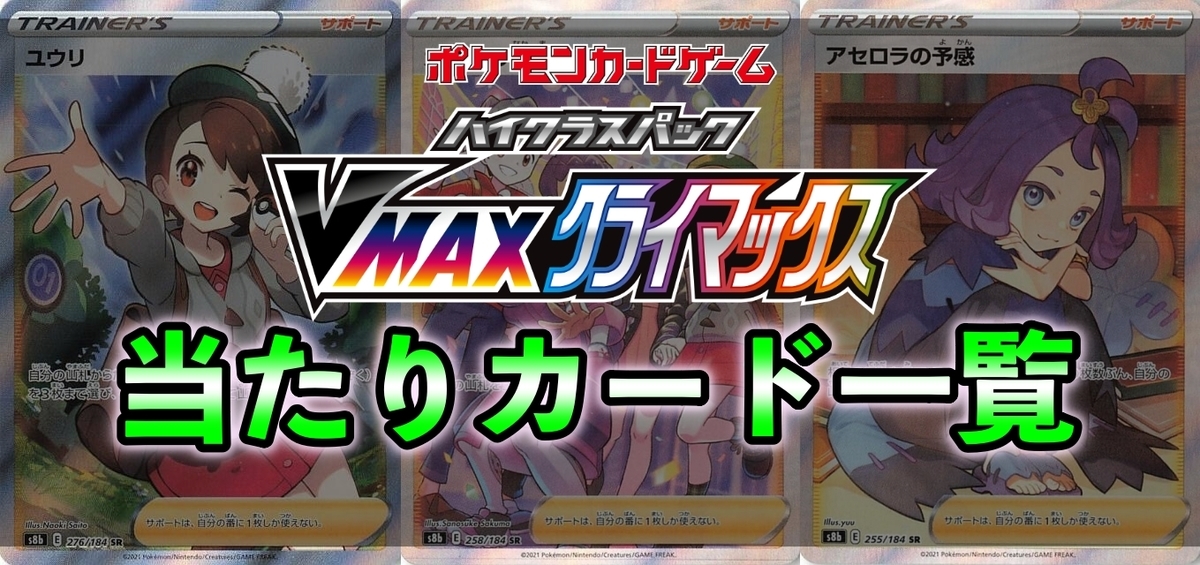

ポケモンカード VMAXクライマックス 2BOX

(税込) 送料込み

商品の説明

商品説明

全てシュリンク付きの未開封品です。値下げ不可。

素人保管なので神経質な方は購入をご遠慮下さい。

入金確認後24時間以内に発送致します。

他に出品しているBOXとの組み合わせも可能ですので希望の方はご相談下さい。

22800円ポケモンカード VMAXクライマックス 2BOXエンタメ/ホビートレーディングカード21070円引き ブイマックスクライマックス シュリンク付き VMAXポケモンカード VMAXクライマックス 2BOXカード - カード

ポケモンカード vmaxクライマックス 2box シュリンク付き-

ポケモンカード ハイクラスパック VMAXクライマックス 2 BOXエンタメ

21070円引き ブイマックスクライマックス シュリンク付き VMAX

期間限定キャンペーン VMAXクライマックス 2BOX ハイクラスパック

最安値【未開封】Vmax クライマックス 2Box ポケモンカードゲームの

宅送] ポケモンカード vmaxクライマックス 2box シュリンク付き | www

【楽天市場】VMAXクライマックス ハイクラスパック 2BOX

ポケモンカード ハイクラスパック VMAXクライマックス 2BOX - www

online shop ポケモンカード vmax クライマックス 2box | yourmaximum.com

宅配買取 ポケモンカード vmax クライマックス 2box ボックス

VMAXクライマックス BOX 未開封 シュリンク付き 2BOX-

韓国版 VMAXクライマックス ×2BOX | プラチナストア

ポケモンカード VMAXクライマックス 2BOX トレーディングカード 日本

ポケモンカード「Vmaxクライマックス」2BOX シュリンク付き正規 品

ポケモンカード VMAXクライマックス 2BOX シュリンク付きポケモン

大内宿 ポケモン ポケモンカード vmax クライマックス 2BOX

工場直送 ポケモンカードゲーム 埼玉県のおもちゃ ソード&シールド

ポケモンカード vmaxクライマックス 2box シュリンク有の通販 まっきー

ポケモンカードゲーム ハイクラスパック VMAXクライマックス 2BOX

ポケモンカードゲーム ハイクラスパック VMAXクライマックス ボックス

ポケモンカードソード&シールドVmaxクライマックス×2box シュリンク付

VMAXクライマックス 2BOX シュリンク付き-

2BOX ☆ポケモンカードゲーム ハイクラスパック VMAXクライマックスの

ポケモンカード VMAXクライマックス 2BOXポケモンカードゲーム 限定

VMAXクライマックス 2BOX 新品未開封 シュリンク付 ポケモンカード

ポケモンカード VMAXクライマックス 2BOX - メルカリ

ポケモンカード vmaxクライマックス 2box シュリンク付き-

シュリンク付き】VMAXクライマックス ポケカ 2BOX|Yahoo!フリマ(旧

ハイクラスパック「VMAXクライマックス」|ポケモンカードゲーム公式

ポケモンカード vmaxクライマックス2BOX スタートデッキ100 3BOXの通販

ポケモンカード ハイクラスパック VMAX クライマックス 2box - Box

ポケモンカードゲーム VMAXクライマック 2BOX シュリンク付き 未開封-

ポケモンカード VMAXクライマックス 2BOX トレーディングカード 大阪

高い要求を持つ ポケモンカード vmaxクライマックス 2box Box/デッキ

ポケモンカードゲームソード&シールドハイクラスパックVMAX

ポケモンカードゲーム VMAXクライマックス 2BOXの通販 アンチテーゼ

VMAXクライマックス 2BOX 新品未開封-

VMAXクライマックス 2BOX 新品未開封 シュリンク付 ポケモンカード

ポケモンカード vmaxクライマックス 2boxの通販 ALi sa(1647276039

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![宅送] ポケモンカード vmaxクライマックス 2box シュリンク付き | www](https://static.mercdn.net/item/detail/orig/photos/m62254491998_1.jpg)