【品質保証書】美しい♪ K18 ゴールド チェーン ブレスレット シンプル

(税込) 送料込み

商品の説明

商品説明

■■■■■■■■■■■■■■■■■■■即購入◎24時間ご質問◎English◎

■■■■■■■■■■■■■■■■■■■

【管理番号】A688.999

最終価格です。

交渉はご遠慮くださいm(._.)m

ーーーーーーー商品説明ーーーーーーー

✴️美しいK18素材のブレスレット♪

✴️男女兼用サイズ(全長約18cm)

✴️重ね付けも◎

もう一点別で出品中

【状態】

中古品の為、金属部分に多少のスレ•ヤケがございますが、大きなダメージはありません。

※状態判断や記載ミスがある場合は【写真優先】でお願いします。

※写真は【アップ】で撮影しており、必ず実寸サイズをご確認ください。想像以上に【小さかった】【軽かった】などと不当に評価下げされる方はご遠慮下さい。

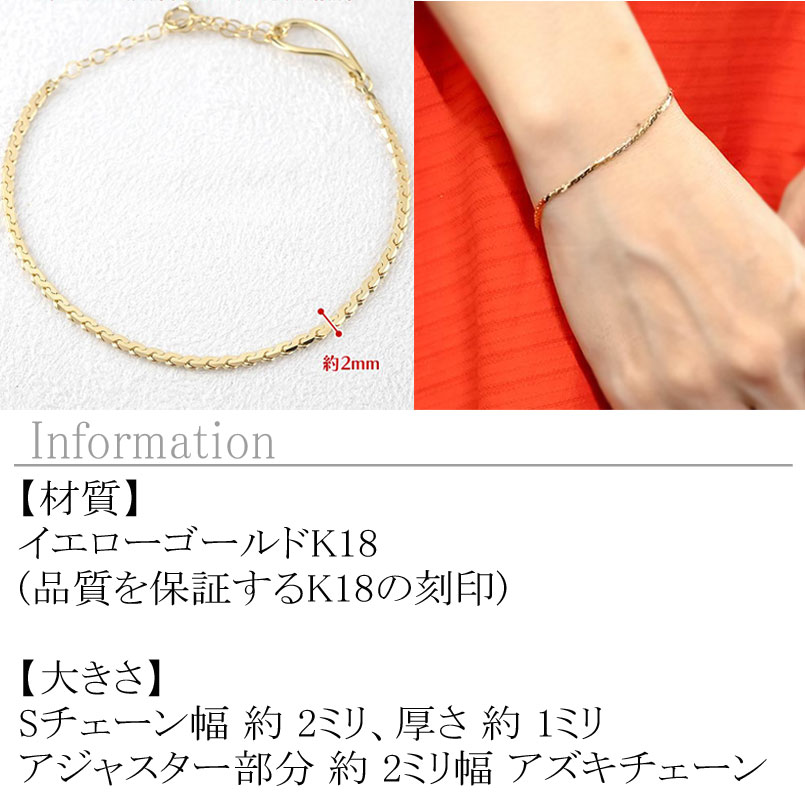

【地金や総重量】K181.5g

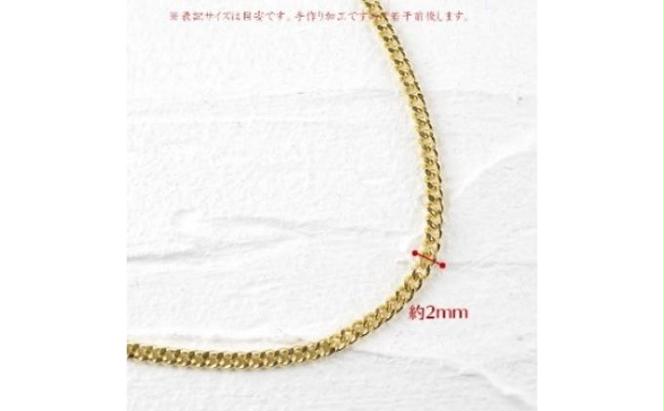

【サイズ】約18cm約2.3mm幅

※多少の誤差あり

【内容】ブレスレット一点

【購入元々】親族がオーナーの大手買取店

他のサイトにも出品しており、早いもの勝ちとなります。

気になった方は是非、お早めにご検討くださいませ♪

ーーーーーーーーーーーーーーーーーー

●あんしん返金・品質保証あり●

お届け後、【説明文】や【写真】では判断できない、不備がある場合は誠意を持って対応させていただきます。必ず【評価前】にご連絡ください。

●当アカウント●

兵庫県古物商許可第63141180007号

大手買取店にて品質確認済み

【チェック内容】

・貴金属テスター

●注意●

・画像に写り込まないダメージや多少の見落としがあったり、モニターによっては色の見え方が違う場合もあります

・ネコポス配送(合計金額4万円以下のみ)

・配送会社は予告なく変更します

親切・丁寧なお取引きを心がけます^^

12349円【品質保証書】美しい♪ K18 ゴールド チェーン ブレスレット シンプルレディースアクセサリー18金 ブレスレット レディース 喜平 シンプル チェーンのみ 18cm18金 ブレスレット レディース 喜平 シンプル チェーンのみ 18cm

ブレスレット レディース k18 人気 20代 30代 40代 50代 60代 18金 18k

18金 ブレスレット レディース 18k K18 粗目小豆チェーン チェーンだけ カット 地金 チェーン イエローゴールドK18 女性 シンプル おしゃれ 人気 送料無料 | ジュエリー工房アトラス

18金 ブレスレット レディース 喜平 シンプル チェーンのみ 18cm

k18 ブレスレット レディースの人気商品・通販・価格比較 - 価格.com

18金 ブレスレット レディース 喜平 シンプル チェーンのみ 18cm

ブレスレット チェーン レディース モーグルチェーン 金属アレルギー対応 チェーンブレスレット k18 地金 ゴールドブレスレット ゴールド 引き輪 ブレスレットチェーン つけっぱなし 華奢 上品 アクセサリー アレルギー シンプル 誕生日 プレゼント 女性 ギフト

楽天市場】18金 ブレスレット レディース シンプル 2連 ひし形 大 3.1

k18 ペーパークリップチェーン ブレスレット ゴールドチェーン 中空 幅

楽天市場】オープン記念 K18YG/WG チェーンモチーフ リング【送料無料

18金 ブレスレット レディース 喜平 シンプル チェーンのみ 18cm

ネックレス レディース ブレスレット セット ロングネックレス ゴールド K18 ブランド H&C CZ ジルコニア ペンダント チェーンブレスレット ステーション 金属アレルギー アクセサリー シンプル クリスマス プレゼント 女性 誕生日 妻 ギフト かわいい 誕生日プレゼント

楽天市場】K10YG【フリーサイズ】スクエア カラーストーン チェーン

18金 ブレスレット レディース 喜平 シンプル チェーンのみ 18cm

18金 ペーパークリップ チェーン ネックレス チェーン ゴールド 50cm

楽天市場】18金 ブレスレット レディース シンプル ひし形 デザイン

⭐️K18 あこや ベビ-パール 揺れ感 ブレスレット 保証書付

実はプレゼントにピッタリなジュエリー、ブレスレット!本当に人気の

18金 ブレスレット レディース ゴールド S字チェーンだけ アジャスター 選べる長さ イエローゴールドk18 18k 人気 地金 シンプル 女性 ジュエリー ギフト 贈り物 プレゼント 人気 | ジュエリー工房アトラス

ブレスレット 18金 K18 ゴールド しっかり 1.5mm幅 スクリューチェーン

楽天市場】Pt950/K18YG【1.0ct】ダイヤモンド 形状記憶 ブレスレット

k18 ブレスレットの人気商品・通販・価格比較 - 価格.com

K18 Pt950 カラーストーンブレスレット】 ゴールドブレスレット

ネックレス レディース ブレスレット セット ロングネックレス ゴールド K18 ブランド H&C CZ ジルコニア ペンダント チェーンブレスレット ステーション 金属アレルギー アクセサリー シンプル クリスマス プレゼント 女性 誕生日 妻 ギフト かわいい 誕生日プレゼント

楽天市場】18金 ブレスレット レディース シンプル 2連 ひし形 大 3.1

ネックレス レディース ブレスレット セット ロングネックレス

k18 ネックレスチェーン ペーパークリップ チェーン ゴールド イエロー

ダイヤ ヌード」ブレスレット / 【オレフィーチェ】Orefice オンライン

ネックレス レディース ブレスレット セット ロングネックレス

ペアリング】手書き刻印可能【『シンプルが美しい』4mm 平打ちフラット

18金 ブレスレット レディースの人気商品・通販・価格比較 - 価格.com

ステンレス チェーンブレスレット マンテル 太幅 アズキ メンズ

k18 ブレスレット レディースの人気商品・通販・価格比較 - 価格.com

ペアリング】手書き刻印可能【『シンプルが美しい』4mm 平打ちフラット

k18 ペーパークリップチェーン ブレスレット ゴールドチェーン 中空 幅

K18 アンクレット ペタルチェーン パワーリング アクセサリー2

ブレスレット チェーン レディース モーグルチェーン 金属アレルギー対応 チェーンブレスレット k18 地金 ゴールドブレスレット ゴールド 引き輪 ブレスレットチェーン つけっぱなし 華奢 上品 アクセサリー アレルギー シンプル 誕生日 プレゼント 女性 ギフト

イニシャルコイン」ブレスレット / 【オレフィーチェ】Orefice

24金 ブレスレット 純金 レディース チェーンのみ 16cm ペタルチェーン

k18 ブレスレット レディースの人気商品・通販・価格比較 - 価格.com

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています