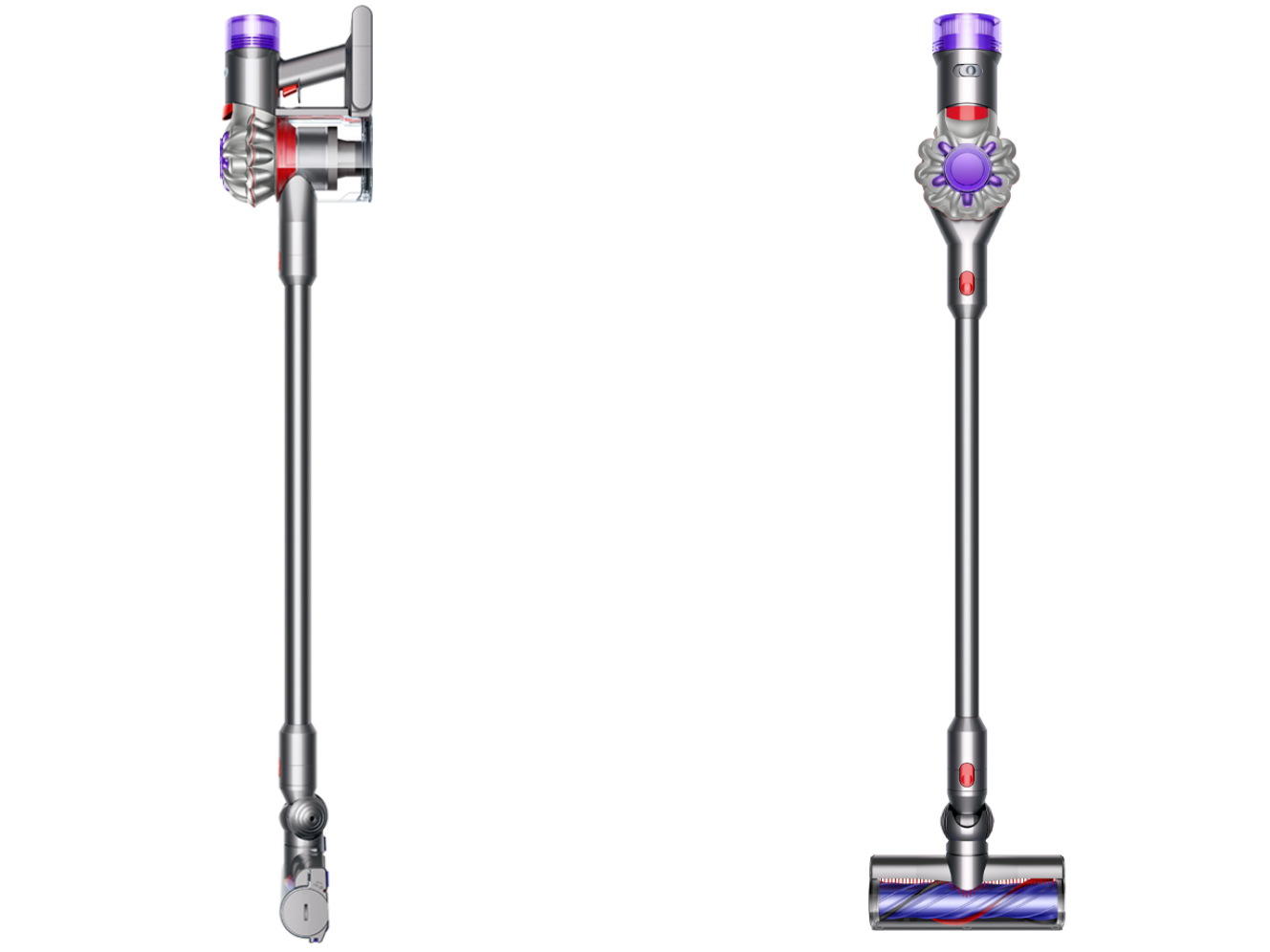

【新品未開封】Dyson V8 Slim Fluffy SV10KSLM

(税込) 送料込み

商品の説明

商品説明

新品未開封】Dyson/V8/Slim/Fluffy/SV10KSLMDyson/V8/Slim/Fluffy/SV10KSLM

2021年7月下旬Dyson公式ストアにて新品未開封品購入です。

購入後自宅で使用予定でしたが、使用機会が無く出品します。

保証は2021年7月下旬よりメーカー保障となります。

※付属品

SlimFluffy™クリーナーヘッド

収納用ブランケット

コンビネーションノズル

隙間ノズル

おまけ

フトンツール

公式ストア通常価格:税込53,900円です。

#Dyson

#dyson

#ダイソン

#SV10

#V8

#Dyson掃除機

#Dysonコードレス

#DysonCycloneV8Fluffy

22320円【新品未開封】Dyson V8 Slim Fluffy SV10KSLMスマホ/家電/カメラ生活家電新品未開封 Dyson V8 Slim Fluffy SV10KSLM - 掃除機新品未開封] Dyson V8 Slim Fluffy+スマホ/家電/カメラ - www

新品未開封Dyson V8 Slim Fluffy+ SV10KSLMCOM-

Amazon.com - Dyson (214730-01) V8 Absolute Cordless Stick Vacuum

新品未開封 Dyson V8 Slim Fluffy SV10KSLM - 掃除機

新品未開封Dyson V8 Slim Fluffy+ SV10KSLMCOM-

Dyson V8 Slim Fluffy SV10KSLM | www.fleettracktz.com

Dyson V8 Cordless Vacuum | Silver | New - Walmart.com

新品未開封 Dyson V8 Slim Fluffy SV10KSLM - 掃除機

今だけ限定価格! Dyson 新品 新品未開封】Dyson Dyson Fluffy V8 掃除

新品未開封Dyson V8 Slim Fluffy+ SV10KSLMCOM-

Dyson V8

Dyson V8 Slim ™ Fluffy Cordless Vacuum Cleaner | iShopChangi

Dyson V8 Slim Fluffy サイクロン式コードレススティッククリ…-

新品未開封 Dyson V8 Slim Fluffy SV10KSLM - 掃除機

Amazon.com - Dyson (214730-01) V8 Absolute Cordless Stick Vacuum

Dyson V8 Slim Fluffy サイクロン式コードレススティッククリ…-

経典 Dyson V8 サイクロン式コードレス Fluffy Slim 掃除機 - www

新品未開封】Dyson V8 Slim Fluffy ダイソン - 生活家電

新品未開封】Dyson V8 Slim Fluffy ダイソン - 生活家電

Dyson V8 Slim Fluffy 無線吸塵機| Dyson Taiwan

新品未開封Dyson V8 Slim Fluffy+ SV10KSLMCOM-

Dyson V8 Slim Fluffy+ SV10KSLMCOM 未開封品 - 掃除機

Dyson V8 Slim Fluffy 無線吸塵機| Dyson Taiwan

新品未開封】Dyson V8 Slim Fluffy+スマホ/家電/カメラ - mirabellor.com

新品未開封 Dyson V8 Slim Fluffy SV10KSLM - 掃除機

Dyson - 【新品・未開封】ダイソン V8 slim fluffy SV10KSLMの通販 by

格安セール】 Dyson - ダイソン dyson v8 slim fluffy 新品未開封の

新品・未開封】ダイソン V8 Slim Fluffy SV10K SLM - 掃除機

新品未開封Dyson V8 Slim Fluffy+ SV10KSLMCOM-

Dyson V8 Slim Fluffy SV10K SLM コードレス+inforsante.fr

Dyson V8

品質は非常に良い SV10KSLM Dyson コードレス Dyson V8 V8 Slim Fluffy

dyson ダイソンV8 V8 SLIM FLUFFY EXTRASV1OK EXT FU 新品未開封品

1円 新品未開封 ダイソン dyson コードレス掃除機 SV10KSLM BU V8 Slim

Dyson V8 Slim Fluffy SV10KSLM ニッケル/アイアン/レッド [サイクロン

Dyson V8 Slim Fluffy サイクロン式コードレススティッククリ… - 掃除機

Dyson V8 Slim Fluffy+ SV10K SLM COM | www.fleettracktz.com

新品未開封】 SV10KSLM ダイソン V8 Slim Fluffy ダイソン 掃除機 本物

Dyson V8 Slim Fluffy+ SV10KSLMCOM 未開封品 - 掃除機

1円 新品未開封 ダイソン dyson コードレス掃除機 SV10KSLM BU V8 Slim

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![新品未開封] Dyson V8 Slim Fluffy+スマホ/家電/カメラ - www](https://www.dyson.co.jp/medialibrary/Japan-Responsive-Site/Categories/Vaccums/V8-Slim/Variants/hero_V8slim-Black.png)