鬼滅の刃 きめつのやいば 全巻セット

(税込) 送料込み

商品の説明

商品説明

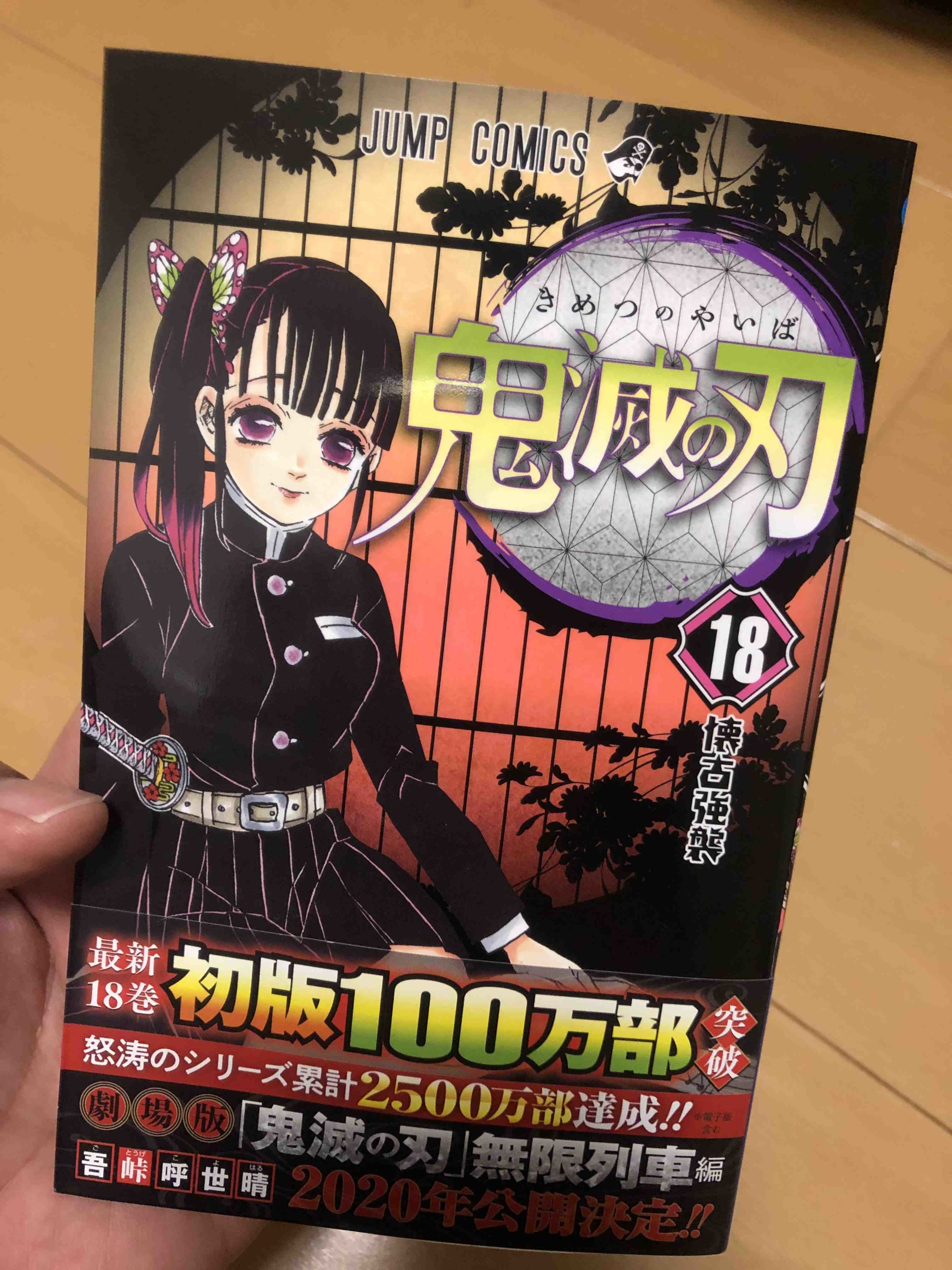

ご覧いただきありがとうございます。売り切れ続出中の「鬼滅の刃」集英社少年ジャンプコミックCOMIC漫画全巻18巻セットまとめ売り

支払い完了後、24時間以内に発送させて頂きます。

全巻セット計18冊

※新品未使用未開封、シュリンク付き

※バラ売不可、18巻帯なし

ご不明点等ありましたらコメントより宜しくお願い致します。

6955円鬼滅の刃 きめつのやいば 全巻セットエンタメ/ホビー漫画鬼滅の刃 漫画全巻 通常版 きめつのやいば 全巻セット 1〜22巻漫画全巻セット 鬼滅の刃 きめつのやいば キメツノヤイバ 鬼滅ノ刃 漫画本

鬼滅の刃1~19巻セット☆きめつのやいば全巻セット漫画 - 全巻セット

楽天市場】【新品シュリンク】鬼滅の刃 1〜20巻セット 全巻 全巻セット

鬼滅の刃 漫画全巻 通常版 きめつのやいば 全巻セット 1〜22巻漫画

62 鬼滅の刃 きめつのやいば キメツノヤイバ 鬼滅ノ刃 漫画本 全巻

楽天市場】【新品シュリンク】鬼滅の刃 1〜23巻セット 全巻 全巻セット

鬼滅の刃 1-23巻 全巻セット ➕外伝 零きめつのやいば - 全巻セット

エンタメ/ホビー鬼滅の刃 1-23巻 全巻セット きめつのやいば 漫画

鬼滅の刃 全巻セットきめつのやいば - 全巻セット

輝く高品質な 鬼滅の刃 鬼滅の刃 鬼滅ノ刃 きめつのやいば 全巻セット

7 鬼滅の刃 きめつのやいば キメツノヤイバ 鬼滅ノ刃 漫画本 全巻

新品 鬼滅の刃 全巻セット 鬼滅ノ刃 きめつのやいば - 全巻セット

全巻セット鬼滅の刃 鬼滅ノ刃 きめつのやいば 漫画 全巻セット

コミック【新品送料無料】 鬼滅の刃 鬼滅ノ刃 きめつのやいば 全巻

鬼滅の刃 きめつのやいば キメツノヤイバ 鬼滅ノ刃 漫画本 全巻セット

鬼滅の刃 漫画 全巻セットの人気商品・通販・価格比較 - 価格.com

最新グッズがいっぱい 7セット 鬼滅の刃 鬼滅ノ刃 きめつのやいば 全巻

00以降の場合は翌朝発送予定鬼滅の刃(1〜23) きめつのやいば 鬼滅ノ刃

全巻セット64 鬼滅の刃 きめつのやいば キメツノヤイバ 鬼滅ノ刃 漫画

お得な情報満載 鬼滅の刃 きめつのやいば 全巻セット 新品未使用

送料無料u3000鬼滅の刃 きめつのやいば 全巻セット 1-23 23冊美品全巻

全巻セット鬼滅の刃 きめつのやいば 全巻セット 特装版 1-22巻 - www

全巻セット鬼滅の刃 きめつのやいば 全巻セット 特装版 1-22巻 - www

漫画46 鬼滅の刃 きめつのやいば キメツノヤイバ 鬼滅ノ刃 漫画本 全巻

コミック】鬼滅の刃(全23巻)セット | ブックオフ公式オンラインストア

鬼滅の刃全巻セット

産屋敷耀哉7セット 鬼滅の刃 鬼滅ノ刃 きめつのやいば 全巻セット 1

日本産 鬼滅の刃 きめつのやいば 全巻セット 全巻セット 特装版 1-22巻

全巻セット鬼滅の刃 鬼滅ノ刃 きめつのやいば 漫画 全巻セット

鬼滅の刃 漫画全巻 通常版 きめつのやいば 全巻セット 1〜22巻

全巻セット鬼滅の刃 鬼滅ノ刃 きめつのやいば 漫画 本 コミック 全巻 1

Amazon.co.jp: 鬼滅の刃 全巻 1-23巻 + 外伝 セット きめつのやいば

鬼滅の刃 きめつのやいば 全巻 1〜22巻セット シュリンク付き - 全巻セット

鬼滅の刃 鬼滅ノ刃 きめつのやいば 漫画 全巻セット コミック 全巻 1

超人気高品質 きめつのやいば 全巻セット 【コミック】鬼滅の刃(全

最終決算 鬼滅の刃 1-23巻 - 全巻セット きめつのやいば 全巻セット 鬼

10900 円 限定製作 鬼滅の刃全巻 きめつのやいば全巻 1-19 18のみなし

鬼滅の刃 鬼滅ノ刃 きめつのやいば 全巻セット 1〜19巻吾峠呼世晴

52 鬼滅の刃 きめつのやいば キメツノヤイバ 鬼滅ノ刃 漫画本 全巻

鬼滅の刃 きめつのやいば 1-20巻セット 20巻特装版全巻セット - 全巻セット

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています