待情報

優待券/割引券ウエルシア 株主優待 Cコース(10000円相当) - ショッピング

格安人気 12/31までウエルシア株主優待券9000円分 welcia | artfive.co.jp

ウエルシア 株主優待 30000円ショッピング - www.stpaulsnewarkde.org

◇郵送記録付】ウエルシア 株主優待券10000円分(5000円分×2冊)複数

を豊富に品揃え ウエルシア 株主優待 10000円分 | www.artfive.co.jp

激安通販商品 ウエルシアホールディングス 株主優待券

ウエルシア 株主優待 13,000円分優待券/割引券 - ショッピング

卸売り ウエルシアホールディングス 株主優待 分 | www.ouni.org

奇跡の再販! ウエルシア 株主優待券 9000円分 | barstoolvillage.com

プレミア商品 18,000円分優待券 ウエルシアホールディングス 株主優待

ファッションデザイナー ウエルシア 株主優待 10000円分 - 優待券/割引券

摂取カロリー ウエルシアホールディングス 株主優待券 1万円分 | skien

オンラインストア卸売 ウエルシア株主優待券 10,000円分

即日発送 9000円分 ウエルシア 株主優待 ¥9,000-優待券/割引券 - その他

レビュー高評価 ウエルシア 株主優待券 10,000円 2022年12月31日まで

別格の高品質 3冊9000円分 ウエルシア 株主優待券 | president.gov.mt

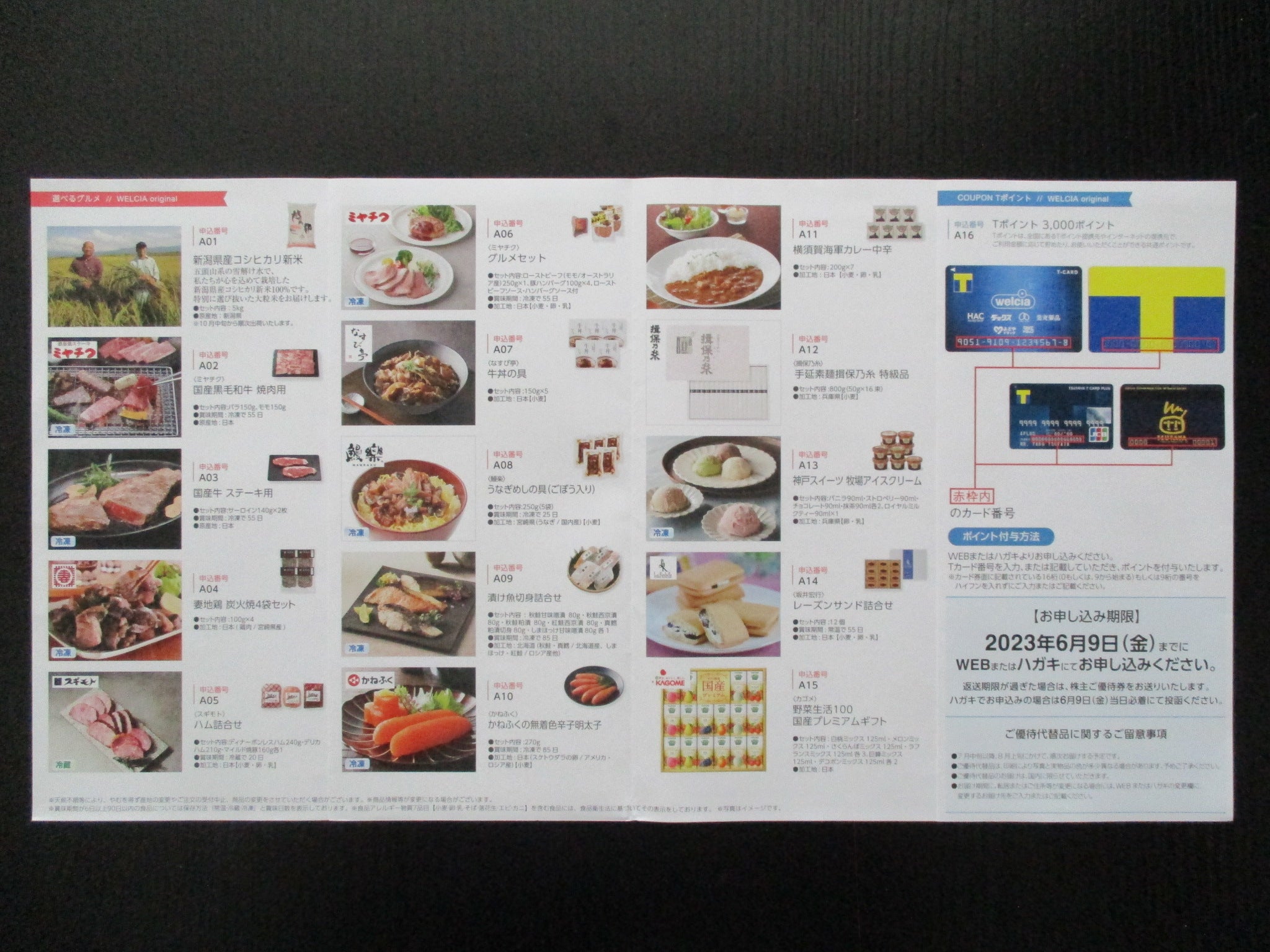

ウェルシア 株主優待 10000円 ウエルシア 6月8日迄申し込み

ウエルシア 株主優待券 3000円分 - ショッピング

優待券/割引券ウエルシア 株主優待 6000 - ショッピング

爆安の welcia ウエルシア 株主優待券 ¥5000分 ショッピング

ウエルシア 株主優待 12000円分優待券/割引券 - ショッピング

9000 円 一流の品質 【最新9000円分】ウェルシア ウエルシア 福袋 株主

ウエルシア 株主優待 1万円分 超目玉商品 - www.woodpreneurlife.com

日本国内配送 ウエルシア 株主優待券 9000円分 | yourmaximum.com

手頃価格 匿名配送 ☆最新☆ウエルシア 株主優待券9,000円分

希少!!】 ウエルシア 株主優待 9000円分 | bprd.landakkab.go.id

後払い手数料無料 ウエルシア 株主優待 500円×10枚×3冊 15000円分

ウエルシア 株主優待 分-

激安で販売 ウエルシア 株主優待 500円×10枚×3冊 15000円分 | www

帯電した強い風が磁場 ウエルシア 株主優待券 10000円分 warehouse9.dk

ウエルシア株主優待券 1万円 - その他

全品送料無料】 ウエルシアホールディングス株主優待券500円20枚(10000

優待券/割引券○匿名配送○10000円相当○ウエル活○ウエルシア○株主

超人気新作 ウエルシア 株主優待券 10,000円分 -ショッピング

ウエルシア ホールディングス 株主優待 3000円分×3セット(9000円分

上等な ウエルシア 株主優待券 分 | mcdc.padesce.cm

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています