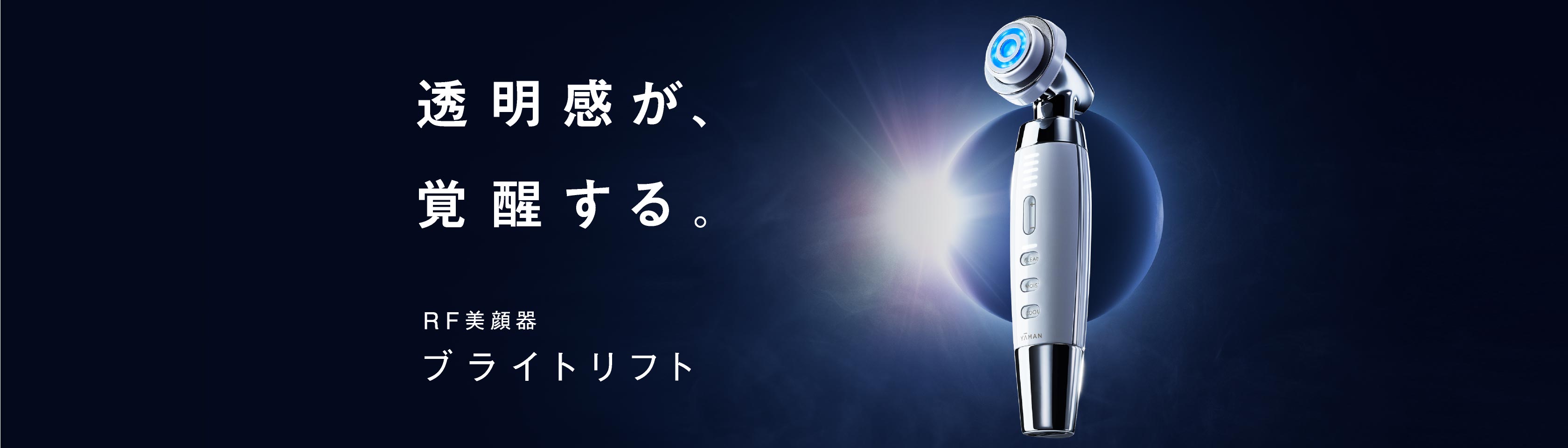

ヤーマン RF美顔器 ブライトリフトEX ホワイト※37187

(税込) 送料込み

商品の説明

商品説明

"肌の透明感*にこだわりたい方により表情筋をケアしたい方に"毛穴目立ちを抑えてくすみを軽減!

乾燥によるキメの粗さを抑えて肌の陰影を軽減!

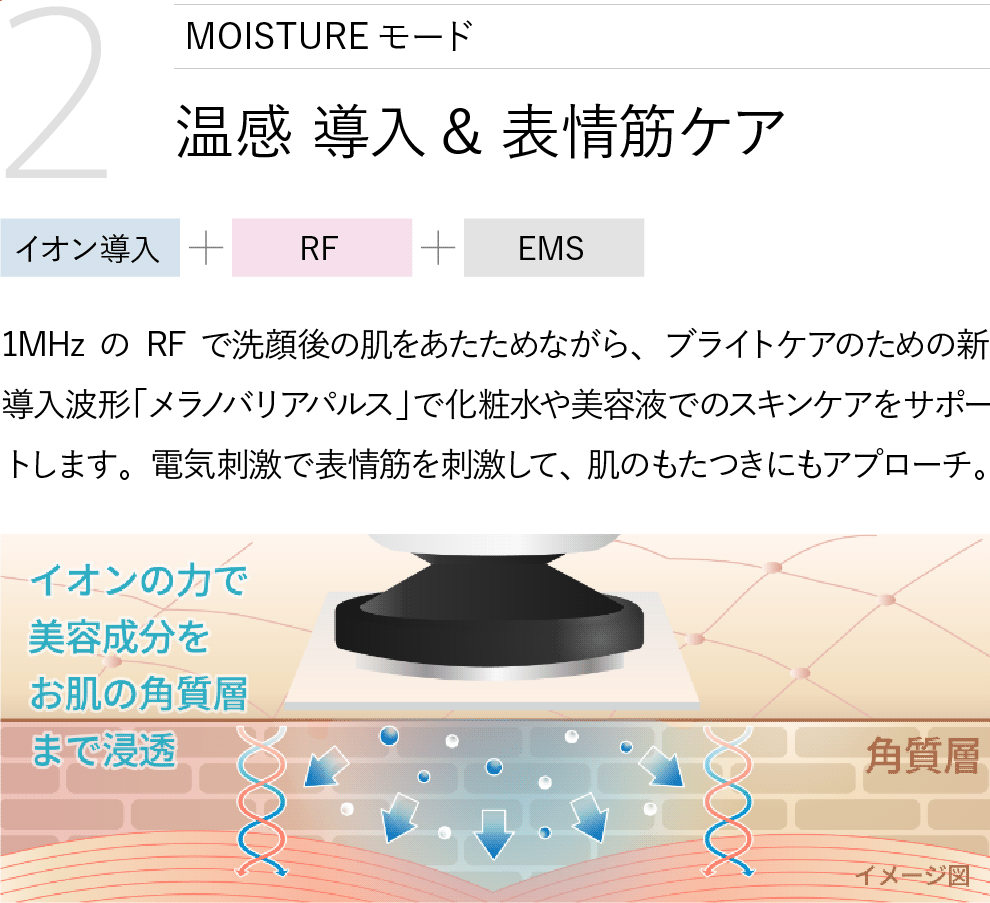

メラノバリアパルスの力で、美白成分※1の導入※2をサポート。※1美白成分:ビタミンC誘導体、トラネキサム酸※2角質層まで

"YA-MANブライトリフトEX/HRF50N/サイズ:本体(コットンストッパー付):約W45×D66×H211(mm)、充電台:約W55×D54×H56(mm)/重量:約230g(コットンストッパー付)/セット内容:本体、充電台、充電台USBケーブル(USBType-C)、ACアダプター、コットンストッパー、取扱説明書(保証書付)/消費電力:約4.5W、動作時間:約40分(満充電の状態から)※使用モード・使用レベル・使用環境によって、動作時間は変わります。充電時間:約3時間※電池残量や充電環境によって、充電時間は前後します。/製造国:日本"

22312円ヤーマン RF美顔器 ブライトリフトEX ホワイト※37187スマホ/家電/カメラ美容/健康ブライトリフト EX | YA-MAN TOKYO JAPAN | ヤーマン株式会社RF美顔器 ブライトリフト EX|ヤーマン公式通販サイト | ヤーマン

RF美顔器 ブライトリフト EX|ヤーマン公式通販サイト | ヤーマン

Amazon.co.jp: ヤーマン RF美顔器 ブライトリフトEX ホワイト

ブライトリフト EX | YA-MAN TOKYO JAPAN | ヤーマン株式会社

Amazon.co.jp: ヤーマン RF美顔器 ブライトリフトEX ホワイト

ヤーマン RF美顔器 ブライトリフト

13,200円OFF 美顔器 / イオン導出 EMS LED / RF美顔器 ブライトリフト

ブライトリフト EX | YA-MAN TOKYO JAPAN | ヤーマン株式会社

ヤーマンのブライトリフトを使って使用感をレビュー!普段のスキンケア

Amazon.co.jp: ヤーマン RF美顔器 ブライトリフトEX ホワイト

13,200円OFF 美顔器 / イオン導出 EMS LED / RF美顔器 ブライトリフト

楽天市場】【50%OFF☆3/11 1:59まで】美顔器 【ヤーマン公式

13,200円OFF 美顔器 / イオン導出 EMS LED / RF美顔器 ブライトリフト

ヤーマンのブライトリフトを使って使用感をレビュー!普段のスキンケア

ブライトリフト | YA-MAN TOKYO JAPAN | ヤーマン株式会社

ヤーマンのブライトリフトを使って使用感をレビュー!普段のスキンケア

RF美顔器 ブライトリフトEX 自動お届けコース|ヤーマン公式通販サイト

楽天市場】【50%OFF☆3/11 1:59まで】美顔器 【ヤーマン公式

YAMAN】ブライトリフトEXの口コミやレビューは?詳細や効果も解説!

ヤーマンのブライトリフトを使って使用感をレビュー!普段のスキンケア

Amazon.co.jp: ヤーマン RF美顔器 ブライトリフトEX ホワイト

RF美顔器 ブライトリフトEX 自動お届けコース|ヤーマン公式通販サイト

約45W動作時間ヤーマン RF美顔器 ブライトリフトEX ホワイト※37187

YAMAN】ブライトリフトEXの口コミやレビューは?詳細や効果も解説!

13,200円OFF 美顔器 / イオン導出 EMS LED / RF美顔器 ブライトリフト

楽天市場】【50%OFF☆3/11 1:59まで】美顔器 【ヤーマン公式

Amazon.co.jp: ヤーマン RF美顔器 ブライトリフト ホワイト HRF40S

ヤーマン RF美顔器 ブライトリフトEX ホワイト※37187-

試してみた】RF美顔器 ブライトリフト / ヤーマンのリアルな口コミ

YAMAN】ブライトリフトEXの口コミやレビューは?詳細や効果も解説!

YA-MAN TOKYO JAPAN(ヤーマントウキョウジャパン) / RF美顔器 ブライト

13,200円OFF 美顔器 / イオン導出 EMS LED / RF美顔器 ブライトリフト

YA-MAN ブライトリフト EX

楽天市場】【50%OFF☆3/11 1:59まで】美顔器 【ヤーマン公式

ブライトリフト | YA-MAN TOKYO JAPAN | ヤーマン株式会社

新品未開封 HRF-50N ヤーマンRF美顔器 ブライトリフトEX美白 - pure

13,200円OFF 美顔器 / イオン導出 EMS LED / RF美顔器 ブライトリフト

YA-MAN ブライトリフト EX

一流の品質 Exideal mini EX-120 LED美顔器 ミニ エクスイディアル

ランキングや新製品 イオンエフェクター EH-ST76 フェイスケア/美顔器

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています