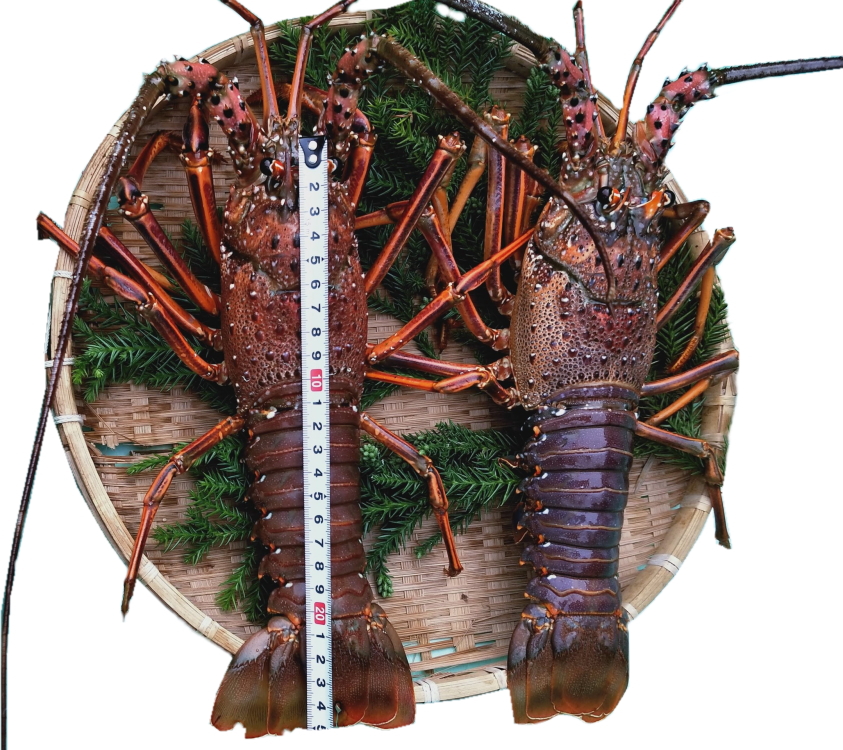

エルフィン様専用ページ!伊勢エビ2キロ!

(税込) 送料込み

商品の説明

商品説明

他の方は落札しないでください!8872円エルフィン様専用ページ!伊勢エビ2キロ!食品/飲料/酒食品エルフィン様専用ページ!伊勢エビ2キロ!の通販 by コウs shop|ラクマエルフィン様専用ページ!伊勢エビ2キロ!の通販 by コウ's shop|ラクマ

エルフィン様専用ページ!伊勢エビ2キロ!の通販 by コウ's shop|ラクマ

エルフィン様専用ページ!伊勢エビ2キロ!の通販 by コウ's shop|ラクマ

エルフィン様専用ページ!伊勢エビ2キロ!の通販 by コウ's shop|ラクマ

エルフィン様専用ページ!伊勢エビ2キロ!の通販 by コウ's shop|ラクマ

楽天市場】【T】訳あり 伊勢海老 2~3尾で500g分 数量指定不可 ご家庭

伊勢海老詰合せ2尾〜4尾で1kg 送料無料 美し国三重 伊勢路−縁−ギフトパッケージ 刺身用瞬間冷凍伊勢エビ詰合せp2 寒中見舞い ギフト

エルフィン様専用ページ!伊勢エビ2キロ!の通販 by コウ's shop|ラクマ

伊勢海老2尾セット(約1kg) | 活魚問屋 丸保商店(まるやすしょうてん

千葉房総の【活】伊勢海老 2kg | 船団丸(SENDANMARU)|ファースト

予約専用、送料込み伊勢エビ2キロ魚介 - 魚介

朝穫れ 天然 伊勢海老 2kg 以上 伊勢海老 伊勢エビ 伊勢 海老 エビ

メガギガ特大伊勢海老(2kg~) | 特大伊勢えび | 活き伊勢海老通販 長崎

楽天市場】伊勢エビ 400g(3本)伊勢海老 伊勢えび いせえび イセエビ

予約専用、送料込み伊勢エビ2キロ魚介 - 魚介

活き 伊勢海老 2kg サイズお任せ 伊豆 下田 生きたまま 刺身 伊勢エビ

長崎五島産・活伊勢エビ2〜3匹入り(約1kg)活きたまま伊勢海老を

朝穫れ 天然 伊勢海老 2kg 以上 伊勢海老 伊勢エビ 伊勢 海老 エビ イセエビ 生きたまま発送 刺身 焼き物 お味噌汁 鍋 ボイル エビフライ アレンジ可 産地直送 職人厳選 新鮮 海鮮 常温 ギフト 贈答 高知県 須崎市 IKY010

長崎五島産・活伊勢エビ2〜3匹入り(約1kg)活きたまま伊勢海老を直送

送料込み‼︎冷凍伊勢エビ2キロ‼︎魚介 - 魚介

商品が購入可能です 2個 ディーエヌエス プロテイン ホエイ100

伊勢海老2尾セット(約1kg) | 活魚問屋 丸保商店(まるやすしょうてん

楽天市場】伊勢海老 1キロ入れ 本数やサイズがバラバラですがお買い得

純正 バルクス ハエプロテイン ベリー風味 | badenbaden-net.com

送料無料直送 エルフィン様専用ページ!伊勢エビ2キロ! | yourmaximum.com

メガギガ特大伊勢海老(2kg~) | 特大伊勢えび | 活き伊勢海老通販 長崎

C02-E43 活〆冷凍伊勢海老 1.2kg - 千葉県長生村|ふるさとチョイス

活き 伊勢海老 2kg サイズお任せ 伊豆 下田 生きたまま 刺身 伊勢エビ

魚介 堅実な究極の - www.capitalconsignado.com.br

大~超特大イセエビ!2㎏ 2匹~3匹! | 魚介類/エビ 産直アウル

送込)本州最南端の地より 活け伊勢エビ 10~14尾で2キログラム

超歓迎 ロマンス製菓 甘酒ソフトキャンディ96g50袋 千歳鶴 甘酒ソフト

千葉房総の【活】伊勢海老 2kg | 船団丸(SENDANMARU)|ファースト

朝穫れ 天然 伊勢海老 2kg 以上 伊勢海老 伊勢エビ 伊勢 海老 エビ

楽天市場】訳あり 伊勢海老 2~3尾で500g分 数量指定不可 ご家庭用

ボイル伊勢海老2尾セット(冷凍) | 活 伊勢海老料理 中納言

伊勢海老詰合せ2尾〜4尾で1kg 送料無料 美し国三重 伊勢路−縁−ギフトパッケージ 刺身用瞬間冷凍伊勢エビ詰合せp2 寒中見舞い ギフト : iseji-enishi1kg : 伊勢鳥羽志摩特産横丁 - 通販 - Yahoo!ショッピング

送込)本州最南端の地より 活け伊勢エビ 10~14尾で2キログラム

メガギガ特大伊勢海老(2kg~) | 特大伊勢えび | 活き伊勢海老通販 長崎

専用ページ】4点セット の+solo-truck.eu

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています