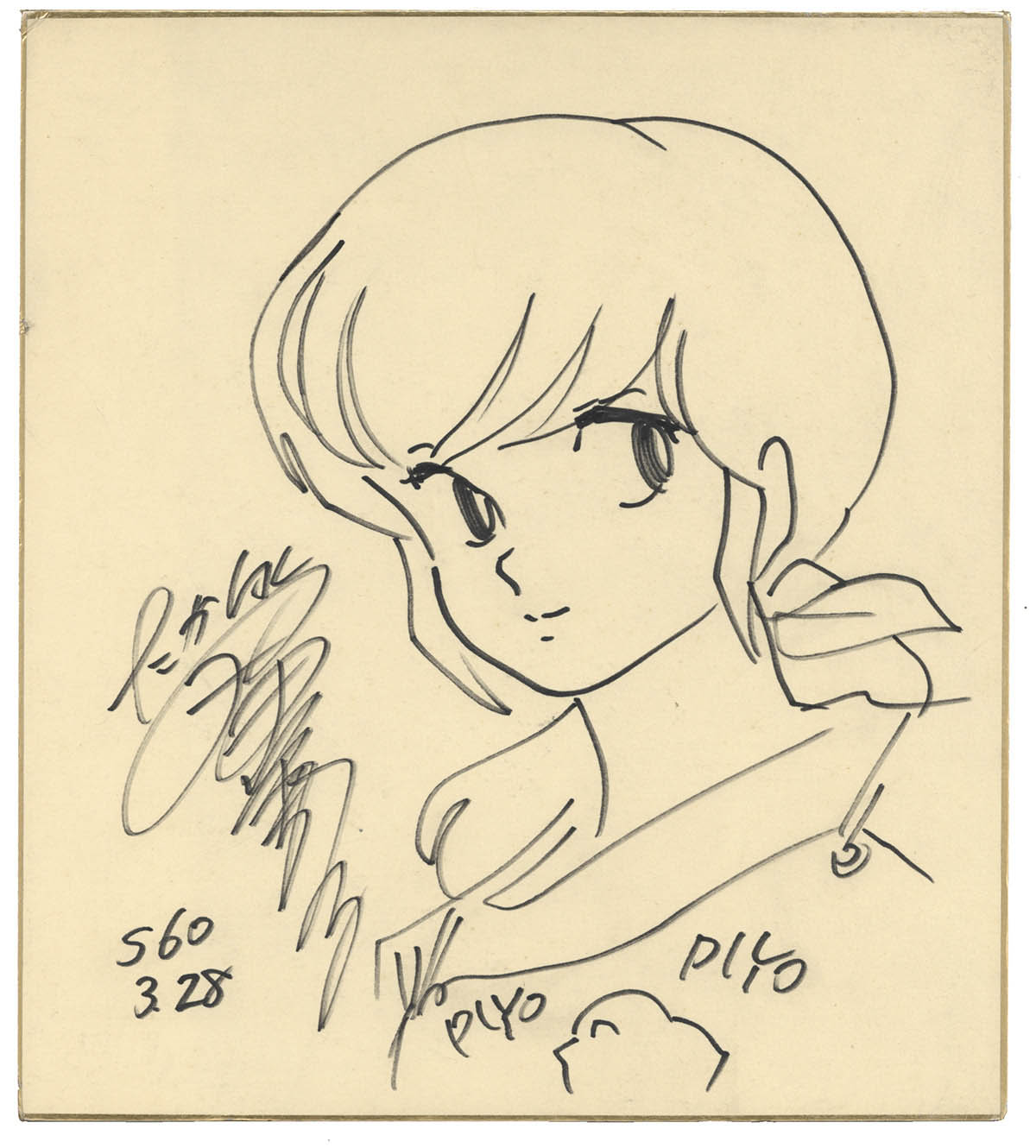

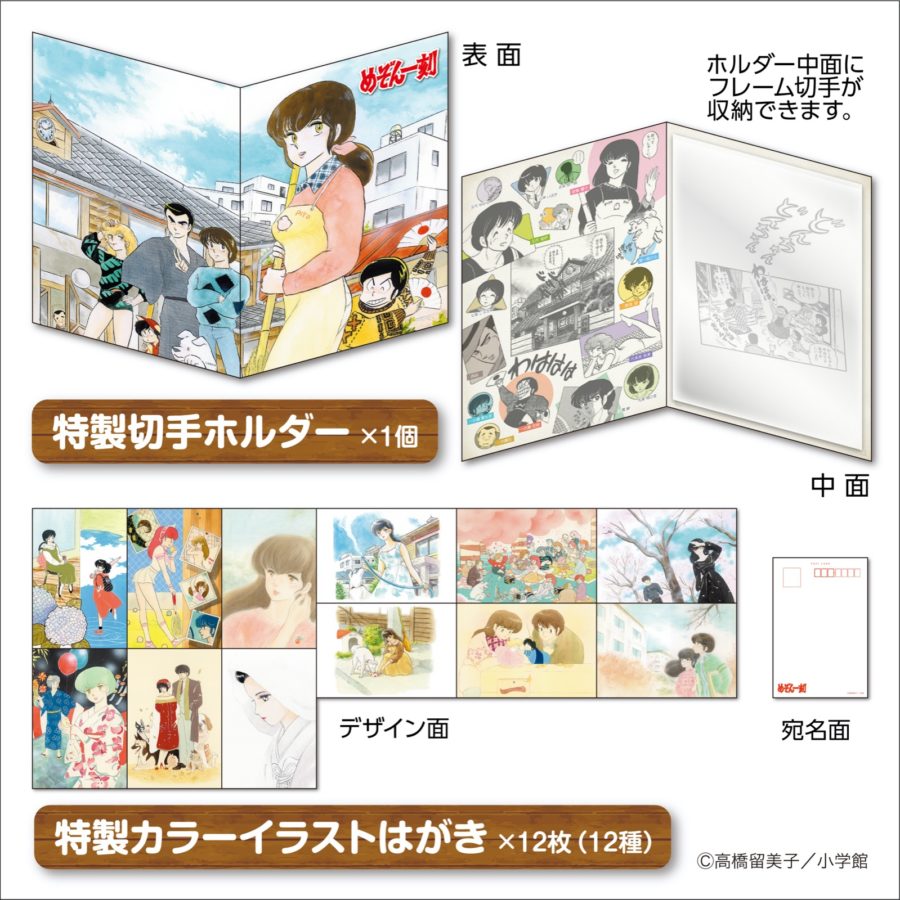

めぞん一刻イラスト額縁直筆サイン入り

(税込) 送料込み

商品の説明

商品説明

同様の品物と同じ経由と理由ですご質問等承ります12675円めぞん一刻イラスト額縁直筆サイン入りエンタメ/ホビー漫画公式店舗 めぞん一刻イラスト額縁直筆サイン入り | artfive.co.jpめぞん一刻イラスト額縁直筆サイン入り | www.fleettracktz.com

エンタメ/ホビーめぞん一刻イラスト額縁直筆サイン入り

めぞん一刻イラスト額縁直筆サイン入り | www.fleettracktz.com

公式店舗 めぞん一刻イラスト額縁直筆サイン入り | artfive.co.jp

エンタメ/ホビーめぞん一刻イラスト額縁直筆サイン入り

ポイント10倍 めぞん一刻イラスト額縁直筆サイン入り | www.butiuae.com

公式店舗 めぞん一刻イラスト額縁直筆サイン入り | artfive.co.jp

めぞん一刻イラスト額縁直筆サイン入り | www.fleettracktz.com

工房直送価格! めぞん一刻イラスト額縁 直筆サイン入り

公式店舗 めぞん一刻イラスト額縁直筆サイン入り | artfive.co.jp

エンタメ/ホビーめぞん一刻イラスト額縁直筆サイン入り

アニメグッズ乱馬 イラスト額縁直筆サイン入り - benjaminstrategy.co

エンタメ/ホビーめぞん一刻イラスト額縁直筆サイン入り

早割クーポン! めぞん一刻イラスト額縁直筆サイン入り - 漫画

早割クーポン! めぞん一刻イラスト額縁直筆サイン入り - 漫画

エンタメ/ホビーめぞん一刻イラスト額縁直筆サイン入り

早割クーポン! めぞん一刻イラスト額縁直筆サイン入り - 漫画

アニメグッズ乱馬 イラスト額縁直筆サイン入り - benjaminstrategy.co

全て無料 めぞん一刻イラスト額縁 直筆サイン入り | www.butiuae.com

超お徳用 めぞん一刻イラスト額縁直筆サイン入り

早割クーポン! めぞん一刻イラスト額縁直筆サイン入り - 漫画

公式店舗 めぞん一刻イラスト額縁直筆サイン入り | artfive.co.jp

ポイント10倍 めぞん一刻イラスト額縁直筆サイン入り | www.butiuae.com

めぞん一刻 音無響子の「あたしより長生きして」の言葉に悟った五代

めぞん一刻イラスト額縁 直筆サイン入り-eastgate.mk

エンタメ/ホビーめぞん一刻イラスト額縁直筆サイン入り

めぞん一刻イラスト額縁直筆サイン入りの通販 by うたや's shop|ラクマ

アニメグッズ乱馬 イラスト額縁直筆サイン入り - benjaminstrategy.co

その他めぞん一刻イラスト額縁直筆サイン入り - その他

ポイント10倍 めぞん一刻イラスト額縁直筆サイン入り | www.butiuae.com

アップルシードα 直筆サイン入り限定複製原画【販売終了】 | 特集から

めぞん一刻イラスト額縁 直筆サイン入り-eastgate.mk

早割クーポン! めぞん一刻イラスト額縁直筆サイン入り - 漫画

アニメグッズ乱馬 イラスト額縁直筆サイン入り - benjaminstrategy.co

めぞん一刻イラスト額縁直筆サイン入りの通販 by うたや's shop|ラクマ

輸入品格安 藤城清治先生 直筆サイン入り 夕陽の中の愛の奇跡

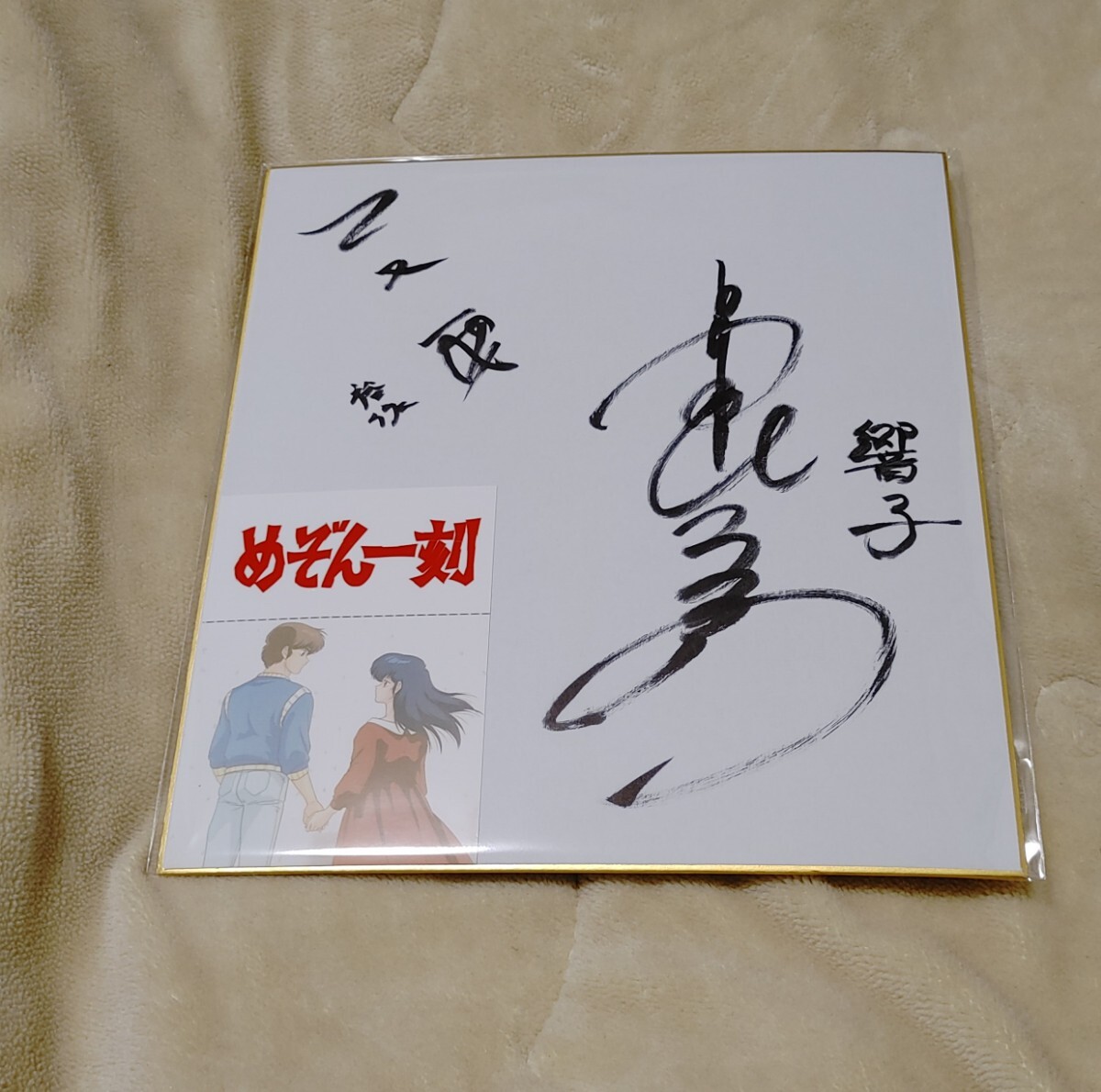

美品】高橋留美子 めぞん一刻 直筆サイン色紙 うる星やつら らんま1/2

超お徳用 めぞん一刻イラスト額縁直筆サイン入り

めぞん一刻 二又一成 島本須美 声優 直筆サイン色紙(サイン)|売買され

めぞん一刻 響子浴衣色紙-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています