◆新品未開封品◆Nintendo Switch 同梱版◇あつまれどうぶつの森◆

(税込) 送料込み

商品の説明

商品説明

○●○●○●○●○●○●○●○●○●商品に興味をもっていただき誠にありがとうございます。

こちらの商品はビックカメラ.comの抽選販売にて当選購入したものになります。

以下お読みいただき、ご購入をお待ちしております。

○●○●○●○●○●○●○●○●○●

【商品説明】

新品未使用・未開封

●NintendoSwitch本体(特別デザイン)×1台

●Joy-Con(L)(特別色)×1個

●Joy-Con(R)(特別色)×1個

●NintendoSwitchドック(特別デザイン)×1個

●Joy-Conグリップ×1個

●NintendoSwitchACアダプター×1個

●Joy-Conストラップ(特別デザイン)×2個

●ハイスピードHDMIケーブル×1個

●セーフティーガイド

●NintendoSwitchソフト「あつまれどうぶつの森」ダウンロード版※

○●○●○●○●○●○●○●○●○●

気になる点ご不明な点ございましたら、ご購入前に必ず質問の方宜しくお願い致します。こちらの商品は、新品未使用品になりますが、神経質な方のご購入はお控え下さい。

尚、ふつう・わるいの評価が当方で多い(10前後)と判断した場合は、お取引をキャンセルさせて頂く場合もございますので予めご了承宜しくお願い致します。

○●○●○●○●○●○●○●○●○●

26950円◆新品未開封品◆Nintendo Switch 同梱版◇あつまれどうぶつの森◆エンタメ/ホビーゲームソフト/ゲーム機本体switch どうぶつの森 同梱版 - ゲームソフト/ゲーム機本体Nintendo Switch本体 どうぶつの森の同梱版 未開封新品未使用 - ゲーム

お買得】 - Switch Nintendo Nintendo 同梱版 あつまれどうぶつの森

即日発送可 新品未開封◇◇ニンテンドー スイッチ どうぶつの森セット

switch どうぶつの森 同梱版 - ゲームソフト/ゲーム機本体

限定販売】 任天堂 どうぶつの森セット あつまれ Switch Nintendo

新品】任天堂 Nintendo Switch あつまれ どうぶつの森 ソフト ※レター

即日発送可 新品未開封◇◇ニンテンドー スイッチ どうぶつの森セット

Nintendo Switch どうぶつの森同梱版 新品未開封 - www.sorbillomenu.com

新品 Nintendo Switch本体 あつまれどうぶつの森同梱版|Yahoo!フリマ

NintendoSwitch あつまれどうぶつの森-

新品未開封 Nintendo Switch lite あつまれどうぶつの森 - メルカリ

Nintendo Switch本体 どうぶつの森の同梱版 未開封新品未使用 - ゲーム

SE528-0323-49 【】 Nintendo Switch あつまれ どうぶつの森セット

任天堂あつまれ どうぶつの森 Switch 新品未開封品 即日発送 - 家庭用

Yahoo!オークション -「あつまれどうぶつの森 switch 本体」の落札相場

即日発送可 新品未開封◇◇ニンテンドー スイッチ どうぶつの森セット

□【中古】任天堂◇ニンテンドースイッチ本体◇Nintendo Switch

ニンテンドーSwitch どうぶつの森Ver - www.sorbillomenu.com

Nintendo Switch本体 どうぶつの森の同梱版 未開封新品未使用 - ゲーム

2024年最新】どうぶつの森 switch ダウンロードの人気アイテム - メルカリ

NintendoSwitch あつまれどうぶつの森-

Yahoo!オークション -「ニンテンドースイッチ 本体 どうぶつの森」の

任天堂Switch純正品 左右Joy-Conストラップ

Yahoo!オークション -「ニンテンドースイッチ 本体 どうぶつの森」の

2024年最新】どうぶつの森 switch ダウンロードの人気アイテム - メルカリ

Nintendo Switch 本体 あつまれ どうぶつの森セット ×3台セット - www

純正卸し売り あつまれどうぶつの森 Switch ピクミン4 スイッチソフト

当社の 【中古】2本セット あつまれ動物の森 SWITCH ゲームソフト

Nintendo Switch本体 どうぶつの森の同梱版 未開封新品未使用 - ゲーム

2022新入荷 25M 【中古品】 Nintendo Switch XKJシリーズ JoyCon

動作品】Nintendo Switch 本体 新型 拡張バッテリー HAD-S-

switch 新品の値段と価格推移は?|6945件の売買データからswitch 新品

◇◇switch Lite/あつまれどうぶつの森セット/~まめきち&つぶきち

ふるさと納税 Nintendo ニンテンドースイッチ Switch ニンテンドー

動作品】Nintendo Switch 本体 新型 拡張バッテリー HAD-S-

2024年最新】どうぶつの森同梱版の人気アイテム - メルカリ

あつ森 SwitchのYahoo!オークション(旧ヤフオク!)の相場・価格を見る

新品未開封☆Nintendo Switch あつまれどうぶつの森 本体同梱版 - www

Yahoo!オークション -「switch 本体 どうぶつの森」の落札相場・落札価格

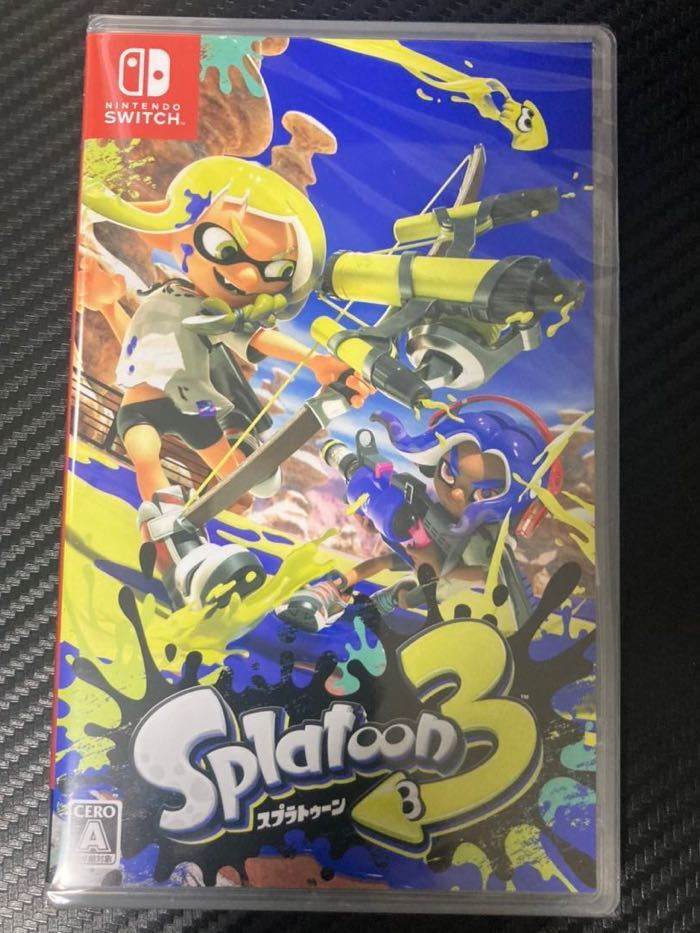

◇ 新品未開封 ◇ スプラトゥーン3 パッケージ版 任天堂 スイッチ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています