ヒステリックミニ スパンコール ハーフパンツ 130

(税込) 送料込み

商品の説明

商品説明

プロフ確認お願い致します。新品未使用

サイズ130

袋一枚の簡易梱包発送

10110円ヒステリックミニ スパンコール ハーフパンツ 130キッズ/ベビー/マタニティキッズ服男の子用(90cm~)ヒステリックミニ スパンコール ハーフパンツ 130 | hartwellspremium.comHYSTERIC MINI - ヒステリックミニ スパンコール ハーフパンツ 130の

ヒステリックミニ スパンコール ハーフパンツ 130 | hartwellspremium.com

ヒステリックミニ スパンコール ハーフパンツ 130 | hartwellspremium.com

ヒステリックミニ スパンコール ハーフパンツ 130 | hartwellspremium.com

ヒステリックミニ スパンコール ハーフパンツ 130 | hartwellspremium.com

ヒステリックミニ スパンコール ハーフパンツ 130 | hartwellspremium.com

ヒステリックミニ スパンコール ハーフパンツ 130 | bukavufm.com

ヒステリックミニ スパンコール ハーフパンツ 130 | hartwellspremium.com

ヒステリックミニ テディ 刺繍 ハーフパンツ 130

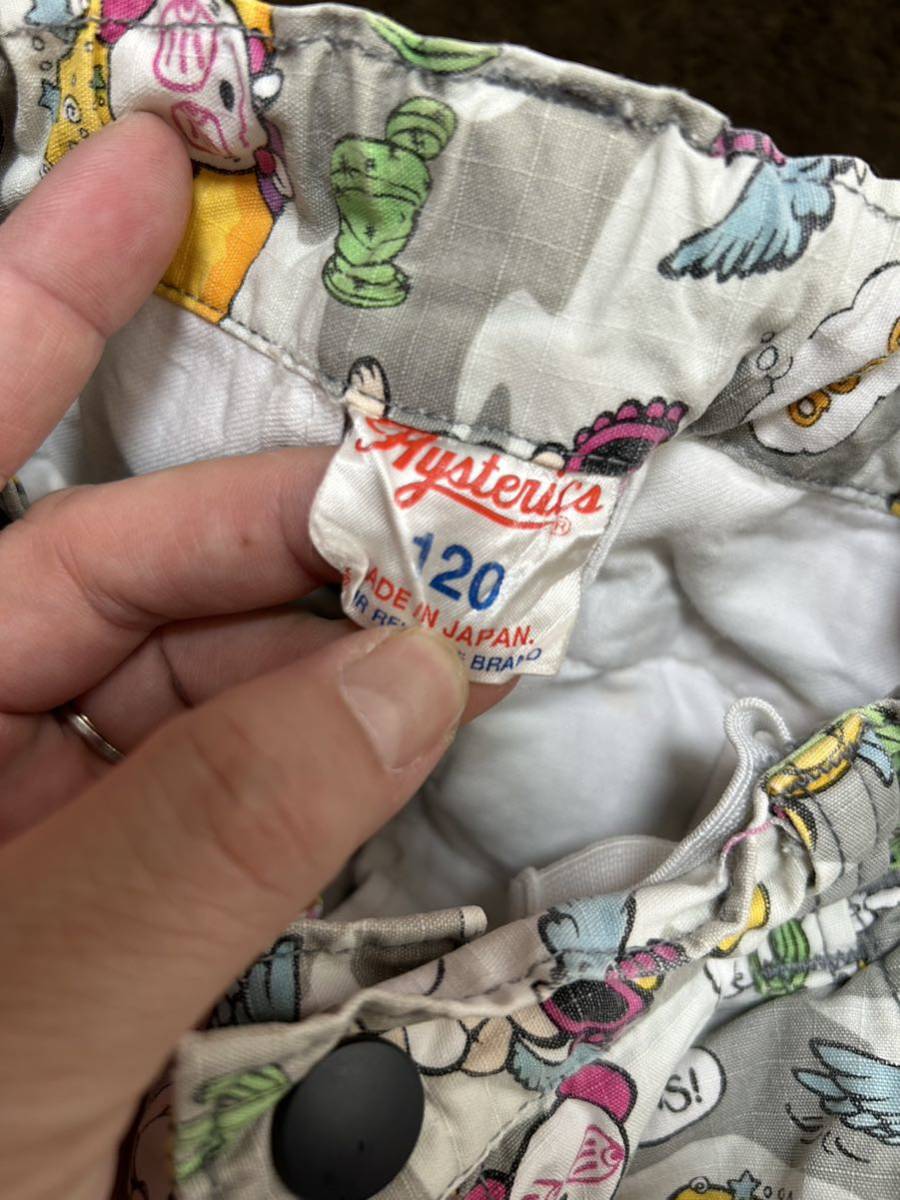

ヒスミニハーフパンツ120

HYSTERIC MINI - ヒステリックミニ スパンコール ハーフパンツ 130の

HYSTERIC MINI - ヒステリックミニ スパンコール ハーフパンツ 130の

ヒステリックミニ パンツ ピンク秋冬物 - パンツ

HYSTERIC MINI - ヒステリックミニ スパンコール ハーフパンツ 130の

パンツ/スパッツヒステリックミニ スパンコール ハーフパンツ 130

ヒステリックミニのハーフパンツ

ヒステリックミニ スパンコール ハーフパンツ 130 - ボトムス

ブランド品専門の - ヒステリックミニ 130 2024年最新】ヒョウ柄

HYSTERIC MINI - ヒステリックミニ スパンコール ハーフパンツ 130の

ヒスミニハーフパンツ120

HYSTERIC MINI - ヒステリックミニ スパンコール ハーフパンツ 130の

HYSTERIC MINI - ヒステリックミニ スパンコール ハーフパンツ 130の

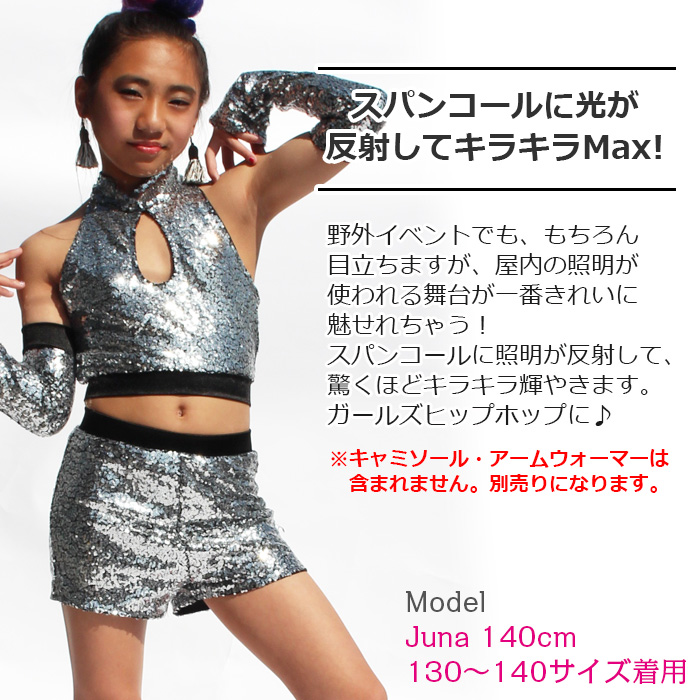

楽天市場】スパンコール ショートパンツ ホットパンツ 女の子 子供服

パンツ/スパッツヒステリックミニ スパンコール ハーフパンツ 130

ヒステリックミニ スパンコール ハーフパンツ 130 - ボトムス

HYSTERIC MINI - ヒステリックミニ スパンコール ハーフパンツ 130の

ヒステリックミニのハーフパンツ

ヒステリックミニ テディ 刺繍 ハーフパンツ 130 | フリマアプリ ラクマ

楽天市場】スパンコール ショートパンツ ホットパンツ 女の子 子供服

ヒステリックミニ スパンコール ハーフパンツ 130 - ボトムス

ヒスミニハーフパンツ120

楽天市場】スパンコール ショートパンツ ホットパンツ 女の子 子供服

ヒスミニハーフパンツ120

ヒスミニハーフパンツ120

2024年最新】パンツ HYSTERIC MINIの人気アイテム - メルカリ

ヒステリックミニの通販 80,000点以上 | HYSTERIC MINIを買うならラクマ

ヒスミニハーフパンツ120

ヒステリックミニ スパンコール ハーフパンツ 130 - ボトムス

ヒステリックミニ ヒスミニ スパンコール トレーナー - トップス

2024年最新】パンツ HYSTERIC MINIの人気アイテム - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています