たまご様専用【新品・送料込み】dod ヤバイッス カーキ

(税込) 送料込み

商品の説明

商品説明

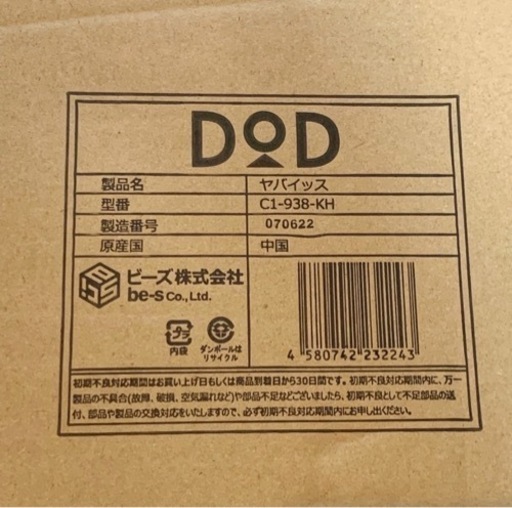

dodヤバイッスカーキ新品です

使用機会がないためお譲りいたします

※商品確認のため一度開封のみしていますが、

段ボールの伝票を貼り変えてお送りします

※段ボールに若干凹みがある場合がありますが、

中身は問題ございません

HP抜粋※画像もお借りしています

設営が終わった後のリラックスタイム、座り心地の良い大きなチェアで思いっきりくつろげたら最高だろうな。

でもそういうチェアは大きくて車に積むのが大変。そんなジレンマを解消します。

コンパクトに収納できるのに、広げるとオットマン付きのハイバックチェアが完成。

角度調整できるのでリラックスタイムだけでなく、キャンプの食事シーンでも使用可能。

これ一台でキャンプのあらゆるシーンに対応するヤバいイスです。

#dod

#ヤバイッス

#チェア

#キャンプ

10920円たまご様専用【新品・送料込み】dod ヤバイッス カーキスポーツ/アウトドアアウトドアDOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 byDOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 by

DOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 by

DOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 by

DOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 by

DOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 by

DOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの

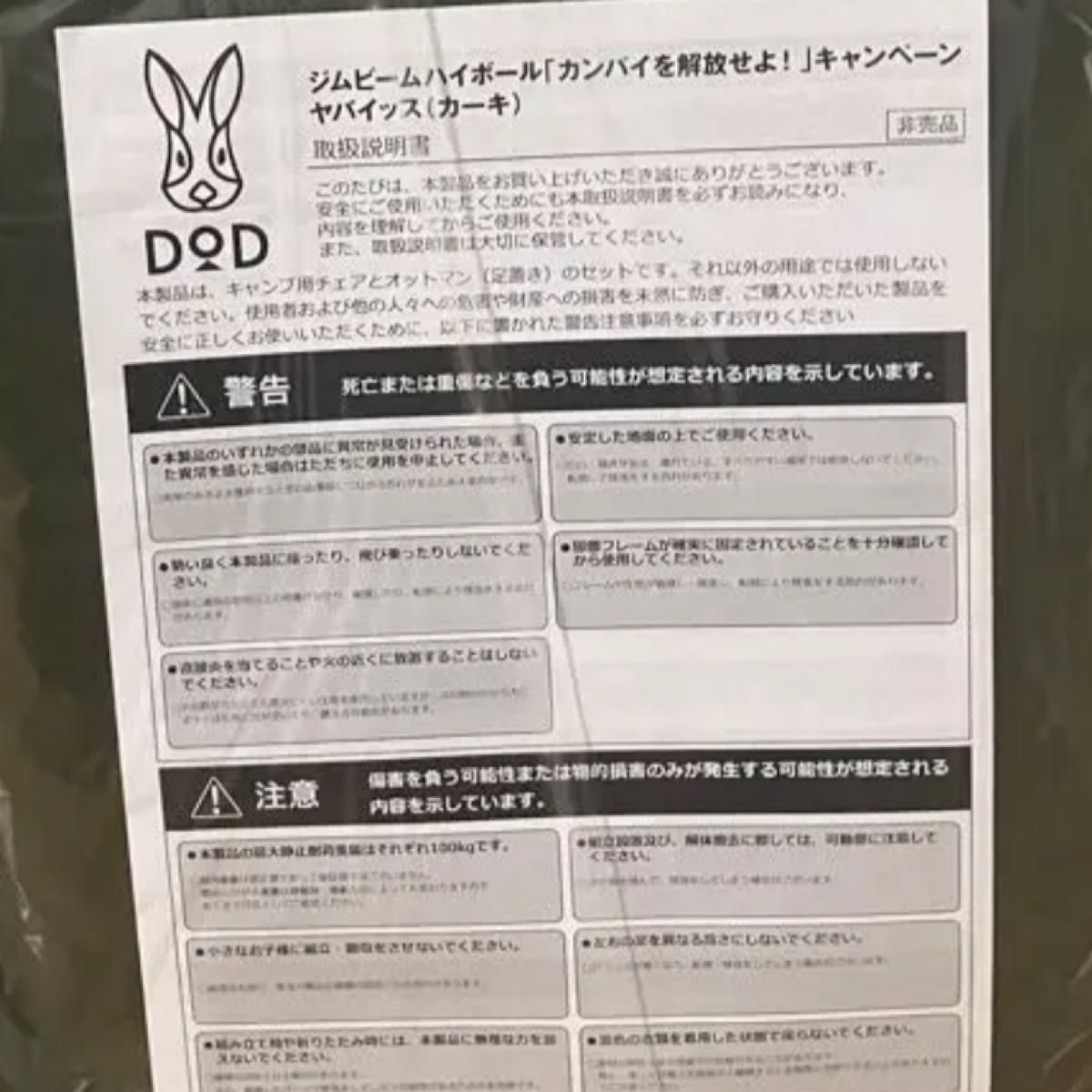

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

海外限定 DOD ディーオーディー ヤバイッス dod カーキ 新品

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

DOD ヤバイッス(ジムビーム・キャンペーンコラボデザイン)新品未使用

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー-

販売正本 DOD ヤバイッス カーキ | temporada.studio

DOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 by

DOD ヤバイッス(ジムビーム・キャンペーンコラボデザイン)新品未使用

2024年最新】ヤバイッスの人気アイテム - メルカリ

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

ジムビームコラボ ヤバイッス カーキ(DOD ) 新品未開封 - テーブル/チェア

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

ヤバイッス(カーキ) C1-938-KH - DOD(ディーオーディー):キャンプ

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

DOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 by

DOD ヤバイッス(ジムビーム・キャンペーンコラボデザイン)新品未使用

ヤバイッス | DOD STORE (ディーオーディー公式オンラインストア)

販売正本 DOD ヤバイッス カーキ | temporada.studio

DOD - たまご様専用【新品・送料込み】dod ヤバイッス カーキの通販 by

ヤバイッス(カーキ) C1-938-KH - DOD(ディーオーディー):キャンプ

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

ヤバイッス(カーキ) C1-938-KH - DOD(ディーオーディー):キャンプ

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

DOD ヤバイッス カーキ ジムビーム キャンペーン ディーオーディー

販売正本 DOD ヤバイッス カーキ | temporada.studio

ヤバイッス(カーキ) C1-938-KH - DOD(ディーオーディー):キャンプ

販売正本 DOD ヤバイッス カーキ | temporada.studio

アウトドア チェア ハイバックチェアの通販 400点以上 | フリマアプリ

販売正本 DOD ヤバイッス カーキ | temporada.studio

ヤバイッス(カーキ) C1-938-KH - DOD(ディーオーディー):キャンプ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています