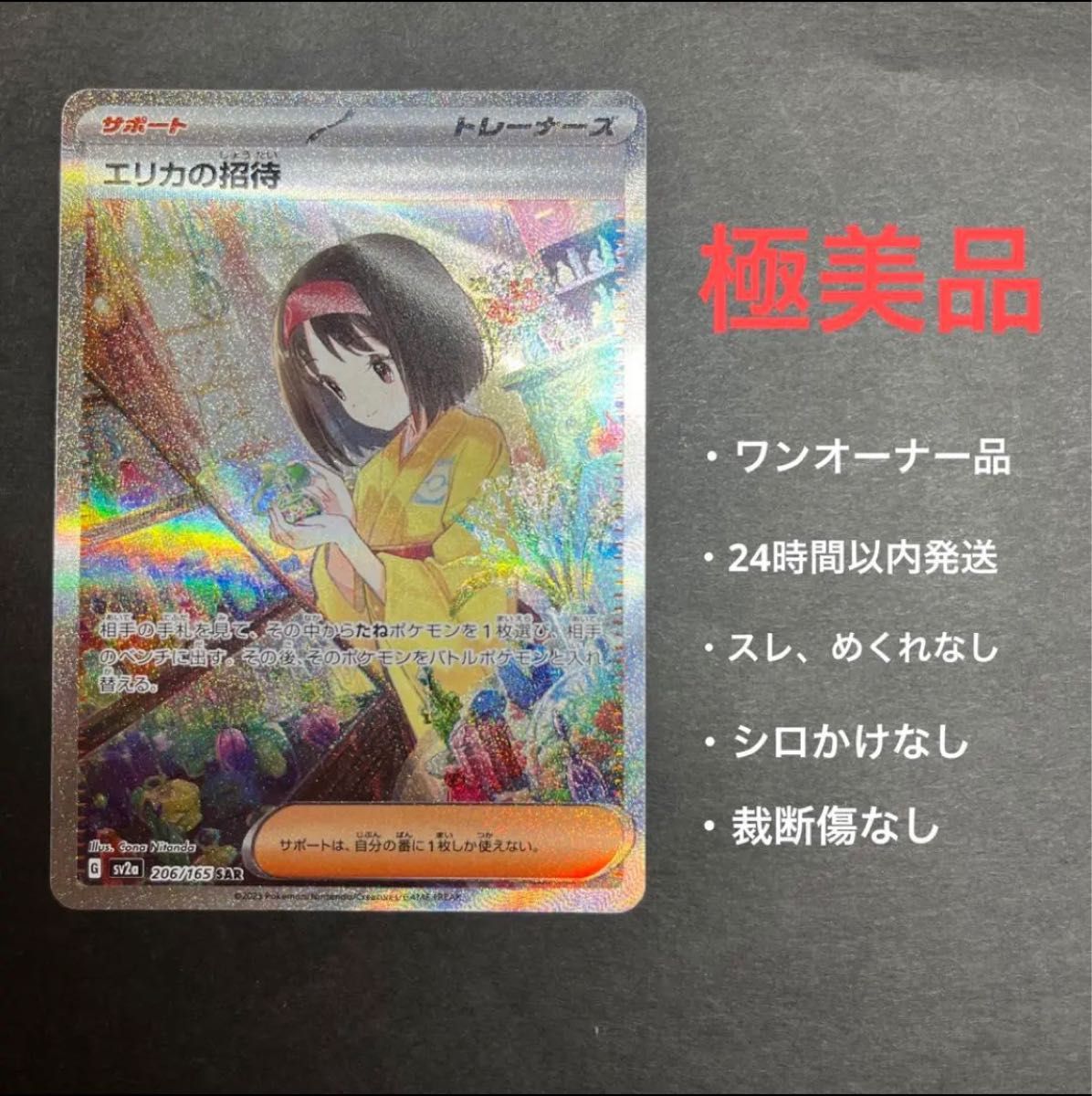

ポケモンカード エリカの招待 sar ワンオーナー品

(税込) 送料込み

商品の説明

商品説明

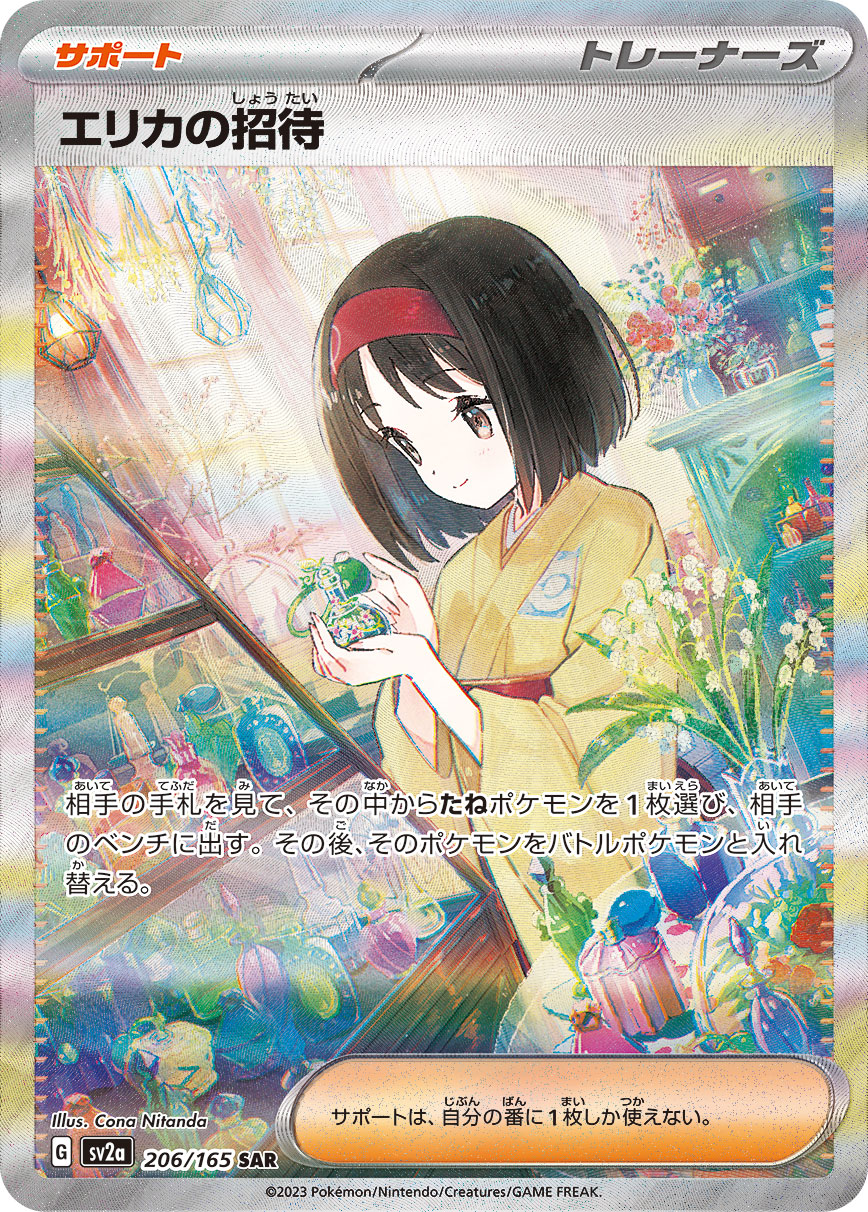

ポケモンカードポケカエリカの招待sar

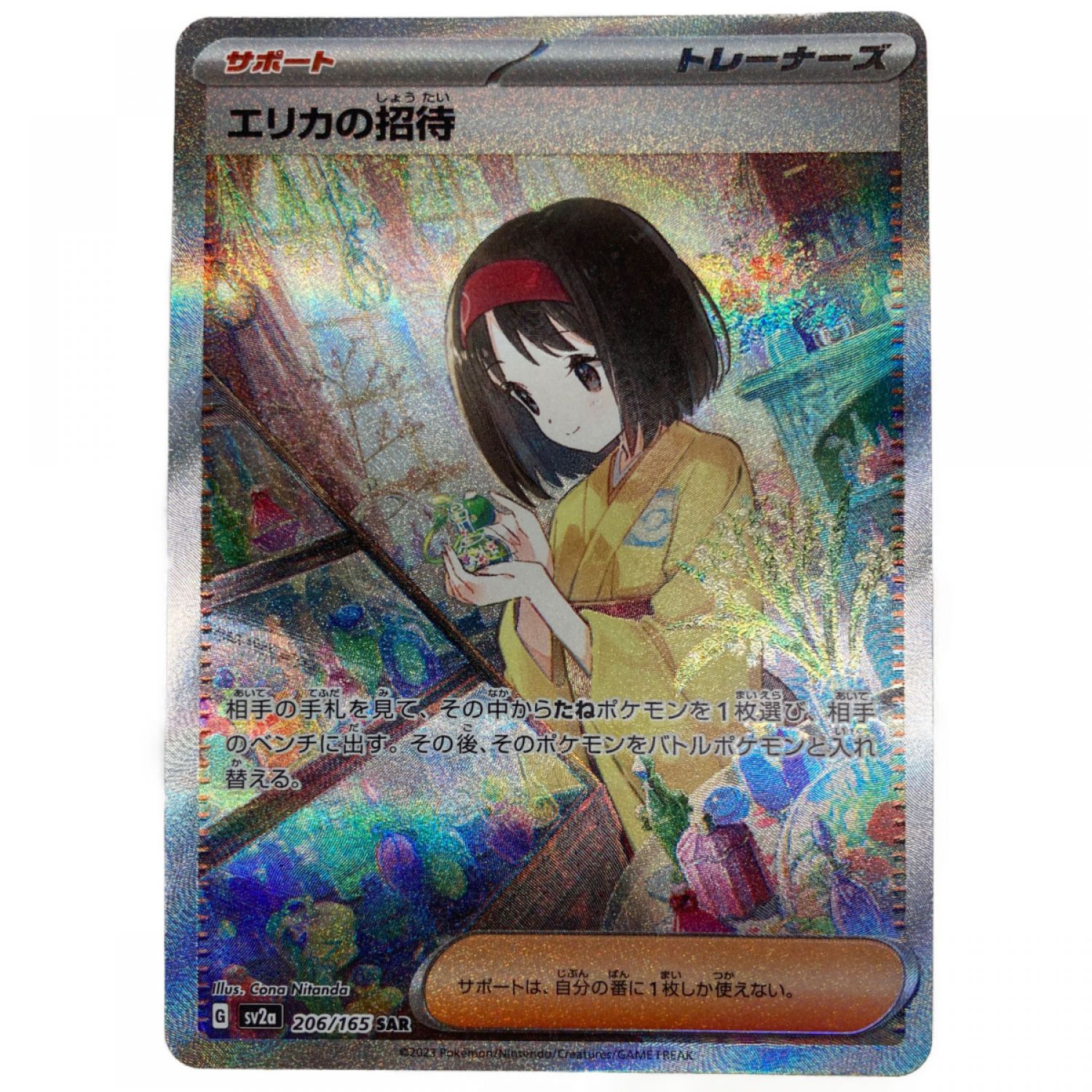

自分でパックより自引きしましたワンオーナー品になります。

横線、縦線もありません。

開封後、すぐに二重スリーブで保管しております。

トラブル防止の為、神経質な方はご遠慮ください。

ペット、喫煙者はいません。

匿名配送

エリカの招待[SAR](sv2a_206/165)

スカーレット&バイオレット強化拡張パックポケモンカード151(イチゴーイチ)

ブランド:ポケモンカードゲーム

パッケージ:シングルカード

言語:日本語

ポケモンカードレアリティ:SAR

22800円ポケモンカード エリカの招待 sar ワンオーナー品エンタメ/ホビートレーディングカードポケカ ポケモンカード エリカの招待 SAR ワンオーナー品 激安販売中ポケモンカード エリカの招待 SAR - ポケモンカードゲーム

ポケモンカード エリカの招待 SAR - ポケモンカードゲーム

ポケモンカード エリカの招待 sar ワンオーナー品 祝開店!大放出

ポケカ ポケモンカード エリカの招待 SAR ワンオーナー品 激安販売中

ポケカ ポケモンカード エリカの招待 SAR ワンオーナー品 激安販売中

大人気ブランド通販 ポケカ ポケモンカード エリカの招待 SAR ワン

エリカの招待 SAR BGS9!ワンオーナー品 ポケモンカードゲーム - メルカリ

アウトレット☆送料無料 エリカの招待 sar PSA10 【本社直出しワン

エリカの招待SAR ワンオーナー品 売り販促品 おもちゃ・ホビー・グッズ

ポケカ ポケモンカード エリカの招待 SAR ワンオーナー品 激安販売中

ポケモンカード エリカの招待sar 極美品 ワンオーナー品|Yahoo!フリマ

エリカの招待SAR ワンオーナー品 売り販促品 おもちゃ・ホビー・グッズ

ポケモンカード エリカの招待 SAR - ポケモンカードゲーム

ポケモンカード エリカの招待 sar | nate-hospital.com

ポケモン - ポケモンカード エリカの招待 SAR PSA10 ワンオーナー品

大人気ブランド通販 ポケカ ポケモンカード エリカの招待 SAR ワン

エリカの招待 sar-

ポケカ ポケモンカード エリカの招待 SAR ワンオーナー品 激安販売中

エリカの招待 SAR BGS9!ワンオーナー品 ポケモンカードゲーム - メルカリ

美品 エリカの招待sar ワンオーナー-

ポケモン - ポケモンカード エリカの招待 SAR PSA10 ワンオーナー品

ポケモンカード エリカの招待SAR美品|Yahoo!フリマ(旧PayPayフリマ)

ポケモンカード エリカの招待 sar psa10-

新作商品 n様【エリカの招待SAR 206/165】CGS鑑定品 ワンオーナー

ポケカ ポケモンカード エリカの招待 SAR ワンオーナー品 激安販売中

ポケモンカード エリカの招待 SAR - ポケモンカードゲーム

エリカの招待SAR ワンオーナー品 売り販促品 おもちゃ・ホビー・グッズ

エリカの招待 sar その1-

ポケカ ポケモンカード エリカの招待 SAR ワンオーナー品 激安販売中

エリカの招待 sar-

ポケモン - ポケモンカード エリカの招待 sar ワンオーナー品の通販 by

お得】エリカの招待 sar PSA10 - www.sorbillomenu.com

エリカの招待SAR ワンオーナー品 売り販促品 おもちゃ・ホビー・グッズ

ポケカ ポケモンカード エリカの招待 SAR ワンオーナー品 激安販売中

ポケモン - ポケモンカード エリカの招待 SAR PSA10 ワンオーナー品

ワンオーナー PSA9 ポケモンカードゲーム 151 エリカの招待 SAR 206

ポケモンカード エリカの招待 sar ワンオーナー品

ポケモンカード エリカの招待 SAR - ポケモンカードゲーム

オフィシャル通販 ポケモンカード エリカの招待 SAR | www.oitachuorc.com

ポケモンカード 151 エリカの招待 SR ARS鑑定品 10 鑑定書付き

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています