wtaps doctor L/S ロングシャツ 黒 L

(税込) 送料込み

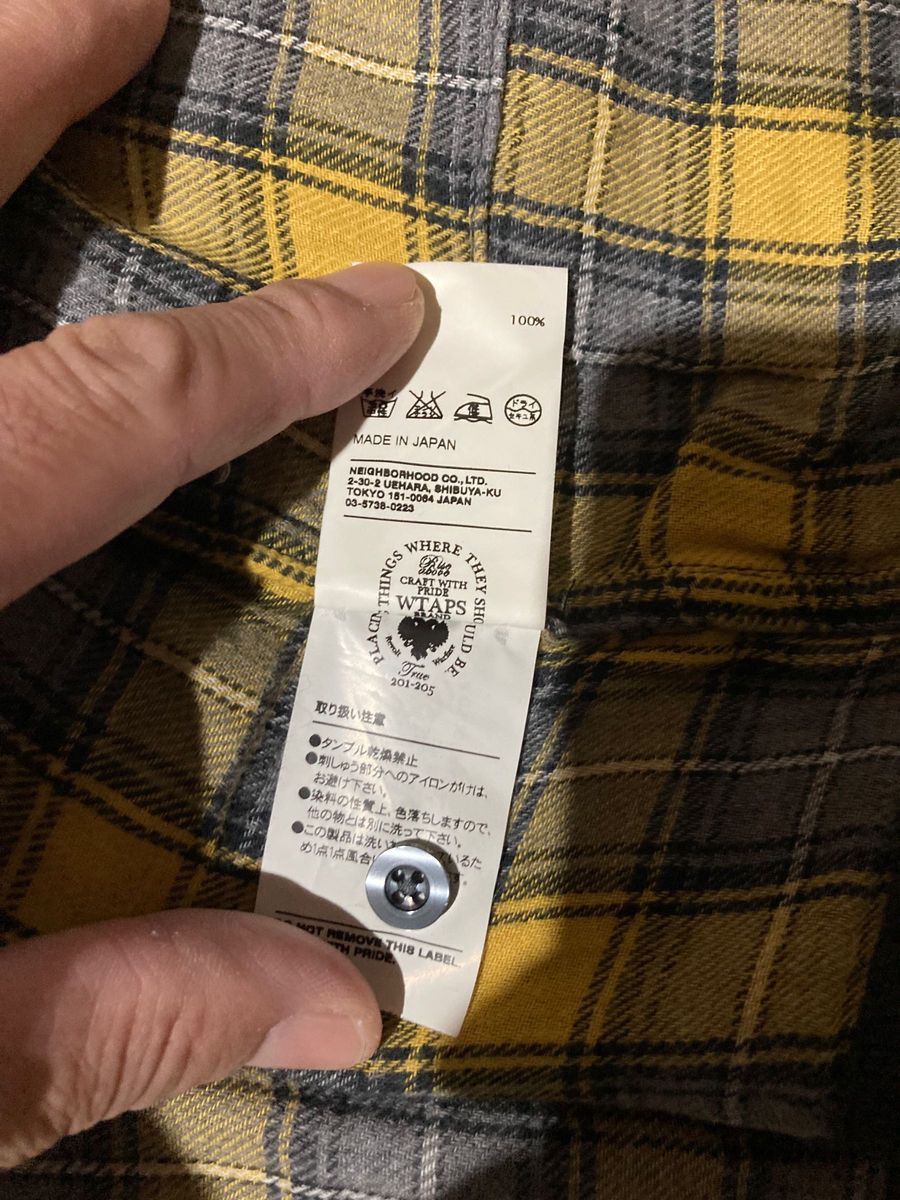

商品の説明

商品説明

中古品になります。特に目立ったキズ汚れ等は、見受けられません。

素人検品のため、見落としがあるかもしれませんがご了承ください。

ご購入後の返品交換は、致しませんので、よろしくお願い致します。

9750円wtaps doctor L/S ロングシャツ 黒 Lメンズトップスwtaps doctor L/S ロングシャツ 黒 Lwtaps doctor L/S ロングシャツ 黒 L-

wtaps doctor L/S ロングシャツ 黒 L-

wtaps doctor L/S ロングシャツ 黒 L

wtaps doctor L/S ロングシャツ 黒 L

wtaps doctor L/S ロングシャツ 黒 L-

wtaps doctor L/S ロングシャツ 黒 L-

wtaps doctor L/S ロングシャツ 黒 L

wtaps doctor L/S ロングシャツ 黒 L

wtaps doctor L/S ロング シャツ 黒 L

wtaps doctor L/S ロングシャツ 黒 L

オンラインストア売上 wtaps doctor L/S ロングシャツ 黒 L - トップス

wtaps doctor L/S ロング シャツ 黒 L

WTAPS(ダブルタップス) / DOCTOR L/S SHIRTS WOPO TEXTILE/ロング長袖

WTAPS(ダブルタップス) / DOCTOR L/S SHIRTS WOPO TEXTILE/ロング長袖

WTAPS x Dr. Martens 20AW STOMPER 1460 WTAPS 202DMDMD-FW01S サイズ

H】WTAPS 11SS DOCTOR L/S SHIRT 2 - シャツ

WTAPS x Dr. Martens 20AW STOMPER 1460 WTAPS 202DMDMD-FW01S サイズ

WTAPS(ダブルタップス) / DOCTOR L/S SHIRTS WOPO TEXTILE/ロング長袖

◇WTAPS◇11SS/MUMMY L/S SHIRTS◇S◇VATOS◇UNION◇DOCTOR◇JUNGLE

クリスマス特集2020 wtaps doctor L/S ロングシャツ 黒 L | paraco.ge

H】WTAPS 11SS DOCTOR L/S SHIRT 2 - シャツ

WTAPS(ダブルタップス) / DOCTOR L/S SHIRTS WOPO TEXTILE/ロング長袖

WTAPS (ダブルタップス) 11AW DOCTOR L/S SHIRTS.WOPO.TEXTILE ロング

WTAPS[ダブルタップス] | 21AW ロングスリーブ コットン デニムシャツ

WTAPS(ダブルタップス) / DOCTOR L/S SHIRTS WOPO TEXTILE/ロング長袖

H】WTAPS 11SS DOCTOR L/S SHIRT 2 - シャツ

2024年最新】wtaps シャツ ロングの人気アイテム - メルカリ

H】WTAPS 11SS DOCTOR L/S SHIRT 2 - シャツ

WTAPS[ダブルタップス] | 22AW ワッフル ロングスリーブTシャツ(WAFFLE

WTAPS VISUAL UPARMORED ロングスリーブTシャツ Lメンズ - dibrass.com

オンラインストア売上 wtaps doctor L/S ロングシャツ 黒 L - トップス

2024年最新】wtaps シャツの人気アイテム - メルカリ

Yahoo!オークション -「shm03」(長袖シャツ) (トップス)の落札相場

H】WTAPS 11SS DOCTOR L/S SHIRT 2 - シャツ

W)taps - wtaps doctor L/S ロングシャツ 黒 Lの通販 by mellow side

楽天市場】X-LARGE【WTAPS x VANS WAFFLE LOVERS CLUB L/S T-SHIRT

WTAPS x Dr. Martens 20AW STOMPER 1460 WTAPS 202DMDMD-FW01S サイズ

WTAPS(ダブルタップス)の古着・中古通販|ブランド買取販売店LIFE

WTAPS 2023SS INGREDIENTS LS BLACK Lサイズ ダブルタップス イング

2024年最新】wtaps シャツ ロングの人気アイテム - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![WTAPS[ダブルタップス] | 21AW ロングスリーブ コットン デニムシャツ](https://boo-bee-2.s3-ap-northeast-1.amazonaws.com/upload/save_image/09171750_6506bdd1add34.jpg)

![WTAPS[ダブルタップス] | 22AW ワッフル ロングスリーブTシャツ(WAFFLE](https://boo-bee-2.s3-ap-northeast-1.amazonaws.com/upload/save_image/03021744_65e2e6e9dbb49.jpg)