Canon EF 50mm f1.8 STM

(税込) 送料込み

商品の説明

商品説明

【状態について】

多少の使用感のみで、比較的コンディションの良い商品です!

レンズ内に目立つカビ、くもりは見受けられません。

ホコリも少なく綺麗だと思います。撮影に影響はございません。

対応マウント:キャノンEFマウント

【動作について】

先日まで問題なく使用しました。

【付属品】

元箱

レンズキャップ前後

レンズフィルター

※付属品に関しては画像にてご確認いただけるものが全てとなっております。

7475円Canon EF 50mm f1.8 STMスマホ/家電/カメラカメラCanon EF 50mm F1.8 STMCanon EF 50mm f/1.8 STM Normal Lens for EF Cameras : CANON

Canon EF 50mm f/1.8 STM Lens in ORIGINAL RETAIL BOX

Canon EF 50mm f/1.8 STM | Standard & Medium Telephoto Lens

Canon EF 50mm F1.8 STM

Canon EF 50mm f/1.8 STM Lens

Canon EF 50mm f/1.8 STM Lens | Best Buy Canada

Canon EF 50mm f/1.8 STM Lens Review

Canon EF 50mm f1.8 STM review | Cameralabs

Canon EF 50mm f/1.8 STM | Standard & Medium Telephoto Lens

Canon EF 50mm f/1.8 STM Lens Hands-On Review - Bargain Excellence!

Canon EF 50mm f/1.8 STM

Electronics - Cameras - Lenses - Canon EF 50mm f/1.8 STM Lens

Canon EF 50mm f/1.8 STM Lens Review

Canon EF 50mm f/1.8 STM | Lens Review - shanelongphotography.com

Canon EF 50mm f/1.8 STM Review

Canon EF 50mm F1.8 STM

Canon EF 50mm f1.8 STM review | Cameralabs

Canon EF50mm F1.8 STM SHOOTING REPORT | PHOTO YODOBASHI

Canon Nifty Fifty Battle: EF 50mm f/1.8 STM vs RF 50mm f/1.8 STM

Canon EF 50mm f/1.8 STM Lens Hands-On Review

Canon 50mm f/1.8 STM Review

Canon EF 50mm f/1.8 STM Lens Review

Canon EF 50mm f/1.8 STM Normal Lens for EF Cameras : CANON: Amazon

Canon EF 50mm f/1.8 STM Lens 0570C002 013803256871

RF50mm f/1.8 STM vs EF50mm f/1.8 STM: 6 Key Comparisons

Canon EF 50mm f/1.8 STM Lens Hands-On Review

EF50mm f/1.8 STM: A Review with Useful Composition Tips

Canon EF 50mm f/1.8 STM Lens Review

Canon EF 50mm f/1.8 STM Review • Points in Focus Photography

EF 50mm f/1.8 STM Lens | Canon Australia

New vs. Old Nifty Fifty Aperture and Bokeh Comparison

The Canon EF 50mm f/1.8 STM: A classic lens that still shines today

Canon EF 50mm f/1.8 STM review | Digital Camera World

50mm Reversible Lens Hood Shade Fit for Canon EF 50mm f/1.8 STM

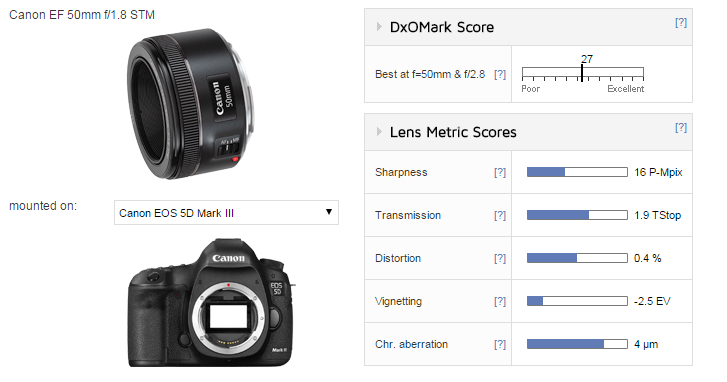

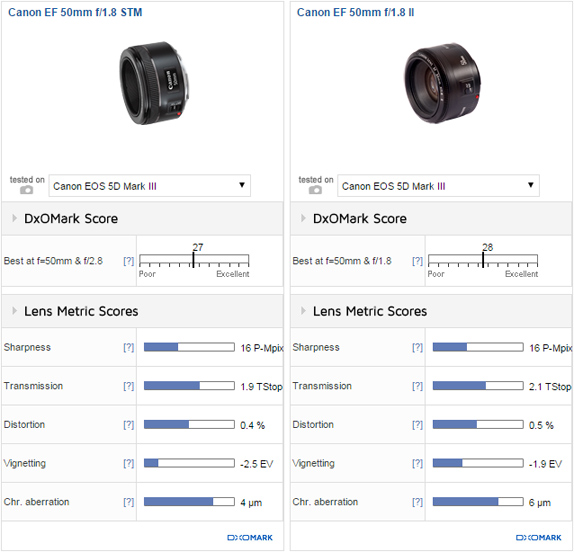

Canon EF 50mm F1.8 STM lens review: Thrifty fifty - DXOMARK

Canon EF 50mm f/1.8 STM Lens Review

Canon 50mm f/1.8 STM Review

Canon EF 50mm F1.8 STM lens review: Thrifty fifty - DXOMARK

Canon EF 50mm f/1.8 STM - Lenses - Camera & Photo lenses - Canon UK

The Canon EF 50mm f/1.8 STM lens is now in stock - Photo Rumors

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています