スザンナ・デ・シモーネ 置物(鶏)

(税込) 送料込み

商品の説明

商品説明

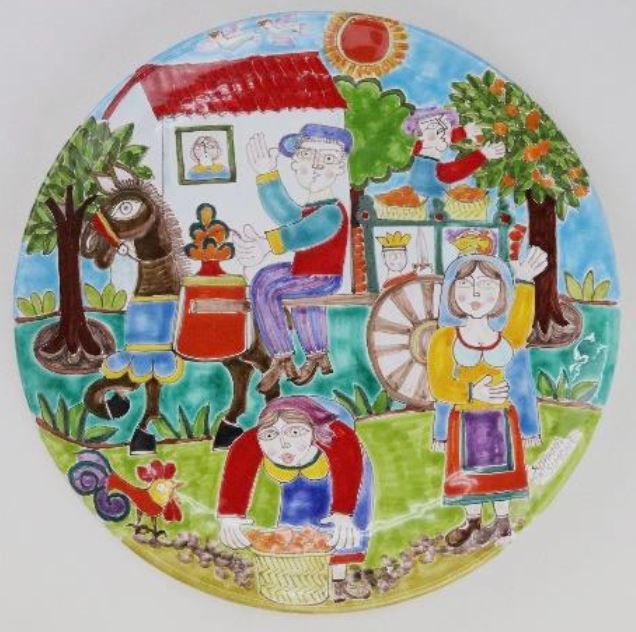

シチリア人陶芸家、スザンナ・デ・シモーネの置物(鶏)の陶器作品です。色彩の明るさと独創性に満ちていて明るい雰囲気を感じられます。

全長15cm

全幅17.5cm

9035円スザンナ・デ・シモーネ 置物(鶏)インテリア/住まい/日用品インテリア小物返品?交換対象商品 スザンナ・デ・シモーネ 置物(鶏) | bprdイタリア製 輸入雑貨 シチリア 陶器 オブジェ 置物 小物入れ ポット

スザンナ・デ・シモーネ 置物(鶏) 小物入れ 【即購入可

イタリア製 輸入雑貨 シチリア 陶器 オブジェ 置物 小物入れ ポット

返品?交換対象商品 スザンナ・デ・シモーネ 置物(鶏) | bprd

楽天市場】IZ51508S☆Susanna de Simone イタリア 絵皿 19cm ニワトリ

IZ51508S☆Susanna de Simone イタリア 絵皿 19cm ニワトリ お皿

素材陶器DESIMONE デシモーネ ヴィンテージ 皿 ニワトリ - 食器

楽天市場】IZ51508S☆Susanna de Simone イタリア 絵皿 19cm ニワトリ

【SUSANNA DE SIMONE(スザンナ・デ・シモーネ) シチリア陶器】絵皿 Ф19×H3cm / M5-537PN

スザンナ・デ・シモーネ 置物(鶏) - 小物入れ

スザンナ・デ・シモーネ 置物(鶏) - 小物入れ

イタリア製 輸入雑貨 シチリア 陶器 オブジェ 置物 小物入れ ポット

デシモーネ 3点 De Simone-

IZ51508S☆Susanna de Simone イタリア 絵皿 19cm ニワトリ お皿

公式商品 スザンナ・デ・シモーネ ティーポット | barstoolvillage.com

スザンナ・デ・シモーネ ティーポットの+borbonrodriguez.com

デシモーネ 3点 De Simone-

販売を販売 スザンナ・デ・シモーネ 置物(鶏) - インテリア小物

デシモーネの値段と価格推移は?|6件の売買データからデシモーネの

【SUSANNA DE SIMONE(スザンナ・デ・シモーネ) シチリア陶器】絵皿 Ф19×H3cm / M5-537PS

公式商品 スザンナ・デ・シモーネ ティーポット | barstoolvillage.com

楽天市場】【送料無料】イタリア製 シチリア陶器 小物入れ トリ(小

最終値下》 花瓶 スザンナ デ シモーネ(※要在庫確認)シチリア陶器

素材陶器DESIMONE デシモーネ ヴィンテージ 皿 ニワトリ - 食器

DESIMONE ITALY デシモーネ イタリア製 太陽と月のフラワーベース

スザンナ・デ・シモーネ 置物(鶏) 小物入れ 【即購入可

景徳鎮の食器セット 106点インテリア/住まい/日用品 - www.sakit.com.sa

デシモーネ DESIMONE 壁掛け 陶器

美品】デシモーネ 置き物 - 置物

スザンナ・デ・シモーネ ティーポットの+borbonrodriguez.com

De Simone デシモーネ 初期作品 allsmart.id

2024年最新】デシモーネの人気アイテム - メルカリ

Susanna de Simoneさんの工房見学(♡▽♡ ) | デザイナーAKIの

鶏 置物 中

絵皿 壁掛け 飾り皿 陶器 「スザンナ デ シモーネ」 インテリア

置物 剥製 鳥 オブジェ インテリア 和風 和室 家具 雑貨 置物

イタリア製 輸入雑貨 シチリア 陶器 オブジェ 置物 小物入れ ポット

IZ51508S☆Susanna de Simone イタリア 絵皿 19cm ニワトリ お皿

その他S-21 水晶 3.3kg クォーツ スフィア 原石 鑑賞石 自然石 鉱物

Susanna de Simoneさんの工房見学(♡▽♡ ) | デザイナーAKIの

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています