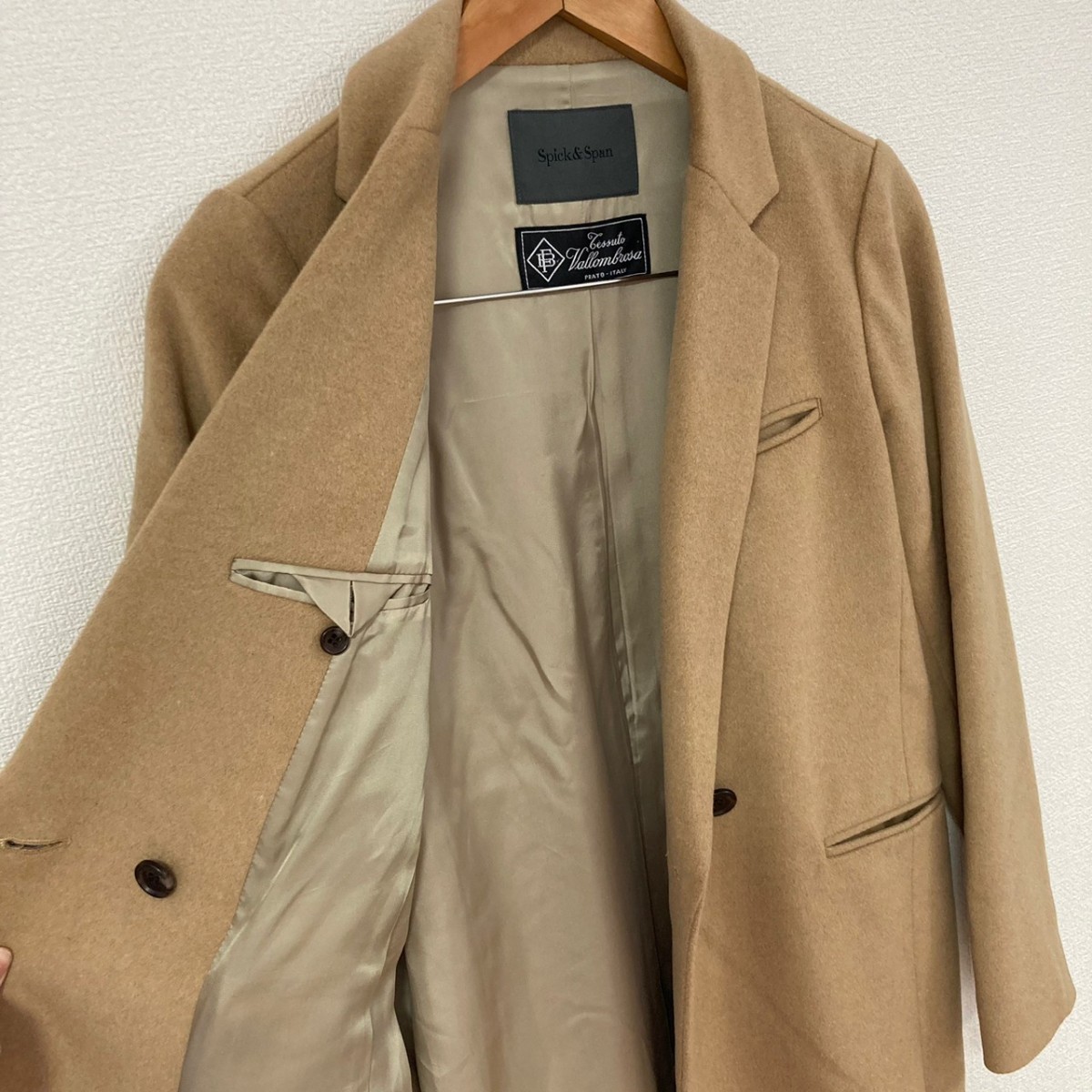

NOBLE ノーブル トレンチコート 38(M位) 茶 【古着】

(税込) 送料込み

商品の説明

商品説明

【ブランド】NOBLE(ノーブル)【アイテム】トレンチコート

【タイプ】レディース

【商品番号】2200379986013r20231208

【コンディション】ランク:A

【カラー】茶

【サイズ】38(M位)

【実寸(cm)】身幅:61cm,裄丈:78.5cm,着丈:118cm

【付属品】ウエストベルト、袖ベルト、チンウォーマー

【素材】(表地、袖裏)ポリエステル100%、(裏地)綿100%

【原産国】日本

【その他詳細】

シーズン:春夏

ポケット:あり外ポケット:2

透け感:なし

生地の厚さ:普通

裏地:あり

伸縮性:なし

光沢:なし

開閉:ボタン

※商品は複数サイトで共有している為システムで在庫調整を行っておりますが、ずれが生じ欠品となる場合もございます。

【商品コード】0224923N0005

こちらの商品はラクマ公式パートナーのRAGTAGによって出品されています。

6720円NOBLE ノーブル トレンチコート 38(M位) 茶 【古着】レディースジャケット/アウタープレゼント対象商品 NOBLE ノーブル トレンチコート 38(M位) 茶 【古着Noble - NOBLE ノーブル トレンチコート 38(M位) 茶 【古着】【中古

Noble - NOBLE ノーブル トレンチコート 38(M位) 茶 【古着】【中古

Noble - NOBLE ノーブル トレンチコート 38(M位) 茶 【古着】【中古

プレゼント対象商品 NOBLE ノーブル トレンチコート 38(M位) 茶 【古着

プレゼント対象商品 NOBLE ノーブル トレンチコート 38(M位) 茶 【古着

2024年最新】Yahoo!オークション -noble ノーブル コート(コート一般

ノーブル トレンチコート(レディース)の通販 69点 | Nobleのレディース

Noble(ノーブル)の「ヴィンテージニュアンスオーバートレンチ

スピックスパン ノーブル Noble チェスターコート ジャケット 総柄 M

Noble(ノーブル)の「ヴィンテージニュアンスオーバートレンチ

ウールナイロンノーカラートレンチコート(ノーカラーコート)|NOBLE

スピックスパン ノーブル Noble チェスターコート ジャケット 総柄 M

2024年最新】Yahoo!オークション -noble ノーブル コート(コート一般

NOBLE(ノーブル) / トレンチコート/38/コットン/BEG/無地 | 古着の販売

ウールナイロンノーカラートレンチコート(ノーカラーコート)|NOBLE

スピックアンドスパン ロング トレンチコート ベージュ 古着

プレゼント対象商品 NOBLE ノーブル トレンチコート 38(M位) 茶 【古着

新品タグ付き W/Nyリバーノーカラーコート 海外並行輸入正規品 - www

秋冬ポケットSpick and Span コート(その他) 38(M位) 茶 - www

ノーブル トレンチコート(レディース)の通販 69点 | Nobleのレディース

中古・古着通販】Noble (ノーブル) MTRカラーレスジップショートコート

スピックスパン ノーブル Noble チェスターコート ジャケット 総柄 M

在庫限り 未使用タグ付 NOBLEノーブル パウダーオックスレトロトレンチ

Noble(ノーブル)19SS TAカルゼレトロトレンチコート 【中古

タグ付き NOBLE ノーブル ピークドラぺルダブルジャケット 金ボタン XS

2024年最新】noble コートの人気アイテム - メルカリ

noble ネイビーショート丈ピーコート - アウター

ウールナイロンノーカラートレンチコート(ノーカラーコート)|NOBLE

年末SALE 【ヴィンテージ / 保管品】◇カルティエ◇ マストライン / W

Noble(ノーブル)】ブランド・古着のネット通販【TREFAC FASHION】

スピックアンドスパン ロング トレンチコート ベージュ 古着

Noble - ◇新品◇NOBLE ノーブル スタンドカラーオーバーコート

2024年最新】Yahoo!オークション -noble ノーブル コート(コート一般

ノーブル NOBLE 千鳥チェックボンディングトレンチコート トレンチ

あり生地の厚さ23区 ニジューサンク コート(その他) 38(M位) 黄系

H2537dL Spick&Span スピックアンドスパン tessuto vallombrosa サイズ

ナイロン トレンチ コート レディースの通販|au PAY マーケット

スピックスパンノーブル コート - アウター

NOBLE(ノーブル) / トレンチコート/38/コットン/BEG/無地 | 古着の販売

ほしい物ランキング ○未使用○ NOBLEノーブル リバーレースIライン

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています