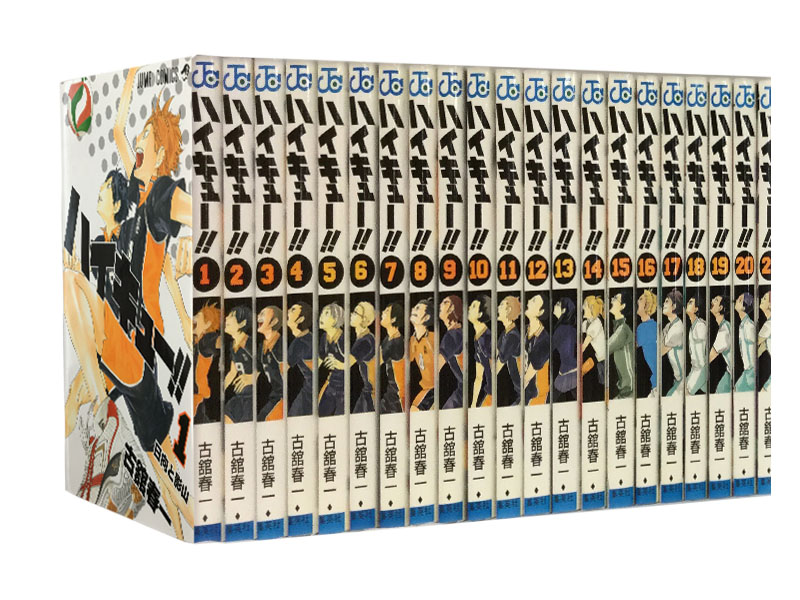

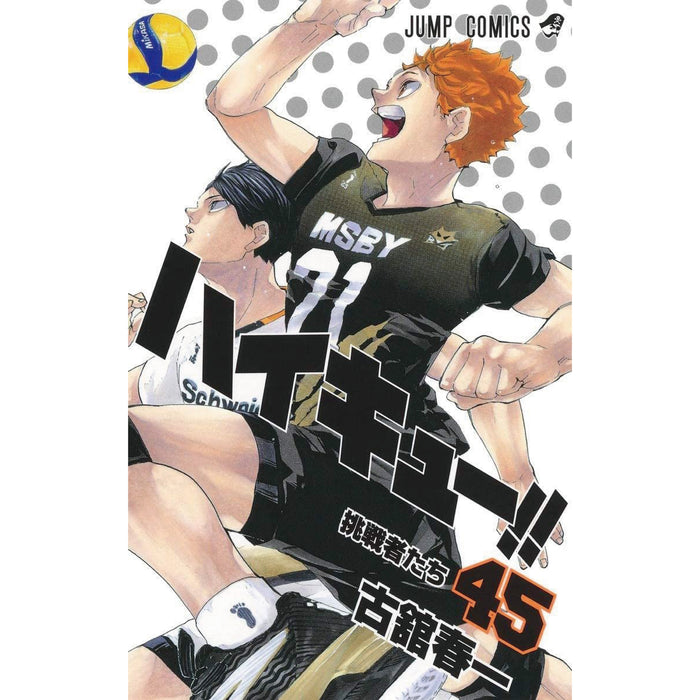

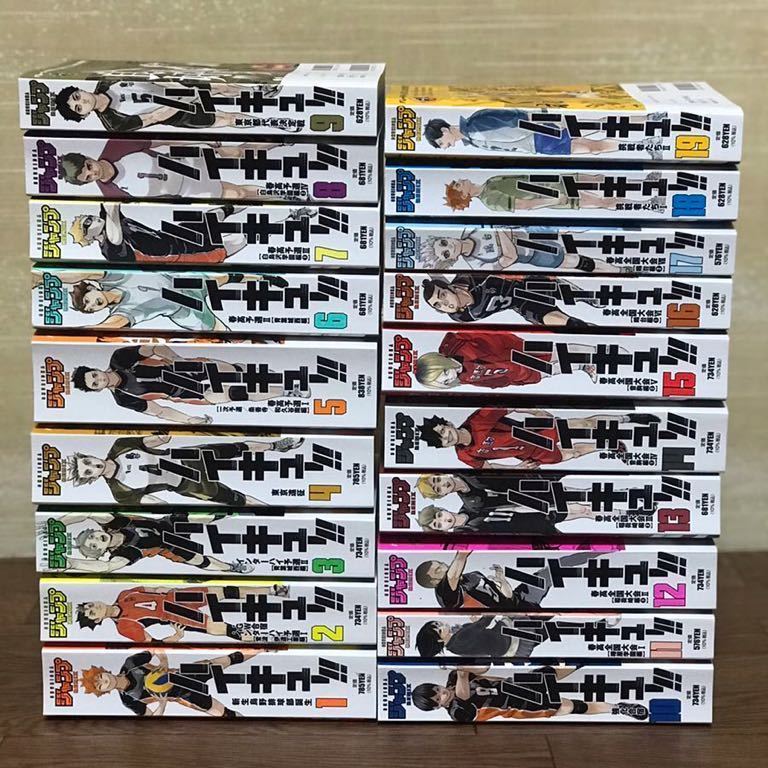

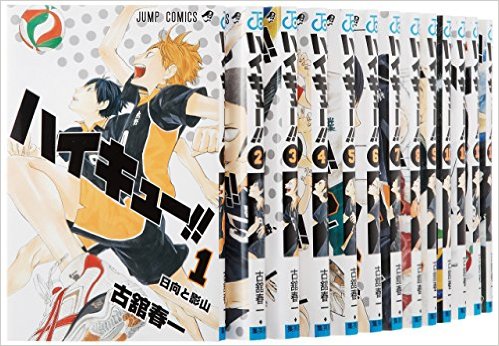

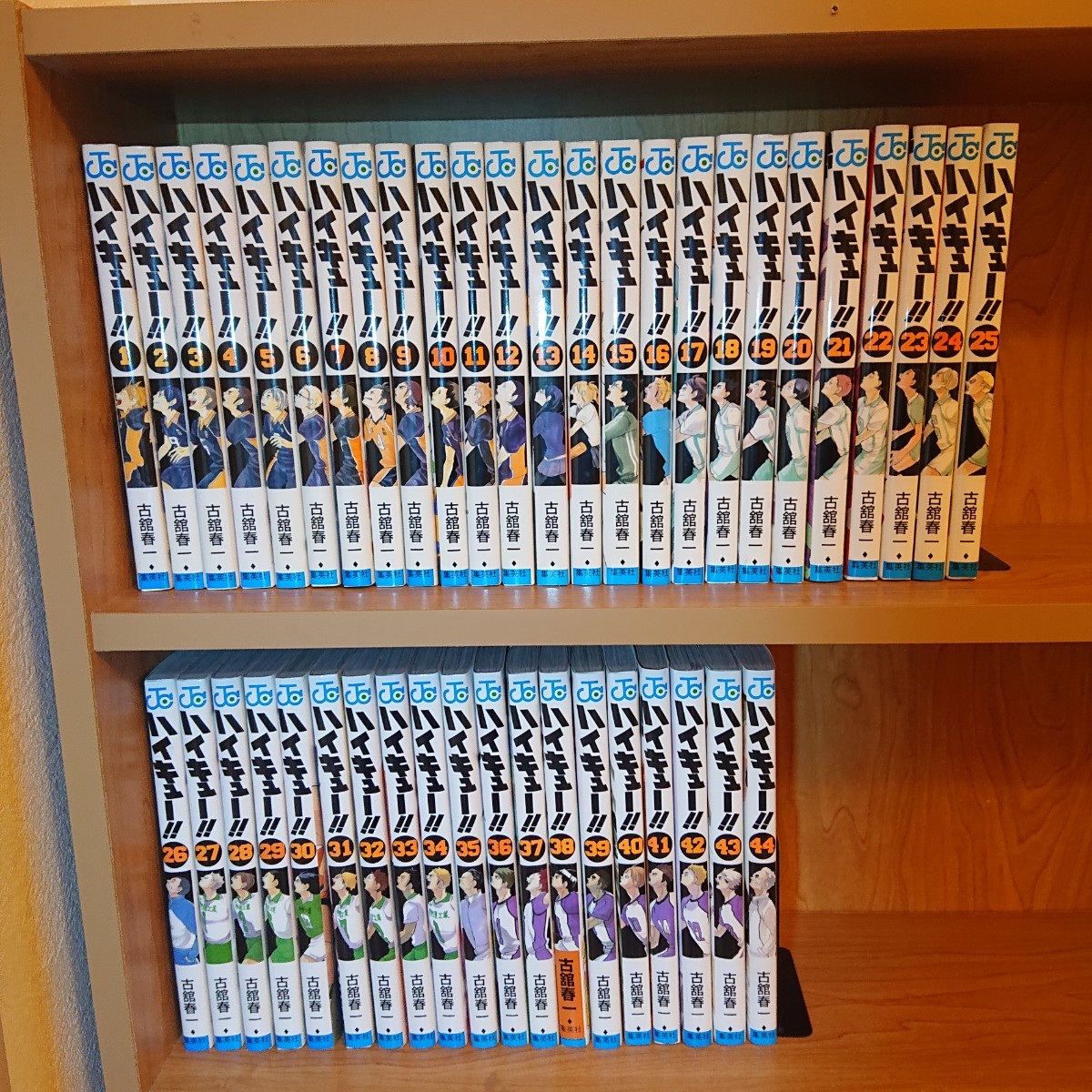

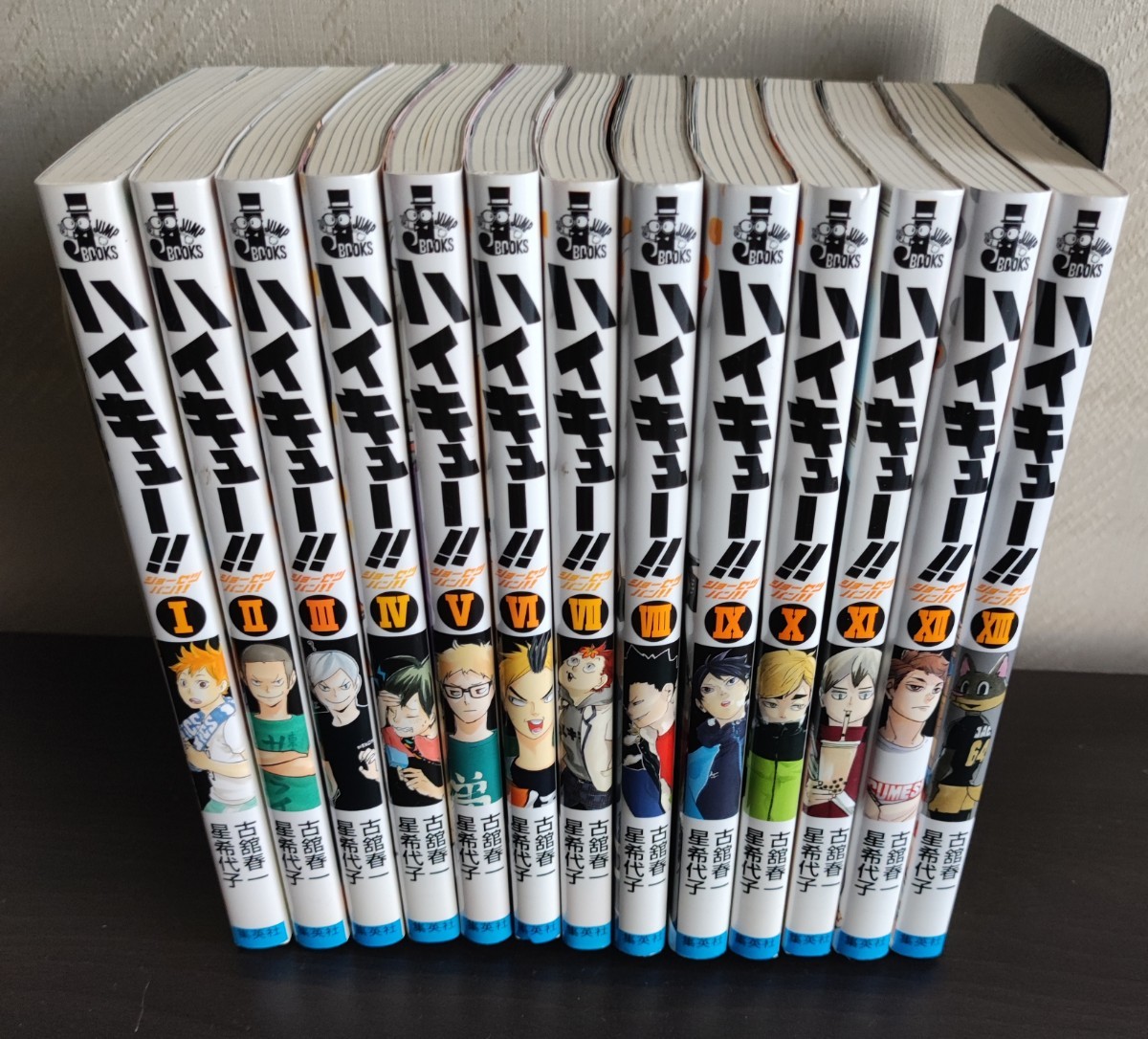

ハイキュー!! 全巻セット

(税込) 送料込み

商品の説明

商品説明

全巻セットです。2、3周くらい読んだので若干の使用感はあるかもしれませんが目立った汚れ、傷はありません。しかし、素人管理ですのでご了承ください。

値下げ検討いたします。

12675円ハイキュー!! 全巻セットエンタメ/ホビー漫画全巻セットマンガ ハイキュー!!全巻セット(1~45巻)漫画コミック【漫画全巻セット】【中古】ハイキュー!! <1~45巻完結> 古舘春一 | もったいない本舗 楽天市場店

ハイキュー!! 全45巻 全巻セット 古舘春一 八文字屋オリジナル特典付き

ハイキュー!!全巻セット - 全巻セット

全巻セットマンガ ハイキュー!!全巻セット(1~45巻)漫画コミック

最終値下】ハイキュー 全巻セット 1~45 古舘春一エンタメ/ホビー

Amazon.co.jp: ハイキュー 全巻セット 古舘春一 1~45巻 完結 最終巻

ハイキューの漫画全巻 - 全巻セット

スピード出荷 ハイキュー 全巻セット | www.artfive.co.jp

通販の人気 ハイキュー 全巻セット(1巻〜45巻) | artfive.co.jp

新品即決 「ハイキュー!!」漫画 ハイキュー 全巻セット1~45巻セット

ハイキュー 漫画 全巻セット abitur.gnesin-academy.ru

注目ショップ - 漫画全巻セット ハイキュー 全巻セット 漫画

交換無料! 1~45 ハイキュー全巻セット- その他 ハイキュー

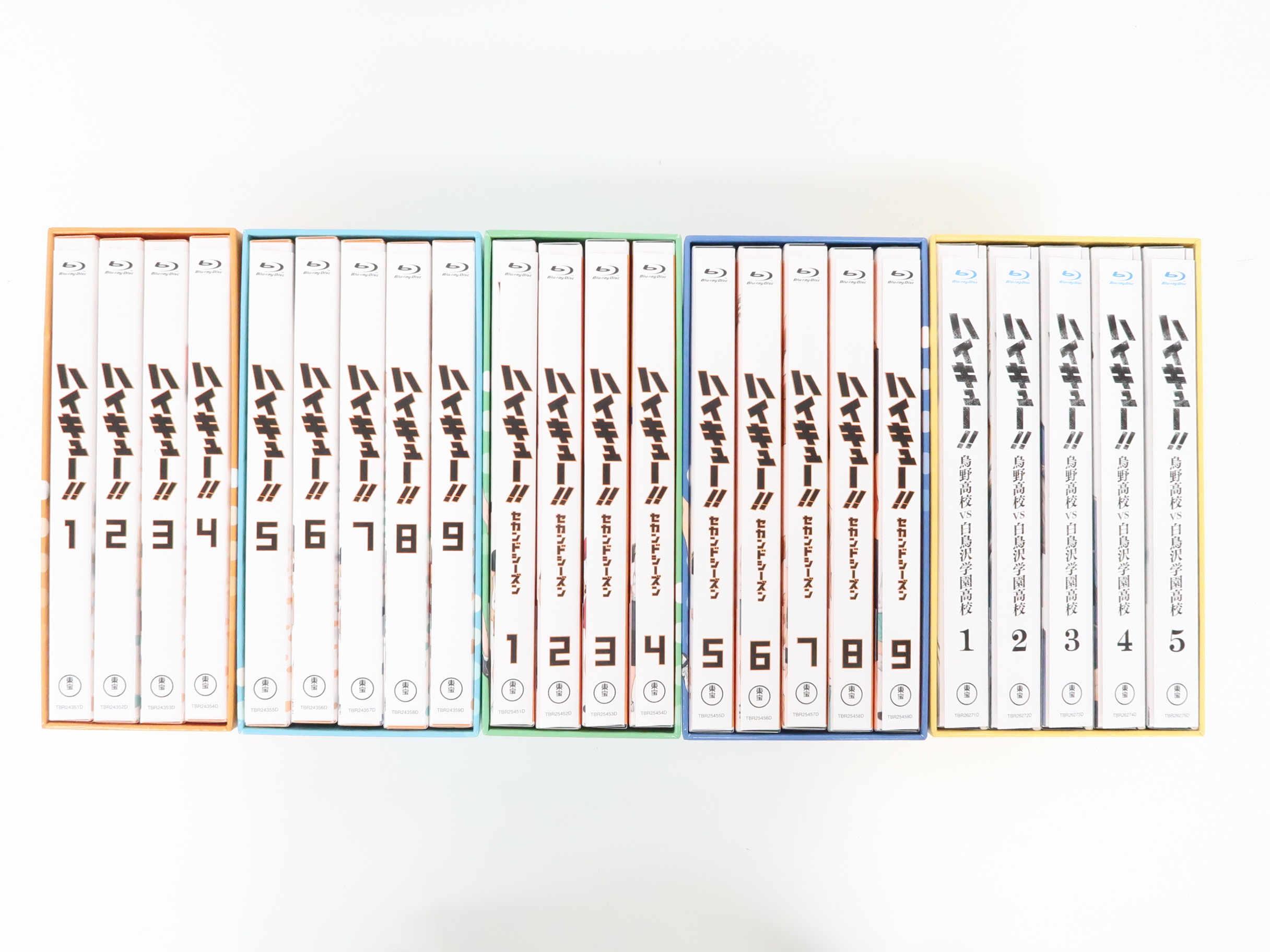

ハイキュー全巻セット➕ハイキュー極 無料配達 www.geyrerhof.com

大人気 ハイキュー 全巻セット ハイキュー!! 漫画 ssiec-co.com

ハイキュー!! 全45巻 全巻セット 古舘春一 八文字屋オリジナル特典付き

ハイキュー!! コミック 全45巻セット | 古舘 春一 |本 | 通販 | Amazon

ハイキュー 漫画全巻-

送料無料 ハイキュー 全巻セット 全巻セット 初回限定版あり。 漫画

高品質/低価格 ハイキュー全巻セット 1〜45巻 | artfive.co.jp

ハイキュー 全巻セットの+inforsante.fr

チェンソーマン&ハイキュー全巻セット漫画 - 全巻セット

ハイキュー!! 全巻セット(1-45巻)/古舘春一 : yf-zk000014 : bookfan

ハイキュー‼︎ 全巻セット - 全巻セット

楽天市場】ハイキュー全巻 ハイキュー!!1〜45巻セット ハイキュー全巻

ハイキュー 全巻セット-siegfried.com.ec

ハイキュー 漫画 全巻セット abitur.gnesin-academy.ru

ハイキュー全巻セット+apple-en.jp

ハイキュー 全巻セット|Yahoo!フリマ(旧PayPayフリマ)

Amazon.co.jp: ハイキュー 全巻セット

ハイキュー!!全巻セット 1〜45巻 – アニメノマツリ

2024年最新】ハイキュー!! 全巻の人気アイテム - メルカリ

ハイキュー 漫画 全巻セット abitur.gnesin-academy.ru

Amazon.co.jp: ハイキュー 全巻セット

スピード出荷 ハイキュー 全巻セット | www.artfive.co.jp

在庫豊富な ハイキュー‼︎全巻セット+おまけ付き reqJv-m52014130914

ハイキュー!!全巻セット y - Illustrations ART street

2024年最新】ハイキュー!! 全巻の人気アイテム - メルカリ

ハイキュー 全巻 セット-

楽天市場】【3月下旬発送予定】ハイキュー!! 全巻 1〜45巻 漫画

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています