【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番

(税込) 送料込み

商品の説明

商品説明

レア!廃盤品です!当出品をご覧頂き誠に有り難うございます^^

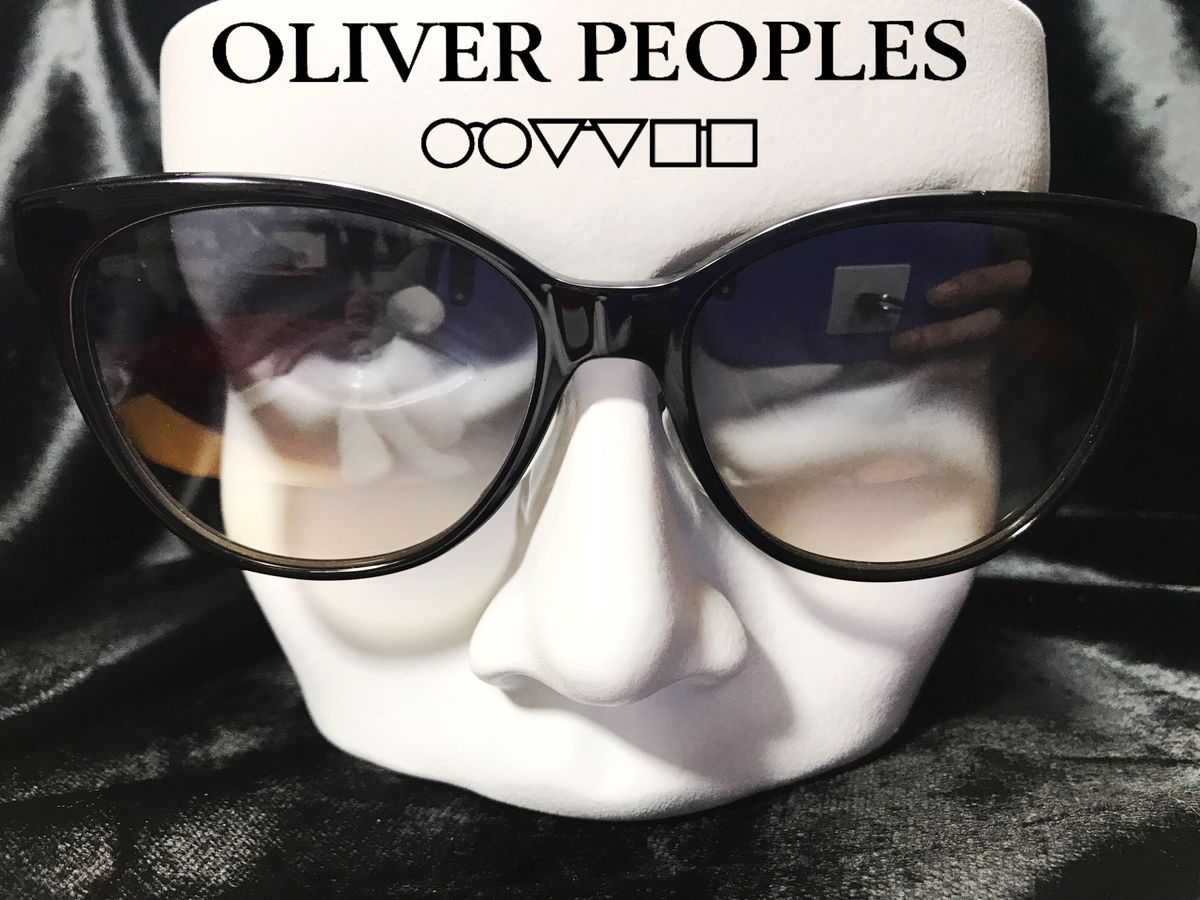

OLIVERPEOPLESオリバーかピープルズDantine金丁番日本製

サングラス/メガネ本体のみの出品になります。

店頭価格:¥31,900-

ブラックのセルとゴールド丁番のコントラストに高級感が溢れるフルリムセルの日本/鯖江製国産フレームです。

目立つキズ等なく綺麗な状態ですが、保管時のスレ程度はご了承下さいませ。

度なしグラデーションレンズが入っておりますのでこのままご着用頂けます。

また、一般的なメガネ形状セルフロントなので度入りレンズへの変更もおすすめです。

出来るだけ客観的に見た状態表記をしておりますが神経質な方はご遠慮くださいませ。m(__)m

こちら一点モノになりますのでこの機会に是非!

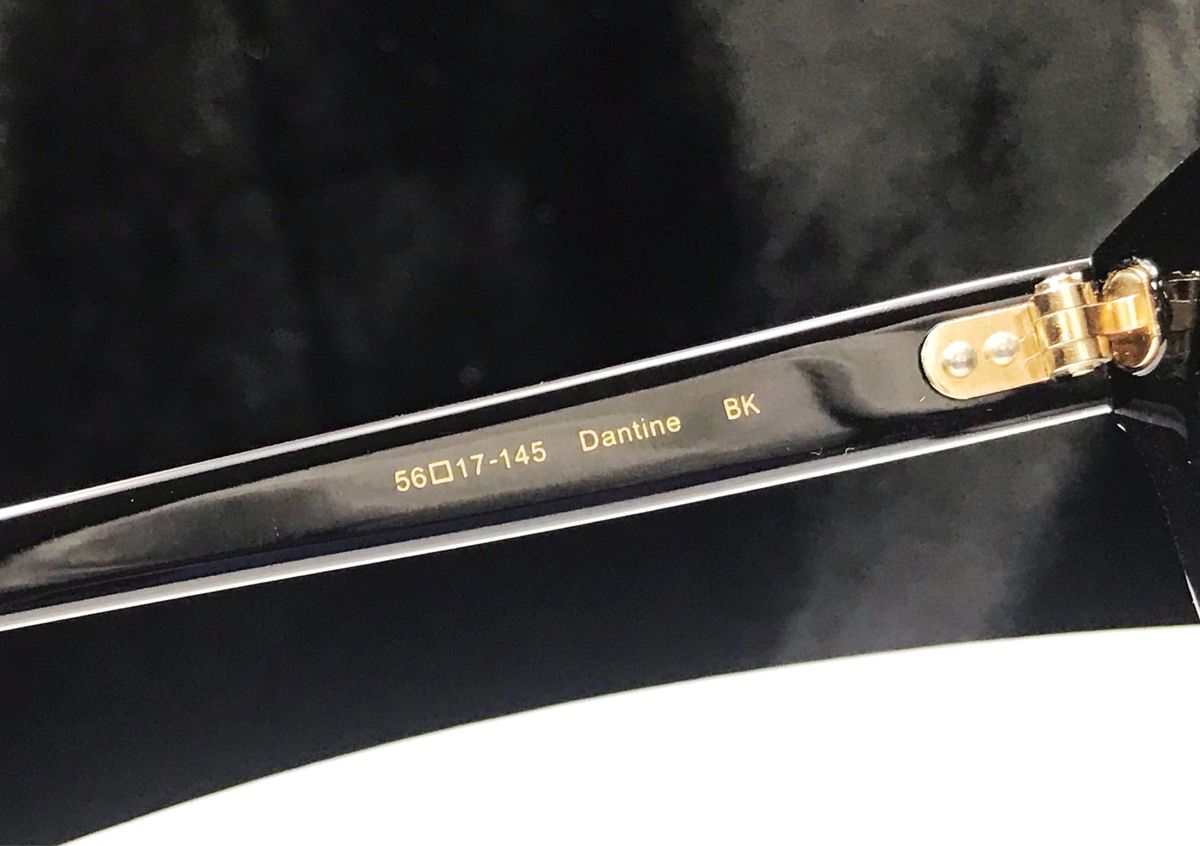

【公称サイズ】

レンズ横幅:56mmレンズ縦幅:45mmブリッジ幅:17mmフロント幅:142mm

レンズカラー···グレー

フレームカラー···ブラック

種類···サングラス

レンズ特徴···度なし

♦︎発送前に殺菌洗浄して梱包いたします。(本鼈甲、木製は除く)

★メガネの着用感につきまして★

メガネ、サングラスは使用者に合わせた調整が可能です。

もしも到着時点でのきついorゆるい等ございましたら、まずは最寄りの眼鏡店様へご相談下さいませ。

※商品の状態表記につきましては、可能な限り客観的視点で判断していますがあくまで個人の見解になります。

写真の映り方、お使いのモニター環境により実物とお色や見え方が異なる場合がありますのでご了承下さい。

中古商品の性質上、使用感や一部瑕疵やにおい等ある場合もございますが、そういった点気にされる方は予めご遠慮くださいませ。ジャンク記載以外は少なくとも形態上使用可能となります。

中には新品、美品もありますが店頭商品同様をお求めの方はご遠慮下さいませ。

サイズの測り方は素人採寸であくまで参考ですので、商品写真の印字等をご参照下さい。

思っていたサイズやお色等と違うといったお客様都合による返品•キャンセルはお受け致しかねます。

基本は写真にてご判断ください。

ご質問には現品チェックして出来るだけ丁寧にお答え致します。ご購入の際は上記ご理解頂いたものと致します。

【許可証番号】古物商免許631142200020

13200円【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番メンズファッション小物【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番 サングラス/メガネ【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番 サングラス/メガネ

【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番

希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番メンズ - www

【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番 サングラス/メガネ

【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番

希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番メンズ - www

【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番

【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番 サングラス/メガネ

正規品質保証 【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁

オンライン売れ済 【希少】OLIVER PEOPLESオリバーピープルズDantine

【希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番

希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番メンズ - www

オリバーピープルズ アーカイヴ OLIVER PEOPLES archive ポンメガネ

Oliver Peoples - 【新品】オリバーピープルズ Oliver Peoples

希少】OLIVER PEOPLESオリバーピープルズDantine 金丁番メンズ - www

最新な KATHARINE HAMNETT KH5334 セルフレーム サングラス/メガネ

GROOVER LEXINGTON グルーバー レキシントン | Buyee 通販購入サポート

Saint Michael Mxxxxxx セントマイケル pants パンツSAINTMICHAEL

DANTINE オリバーピープルズ サングラス取扱い店舗|東京・中目黒

税込?送料無料】 MONCLER モンクレール ML0261 21C セル、プラスチック

最終決算 UNCROWD / ◻︎SAFARI ◻︎アンクラウド( 調光レンズ LANCER

Eyeglasses OV1308 - Brushed Gold/362 - Clear - メタル | Oliver

のオシャレな バレンシアガ 財布 折りたたみ 3 ファッション小物

OLIVER PEOPLES(オリバーピープルズ) | ミナミメガネ -メガネ通販

Eyeglasses OV1308 - Brushed Gold/362 - Clear - メタル | Oliver

Oliver Peoples オリバーピープルズのメガネ、サングラスならD-Eye

GROOVER LEXINGTON グルーバー レキシントン | Buyee 通販購入サポート

楽天市場】【 OLIVER PEOPLES 正規販売店 】オリバーピープルズ アイ

新製品情報も満載 未使用在庫保管品 改良衣 洗える法衣 0524S19r 一般

ルイヴィトン LOUIS VUITTON サングラス ルイヴィトン 激安オンライン

オリバーピープルズ OLIVER PEOPLES ポンメガネ

正式的 ヒーターベスト 2セット | medicalzonemangohill.com.au

DANTINE オリバーピープルズ サングラス取扱い店舗|東京・中目黒

Tory Burch ストラップ キーホルダー アクセサリー かわいい - energie

購入特典付き マルボロ オリジナルジャケット | kotekservice.com

OLIVER PEOPLES archive リーディンググラス通販 OP-76 AG (生産

Saint Michael Mxxxxxx セントマイケル pants パンツSAINTMICHAEL

RayBan サングラス スペシャルシリーズ - beitaharon.com.au

2024年最新】Yahoo!オークション -オリバーピープルズ メガネ

OLIVERPEOPLES オリバーピープルズ | 中目黒のメガネ・サングラス

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています