トラディショナルウェザーウェア Traditional Weatherwear ウール イージースラックスパンツ ブラック【サイズXS】【メンズ】

(税込) 送料込み

商品の説明

商品説明

■ブランドTraditionalWeatherwear(トラディショナルウェザーウェア)

■アイテム

カジュアルスラックスパンツ/メンズ

■カラー

ブラック

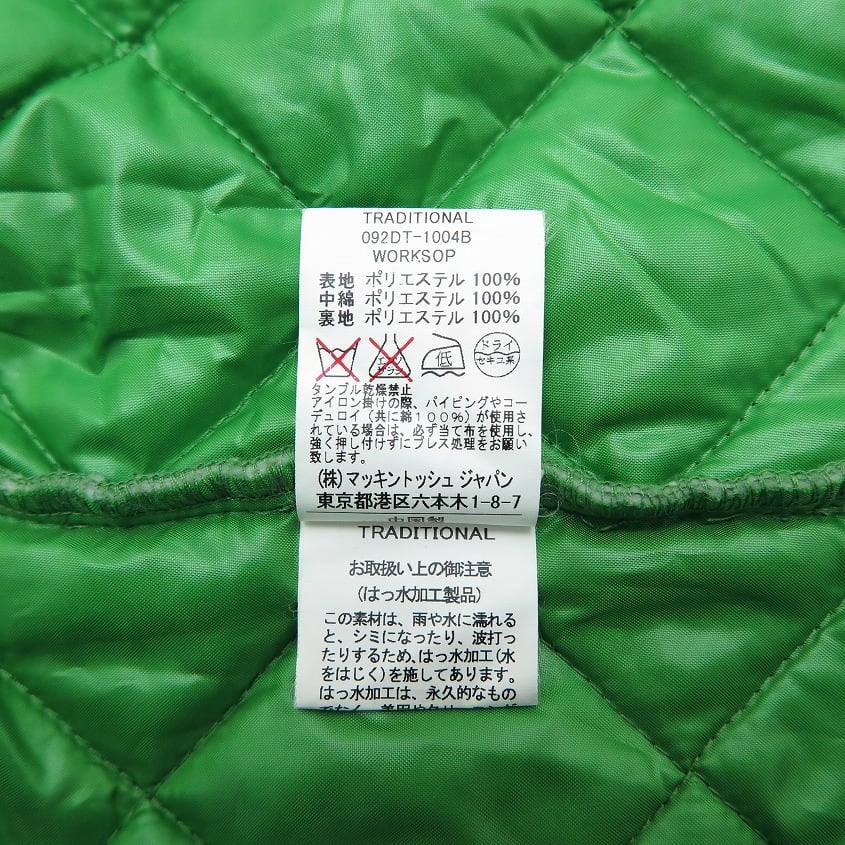

■素材

ウール100%

■付属品

なし

■仕様/モデル

・秋冬向け・イギリス製・ウエストドローコード付き・ノープリーツ・ジッパーフライ・裾ステッチ仕上げ・ウエスト後ろゴム仕様

■コンディション

わずかなスレがございます。

■サイズ

サイズ表記XS

ウエスト78~84cm(平置きにして両端を直線計測した2倍)

ウエスト出し可能寸-cm(ウエスト出しが可能と思われる寸法)

股上26cm(股下中央縫い目から前身最上部まで)

股下76cm(股下中央縫い目から、裾まで縫い目に沿って計測)

裾内側余り寸-cm(裾内側の余り生地寸)

ワタリ30cm(股下0cm部分の腿幅を直線計測)

裾幅19.5cm(裾の両端を直線計測)

※採寸方法における若干の誤差は、ご了承頂きますようお願い致します。

■補足コメント

フランネル調の厚みのあるウール素材を用いたスラックスパンツです。すっきりとしたシルエットになりまして、ウエストにエラスティックを配すことで、履き心地にも秀でた一本に仕上がっています。

[商品番号]20024792

こちらの商品はラクマ公式パートナーのRitagliolibro(リタリオリブロ)によって出品されています。

7507円トラディショナルウェザーウェア Traditional Weatherwear ウール イージースラックスパンツ ブラック【サイズXS】【メンズ】メンズパンツ【新品】バグッタ Bagutta カジュアルシャツトラディショナルウェザーウェア Traditional Weatherwear ウール

購入国内正規品 トラディショナルウェザーウェア Traditional

トラディショナルウェザーウェア Traditional Weatherwear ウール

【新品】バグッタ Bagutta カジュアルシャツ, ブラウン【サイズ40】【BRW】【S/S/A/W】【状態ランクN】【メンズ】, 【769594】 APD

【新品】バグッタ Bagutta カジュアルシャツ, ブラウン【サイズ40】【BRW】【S/S/A/W】【状態ランクN】【メンズ】, 【769594】 APD

購入国内正規品 トラディショナルウェザーウェア Traditional

TRADITIONAL WEATHERWEAR - トラディショナルウェザーウェア

2024年最新】traditional weatherwear パンツの人気アイテム - メルカリ

ジャブスアルキヴィオ テクノウール42

【UNIONWEAR】UNIONSLACKS 106

TRADITIONAL WEATHERWEAR - トラディショナルウェザーウェア

ジャブスアルキヴィオ テクノウール42

UNIONSLACKS301(504626812) | トラディショナル ウェザーウェア

Traditional Weatherwear(トラディショナルウェザーウェア)UNISEX

TWW トラディショナルウェザーウェア イージーパンツ - ワークパンツ

Traditional Weatherwear(トラディショナル ウェザーウェア) 公式

CREW NECK PULLOVER(505757799) | トラディショナル ウェザーウェア

Traditional Weatherwearのパンツ検索結果|古着・中古品の通販サイト

Traditional Weatherwear(トラディショナルウェザーウェア)UNISEX

ZOZO限定】SHIPS.me: リラックス イージー トラウザーパンツ

パンツNEAT Cotton Kersey TAPERED - www.obalovydesign.cz

Traditional Weatherwear(トラディショナルウェザーウェア)の

TWW トラディショナルウェザーウェア イージーパンツ - ワークパンツ

Traditional Weatherwear(トラディショナルウェザーウェア)UNIONSLACKS

Traditional Weatherwear|トラディショナルウェザーウェア(メンズ

Traditional Weatherwear/UNION SLACK 401-

UNIONWEAR】UNIONSLACKS 104 ユニオンスラック 104|ブラック|メンズ

2024年最新】traditional weatherwear パンツの人気アイテム - メルカリ

Traditional Weatherwear トラディショナルウェザーウェア メンズ

トラディショナル ウェザー ウェア アウトレットの通販|au PAY マーケット

パンツNEAT Cotton Kersey TAPERED - www.obalovydesign.cz

ジャブスアルキヴィオ テクノウール42

Traditional Weatherwear (トラディショナルウェザーウェアー) ユニオン スラックスパンツ G231OSFPT0201EC

【UNIONWEAR】UNIONSLACKS 106

Traditional Weatherwear(トラディショナル ウェザーウェア) 公式

Traditional Weatherwear トラディショナルウェザーウェア 中綿

中古・古着通販】Traditional Weatherwear (トラディショナルウェザー

楽天市場】NEUTRALWORKS.(ニュートラルワークス)ユニセックス

パンツ | Octet オクテット 名古屋 by林商店 | メンズ通販セレクトショップ

ウールコットンダブルジャガード イージースラックス

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています