ドゥロワー DRAWER ベスト

(税込) 送料込み

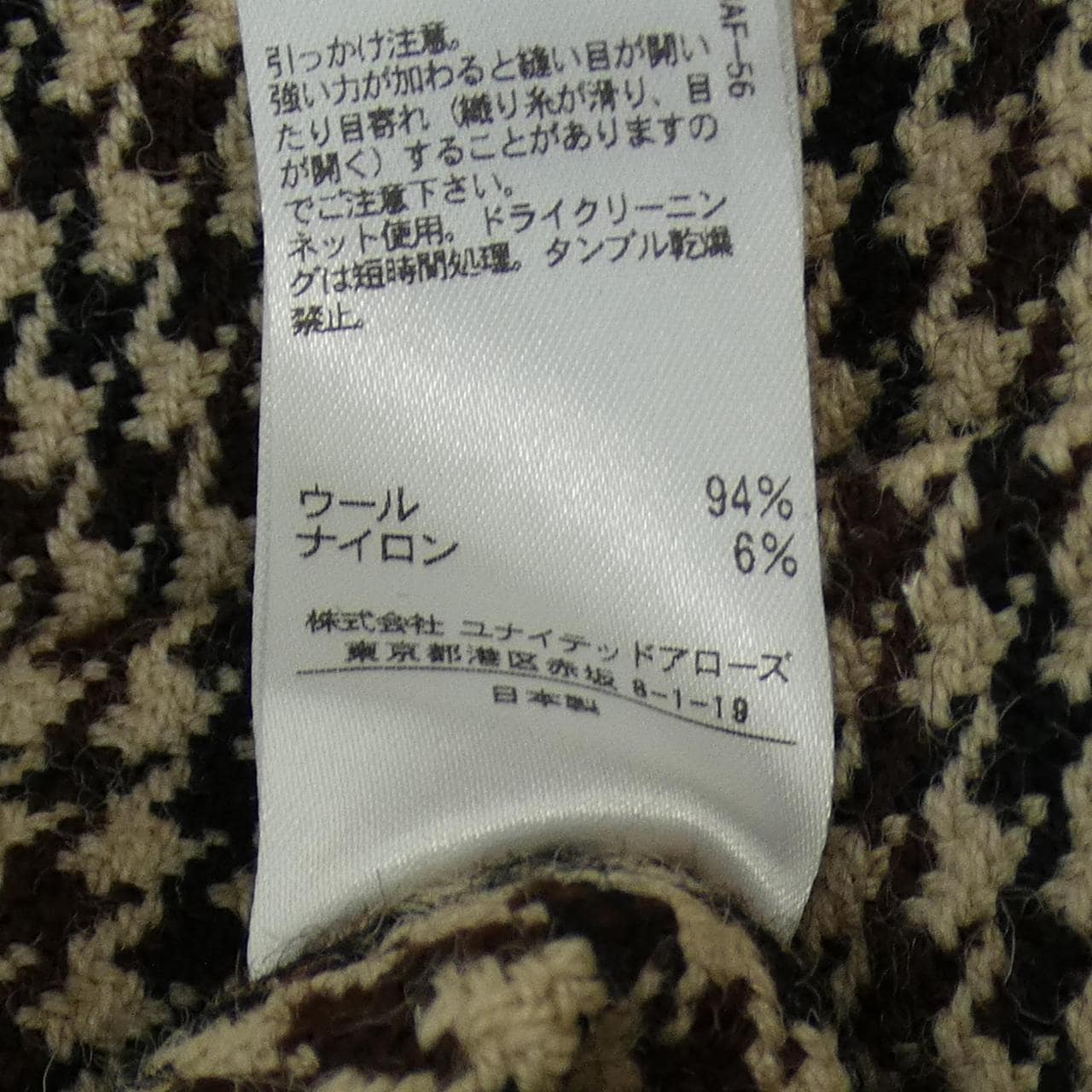

商品の説明

商品説明

【商品コード】241-003-411-7663

【ブランド】

ドゥロワー

【商品名】

ドゥロワーDRAWERベスト

【通称】

6518-105-0496

【品番】

6518-105-0496

【商品ランク】

中古品B

【対象】

レディース

【サイズ】

1

【実寸サイズ】

着丈80cm身幅51.5cm

【カラー】

ブラック系

【詳細説明】

所どころ擦れがあります。

■ご注意ください■

※付属情報について:表記または、写真に掲載のないものは付属しておりません。

また、表記にないキズや汚れ等がある場合があります。

17160円ドゥロワー DRAWER ベストレディーストップスDrawer ドゥロワー 6518-105-0459 7G ウール カシミヤ 畔編み ノースリーブ タートルネック ニット ベスト ブラック系【中古】ドゥロワー DRAWER ベスト - www.sorbillomenu.com

Drawer(ドゥロワー)の「DRAWER Vネックベスト(ニット/セーター

Drawer(ドゥロワー)の「Drawer アラン ベスト(ニット/セーター

Drawer ドゥロワー 6518-105-0459 7G ウール カシミヤ 畔編み ノースリーブ タートルネック ニット ベスト ブラック系【中古】

ドゥロワー DRAWER ベスト - www.sorbillomenu.com

コメ兵|ドゥロワー DRAWER ベスト|ドゥロワー|レディース

ドゥロワー DRAWER ベスト付属情報について - その他

コメ兵|ドゥロワー DRAWER ベスト|ドゥロワー|レディース

ドゥロワー DRAWER ベスト - www.sorbillomenu.com

DRAWER ドゥロワー ドロワー カシミア ケーブル編み セーター ベスト-

ドゥロワーDrawer クルーネックニット1 7G畔編みクルーネックニットベスト-

DRAWER (ドゥロワー) カシミア混ニットベスト ネイビー サイズ:FREE

コメ兵|ドゥロワー DRAWER ベスト|ドゥロワー|レディース

大砲候補 ドゥロワー DRAWER ベスト | skien-bilskade.no

ドゥロワー ベスト/ジレ(レディース)の通販 800点以上 | Drawerの

楽天市場】ドゥロワー DRAWER ベスト【中古】 : KOMEHYO ONLINESTORE

DRAWER(ドゥロワー) ニットベスト ブラウン サイズ:1 | 【公式

ドゥロワー ベスト/ジレ(レディース)の通販 800点以上 | Drawerの

Drawer(ドゥロワー)の「DRAWER ムートンベスト(ブラウン)(その他

drawer ドゥロワー ジレ ベストdrawerドゥロワーカラー - ベスト/ジレ

美品】 Drawer / ドゥロワー | 3Gジャカード ケーブル ニットベスト

ドゥロワー Drawer ニット ベスト BLAMINK LOEFF ドゥロワー

コメ兵|ドゥロワー DRAWER ベスト|ドゥロワー|レディース

ご注意くださいドゥロワー DRAWER ベスト - benjaminstrategy.co

drawer ドゥロワー ジレ ベスト | www.fleettracktz.com

DRAWER(ドゥロワー) 21A/W ウールリバーコンビベスト ベージュ

DRAWER ドゥロワー ドロワー カシミア ケーブル編み セーター ベスト-

ドゥロワー DRAWER ベスト - www.sorbillomenu.com

直営通販 ドゥロワー Drawer グレー フードベスト スウェット パーカー

プロモーション ドゥロワー DRAWER ベスト | www.cc-eventos.com.mx

ドゥロワーのジレの商品一覧|ユナイテッドアローズ公式通販 - UNITED

正規取扱店で ドゥロワー DRAWER ベスト | badenbaden-net.com

ドゥロワー ベスト/ジレ(レディース)の通販 800点以上 | Drawerの

DRAWER(ドゥロワー) / ベスト/--/ナイロン/WHT/6515-199-0567 | 古着の

Drawer / ドゥロワー | 3Gジャカード ケーブル ニットベスト | F | – KLD

drawer商品状態ドゥロワー ニットベスト Vネック ノースリーブ

ドゥロワー DRAWER ベスト : 241-003-274-7350 : KOMEHYO ONLINESTORE

一番の贈り物 ドゥロワー DRAWER ベスト【中古】|KOMEHYO ONLINESTORE

Drawer / ドゥロワー | 3Gジャカード ケーブル ニットベスト | F | – KLD

コメ兵|ドゥロワー DRAWER ベスト|ドゥロワー|レディース

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています