Tシャツ フロントロゴ ホワイト ネイビー

(税込) 送料込み

商品の説明

商品説明

商品番号

849612

商品名

ドルチェアンドガッバーナDOLCE&GABBANATシャツフロントロゴホワイトネイビー

ブランド名

ドルチェアンドガッバーナDOLCE&GABBANA

型番

サイズ

メーカー表示:54、着丈:77cm、肩幅:52cm、身幅:57cm、袖丈:23.5cm

素材

-

カラー

ホワイトネイビー

製造番号

-

仕様

-

付属品

-

特記事項

-

区分

メンズ:トップス:カットソー

商品状態

ABランク

商品詳細

所々:シミ

お問い合わせ番号

PD-0000849612

8554円Tシャツ フロントロゴ ホワイト ネイビーメンズトップスTシャツ フロントロゴ ホワイト ネイビー - www.sorbillomenu.comTシャツ フロントロゴ ホワイト ネイビー - www.sorbillomenu.com

Tシャツ フロントロゴ ホワイト ネイビー - www.sorbillomenu.com

Tシャツ フロントロゴ ホワイト ネイビー - www.sorbillomenu.com

Tシャツ フロントロゴ ホワイト ネイビー - www.sorbillomenu.com

DOLCE&GABBANA - Tシャツ フロントロゴ ホワイト ネイビーの通販 by

Tシャツ フロントロゴ ホワイト ネイビー - Tシャツ/カットソー(半袖

BEAMS HEART(ビームス ハート)BEAMS HEART / スマイルロゴ Tシャツ

楽天市場】1PIU1UGUALE3 RELAX (M)1PIU1UGUALE3 RELAX/UST-813W

Lee】フロントロゴ フリーサイズ ビッグシルエット 半袖Tシャツ LT307

DOLCE&GABBANA - Tシャツ フロントロゴ ホワイト ネイビーの通販 by

楽天市場】1PIU1UGUALE3 RELAX (M)1PIU1UGUALE3 RELAX/UST-813W

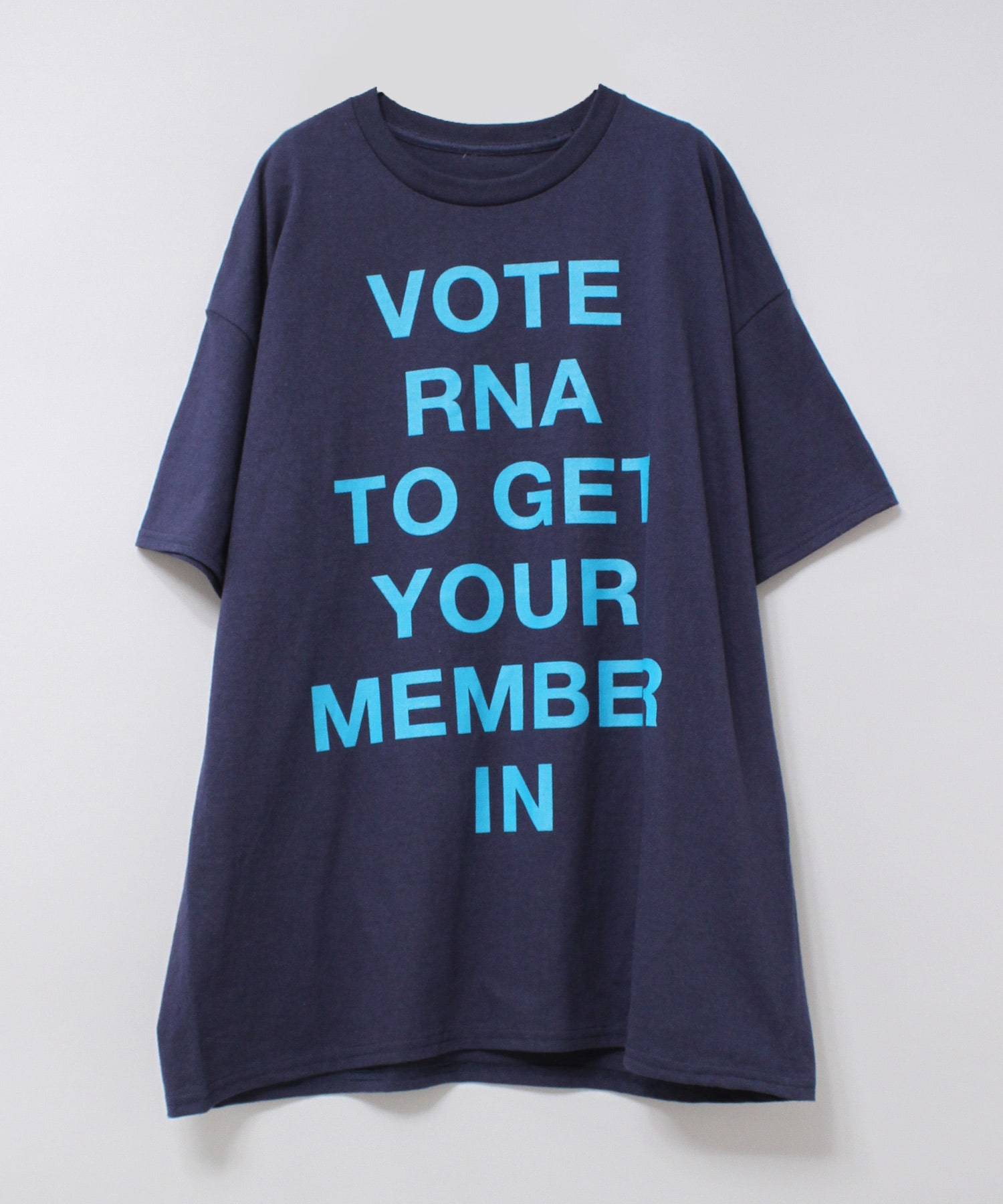

M2126 RNAアライグマプリントTシャツ(M ホワイト/ネイビーロゴ

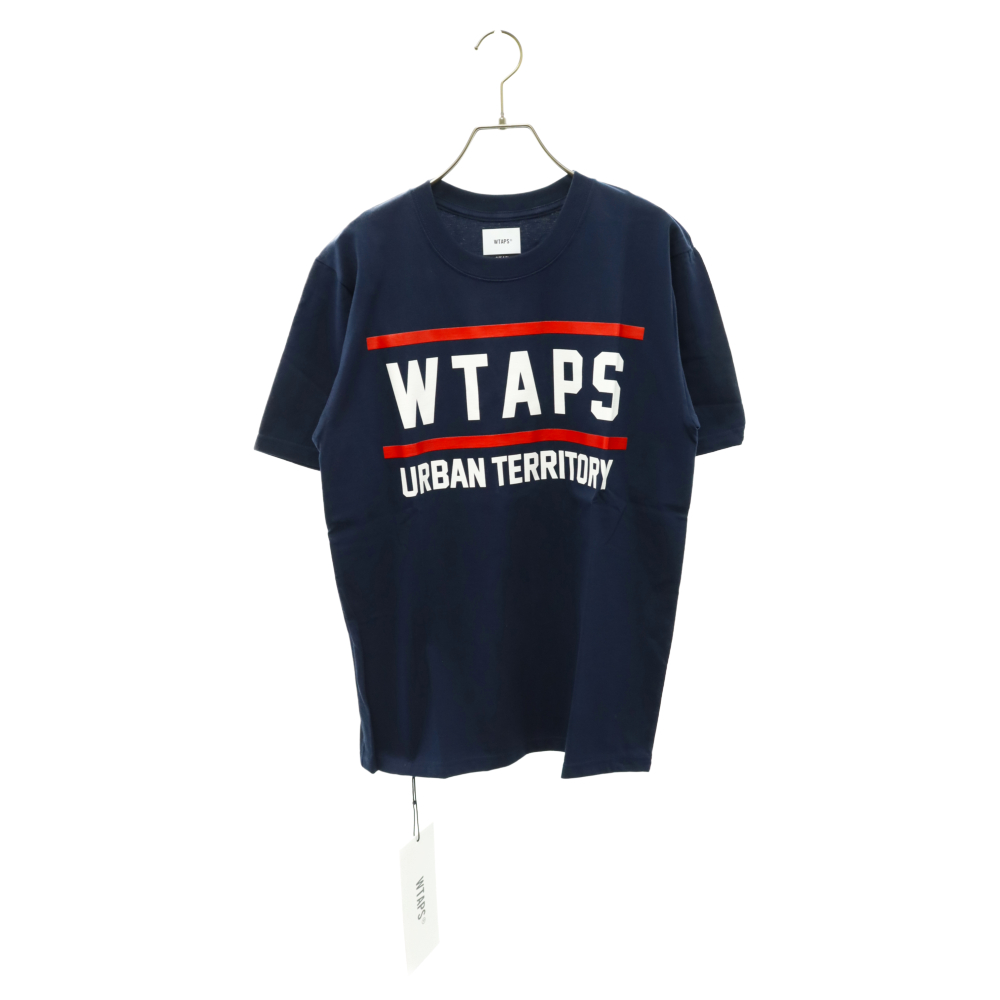

WTAPS(ダブルタップス) サイズ:S 18SS WTVUA 03 TEE フロントロゴ

tシャツ メンズ 半袖 丈夫 厚手 ティーシャツ プリントT ロゴT

M2126 RNAアライグマプリントTシャツ(M ホワイト/ネイビーロゴ

JEFF HO ジェフ・ホー #1 フロントロゴ大アイコン Tシャツ NAVY 紺x

ZEPHYR ゼファー ZP#N1W バック月光 フロントチームコンペ大ロゴ

フロント ロゴ 文字 プリント T ネイビー 紺 Tシャツ HEMWEAR 通販

楽天市場】1PIU1UGUALE3 RELAX (M)1PIU1UGUALE3 RELAX/UST-813W

Tシャツ フロントロゴ ホワイト ネイビー - Tシャツ/カットソー(半袖

tシャツ メンズ 半袖 丈夫 厚手 ティーシャツ プリントT ロゴT

WTAPS(ダブルタップス) サイズ:S 18AW TEAM TEE URBAN TERRITORY SPOT

オラクル レッドブル レーシング チーム CORE ラージ フロント ロゴ T

FILA ネイビー Tシャツ 長袖

M2126 RNAアライグマプリントTシャツ(M ホワイト/ネイビーロゴ

楽天市場】メンズ 長袖Tシャツ ロングTシャツ ロンT フロントロゴ

英字ロゴTシャツ(ネイビー) | サウナイキタイSTORE

【ネイビー】フロントロゴ エンボス加工 半袖Tシャツ 8071[品番:XB000008507]|G&L Style(ジーアンドエルスタイル)のレディースファッション通販|SHOPLIST(ショップリスト)

ZEPHYR LOGO ICON ゼファー 月光 ZP#2GW バック&フロントロゴ

M2126 RNAアライグマプリントTシャツ(M ホワイト/ネイビーロゴ

RUSSELL ATHLETIC ラッセルアスレチック フロントロゴTシャツ

FILA ネイビー Tシャツ 長袖

楽天市場】メンズ 長袖Tシャツ ロングTシャツ ロンT フロントロゴ

Tシャツ《デイジーロゴTシャツ 全5色》レディース トップス カットソー

WM フロントロゴパーカー ホワイト×ネイビー

LA VIE EST AVENTURE×FRAPBOIS Tシャツ フロントプリント|BIGI

オージーオープン Tシャツ(ネイビー)

OKINWAN FISH L/S Tシャツ 【ORION×NAVY APPAREL】(カラー:ホワイト

2023 オラクル レッドブル レーシング チーム オフィシャル CORE ラージ フロント ロゴ Tシャツ ネイビー RedBull F1

アバクロンビー&フィッチ 3パック フロントロゴリラックスフィットTシャツ(ホワイト/ブラウン/ネイビー)

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![【ネイビー】フロントロゴ エンボス加工 半袖Tシャツ 8071[品番:XB000008507]|G&L Style(ジーアンドエルスタイル)のレディースファッション通販|SHOPLIST(ショップリスト)](https://cdn.shop-list.com/res/up/shoplist/shp/__thum370__/glstyle/8071/8071WHT-9.jpg)