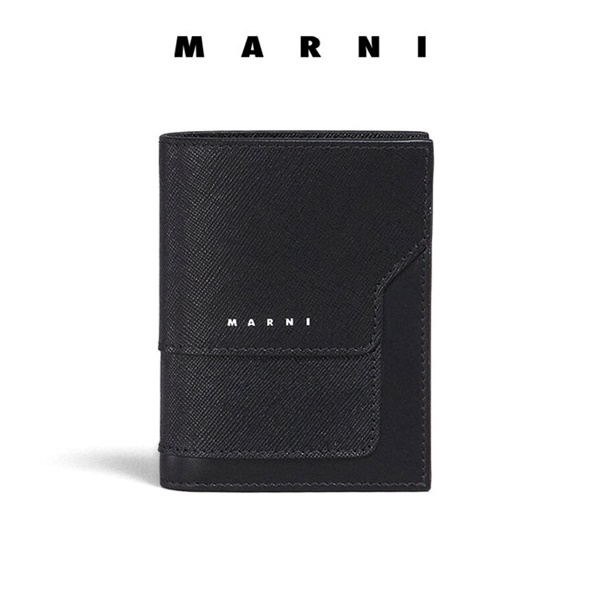

マルニ MARNI 二つ折財布

(税込) 送料込み

商品の説明

商品説明

ブランド名:マルニMARNIメーカー型番:PFMOQ14U13

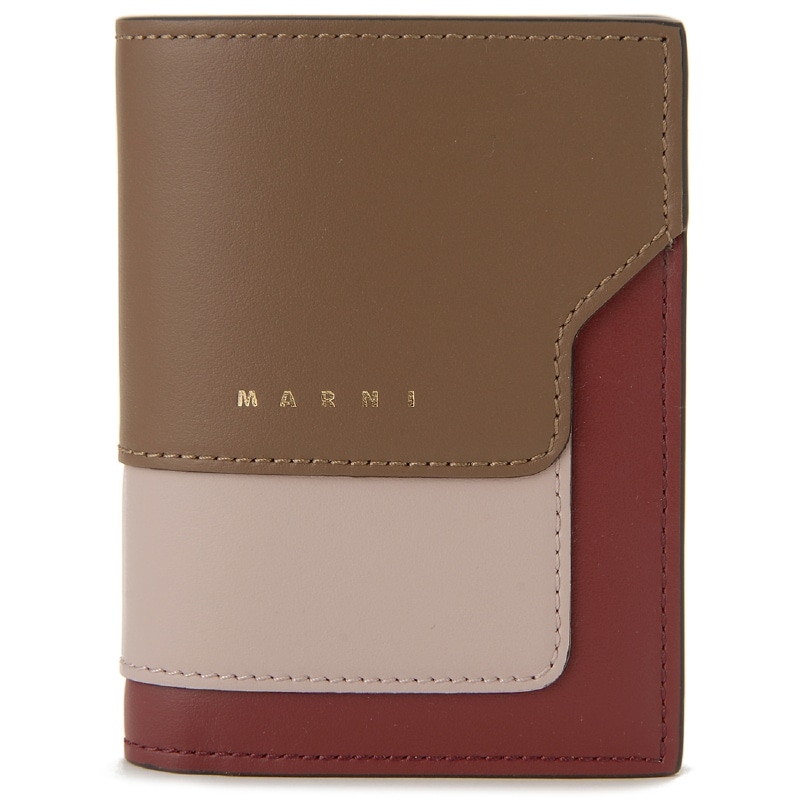

カラー:GOLDBROWN/QUARTZ/BURGUNDY

素材:SMOOTHCALFLEATHER

サイズ(縦×横×マチ)cm:11x8.5x2

開閉:スナップボタン

内側:カードスロットx4、コインポケットx1、コンポートメントx1

外側:

付属品:

19668円マルニ MARNI 二つ折財布レディースファッション小物日本限定カラー☆MARNI 2つ折りコンパクト財布 ミントベージュ (MARNIMARNI(マルニ) 2つ折り財布 - レザーカード入れ ⇒4箇所 - 財布

セール】マルニ 二つ折り財布 トランク ブラウン マルチ レディース

MARNI マルニ 二つ折り財布のご紹介です。 - YouTube

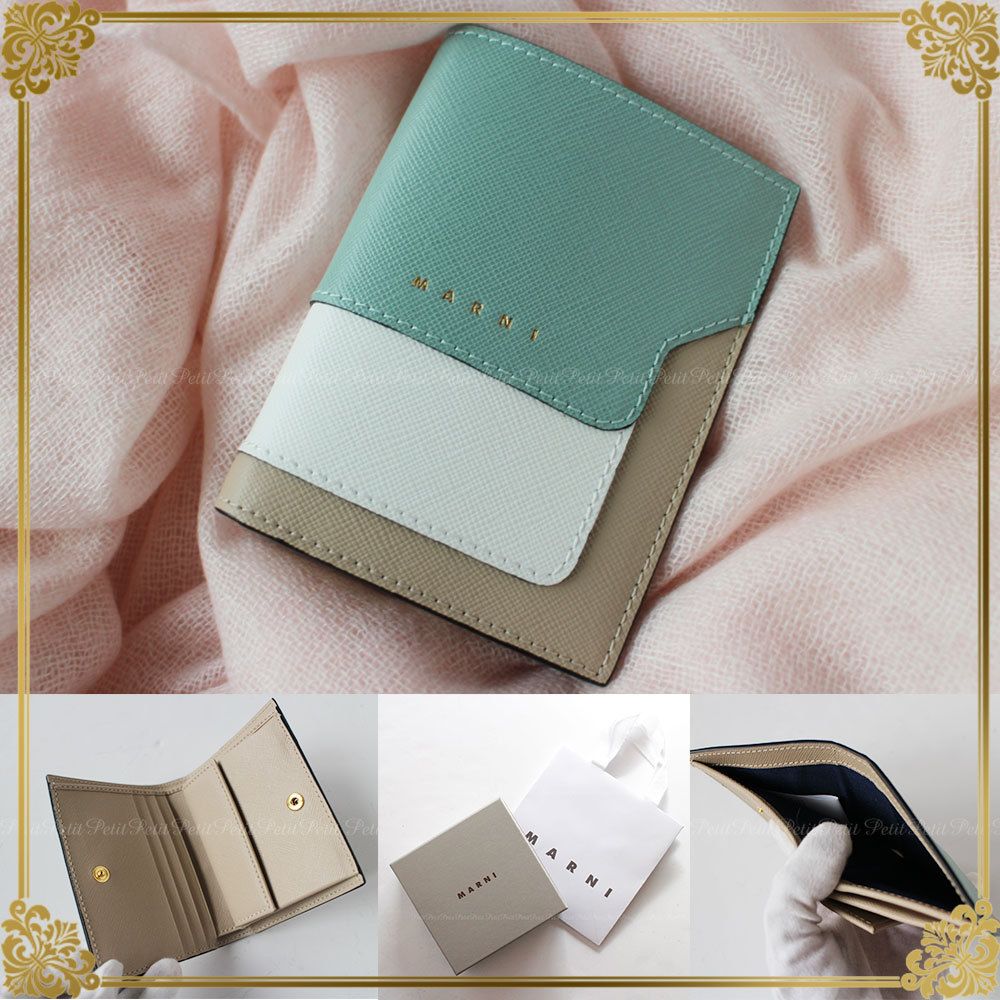

日本限定カラー☆MARNI 2つ折りコンパクト財布 ミントベージュ (MARNI

楽天市場】マルニ 財布 VANITOSI レディース ブランド 本革 MARNI 二

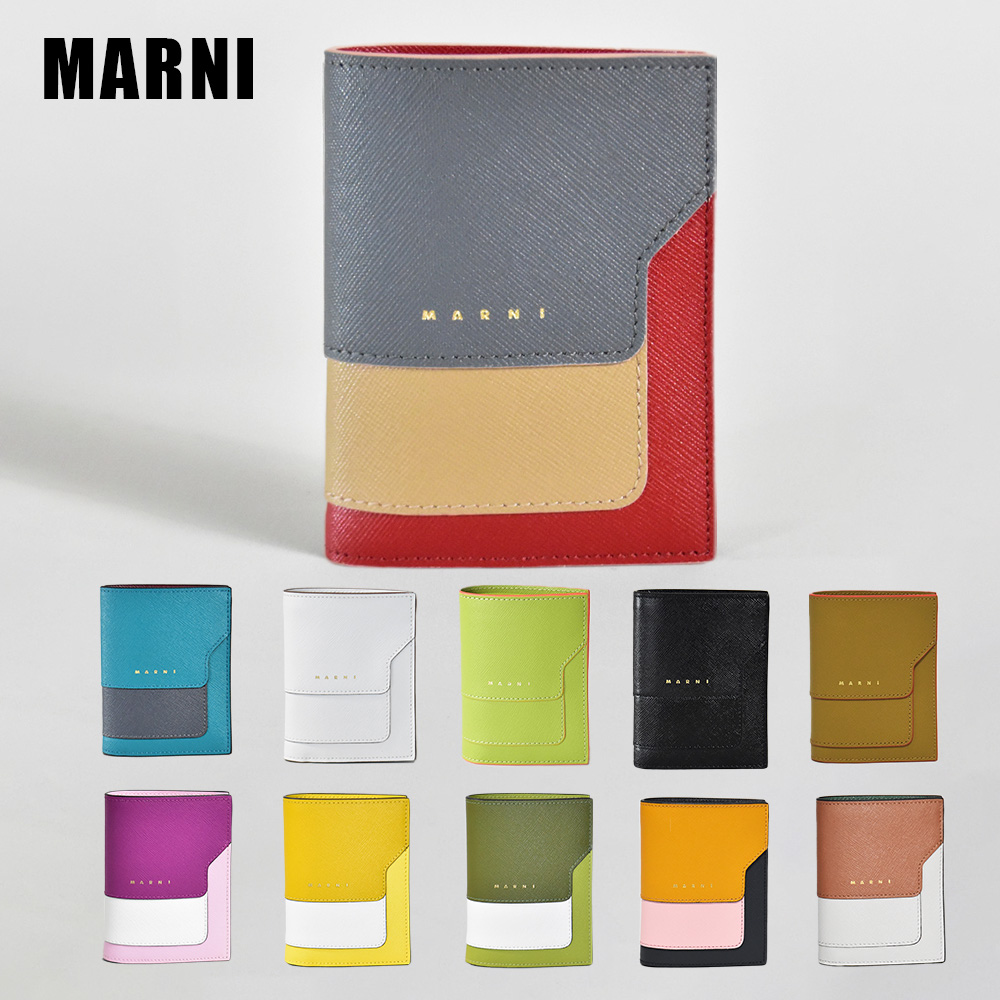

楽天市場】マルニ MARNI 二つ折り財布 レディース 財布 ミニ財布

マルニ 財布 MARNI 二つ折り財布 折り畳み PFMI0049U0 P2644 メンズ ユニセックス モスグリーン マルチカラー Z3O62

MARNI (マルニ) 折りたたみ財布 レディース

【MARNI】2つ折り財布/VANITOSI【NIGHT BLUE+BLACK+WINE】

マルニ MARNI 二つ折り財布 レディース 財布 サフィアーノカーフスキン

マルニ MARNI 二つ折り財布 レザー ラウンドファスナー ウォレット

マルニ MARNI 二つ折財布 PFMOQ14U13 3208 GOLD BROWN/QUARTZ/BURGUNDY

マルニ 二つ折り財布 トランク ミニ財布 ネイビー マルチカラー メンズ

楽天市場】MARNI マルニ 二つ折り財布 PFMOQ14U13 LV520 レディース

楽天市場】マルニ MARNI PFMOQ14U13LV589 二つ折り財布 レディース

MARNI 二つ折り財布 サフィアーノレザー マルニ レディース 折り財布

マルニ MARNI 二つ折り財布 PFMOQ14U13 LV520 Z564N BILLFOLD WALLET

マルニ marni レザー製2つ折り財布 - 折り財布

Marni - マルニ MARNI 二つ折り財布 バイフォールドウォレット モカ

MARNI(マルニ)|ロゴ刺しゅう二つ折り財布/カシス の通販|ELLESHOP

マルニ MARNI 二つ折り財布[品番:TRDW0001062]|U-STREAM(ユー

マルニ MARNI PFMO0052U1-LV520 二つ折り財布 レディース 財布 ミニ

マルニ 財布 MARNI 二つ折り財布 モスストーン グリーン コンパクト

Amazon | [Marni] [マルニ] 財布 二つ折り ミニ財布 サフィアーノ

マルニ(MARNI) サフィアーノレザー 二つ折り 財布 | 通販・人気

マルニ MARNI 二つ折り財布 レディース ジップ コンパクトウォレット

MARNI マルニ 二つ折り財布 バイフォールド ウォレット グリーン 正規

マルニ MARNI 二つ折り財布 PFMOQ14U07 LV520 レディース 財布 二

マルニ MARNI 二つ折り財布 トランク ミニ財布 ホワイト ユニセックス

MARNI(マルニ)|TRUNK 二つ折り財布/タバスコ×ホワイト×ブルー の通販

マルニ Marni 二つ折り財布 サフィアーノレザーナッパーレザー

マルニ MARNI 二つ折り財布 レザー ラウンドファスナー ウォレット

マルニ Marni 二つ折り財布 サフィアーノレザーナッパーレザー

札入れ⇒1箇所MARNI(マルニ) 2つ折り財布 - レザー - 財布

マルニ MARNI 二つ折り財布 レザー ラウンドファスナー ウォレット

マルニ MARNI 二つ折り財布[品番:TRDW0001062]|U-STREAM(ユー

Marni - マルニ MARNI 財布 二つ折り タンブルレザー ミニ 二つ折り

マルニ MARNI 二つ折り財布 レディース コンパクトウォレット

高級素材使用ブランド MARNI 二つ折り財布 マルニ MARNI 二つ折り財布

MARNI マルニ サフィアーノ&カーフレザー ロゴ 二つ折り財布

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![マルニ MARNI 二つ折り財布[品番:TRDW0001062]|U-STREAM(ユー](https://cdn.shop-list.com/res/up/shoplist/shp/__thum370__/u-stream/u-stream/cabinet/item/mar/mar-pfmoq09u07l_8.jpg)

![Amazon | [Marni] [マルニ] 財布 二つ折り ミニ財布 サフィアーノ](https://m.media-amazon.com/images/I/51ndSbgFRWL._AC_UY580_.jpg)

![マルニ MARNI 二つ折り財布[品番:TRDW0001062]|U-STREAM(ユー](https://cdn.shop-list.com/res/up/shoplist/shp/__thum370__/u-stream/u-stream/cabinet/item/mar/mar-pfmoq09u07l_1.jpg)