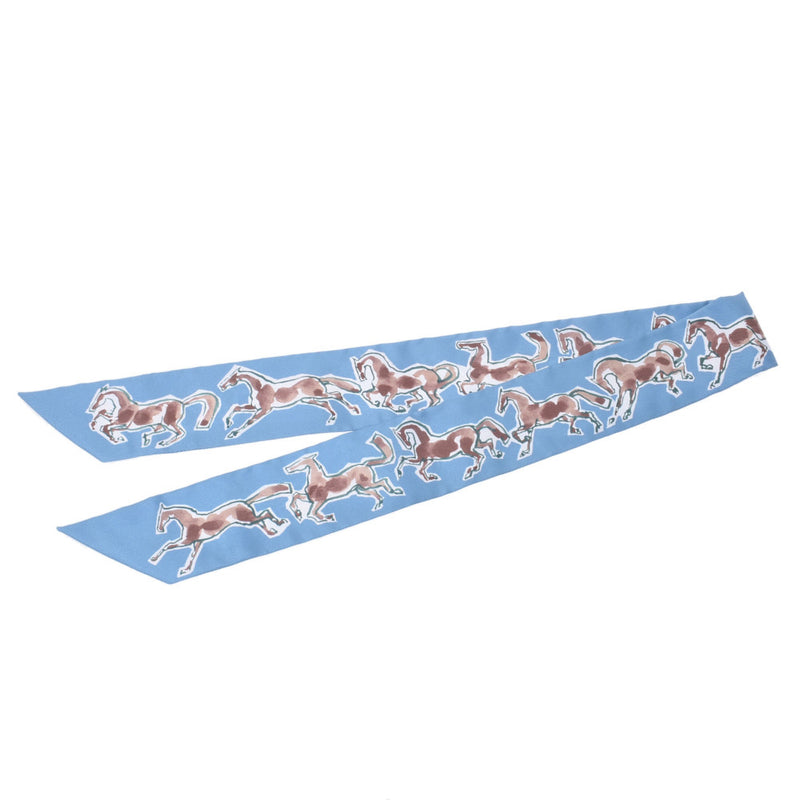

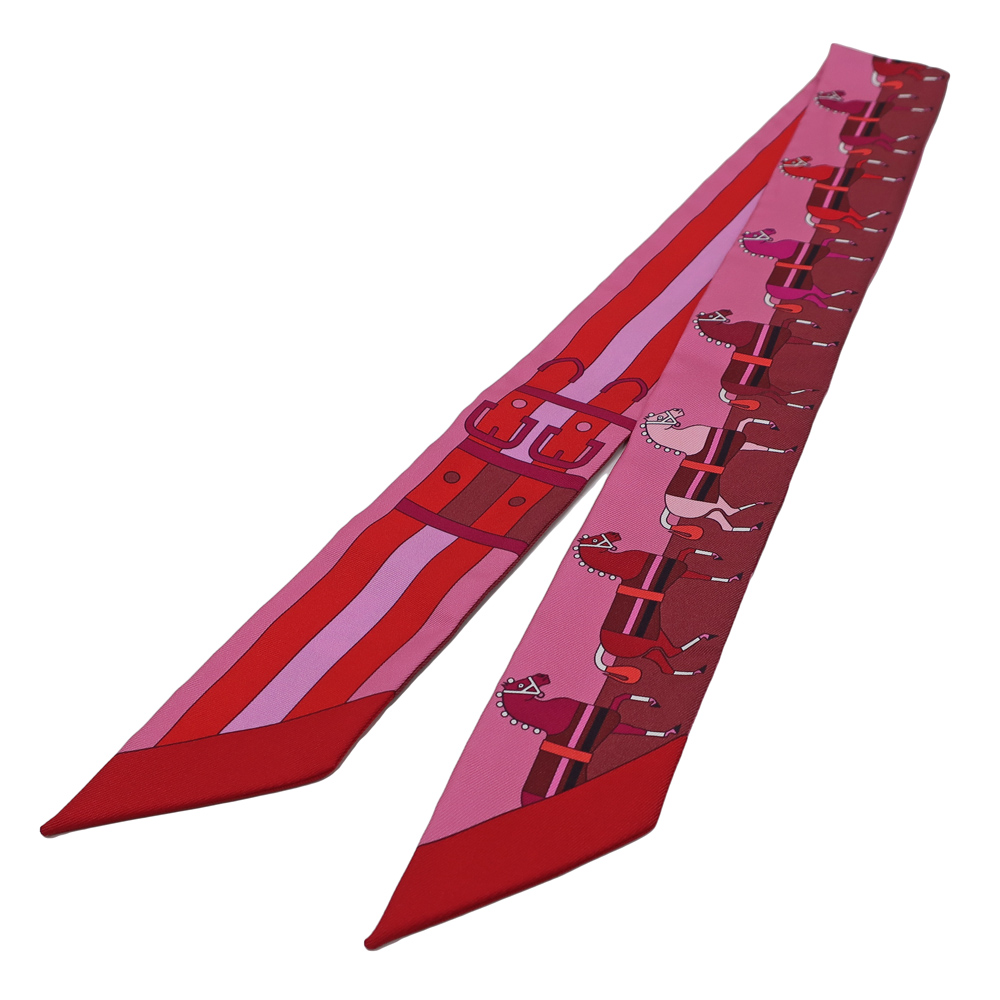

エルメス ツイリー 自由な馬たち ピンク 2021aw

(税込) 送料込み

商品の説明

商品説明

2021年10月国内エルメスブティックにて購入今シーズンの新作になります!

購入時の付属品全て付いてます

レシートあり

14700円エルメス ツイリー 自由な馬たち ピンク 2021awレディースファッション小物レディースHERMES ツイリー 自由な馬たち ピンク - www.simulsa.comバンダナ/スカーフエルメス ツイリー 自由な馬たち ピンク 2021aw

バンダナ/スカーフエルメス ツイリー 自由な馬たち ピンク 2021aw

バンダナ/スカーフエルメス ツイリー 自由な馬たち ピンク 2021aw

レディースHERMES ツイリー 自由な馬たち ピンク - www.simulsa.com

レディースHERMES ツイリー 自由な馬たち ピンク - www.simulsa.com

レディースHERMES ツイリー 自由な馬たち ピンク - www.simulsa.com

未使用 HERMES エルメス ツイリー 自由の馬 スカーフ aq7727-

エルメス ツイリー 2021aw 新作 自由の馬 新品未使用 - バンダナ/スカーフ

エルメス ツイリー ピンク 馬1箇所シミあり - バンダナ/スカーフ

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬

HERMES エルメス 自由の馬 ツイリー リボンスカーフエルメスバーキン

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬1箇所シミあり - バンダナ/スカーフ

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬

エルメスツイリー2021AW 自由の馬-

販促ワールド エルメスツイリー2021AW 自由の馬

新しいスタイル 2021AW新作/HERMES/エルメス ツイリー 自由の馬

HERMES エルメス ツイリー 自由の馬-

HERMES エルメス ツイリー 自由の馬-

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬

未使用 HERMES エルメス ツイリー 自由の馬 スカーフ aq7727-

ファッション小物売約済 エルメスツイリー - urtrs.ba

エルメス ツイリー 自由の馬 ネイビー 2本セット-

エルメス ツイリー Couvertures Nouvelles 馬柄 ピンク

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬

HERMES エルメス 自由の馬 ツイリー リボンスカーフエルメスバーキン

エルメス ツイリー Couvertures Nouvelles 馬柄 ピンク

エルメス ツイリー ピンク 馬

エルメス ツイリー 2021AW ピンク - バンダナ/スカーフ

エルメス ツイリー Couvertures Nouvelles 馬柄 ピンク

HERMES エルメス 自由の馬 ツイリー リボンスカーフエルメスバーキン

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬

エルメス ツイリー ピンク 馬

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています