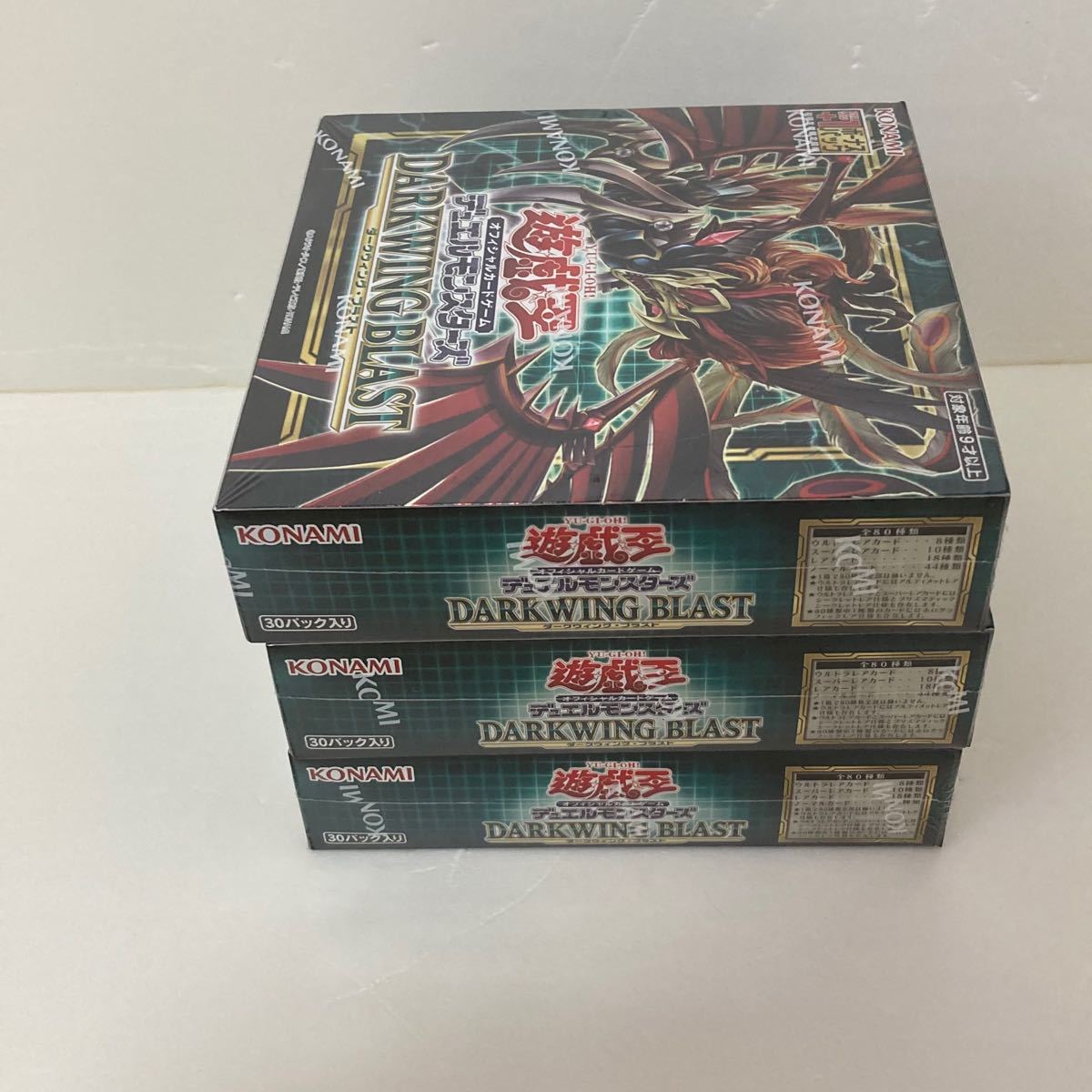

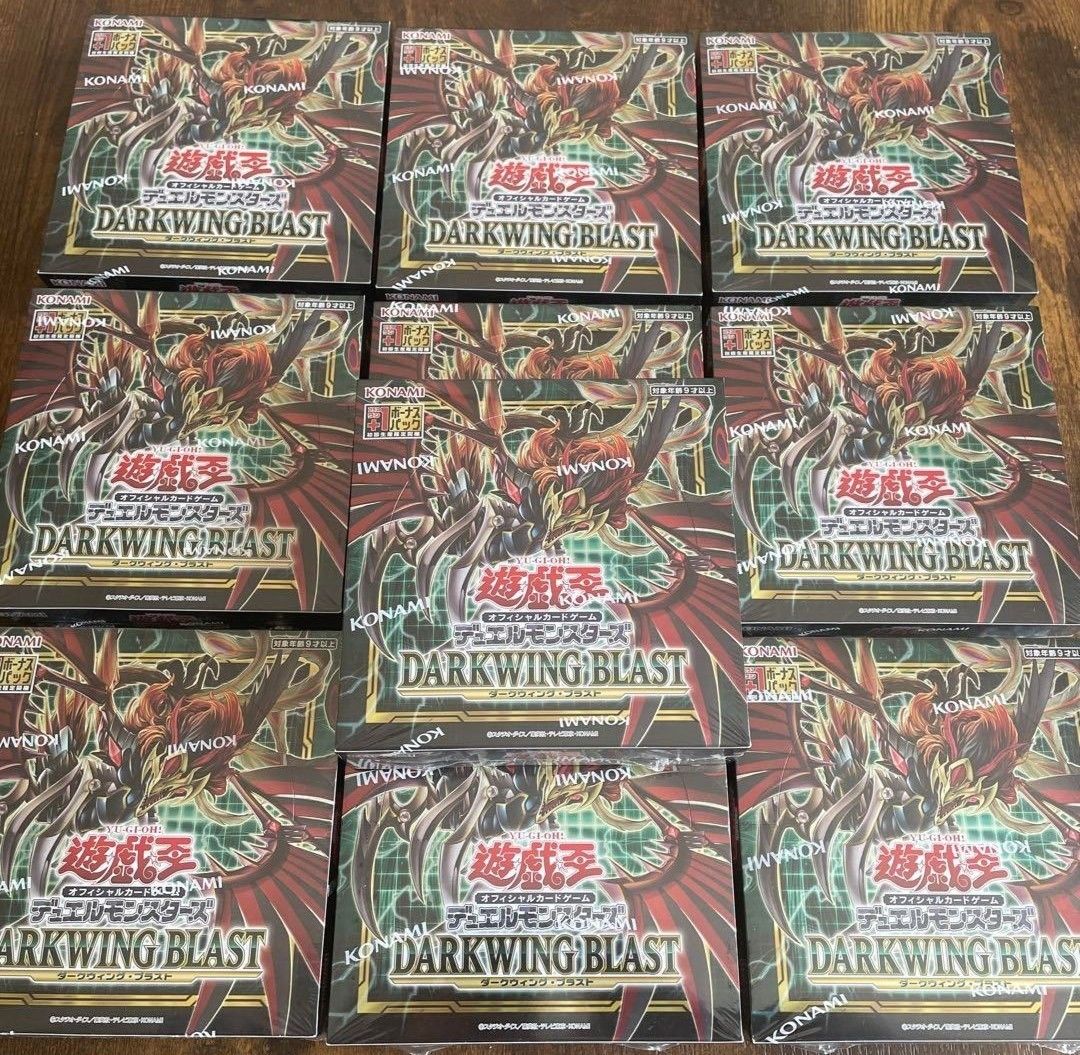

ダークウィングブラスト 初版 10BOX

(税込) 送料込み

商品の説明

商品説明

ダークウィングブラスト22800円ダークウィングブラスト 初版 10BOXエンタメ/ホビートレーディングカード遊戯王 DARKWING BLAST 未開封 シュリンク付 8box 初版-遊戯王 ダークウイングブラスト 未開封 10 BOX - www.sorbillomenu.com

直営の通販サイト 初版 遊戯王 ダークウィングブラスト 10box プラス

新品未開封☆初版+1付き☆ダークウイングブラスト×10BOX-

遊戯王 DARKWING BLAST 未開封 シュリンク付 8box 初版-

遊戯王 ダークウィングブラスト DARK WING BLAST 未開封10BOX-

遊戯王OCG デュエルモンスターズ ダークウィングブラストDARKWING

新品未開封☆初版+1付き☆ダークウイングブラスト×10BOX-

遊戯王 ダークウィングブラスト 未開封 初版 5箱セット - 遊戯王

新品未開封 遊戯王 DARK WING BLAST ダークウィングブラスト10箱 - www

遊戯王 ダークウィングブラスト DARK WING BLAST 未開封10BOX-

2023人気No.1の 遊戯王 ダークウィングブラスト シュリンク付き

今だけ限定価格! 新品未 遊戯王 ダークウィング・ブラスト 未開封

2024年最新】ダークウィングブラスト box 初版の人気アイテム - メルカリ

遊戯王 ディメンションフォース ダークウィングブラスト 20BOX 全て

遊戯王 ダークウィングブラスト 初回生産版 10box シュリンク付き - 遊戯王

2024年最新】ダークウィングブラスト box 初版の人気アイテム - メルカリ

DARKWINGBLASTシュリンク付 初版 ダークウィングブラスト プラスワン付

新品未開封☆初版+1付き☆ダークウイングブラスト×10BOX-

特定 ダークウィングブラスト 10 BOX - トレーディングカード

宅送] 遊戯王 初版 DARKWING BLAST ダークウィングブラスト 1カートン

特価品コーナー 遊戯王 ダークウイングブラスト 初版シュリンク付き

遊戯王 ダークウィングブラスト DARK WING BLAST 未開封10BOX-

遊戯王 ダークウィングブラスト 3BOX Yahoo!フリマ(旧)-

遊戯王 ダークウィングブラスト 未開封 初版 5箱セット - 遊戯王

直営の通販サイト 初版 遊戯王 ダークウィングブラスト 10box プラス

遊戯王 OCG DARKWING BLAST ダークウィングブラスト 12BOX - Box

遊戯王 ダークウイングブラスト 未開封 10 BOX - www.sorbillomenu.com

DARKWING BLAST ダークウィングブラスト 2box遊戯王 未開封エンタメ

ブラックフェザードラゴン初回生産 ダークウイングブラスト 1box 新品

遊戯王 ダークウィング ブラスト 6box +1ボーナスパック シュリンク

遊戯王 DARKWING BLAST 未開封 シュリンク付 8box 初版-

素敵な 遊戯王 ダークウィングブラスト DARKWING BLAST シュリンク付き

2024年最新】ダークウィングブラスト パックの人気アイテム - メルカリ

新品未開封 遊戯王 DARK WING BLAST ダークウィングブラスト10箱 - www

遊戯王 ダークウィング・ブラスト 初回生産版 1カートン-

オンライン 【シュリンク未開封】2box ダークウイングブラスト 遊戯王

遊戯王 DARKWING BLAST 未開封 シュリンク付 8box 初版-

遊戯王 ダークウィングブラスト 未開封 初版 5箱セット - 遊戯王

遊戯王 ダークウィングブラスト DARK WING BLAST 未開封10BOX-

遊戯王 ダークウィングブラスト 1BOX 未開封 初版 シュリンク付|Yahoo

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![宅送] 遊戯王 初版 DARKWING BLAST ダークウィングブラスト 1カートン](https://auctions.c.yimg.jp/images.auctions.yahoo.co.jp/image/dr000/auc0501/users/ebca9f21714f03a7fb0c09162346cbf53f0d3952/i-img1198x898-1704355738bnma9z428558.jpg)