【在庫一掃】 エム・シー・エム ロゴグラム 二つ折り財布 レディース

(税込) 送料込み

商品の説明

商品説明

【管理番号】1000041913306【ブランド名】エム・シー・エム/MCM

【ブランド状態ランク】ランクA

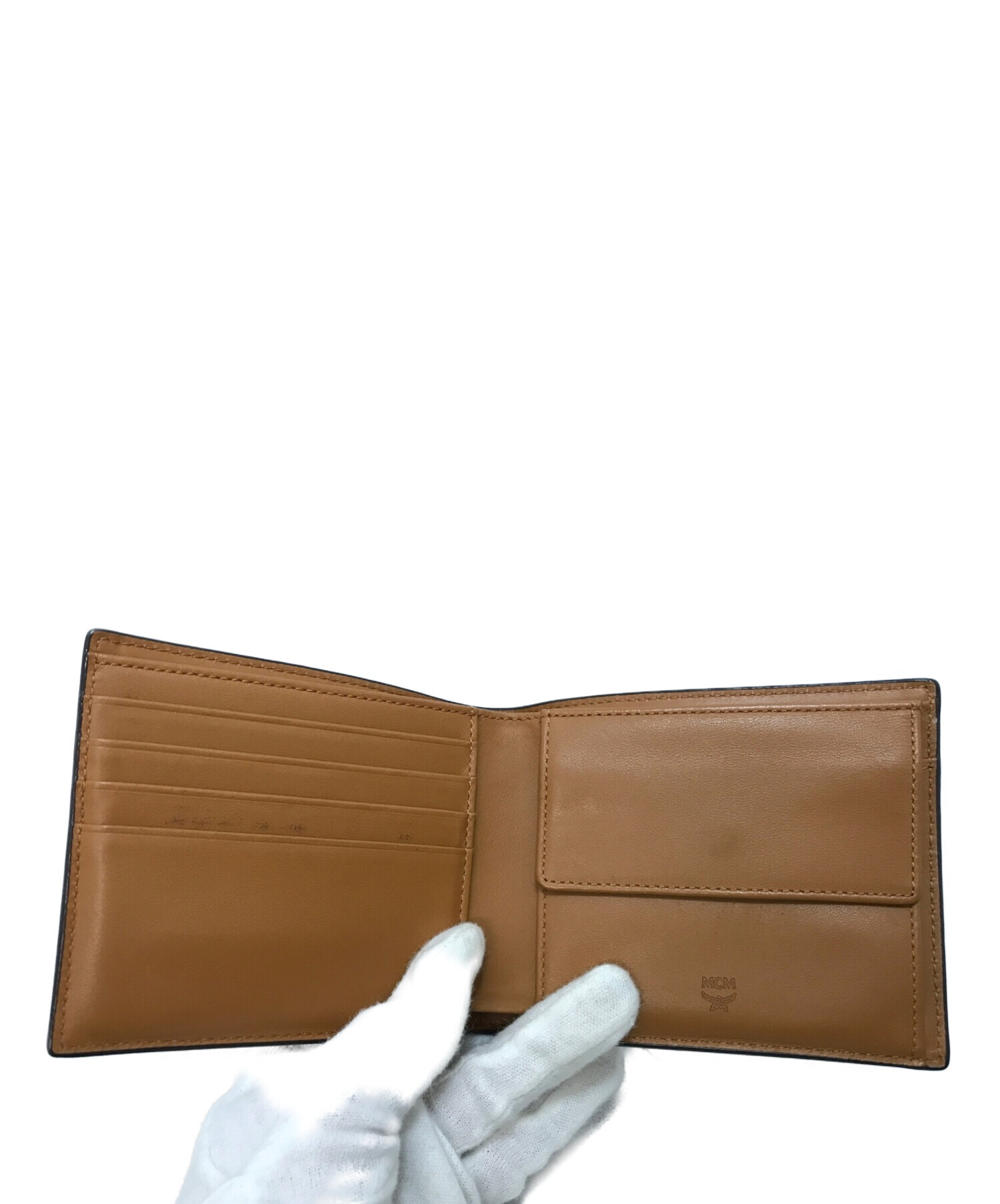

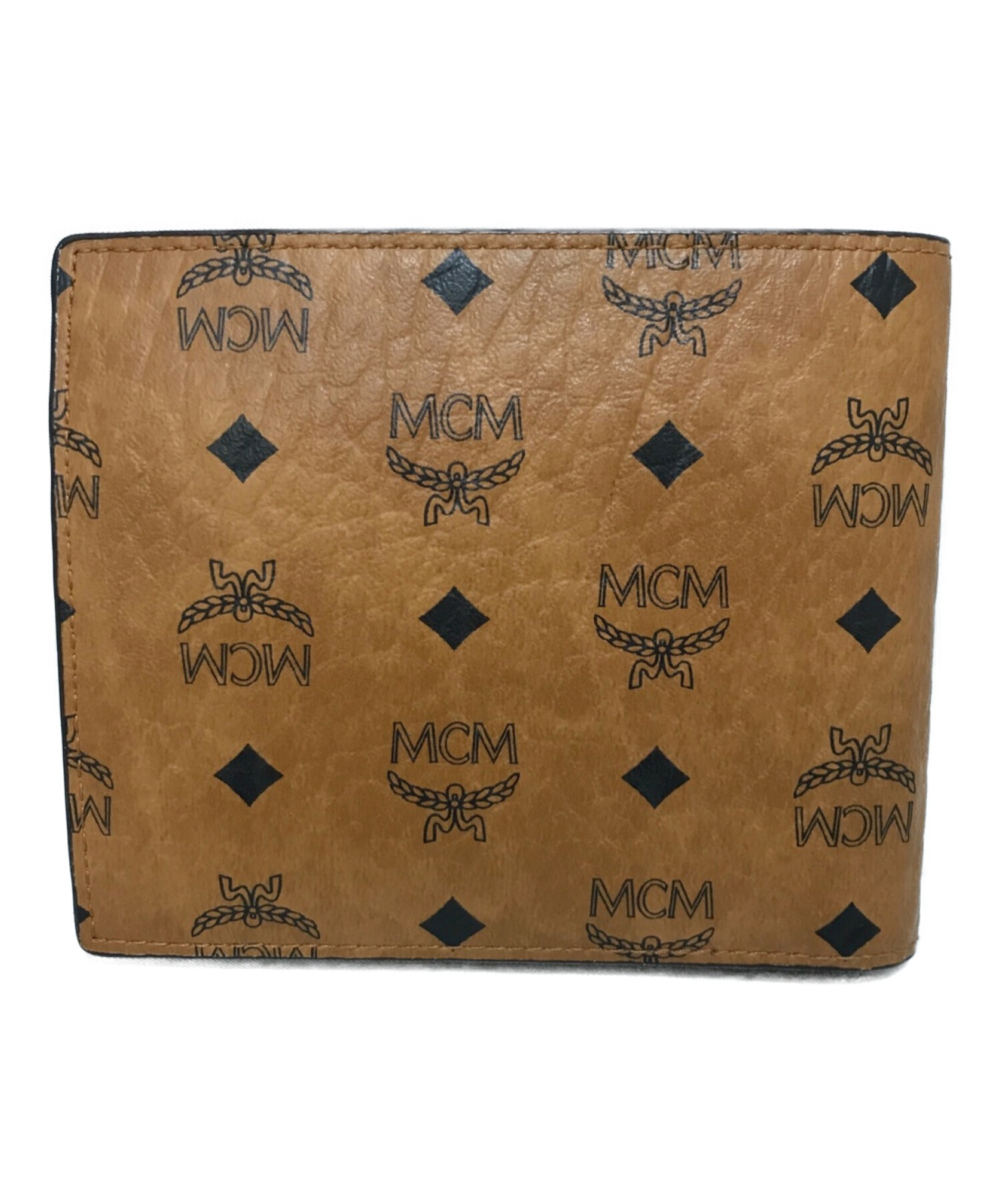

【タイプ】ロゴグラム二つ折り財布

【ライン】ヴィセトス

【対象】レディース

【幅】約11cm

【高さ】約8cm

【奥行き】約3.5cm

【素材】レザー

【表記カラー】ブラック

【コメント】

中古品ですが、綺麗な状態です。僅か箱や保存袋に劣化あり。にスレやキズあり。

【付属品】箱、保存袋

こちらの商品はラクマ公式パートナーのバイセルによって出品されています。

二つ折り財布のお探しは、バイセルで検索!

#バイセルブランドアイテム

#バイセル財布

#バイセル二つ折り財布

#バイセルエム・シー・エム

12870円【在庫一掃】 エム・シー・エム ロゴグラム 二つ折り財布 レディースレディースファッション小物バイセル公式】【在庫一掃】 エム・シー・エム ロゴグラム リュック【在庫一掃】 エム・シー・エム ロゴグラム 二つ折り財布 レディース 【中古】

【在庫一掃】 エム・シー・エム ロゴグラム 二つ折り財布 レディース 【中古】

最安値販売中 【在庫一掃】 エム・シー・エム ロゴグラム 二つ折り財布

バイセル公式】【在庫一掃】 エム・シー・エム ロゴグラム リュック

お買い得アイテム 【在庫一掃】 エム・シー・エム ロゴグラム

MCM 二つ折り財布の値段と価格推移は?|13件の売買データからMCM 二

MCM(MCM) 財布(レディース)(ブラック/黒色系)の通販 100点以上

中古・古着通販】MCM (エムシーエム) 2つ折り財布|ブランド・古着通販

バイセル公式】【在庫一掃】 エム・シー・エム ロゴグラム リュック

MCM MXL8SVI92-BK001 VISETOS ORIGINAL ZIP AROUND WALLET エムシー

在庫一掃】 エム・シー・エム ロゴグラム 二つ折り財布 レディース

エム・シー・エム 3つ折り財布 ピンク 二つ折り財布レディース | 中古

エム シー エム ヴィセトス ロゴグラム スタッズ リュック バック

MCM - 【在庫一掃】 エム・シー・エム ロゴグラム 二つ折り財布

1円~ MCM エムシーエム ロゴグラム 総柄 二つ折り 財布 ナイロン

エムシーエム (エム・シー・エム) 三つ折り財布 財布 レディース

エムシーエム MCM 2つ折財布[品番:CHLW0009593]|1st STREET

バイセル公式】【在庫一掃】 エム・シー・エム ロゴグラム リュック

売り尽くしセール開催中】エムシーエム (エム・シー・エム) 三つ折り

お買い得アイテム 【在庫一掃】 エム・シー・エム ロゴグラム

楽天市場】MCM エムシーエム ロゴグラム レザー 3つ折り ウォレット 3

MCM】在庫あり ☆ Tracy 3つ折り ロゴ 財布☆ MYSESXT01 (MCM

MCM MXL8SVI92-BK001 VISETOS ORIGINAL ZIP AROUND WALLET エムシー

ー品販売 【新品・未使用】Louis vuitton ポルトフォイユ・クレア おり

最安値販売中 【在庫一掃】 エム・シー・エム ロゴグラム 二つ折り財布

MCM(MCM) 財布(レディース)(ライン)の通販 36点 | エムシーエムの

1円~ MCM エムシーエム ロゴグラム 総柄 二つ折り 財布 ナイロン

楽天市場】MCM エムシーエム 二つ折り長財布 チェーンウォレット

エム・シー・エム 3つ折り財布 ピンク 二つ折り財布レディース | 中古

ー品販売 【新品・未使用】Louis vuitton ポルトフォイユ・クレア おり

中古・古着通販】MCM (エムシーエム) 2つ折り財布|ブランド・古着通販

バイセル公式】エム・シー・エム ロゴグラム リュックサック

2024年最新】mcm 財布 2つ折りの人気アイテム - メルカリ

MCM MXL8SVI92-BK001 VISETOS ORIGINAL ZIP AROUND WALLET エムシー

お買い得アイテム 【在庫一掃】 エム・シー・エム ロゴグラム

エムシーエム(MCM) メンズ二つ折り財布 | 通販・人気ランキング - 価格.com

楽天市場】MCM エムシーエム 二つ折り長財布 チェーンウォレット

エムシーエム(MCM)|二つ折り財布|レザー|アイボリー|ラウンド

オモウマい店 【在庫一掃】 ルイ・ヴィトン ジッピーウォレット

MCM 二つ折り財布の値段と価格推移は?|13件の売買データからMCM 二

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![エムシーエム MCM 2つ折財布[品番:CHLW0009593]|1st STREET](https://cdn.shop-list.com/res/up/shoplist/shp/__thum370__/chelsea/1ststreet/cabinet/223/1223340002123_0.jpg)