シビラ スカートスーツ レディース美品 -

(税込) 送料込み

商品の説明

商品説明

[カテゴリ]スカートスーツ

[ブランド]

Sybilla(シビラ)

[商品名]

-

[型番]

-

[男女別]

レディース

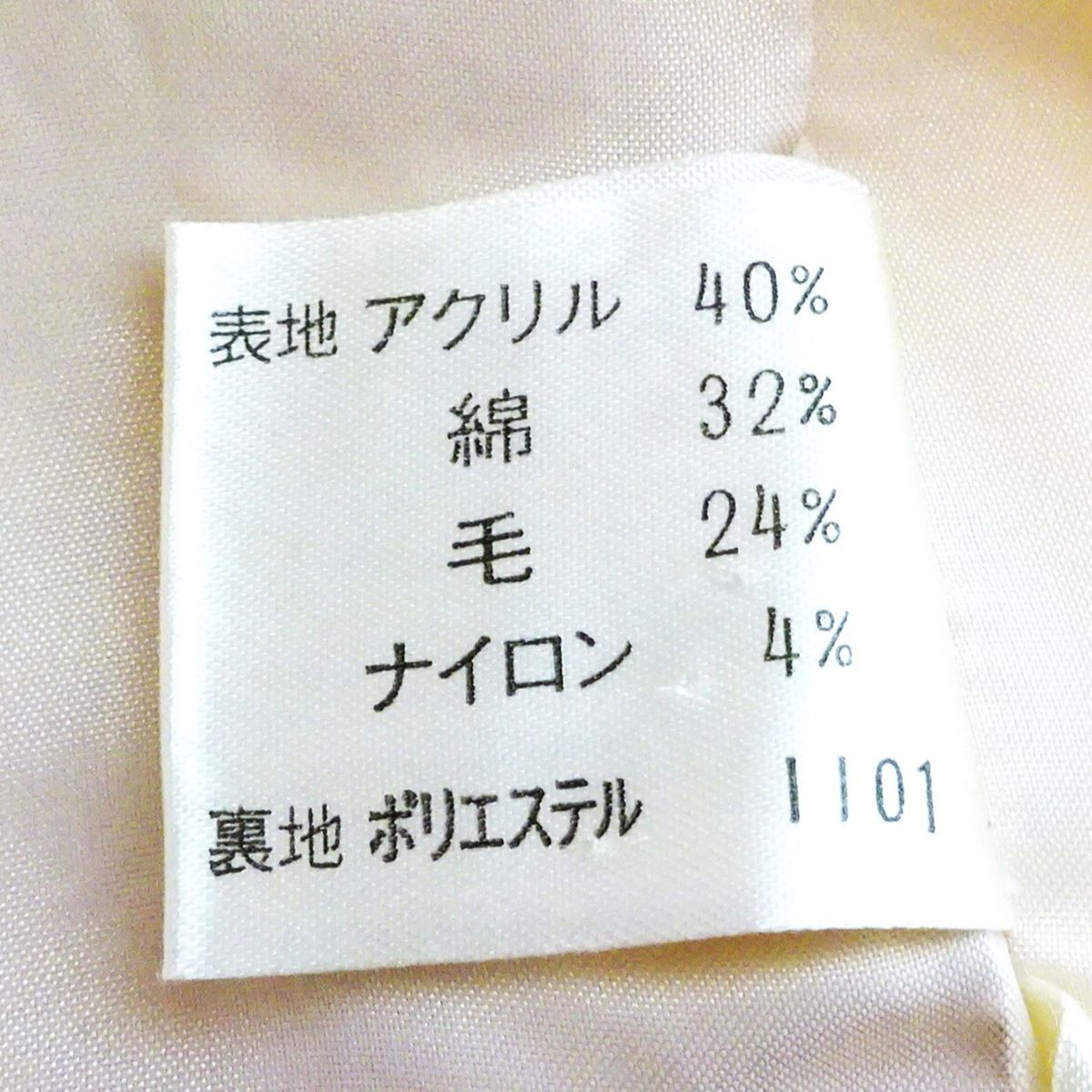

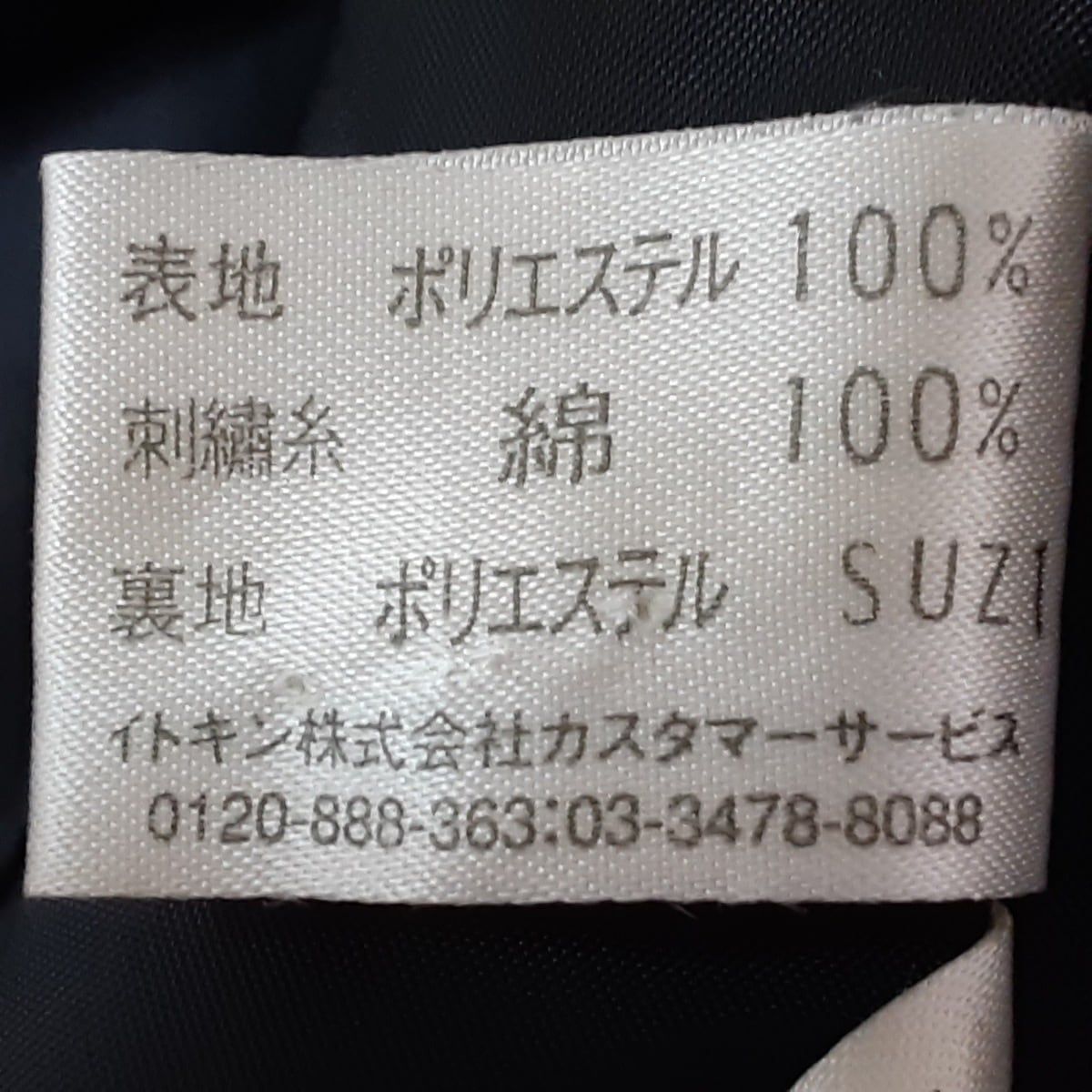

[表記サイズ]

ジャケット:M

スカート:M

[実寸サイズ]

■ジャケット

肩幅:約35cm

袖丈:約56cm

身幅:約41cm

着丈:約49cm

■スカート

ウエスト:約64cm(半身×2のサイズ)

総丈:約52cm

[カラー]

ダークブラウン

[デザイン]

フェイクスエード

スカートウエストハンガー跡目立つ

[コンディションの備考]

【ジャケット外側】

・全体的⇒シワ目立つ/毛羽立ち若干

【ジャケット内側】

・特筆すべきダメージなし

【スカート外側】

・全体的⇒シワ目立つ/毛羽立ち若干

【スカート内側】

・特筆すべきダメージなし

[製造番号・刻印]

-

[シリアル]

***

[付属品]

なし

こちらの商品はラクマ公式パートナーのBrandear(ブランディア)によって出品されています。

以下の内容のお問い合わせについてはお返事ができませんのであらかじめご了承ください。

・商品状態の確認(汚れ具合、形状の確認等々)

・お値下げの交渉

6720円シビラ スカートスーツ レディース美品 -レディースフォーマル/ドレス美品】シビラ セレモニーフォーマルスーツ セットアップ-Sybilla - シビラ スカートスーツ レディース美品 -の通販 by ブラン

シビラ Sybilla スカートスーツ レディース 美品 - ネイビー 新着

シビラ スーツ(レディース)の通販 100点以上 | Sybillaのレディースを

美品】シビラ セレモニーフォーマルスーツ セットアップ-

美品 Sybilla シビラ セットアップ ツイード M グリーン シルク混

シビラ ロングスカートスーツ - スカートスーツ上下

美品⭐️シビラ スカートスーツセットアップ リネン混 フォーマル 紺 M

シビラワンピース スーツ美品Lサイズ

シビラ スカートスーツ レディース美品 - 商品の状態 激安購入

Sybilla - 美品 シビラ スカート ノーカラー セットアップ マルチ

美品 Sybilla シビラ セットアップ ツイード M グリーン シルク混

シビラ Sybilla スカートスーツ レディース 美品 - ネイビー 新着

Sybilla(シビラ) スカートスーツ レディース美品 - ライトピンク

シビラ ロングスカートスーツ - スカートスーツ上下

⁑【美品】シビラ 7部袖 セレモニースーツ ロング丈タイトスカート

シビラワンピース スーツ美品Lサイズ

シビラ Sybilla スカートスーツ レディース 美品 - ネイビー 新着

美品 Sybilla シビラ セットアップ ツイード M グリーン シルク混

Sybilla(シビラ) スカートスーツ レディース美品 - ライトピンク

シビラ の買取【ブランディア】 (1ページ目)

SYBILLA シビラ セットアップ - スカートスーツ上下

オンラインストア入荷 シビラ スカートスーツ レディース - | www

シビラ スーツ(レディース)の通販 100点以上 | Sybillaのレディースを

美品⭐️シビラ スカートスーツセットアップ リネン混 フォーマル 紺 M

格安人気 【美品】ホコモモラデシビラ ふんわり スーツ(レディース)の

今日の超目玉 ⁑ユキトリイ お受験 セレモニースーツ セットアップ 7号

Sybilla(シビラ) スカートスーツ レディース美品 - ライトピンク

シビラ Sybilla スカートスーツ レディース 美品 - ネイビー 新着

シビラ ロングスカートスーツ - スカートスーツ上下

シビラ sybilla セットアップ スカート スーツ 刺繍 ブラック M

24時間限定 ホコモモラ sybilla シビラ セットアップ フォーマル

美品⭐️シビラ スカートスーツセットアップ リネン混 フォーマル 紺 M

シビラ スーツ(レディース)の通販 100点以上 | Sybillaのレディースを

美品】シビラ セレモニーフォーマルスーツ セットアップ-

シビラ Sybilla スカートスーツ レディース 美品 - ネイビー 新着

楽天市場】美品【中古】シビラ Sybilla ブラックフォーマルワンピース

シビラ スーツ(レディース)の通販 100点以上 | Sybillaのレディースを

Sybilla(シビラ) スカートスーツ レディース美品 - ネイビー - メルカリ

美品 Sybilla シビラ セットアップ ツイード M グリーン シルク混

注目ブランドのギフト 23区 シビラ 超美品 上質 スーツ セットアップ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています